The Mitsubishi Lancer Evolution X (Evo X) stands as a symbol of performance and automotive engineering excellence. For business owners in the automotive industry, understanding the dynamics of Evo X engines is essential. This article delves into four key areas: purchasing options available for Evo X engines, a comprehensive overview of aftermarket parts, a detailed cost analysis, and insights into international market trends. These chapters provide a holistic understanding of what’s critical for sourcing Evo X engines and components.

Paths to Power: Navigating Evo X Engine Purchases in a Global Market

When a project calls for the Evo X heart, the buying landscape unfurls like a map of possible futures. You can source a complete, pre-owned engine ready to bolt in, or you can assemble a parts-backed rebuild from a network of specialized suppliers. The choice hinges on timing, budget, and how much you value originality versus customization. In recent market chatter, two broad avenues emerge clearly. One is the direct route via consumer marketplaces, where a single engine can be procured with a click and the promise of door-to-door delivery. The other is a B2B, supply-chain approach, where factories, distributors, and tuning shops in major manufacturing hubs stand ready to supply components in bulk, or to tailor powertrain packages for high-performance builds. The Evo X’s turbocharged four, harvested from a late-model Lancer Evolution X, remains a compelling centerpiece for almost any project, even though the model faded from the showroom floor in 2015. The chassis and engine pairing, with the 4B11T powerplant at its core, has left a lasting impression on enthusiasts who chase quick spools, precise throttle response, and the kind of rugged reliability that fresh parts alone can’t guarantee when you’re pushing a setup beyond stock specifications.

On the consumer front, marketplaces such as a well-known global platform now host pre-owned engines that come with a clear price tag and delivery promise. A typical listing might reveal a 2009–2015 Mitsubishi Lancer Evolution X 4B11 2.0L DOHC turbo engine in a used condition, with a price around 3,895 USD and the perk of free shipping within the United States. The explicit value proposition is straightforward: a buyer can assess a unit’s age, mileage, and known service history at a glance, decide quickly, and complete the transaction with confidence. This pathway suits an owner-builder project where time is of the essence and risk is manageable through buyer protection programs and seller reputation. It also suits a preservationist mindset—someone who wants a historically accurate engine that has already proven itself in rally and performance contexts. The practical upside is that you can see the unit, confirm the mounting points, and align expectations with a transparent price. The potential downside, of course, is that a used engine carries unknown wear, possible internal emissions of fatigue, and the risk of hidden issues that only become apparent after a dyno pull or a long break-in period. Still, the immediacy of this route cannot be overstated for a project that needs to move from concept to test run within days rather than weeks or months.

Beyond the consumer marketplace, the Evo X keeps a robust presence in the B2B ecosystem, particularly in manufacturing hubs with a deep history of precision engineering. The Pearl River Delta region, including Guangzhou and Shenzhen, has long been an epicenter for powertrain components, driven by semiconductor-grade machining, tight tolerances, and the capability to produce parts that meet OEM-style durability. Here, buyers who are not just chasing a single engine but a steady supply of parts or a large-scale rebuild have a different calculus. Suppliers in these markets specialize in a range of components—turbochargers tuned for the 4B11T, radiators designed to withstand the heat of turbocharged operation, and other critical subsystems essential for a high-performance build. The value proposition shifts from “one unit, one price” to “value in volume, consistency, and customization.” When a project requires more than a replacement engine—perhaps a full rebuild kit, extra turbo spares, or a complete cooling package—the B2B channels can deliver a more cohesive solution, albeit with longer lead times and more complex logistics. The trade-off is clear: suppliers guarantee part compatibility, availability in the right spec, and the possibility of batch production that aligns with a tuning shop’s pipeline. That is especially important for shops that operate on tight schedules, where even a small delay in supply can ripple across multiple builds and deadlines.

Between these two pathways, a number of practical questions rise to the surface. How does one verify the condition and history of a pre-owned engine? What are the telltale signs of a solid remanufacture versus a cosmetic rebuild that doesn’t address core wear? How do you navigate the often opaque logistics of importing a turbocharged inline-four from a distant market, where shipping, duty, and handling fees can eclipse the price of the engine itself? The market’s current texture shows that the solution lies in a balanced approach: a clear understanding of risk, a plan for inspection, and an honest assessment of how much you value originality versus upgrade potential. A pre-owned engine gives you the essence of an Evo X experience at a predictable cash outlay, provided you can verify core integrity and service history. A parts-based or bulk-supply route, on the other hand, affords a tuning operation a reliable ladder of components to climb toward a target performance profile, while also allowing for the replacement of critical items at controlled intervals. In both cases, the engine’s 4B11T lineage remains a unifying thread, a reference point for what is possible when precision engineering, heat management, and meticulous assembly converge.

From the buyer’s vantage, it helps to be practical about what constitutes a complete engine package versus a partial assembly. If you opt for the complete unit, you’ll want to cross-check the exact engine model year, the compatibility with your car’s ECU and exhaust configuration, and the condition of ancillary systems such as the turbocharger, intake plumbing, and the intercooler path. Some listings clearly identify the turbo as a specific variant, which matters for spool characteristics and potential boost levels. In other cases, a seller’s description might name a turbocharger model and a handful of compatible engine codes without guaranteeing the full compatibility with a given chassis. That’s where due diligence—direct questions to the seller about mileage, maintenance history, compression test results, and the presence of any head gasket or ring wear—becomes the deciding factor. If a buyer discovers a well-documented service record, a recent compression test, and photos that reveal a clean, corrosion-free mounting surface, the risk factor drops. If not, the price point should reflect the uncertainty, or the buyer should insist on additional verification steps, such as a live engine start or a dyno baseline before purchase.

In the bulk-or-parts path, the decision matrix grows more layered. The package can include a turbo, an intercooler, radiators, and a complete front-end engine subassembly—or simply a catalog of components to assemble into a bespoke powertrain. The opportunity here is to tailor a build around the car’s intended use, whether that means a street-driven machine with daily-driver manners or a track-ready, high-boost contender. The Chinese supplier network, with its emphasis on precision components, makes this possible by offering not just individual parts, but coordinated sets—turbochargers, engine cooling, and engine blocks or variants that align with the 4B11T architecture. The upside is customization, potentially lower per-unit costs in bulk, and the ability to source compatible parts in a way that preserves engine integrity across a rebuild. The caveat is lead time. The process can require more planning, as it involves aligning multiple parts from different suppliers, ensuring that the final assembly will work in concert and that all parts share compatible tolerances and metallurgy. Importantly, the Evo X’s value proposition remains in its efficiency and responsiveness when properly matched with supportive components; a well-chosen turbo, radiator, and intake path can dramatically sharpen throttle response and reduce heat soak under sustained high-load operation.

To navigate these currents with confidence, a practical framework helps. Start with a clear objective: is this a restoration, a weekend project, or a high-performance build intended for track days? Then quantify the budget, including potential import duties, shipping insurance, and any required ecu reprogramming or validation work after installation. A tester’s mindset—planning for a bench inspection, a compression check, and a non-load dyno baseline if possible—can dramatically reduce risk. If you choose the consumer route, set a reserve for post-purchase inspection and the necessary contingencies for replacing worn components in the near term. If you choose the B2B route, sketch a parts list with substitutable options, and establish a lead-time plan that minimizes downtime in the shop while ensuring you have critical spares on hand. In either path, the Evo X engine’s reputation for robust performance when correctly assembled remains the anchor, a reminder that great power comes from attention to detail as much as from raw horsepower.

For readers who want a concrete bridge between this narrative and the broader market, a curated route of exploration proves useful. If you’re curious about how a dedicated Evo X parts ecosystem can be navigated with more granularity, a dedicated evo-x half-cut option represents a turnkey alternative that keeps the engine and primary front-end components together as a single unit evo-x-halfcut. This approach can streamline the path from purchase to testing, particularly for shops that want to minimize customization time and maximize consistency in fitment. It is not the only path, but it is a credible one, especially when reliability and mechanical compatibility take priority over the convenience of a single, stockreplacement engine.

As this marketplace evolves, it’s helpful to maintain a posture of informed skepticism and practical pragmatism. The assembled body of knowledge around Evo X engine sourcing suggests that the best outcomes arise from deliberate planning coupled with selective flexibility. Enthusiasts drawn to the direct pre-owned route should leverage buyer protections, insist on clear service histories, and use compression data to corroborate the engine’s internal health. Those drawn to the parts or bulk route should pursue a modular plan—treat the kit as a program rather than a one-off purchase—and keep a running log of component specifications, tolerances, and expected lifespan under the anticipated duty cycle. In both paths, the objective remains the same: to capture the Evo X’s distinctive blend of torque, response, and mechanical authenticity, and to translate that essence into a dependable platform for performance and enjoyment.

Beyond personal projects, the market’s structure offers a broader lesson about sourcing in the aftermarket. It demonstrates how a well-loved model can sustain a vibrant afterlife through a mix of consumer marketplaces and global B2B networks, even after production ends. It also highlights the importance of bridging the gap between engineering intent and supply-chain reality. Whether you’re chasing a single replacement engine to drop into a garage project or assembling a tuned package for a showroom-ready build, the present landscape rewards buyers who pair technical diligence with financial prudence and logistical foresight. If you treat the process as a careful dialogue between knowns and unknowns—knowns like engine family, bore, and compression, and unknowns like the exact condition of critical seals—your chances of realizing a successful outcome rise markedly. The Evo X engine, with its compact 4B11T heart, continues to be a compelling canvas for those who value drivability, heat management, and the clean, visceral feel of a turbocharged four that has endured in enthusiast lore. The road to ownership, after all, is as much about assembling the right elements as it is about turning the key and hearing the engine come alive.

External resource: for a broader perspective on sourcing strategies in this niche, see the external guide that aggregates insights from multiple suppliers and buyers in 2026. https://www.b2b-supplier-guide.com/evo-x-engine-producers-sourcing-guide-2026

Rally-Bred Power on the Market: Navigating Evo X Engine Sales and Aftermarket Upgrades

The market for the Evo X engine and its parts reads like a map folded over a blueprint of performance potential. You can find a spectrum of options, from complete, pre-used powerplants that once swallowed miles of open road and winding mountain passes to a bustling ecosystem of aftermarket hardware that promises to spray more vigor into an already spirited four-cylinder heart. Buyers arrive with different goals: some want a turnkey replacement to keep a road car on the move, others seek a platform to build a purpose-built machine, and a few arrive with a plan to stitch together a high-boost, track-ready engine that still drifts on the edge of reliability. What ties these paths together is a shared demand for clear history, robust parts, and a willingness to navigate a marketplace that spans continents and language barriers. The story of Evo X engine sales is, in essence, a story about balancing immediacy with intention, and about understanding what your build actually needs before the first bolt is turned.

On one side of the spectrum, you’ll encounter offerings that are straightforward in intention: a complete engine, jettisoned from a donor car or built to a specification that can be dropped into a chassis with minimal fuss. In the listings I’ve reviewed, a typical scenario is a used 2.0-liter turbocharged core labeled for a specific era of the Evo X, often described with mileage, compression expectations, and a promise of compatibility with the model’s ECU and turbo architecture. When a seller states that an engine is ready for “immediate purchase” and ships with free delivery, what the buyer should hear is a signal that the listing is designed for efficiency as much as it is for performance. It’s not just about the price tag; it’s about the confidence that a dealer stands behind the core they’re offering, and about the buyer’s ability to verify the condition through a set of practical checks—the kind that turn a risky impulse into a level-headed investment. In markets where the core is sourced from Japan’s JPDM tradition or from a local salvage yard that has earned a reputation for careful documentation, the sense of reliability grows with every piece of evidence. The appeal of a complete engine lies in the absence of guesswork: you bolt it in, tune around it, and you hope the miles behind it were well spent rather than misused.

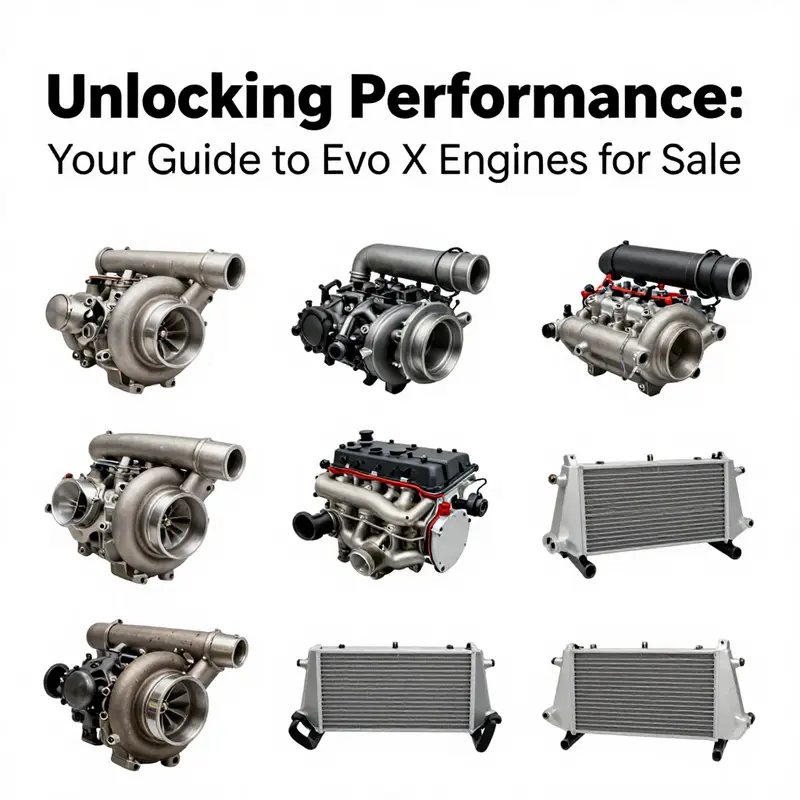

On the other side lies the world of parts and componentry. Here the Evo X is a canvas for customization, a platform that invites you to pick and choose upgrades with a clear sense of your intended outcome. A wholesale marketplace in a major manufacturing economy will list a suite of parts designed to live under the hood of a 4B11-based powerplant. Turbochargers, intercoolers, exhaust manifolds, camshafts, and tuning kits populate the catalog, but so do engine radiators, cooling fans, and a curated set of internals meant to handle additional boost and more aggressive timing. The value of these parts rests less on the price tag and more on their credibility: the origin of the component, its compatibility with the Evo X layout, and its proven performance in a system that can handle the added stress of higher outputs. Buyers who chase a parts-driven upgrade often pursue a different rhythm than those who replace a complete engine: they chase incremental gains, long-term durability, and the ability to swap pieces in and out as goals evolve. The result is a marketplace that rewards patience and technical curiosity as much as it rewards budgetary flexibility.

In this landscape of choices, the intake of knowledge matters as much as the intake of air. The Evo X engine family, with its 2.0-liter turbocharged inline-four configuration, has earned a reputation for linear torque delivery and a responsive throttle that many drivers associate with rally-bred heritage. The engine block and its related subsystems become a hotbed of possibility when you peer beyond a single price point. A used engine with modest mileage can feel like a safe bet, but it becomes even more appealing when paired with a clear service history, verifiable maintenance records, and a documented compression profile that demonstrates consistency across all cylinders. Such attributes reduce the uncertainty that often accompanies rebuilt cores or salvaged powerplants. That is not to say risk disappears; rather, risk becomes a known variable that a careful buyer can manage with diligence and due diligence. In the end, the decision is a balance: do you want the convenience of a complete, ready-to-run unit, or do you prefer the modularity of a parts-driven build that can be engineered to meet a precise target?

The aftermarket ecosystem around the Evo X is a living dialogue between engineering, tuning culture, and the practical realities of street legality and track readiness. The catalog of components reflects a community that has tested interactions between boost levels, cooling capacity, and combustion stability. Turbochargers and intercoolers take the outright horsepower target and translate it into measurable gains at the wheels; intake manifolds and exhaust systems shape the charge and the flow, influencing everything from spool speed to turbo surge behavior. Performance camshafts, valve springs, and a range of ECU tunes fill the space between raw hardware and controlled, repeatable performance. This is where the Evo X becomes more than a car; it becomes a project that invites iteration and experimentation. Buyers who embrace this culture will often pursue a staged approach: establish a reliable baseline with a solid core, then layer in upgrades that improve efficiency and robustness at each milestone of the build.

A practical approach to sourcing emphasizes three pillars: provenance, compatibility, and logistics. Provenance matters, because a credible seller will share a known mileage figure, a documented service history, and, ideally, a recent inspection report. When you buy a complete engine, you want to know what was done in the run-up to removal—whether the timing gear was refreshed, whether oil consumption was stable, and whether there were signs of prior head work or turbo leakage that could influence the engine’s future life. Compatibility is equally crucial. An engine might physically fit a car’s engine bay, but to perform reliably it must speak the same language as the ECU and the transmission pairing. The Evo X engine program benefits from a clear mapping between engine code, block casting, and turbocharger specification. That is why it is wise to verify roster data before committing to a purchase; a simple mismatch can cascade into costly rework and extended downtime.

Logistics, finally, is the difference between a transaction that excites and one that disappoints. International shipments, customs classifications, and import duties can dramatically shift the total landed cost of a core or a kit. Some sellers use protective packaging that minimizes the risk of transport damage and provide tracking that keeps a buyer informed through the transit. Others rely on freight forwarders who can consolidate shipments or facilitate cross-border returns if a problem arises. Sellers who offer “free shipping” are often hedging the total landed cost, but buyers should read the fine print: does the service cover inland delivery to their address, or only door-to-door within a metropolitan hub? These are the small but consequential details that define a purchase’s ultimate value.

For those who prefer a more targeted upgrade path, there is also a robust opportunity to explore specialized components that can serve as the foundation for higher-performance builds. A key example that forum chatter and performance shops discuss is the engine block—the core structure that holds everything together. In the Evo X world, there are options for enhancing the block itself to support increased boost and higher-power goals. A billet-block option represents a compelling case study in modern performance engineering; it exemplifies how a higher-precision component can contribute to reliability under load and enable aggressive tuning without compromising structural integrity. The practical step here is to consider a block upgrade not as a stand-alone purchase but as a foundational piece in a broader plan. If you’re contemplating such a path, note that dedicated suppliers can provide the billet block as a core upgrade that will endure as you push the engine toward higher horsepower targets. For reference and potential sourcing, see a dedicated billet-block option such as this: 4b11t-billet-block. This is not a casual add-on; it’s a deliberate investment in the engine’s future resilience as you advance your build, whether you chase street performance or circuit pace.

To ground this discussion in real-world expectations, it’s useful to consider the practical difference between an engine as a complete unit and a set of aftermarket parts that is designed to work together. A full engine purchase often represents the easiest path to road readiness. It minimizes the risk of misalignment between parts, ensures that the core’s internals are compatible with the car’s intake and exhaust logic, and provides a coherent operating map when paired with an appropriate tune. Yet for enthusiasts who want to tailor their experience, parts-oriented upgrades allow customization that can yield benefits such as cooler intake air, faster spool, or reduced weight in specific areas. The process of building from the ground up is a discipline in itself, drawing on a knowledge base that includes engine dynamics, turbocharger behavior, and the realities of fuel and ignition management in street-legal conditions.

In examining the broader landscape, it is clear that the Evo X engine market rewards informed buyers who respect both the art and the science of high-performance tuning. If you are in the market for a complete engine, you are seeking a balance of reliability and predictability that aligns with a straightforward installation. If you are shopping for aftermarket parts, you are entering a collaborative community where engineers, tuners, and hobbyists share data on boost targets, cooling capacity, and fuel mapping. In either case, your decisions should be guided by a clear set of criteria: verified engine history, compatibility with your chassis and ECU, the credibility of the supplier, and a realistic appraisal of the total cost of ownership, including installation, dyno tuning, and potential contingency for future upgrades.

As you move from consideration to action, you will likely encounter two paradoxes that shape the Evo X’s engine market: scarcity and abundance. Scarcity appears in the form of pristine, low-mileage complete engines from a specific model year window, or in the rare, highly engineered components designed for extreme levels of boost. Abundance manifests in the wide range of aftermarket parts that can be mixed and matched to create personalized performance profiles. The savvy buyer navigates this paradox by anchoring a plan in a preferred outcome—street speed, track reliability, or a balanced blend—while letting the marketplace reveal the practical steps needed to reach that outcome. It’s a journey that rewards patience, technical literacy, and a cautious curiosity about the origin and condition of every piece brought into the build.

Finally, the Evo X engine market illustrates a larger truth about modern performance culture: high-performance components are not merely about raw horsepower. They are about controlled power, predictable behavior, and a consistent development path. The complete engine offers immediate capability and a gateway to dependable performance. The aftermarket parts world offers customization, enabling builders to tailor response curves, cooling efficiency, and power delivery to their preferred driving context. In either direction, the core objective remains the same: to translate the rally-inspired legacy of the Evo X into a road- or track-ready experience that is as satisfying to drive as it is to own. When you approach the market with discipline, you can turn a simple purchase into a durable platform for growth, learning, and the kind of driving that rewards anticipation as much as execution.

External resource: https://www.ebay.com/sch/i.html?_nkw=aftermarket+engine+parts+for+mitsubishi+lancer+evolution+x

Beyond the Price Tag: Sourcing and Value of the Evo X 4B11T Engine for Sale

The Mitsubishi Lancer Evolution X has long stood as a benchmark in the world of rally heritage and street performance. When the moment comes to replace an aging powerplant or to build a project from the ground up, enthusiasts gravitate toward the Evo X engine, the 4B11T turbocharged inline-four that powered the final wave of a legend. The search for an Evo X engine for sale is never merely a matter of chasing the lowest price; it is a careful balancing act between condition, completeness, and the proven potential of the platform. In practical terms, the most straightforward route to a ready-to-fire replacement is often a complete, used engine sourced from reputable marketplaces that specialize in JDM and performance hardware. On a platform like eBay, for example, a pre-owned Mitsubishi Evolution X motor from the late 2000s to mid-2010s—specifically a 2009–2015 Lancer Evolution X 4B11T Turbo Engine labeled as Ralliart or JDM—can surface with a price around the high three-thousands, typically just under the $4,000 mark, and with the possibility of best offers and free delivery within the United States. The market value for such a unit reflects not only the engine’s mechanical robustness but also the desirability of a powerplant that has proven friendly to tuning and reliable under track or street conditions. This price point presents a practical balance for a buyer who aims to restore a Evo X or to implement a high-performance upgrade without embarking on a complete rebuild from scratch. It is important to understand the context of that price: the Evo X, and the 4B11T family, represent a mature generation of a platform whose production ceased in 2016. Yet enthusiasts continue to prize these engines for their tunability, durability in stock form, and the availability of aftermarket support that can take a build from stock to seriously competitive in short order.

Beyond the base value of a complete, used engine, the purchasing landscape widens when you consider the breadth of components that service the Evo X ecosystem. In China, wholesale platforms and regional suppliers offer a different kind of value proposition. Guangdong’s manufacturing hubs, including Guangzhou and Shenzhen, along with Chongqing and Yantai in Shandong, are notable centers where engine components and assemblies can be sourced at cost-efficient scales. The range here is broader than a single engine; it encompasses turbochargers, radiators, manifolds, and other critical subsystems that Evo X owners frequently replace as maintenance or upgrades demand. A typical listing might feature a TD05HA-152G6-12T turbocharger compatible with the 4B11T engine codes—this part is tailored to engines carrying numbers like 49378-01631 and 21595176—alongside essential cooling components like radiators designed specifically for the Evo X cooling loop. The benefit in this wholesale model is clear: economies of scale enable lower per-unit pricing for bulk orders, which suits shops, race teams, or individual builders who plan to refresh multiple engines or stock spare parts in advance. The caveat, however, is equally clear. Wholesale channels favor bulk procurement and lead times, and they require a different risk calculus: greater exposure to supply chain variability, the necessity for clear specifications, and a readiness to manage import logistics. A buyer must decide if they want a complete engine, a lean set of core components, or a combination that supports a rebuild with upgraded parts.

For a buyer focused squarely on a complete engine, the eBay route remains the most direct. A complete 4B11T-powered Evo X unit can offer a more predictable path to installation, provided the listing details are scrutinized. Key questions should include the engine’s stated mileage, whether the unit includes ancillary components such as the wiring harness, ECU, intercooler piping, intake manifolds, and exhaust hardware, and whether the unit is a true drop-in replacement or a more stripped-down core that requires substantial reassembly. Experienced buyers look for evidence of engine health in listings: compression test results, evidence of proper maintenance, and a clear history of use. In addition to the mechanical health, buyers should factor in shipping risk. A complete engine shipped from a seller across the country or from overseas can incur transport damage or delays, adding to the total cost of ownership. The value proposition is strongest when the listing provides a transparent history, reasonable mileage, and a reasonable likelihood that the unit will perform reliably once installed and tuned.

When the project shifted toward a larger build, or when a shop intends to harvest components for multiple Evo X vehicles or other Mitsubishi platforms, the Chinese wholesale route becomes particularly appealing. The parts themselves—whether the turbocharger, radiator, or even a billet-block option for the 4B11T—can be procured with confidence when the supplier’s documentation is thorough and the minimum order quantities are workable. A notable resource for performance-minded builders is the concept of a billet block for the 4B11T, which represents a serious upgrade path for bottom-end robustness in high-boost builds. The billet-block page is a focal reference point for those who want to push the engine beyond stock tuning while maintaining track-friendly reliability. For readers exploring this avenue, the internal page linked here provides a tangible sense of the upgrade options available for the Evo X powerplant: 4B11T billet block. This kind of componentry is not a throwaway purchase; it is a long-term investment in the engine’s durability at elevated power levels. It is a reminder that the Evo X engine is not simply a bolt-in replacement but a platform that invites thoughtful upgrades as part of a larger performance strategy. When considering a billet block or other high-end internals, the overall lifecycle costs—purchase price, installation, tuning, and potential future maintenance—must be weighed against the anticipated performance gains.

The decision-making process around the Evo X engine for sale also benefits from a broader view of installation and compatibility. The 4B11T is a modern, turbocharged, inline-four design with a reputation for strength and a learning curve that many builders embrace. A complete engine is typically designed to be pluggable into Evo X applications with appropriate mount alignments and compatible electronics, but this is not guaranteed across all listings. A crucial step in the purchasing process is verifying that the engine’s ECU, wiring harness, and accessory drives align with the rest of the Evo X’s powertrain architecture. Even with a complete unit, installations can require adapters, new engine mounts, or reconfigured exhaust and intake plumbing to ensure optimal performance and clearance. In some cases, a buyer may face the choice of reprogramming or replacing the ECU to accommodate new sensors, injectors, or turbo configurations. The careful buyer builds a plan that accounts for these contingencies before money changes hands, preserving the value of the investment.

As a practical matter, the economics of buying an Evo X engine are inseparable from the maintenance philosophy of the buyer. A typical Evo X engine project combines the core cost of the engine with the price of necessary upgrades, the costs of shipping and handling, and the anticipated expenses of installation. For many, a complete engine at around the $4,000 range is a compelling starting point, especially when one considers the age of the platform and the depreciation of newer JDM powerplants relative to the Evo X’s own enduring appeal. The decision to move toward a full engine versus component-by-component procurement hinges on one’s budget, the intended use of the vehicle, and one’s capability to perform or supervise installation work. Enthusiasts who aim for a track-ready setup often lean toward obtaining a billet-block option or other upgraded internals to suit higher boost levels, greater reliability under sustained stress, and a longer service interval between major overhauls. In that context, the Evo X engine is less a static purchase than a long-term project, with the value rooted in the engine’s adaptability and the breadth of aftermarket support.

The sourcing landscape also asks buyers to consider the broader ecosystem of Evo X parts and how they integrate with a complete vehicle program. The phrasing of a listing can reveal much about what is included and what must be sourced separately. A straightforward, full engine swap is typically simpler and faster, but for builders who want greater control over every facet of their replacement powertrain, the emphasis shifts toward assembling pieces that fit precisely and maintain OEM reliability where possible. The Evo X engine is widely celebrated for its potential to yield high performance with careful tuning, reliable drivability in daily use, and a surprisingly broad aftermarket that offers everything from basic maintenance parts to advanced, high-performance components. That ecosystem is what keeps the market robust, whether buyers search on consumer marketplaces that emphasize convenience or on wholesale platforms that target volume purchases and custom builds.

In this light, the buyer’s due diligence becomes the most valuable currency. A seller’s transparency about mileage, service history, and completeness of the engine package can dramatically alter the perceived value. A listing that promises a high-mileage engine but offers fresh seals, upgraded components, and a meticulous rebuild plan might be a better long-term asset than a lower-mileage unit that lacks essential accessories or has incomplete documentation. Side by side with the purchase decision is the question of warranty or seller assurances. Some listings may offer limited warranties or return policies, while others may provide no guarantees beyond the engine’s physical delivery. For a project that often requires significant downtime and installation effort, such assurances can translate into meaningful risk mitigation.

The Evo X engine thus sits at the intersection of passion and pragmatism. It is a product that invites builders to imagine what the final vehicle could become: a street machine with track-tuned responsiveness, or a restoration project that recovers a classic breath of rally culture with modern reliability. The price tag is a starting line, not a finish line. The complete, used Evo X engine offers a reliable baseline for restoration, the wholesale market opens doors to a wider array of components and bulk orders, and the billet-block pathway presents a horizon of high-performance resilience for serious builds. The decision to pursue one route over another, and the careful budgeting that accompanies it, will determine not only the engine’s initial performance but its longevity and the satisfaction of the project over time.

For readers who want a concrete example of the current market dynamics, a representative eBay listing from the Evo X engine space shows a pre-owned 2009–2015 Mitsubishi Evolution X Motor Ralliart 2.0L 4B11T Turbo Engine labeled as JDM, priced around the mid-four-thousands, and often accompanied by options for best offer and free US delivery. This snapshot illustrates how the market values a complete engine in reliable condition while acknowledging that the true total cost of ownership includes shipping, potential import fees if purchased internationally, and the costs of any required ancillary hardware. It also highlights the practical reality that such engines remain highly desirable for enthusiasts who want to preserve or elevate the Evo X’s performance profile rather than accept a generic, non-OEM replacement. External resources that document these listings can provide additional context and real-world pricing to calibrate expectations as buyers plan their purchase, installation, and any subsequent upgrades. To review a current, representative listing, see the external resource linked here.

External resource: https://www.ebay.com/itm/2009-2015-Mitsubishi-Evolution-Evo-X-Motor-Ralliart-2-0l-4b11-Turbo-Engine-JDM/403788823978

Global Demand and Sourcing Strategies for Evo X Engines: A Practical Guide for Buyers

The market for Evo X engines has matured into a global ecosystem. Enthusiasts, garages, and small businesses now source complete engines, rebuilt cores, and high-performance parts from a wide network. Demand centers include North America, Western Europe, and Australia. These regions have strong aftermarket cultures. They also host many vehicles that require engine replacement or upgrades. Understanding the market means balancing reliability, cost, and logistics.

Across regions, three buyer profiles dominate. First, private owners seeking a dependable replacement for a daily driver. They prefer rebuilds that carry warranty and verified mileage reports. Second, builders and tuners who chase performance gains. They want high-quality OEM cores and aftermarket upgrades. Third, dealers and resellers who buy in volume. They prioritize predictable supply, certification, and margins. Sellers must adapt to the needs of each profile to remain competitive.

A major trend is the shift from raw used cores to remanufactured engines. Remanufactured units promise consistency and reduced risk. They often include valve work, balanced rotating assemblies, and upgraded bearings. For daily drivers, this reduces the likelihood of early failure. For track-focused cars, remanufactured cores offer a stronger starting point. Sellers offering documented teardown reports and component lists command higher prices. Buyers are willing to pay a premium for transparency.

Platforms that facilitate cross-border transactions play a central role. Online marketplaces provide visibility and logistics tools. They allow sellers to present photos, service history, and shipping options. Listings for complete 4B11T engines routinely highlight features such as upgraded turbo compatibility and reinforced block components. For many buyers, the ability to purchase with a clear return policy matters as much as the asking price. Listings that include freight and handling simplify the decision process.

China-based suppliers are now essential to the Evo X supply chain. Manufacturing clusters in coastal provinces and inland industrial zones have invested in CNC machining, heat treatment, and quality control laboratories. These suppliers serve both B2B and B2C customers. They produce OEM-equivalent parts and specialized upgrades. High-volume suppliers can offer lower per-unit pricing. They also often support sample testing and small production runs. For buyers making larger purchases, these suppliers provide cost effectiveness coupled with customization options.

An important segment is performance aftermarket parts. Turbochargers, strengthened blocks, radiators, and ignition systems are in high demand. Turbos like the TD05-series models remain popular for their balance of spool and top-end power. Radiators designed for improved flow and cooling efficiency address overheating under load. Suppliers marketing these components now provide flow charts and dyno results. Buyers evaluating such parts should request test data and material certifications.

Quality assurance is shaping buyer behavior. More customers require supplier verification, factory audits, and documented certifications. This helps reduce the risk of counterfeit or substandard items. Certifications such as ISO and CE are common checkpoints. Verified supplier programs and escrow payment methods also protect buyers. Sellers that publish inspection protocols and third-party test results navigate international markets more effectively. Over time, these practices reduce returns and improve reputation.

Logistics and compliance are practical realities that influence purchasing decisions. Export paperwork, customs duties, and shipping insurance add to total cost. Many sellers offer door-to-door shipping and consolidated freight options. Buyers should verify HS codes for engines to estimate duties and compliance needs. Some countries impose strict emissions or safety regulations that affect engine swaps. Installing an engine without matching emissions controls can create legal and registration issues. Buyers should factor these constraints into budget and timelines.

Pricing signals in the market vary by engine condition and documentation. Low-mileage used engines with service records command higher prices. Remanufactured units cost more but lower long-term risk. Half-cut units offer a middle ground. They provide the engine, transmission, and ancillary components at reduced cost. For people who need a near-complete drivetrain with easier fitment, half-cuts are attractive. However, half-cuts require careful inspection for collision damage and wiring harness condition. Request full photographs and compression tests before committing.

Warranty and after-sales support influence buyer confidence. Some remanufactured engines come with a limited mileage warranty. Others offer only terminal failure coverage. Buyers should review warranty terms carefully. Look for coverage on internal parts, workmanship, and shipping damage. A clear returns policy and a neutral dispute resolution process are valuable additions. Sellers that stand behind their products with repair or replacement options build repeat customers.

For those focused on upgrades and durability, upgraded engine blocks and reinforced internals are worth considering. Aftermarket billet or sleeved blocks increase strength for high boost and high-rev applications. They often require careful engine management and supporting hardware. Buyers should plan for compatible ECU tuning, fuel system upgrades, and cooling enhancements. Upgrading a block is only one part of a cohesive build. Successful projects consider the whole system.

Sourcing strategies differ by buyer intent. Private buyers may prefer single-unit marketplaces with buyer protection. Tuners and shops often use wholesale platforms and direct supplier relationships. Establishing a local inspection routine for incoming engines speeds turnaround. A quick compression and leak-down test, a visual inspection of mounting points, and a check of the wiring harness can reveal hidden issues. For higher-value purchases, independent third-party inspections can validate claims.

China suppliers often support sample orders, which reduces risk for international buyers. Sample testing helps verify material and fitment before committing to bulk buys. Negotiation of minimum order quantities and lead times is typical. Verified suppliers leverage factory certifications during negotiation. They may also provide machining or modification services. For buyers seeking bespoke solutions, these offerings can be cost-effective compared with custom domestic machining.

Payment methods also play into trust. Escrow-based payments, letter of credit, or platform-handled payments protect both parties. Sellers that accept secure payment routes can attract more international buyers. Avoid wire transfers without contract terms. Use payment methods that allow recourse if merchandise is misrepresented.

Technical documentation and fitment assurance matter for installation success. Buyers should confirm engine mounts, bellhousing patterns, and ECU compatibility. Wiring harness adapters and compatible transmissions mitigate installation headaches. Some sellers include sensors and harness adapters. Others sell core engines only. Clarify what is included before purchase.

Sustainability and salvage markets are evolving. Engines recovered from salvage vehicles find new life through remanufacturing. This reduces waste and lowers costs. Rebuilders that source salvage cores can provide competitive pricing. They also contribute to a circular economy within the community. For buyers, this can be an economical route when paired with proper quality checks.

Market transparency is improving. Listings with dyno sheets, teardown photos, and component-level warranties outperform vague advertisements. Buyers gain confidence from visible evidence. This helps raise the overall quality of available inventory. Consequently, sellers that invest in documentation and verification tend to see higher conversion and better reviews.

Finally, buyer education is critical. Knowing how to evaluate compression tests, recognizing signs of gearbox or turbo damage, and understanding local import rules reduces risk. Planning for installation costs, ancillary parts, and tuning completes a responsible purchase. For many buyers, pairing a remanufactured engine with a trusted local shop yields the best balance of cost and reliability.

If you are evaluating engine options with reinforced cases, check resources on upgraded block offerings, like the 4B11T billet block, for part compatibility and upgrade pathways. For sourcing specific complete 4B11T turbocharged engines and listings, consult a detailed product page that aggregates supplier information and technical details. https://www.alibaba.com/product-detail/Mitsubishi-Lancer-EVO-X-2-0L-4B11T-Turbo_1600348797245.html

These market dynamics have created a professionalized, transnational supply chain for Evo X engines. Buyers who focus on verified suppliers, documented quality control, pragmatic logistics planning, and clear fitment information will secure the best outcomes. Sourcing from established channels, and using inspection and escrow mechanisms, reduces risk. The result is a healthier market for both sellers and buyers, and stronger support for the Evo X community worldwide.

Final thoughts

Understanding the landscape of Evo X engines is crucial for business owners in the automotive sector. With diverse purchasing options, a dynamic aftermarket parts market, thorough cost analysis, and insights into international trends, businesses can make informed decisions. This holistic view equips automotive professionals to enhance their offerings, ensuring they remain competitive in this niche market. Leverage this knowledge for strategic growth in your automotive business.