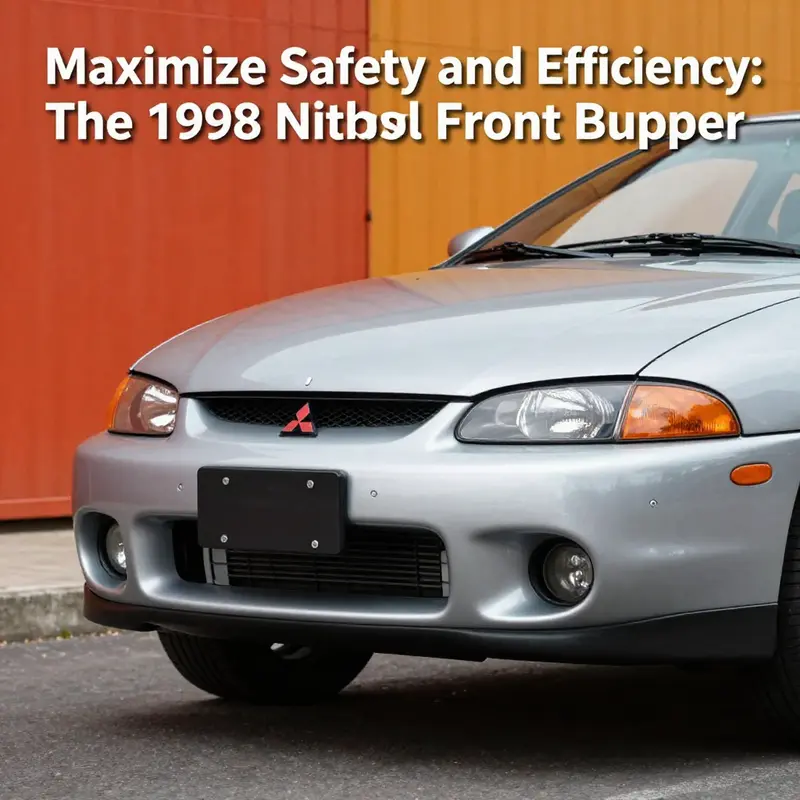

The front bumper of the 1998 Mitsubishi Eclipse is crucial for vehicle safety, serving as the first line of defense in collisions. This article delves into the importance of this component, its market availability, quality and compatibility concerns, B2B supply chain aspects, and its impact on vehicle safety. By exploring these areas, business owners can better understand the value of this part within the automotive industry, paving the way for informed purchasing and sales strategies.

Beyond Appearances: The Function, Fabrication, and Sourcing of the 1998 Mitsubishi Eclipse Front Bumper

The front bumper on a 1998 Mitsubishi Eclipse does more than shape the car’s face. It is a functional assembly engineered to absorb low-speed energy, protect the car’s structure, and support several accessory elements. Understanding its construction, how it performs in common incidents, and where replacement units come from helps owners choose wisely when repair or replacement is required.

At its core, the 1998 Eclipse front bumper is formed from impact-resistant thermoplastic. Materials such as polypropylene or ABS are commonly used because they balance stiffness with controlled deformation. The outer cover is a sculpted shell designed to redirect airflow and hide the reinforcement behind it. Behind that shell sits an energy-absorbing element—often a foam or honeycomb liner—and a metal or polymer reinforcement bar that ties into the vehicle’s front structure. Together, these layers give the bumper the ability to compress and dissipate energy in a minor collision, protecting the radiator support, headlights, and other front-end systems.

This assembly also integrates functional features. The 1998 design includes housings for fog lights, which align with the car’s original lighting geometry. Those housings are molded into the cover or attached as secure brackets. Mounting points for the grille and license plate bracket are incorporated into the same piece, so a damaged cover can affect several fitment areas. While contemporary bumpers sometimes include sensors and active systems, the 1998 Eclipse’s bumper focuses on structural protection and accessory integration rather than electronic detection.

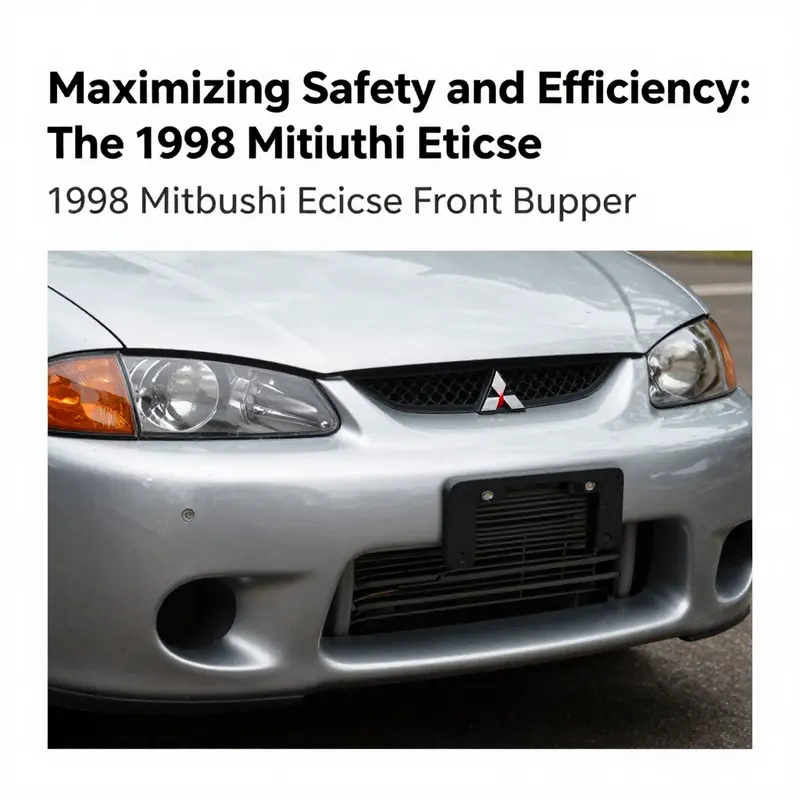

When considering a replacement, buyers face a few decisions: choose an original-style cover, a direct-fit aftermarket piece, or a used OEM part salvaged from another vehicle. New direct-fit aftermarket covers are usually molded to match the original contours. They arrive primed or unpainted, ready for color matching. Used OEM parts offer perfect geometry and original finish options, but they may require repair for chips, scratches, or stress cracks. Reinforcement bars, foam absorbers, and mounting brackets may be sold separately, and it is important to confirm what a listing includes before purchase.

Fitment is a critical concern. A front bumper must align with factory mounting points to ensure proper gap widths and panel alignment. Poor fit can lead to excessive vibration or premature wear at attachment points. Many replacement covers are described as “guaranteed to fit” for specific model years. Even so, buyers should verify whether the listing includes the inner absorber and reinforcement, or only the painted outer cover. Professional installers typically recommend replacing the absorbent liner when the cover is replaced, as it loses some of its energy-absorbing capability after compression.

Beyond individual consumer needs, the supply chain for parts like this is global and tiered. Manufacturing hubs in East Asia produce large volumes of automotive exterior components. Coastal industrial regions offer economies of scale, experienced tooling, and fast shipping to international buyers. Factories there often handle both OEM and aftermarket orders. They can produce parts in batch runs, control surface finishes, and supply higher-volume buyers with consistent quality. For smaller, local orders, regional distributors or salvage yards remain practical sources.

Selecting a replacement also involves aesthetic and preparation choices. New covers may be fully painted to match a vehicle’s original color code or sent primed for local bodyshop painting. Paint-matched covers can reduce labor and lead time, but they require exact color codes and careful transportation to avoid damage. Unpainted covers save on initial cost and allow owners to control paint quality. When painting, proper surface prep and use of flexible automotive paints prevent cracking and ensure durability against road debris and UV exposure.

Installation touches on both safety and appearance. Mounting hardware should be inspected and replaced if corroded or deformed. Fasteners, clips, and brackets are small, but they maintain precise alignment and keep the cover firmly attached. If the reinforcement bar is bent or shows stress, it must be replaced to restore crash performance. Proper torque on fasteners and correct clip engagement help avoid panel gaps and produce a factory-like fit.

For owners balancing cost and reliability, a few practical tips help. Request a picture showing the underside and mounting points when buying used. Confirm whether fog light housings and grille attachments are included. Ask if the absorber and reinforcement are part of the sale. When procuring a painted cover, verify the color code and ask about paint match guarantees. For commercial buyers ordering in bulk, check factory capabilities for batch consistency and lead times.

The Eclipse front bumper also ties into broader maintenance decisions. Cosmetic repairs like sanding and repainting can restore a slightly damaged cover. However, if the inner absorber or reinforcement shows compression or distortion, replacement is the safer option. Even low-speed impacts can transmit force to structural components. Inspecting the radiator support, hood latch area, and headlight mounts helps identify hidden damage.

Owners looking for technical reference should consult the vehicle’s service manual for dimensional tolerances and torque specifications. Industry testing standards outline performance criteria for bumpers, but the service manual provides the mounting and trimming details needed for proper installation. For additional context on styling and related bumper options for different model years, you can review a page focused on a later-generation Eclipse front bumper to compare fitment and styling evolution: 2006-2008 Mitsubishi Eclipse front bumper.

Choosing the right replacement requires matching form, fit, and function. The 1998 Eclipse front bumper is a balance of material engineering, mounting precision, and accessory integration. Whether repairing a minor scrape or replacing a damaged assembly after an impact, understanding the bumper’s layered construction and the sourcing options available leads to smarter, safer decisions. For a direct listing related to parts compatible with this generation of vehicle, see the following resource:

null

null

Choosing a Front Bumper for a 1998 Mitsubishi Eclipse: Materials, Fitment, and Safety Considerations

Materials, Fitment, and Quality Standards

Selecting a front bumper for a 1998 Mitsubishi Eclipse requires a clear view of materials, fitment, and safety standards. The right bumper must do more than look good. It must align with factory mounting points, absorb impact forces, and resist weathering. For the 1997–1999 Eclipse range, common aftermarket options use two primary materials: urethane and fiberglass. Each has distinct strengths that affect durability, repairability, and fit.

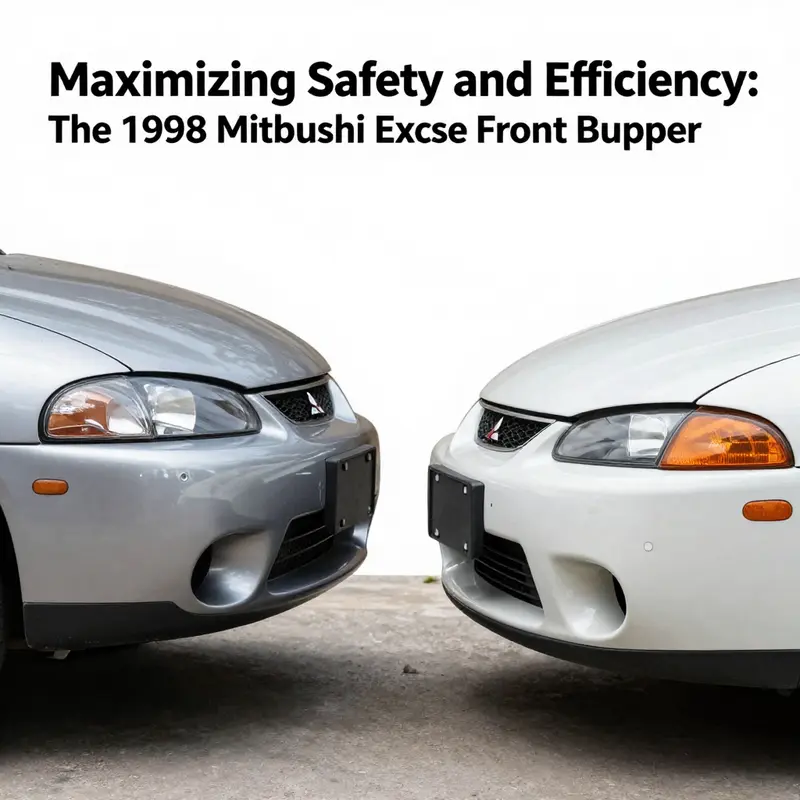

Urethane bumpers are valued for flexibility and impact resistance. They flex instead of cracking when subject to minor collisions. This makes them forgiving on rough city streets and useful for drivers who want a balance between OEM feel and aftermarket styling. Urethane also tends to return to shape more easily after small deformations. That reduces repair costs and extends service life. Precision molding gives urethane parts a snug alignment with original mounting points. For the 1998 Eclipse, that snug fit reduces gaps and minimizes the need for trimming during installation.

Fiberglass bumpers offer a different set of advantages. They are lightweight and often chosen by performance-minded owners. Fiberglass can be shaped into aggressive profiles that enhance airflow and reduce weight. Well-manufactured fiberglass parts blend fiberglass cloth and resins to create an acceptable balance of stiffness and flex. However, fiberglass is more prone to cracking under impact. Repairs require specific skills and materials, and small cracks can grow if left unattended. For drivers who push their cars on tracks or prefer radical styling, fiberglass remains a popular choice because of its sculpting versatility.

Material choice should reflect intended use. Daily drivers generally benefit from urethane’s resilience. Enthusiasts seeking unique styling or reduced weight may opt for fiberglass. Whatever material you choose, check that it adheres to industry standards for automotive parts. Reputable suppliers test for durability and UV resistance. Look for references to compliance with recognized safety standards and quality checks. These provide confidence that the part will behave predictably in a collision and stand up to environmental exposure.

Compatibility across the 1997–1999 Eclipse models is typically strong. These model years share chassis dimensions and mounting points. That uniformity simplifies sourcing a direct-fit replacement. Still, it is crucial to verify part numbers before purchase. Matching an OEM part number or a verified aftermarket reference reduces the risk of ordering an incompatible bumper. If you are replacing a bumper on a 1998 Eclipse, cross-check the part number with the seller and with a trusted parts catalog to ensure the piece aligns with your vehicle’s sub-model and options.

Quality assurance begins well before installation. Inspect the bumper for even molding, consistent surface texture, and properly located mounting tabs. Factory-sealed packaging is a positive sign. It often indicates the part left a controlled environment and was protected during shipment. If a listing claims a direct replacement for the 1997–1999 range and shows factory-sealed packaging, that suggests alignment with original equipment specifications. Still, buyer reviews and fitment photos from other owners add a practical layer of assurance. Those real-world experiences highlight any trimming, filler, or reinforcement the part might require.

For large-scale buyers, the supply chain matters. Manufacturers in established automotive parts regions often provide OEM or OEM-style production runs. These factories can offer customization, consistent quality, and competitive pricing for bulk orders. When sourcing multiple units, request samples and detailed quality reports. Confirm that paint adhesion, material density, and mounting hole tolerances meet expectations. Bulk buyers should also verify lead times and packaging standards to avoid delays and reduce transit damage.

Installation and finishing determine the final appearance and performance. Even correctly molded bumpers can require minor adjustments. Align the bumper to hood and fender gaps to maintain factory lines. Test mounting points before final tightening to prevent stress cracks. If painting is required, use appropriate primers and UV-resistant topcoats. Proper surface prep extends paint life and prevents peeling. Reinforcement brackets or impact-absorbing foam may be necessary for some aftermarket configurations. These components restore the original energy management characteristics and should be installed as part of the replacement process.

When evaluating purchase sources, use multiple information points. Product images, user feedback, and verified fitment notes create a fuller picture than a single specification sheet. Photos from owners who installed the bumper on the same model year highlight real fitment results. Reviewers often point out common workarounds for minor fitment issues. Those tips can save hours during installation and help you budget for paint, hardware, or slight trimming.

Safety considerations should guide final decisions. While many aftermarket bumpers aim to match factory performance, the presence of proper reinforcement, energy-absorbing materials, and correct mounting geometry matters most. A visually perfect bumper that lacks structural reinforcement may compromise the vehicle’s crash performance. Prioritize parts that specify reinforcement compatibility or include the necessary brackets and foam inserts.

For hands-on reference, there are resources that show how front bumpers for later Eclipse generations are shaped and fitted. That practical perspective can inform expectations when sourcing and installing parts for a 1998 model. See this guide to a later-model front bumper for comparative insights: 2006–2008 Eclipse front bumper resource.

If you want an example listing to review packaging claims and fitment language, consult this product link. It illustrates how sellers present direct-replacement bumpers and factory-sealed items: https://www.amazon.com/dp/B07XJFVZQW

Balancing material, fitment verification, and quality assurance will yield the best outcome. A well-chosen bumper restores appearance, preserves safety, and minimizes future repairs. For the 1998 Mitsubishi Eclipse, focus on parts that match mounting points, meet quality standards, and include or accommodate reinforcement. That approach ensures a replacement that looks right and performs as intended.

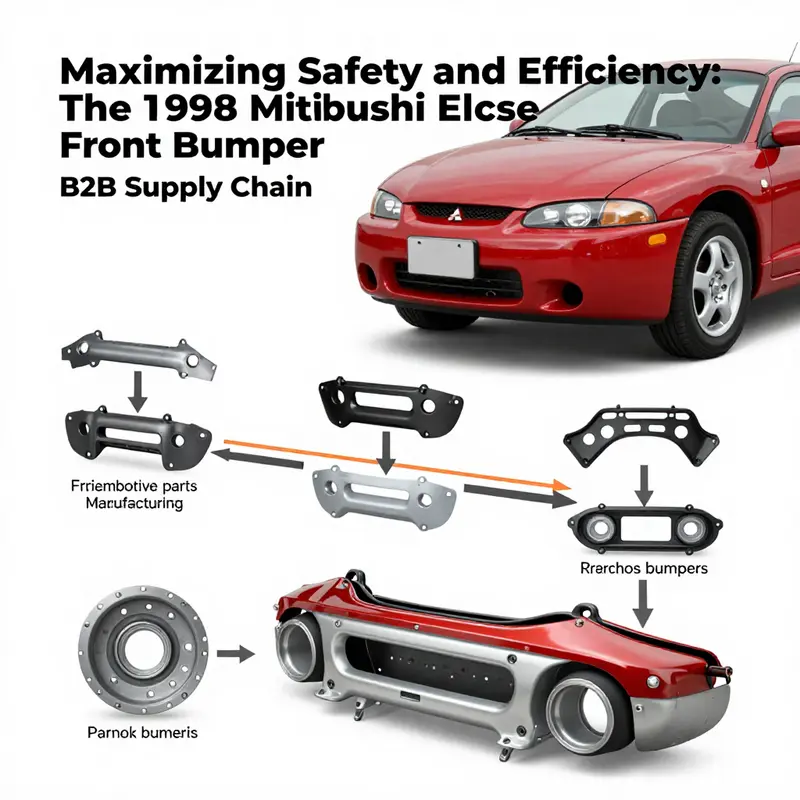

Building a Reliable B2B Supply Chain for 1998 Mitsubishi Eclipse Front Bumpers

Supply chain dynamics and manufacturing realities

The market for front bumpers compatible with the 1998 Mitsubishi Eclipse is anchored by a mature aftermarket supply chain. Demand is steady because the vehicle remains a common restoration and replacement target. That stability shapes how procurement teams, distributors, and manufacturers design partnerships, plan inventory, and set quality gates. For buyers seeking volume pricing and consistent lead times, the optimal approach balances technical due diligence with practical logistics and commercial negotiation.

Manufacturing capacity for this niche is concentrated in coastal industrial regions of China. Clusters around major cities combine tooling shops, injection molding lines, composite shops, and finish houses in close proximity. This geographic density lets suppliers offer end-to-end services: prototyping, mold making, sample production, painting, and final assembly. For bumpers, the critical manufacturing steps are material selection, mold precision, surface finishing, and logistics readiness.

Material choices typically favor impact-resistant thermoplastics and flexible polyurethanes. ABS blends deliver a good balance of dimensional stability and cost efficiency. Polyurethane formulations offer superior flex and resistance to minor impacts. Fiberglass and composite processes remain an option for specialty or low-volume runs where low tooling cost outweighs per-unit labor. Procurement managers must specify performance targets: tensile strength, flex modulus, UV resistance, and paint adhesion. These parameters guide material selection and supplier scoring.

Tooling drives time and cost. High-precision steel molds produce consistent parts at scale but require significant upfront investment. Aluminum molds lower initial cost and shorten lead time, but they wear faster. For buyers, amortizing mold cost across expected volume is essential. A typical strategy is to lock favorable unit pricing with a supplier in exchange for partial tooling cost sharing. Technical validation during mold trials should include dimensional verification, fit checks on a vehicle jig, and paint adhesion tests. 3D scan comparisons to OEM CAD or to a master part reduce subjective fit debates.

Surface finish and paint are non-negotiable for many customers. A bumper must match a vehicle’s lines and primer/paint quality expectations. Integrated finish houses in the production cluster offer wet paint and powder coat options, along with primer and clearcoat processes. Color match can be achieved with spectrophotometer data and controlled batches. Buyers should include surface finish tolerances and gloss targets in contracts and require batch-wise color reports for consistency.

Quality management spans in-line inspections, sample approval processes, and pre-shipment checks. Core inspection points include wall thickness uniformity, gate vestige locations, mounting boss accuracy, and grille or fog light cutout dimensions. Third-party inspection agents can perform random sampling during production runs. A practical inspection checklist accelerates issue detection and reduces rework at arrival. For larger contracts, arrange pilot runs followed by a slightly larger pre-production batch to confirm every step before full-scale manufacture.

Logistics and export readiness are competitive differentiators. Major port access and experienced freight forwarders provide predictable transit times to North America, Europe, and other markets. Buyers should negotiate Incoterms that match their risk tolerance. Sea freight remains cost-effective for full-container loads, while air freight suits urgent, low-volume shipments. Proper palletization, protective corner guards, and shrink wrap reduce damage rates. Many suppliers offer consolidated shipments and drop-shipping solutions for distributors who sell to multiple retailers.

Documentation and regulatory compliance add friction that must be managed early. Required paperwork can include commercial invoices, packing lists, certificates of origin, and material conformity statements. For certain markets, additional documentation may be needed for environmental or safety compliance. Engaging a customs broker familiar with automotive components will reduce clearance delays and unexpected duties. For high-volume programs, consider registering supplier facilities in preferred trader schemes to reduce customs friction.

Commercial terms hinge on minimum order quantities, lead times, payment terms, and warranty policies. MOQ is often driven by tooling amortization and production efficiency. Expect shorter lead times and better unit pricing for buyers willing to commit to larger volumes or to provide forecasted demand. Payment terms vary; common arrangements include partial deposit for tooling, followed by staged payments tied to milestones. Warranty clauses should address fitment defects, material failures, and paint issues. Clear return and replacement procedures reduce disputes and speed resolution.

Supplier selection should include capability audits and sample evaluation. Visits to factories, when possible, validate claims about capacity and processes. Remote auditing can be effective when supplemented by video tours, process documentation, and third-party inspection reports. Key evaluation criteria are material traceability, tooling capacity, paint booth throughput, and previous experience with similar body components. When a supplier serves as an OEM/ODM partner, the ability to handle custom packaging and labeling becomes valuable for distributors building private-label product lines.

Risk management covers supply continuity and quality drift. Maintain a secondary supplier or a backup capacity plan to avoid single-source risk. Build buffer inventory or implement a just-in-case reorder point to absorb shipping delays. Monitor quality metrics over time and require corrective action plans for recurring issues. For long-lifecycle vehicles like the 1998 Eclipse, warranty service and spare availability can influence brand perception among restoration communities.

Aftermarket distribution channels wrap around the B2B core. Retail marketplaces and specialist stores serve end consumers and installers. For distributors buying in bulk, these marketplaces operate as secondary retail outlets that shift leftover inventory. However, retail portals usually do not offer the same unit economics as direct B2B contracts. Buyers should plan a dual-channel approach: secure long-term supply through direct manufacturing contracts while using retail platforms for occasional retail-level demand or overstock clearance.

Operational practices that smooth program delivery include technical data exchange, sample sign-off procedures, and iterative improvements. Share precise mounting point measurements, hole patterns, and assembly notes. Keep track of change control: any modification to tooling, material, or coating should trigger a documented re-approval. Use sample photos, measurement reports, and fitment checklists to codify expectations.

Embedding these practices yields a resilient supply chain for front bumpers tailored to the 1998 Mitsubishi Eclipse. Manufacturing clusters provide scale and integrated services. Careful supplier selection, technical validation, and logistics planning turn that industrial capability into consistent deliveries. With clear quality criteria and commercial terms aligned to tooling economics, buyers can access reliable, cost-effective bumpers that meet restoration and replacement market needs.

For a sampling of aftermarket listings used as comparative resources during procurement, see: https://www.ebay.com/sch/i.html?nkw=1998+Mitsubishi+Eclipse+Front+Bumper&sacat=0&LHTitleDesc=0&osacat=0&_odkw=1998+Mitsubishi+Eclipse+front+bumper+cover

For a related part reference and context on bumper offerings, consult this product page: 2006-2008 Mitsubishi Eclipse front bumper.

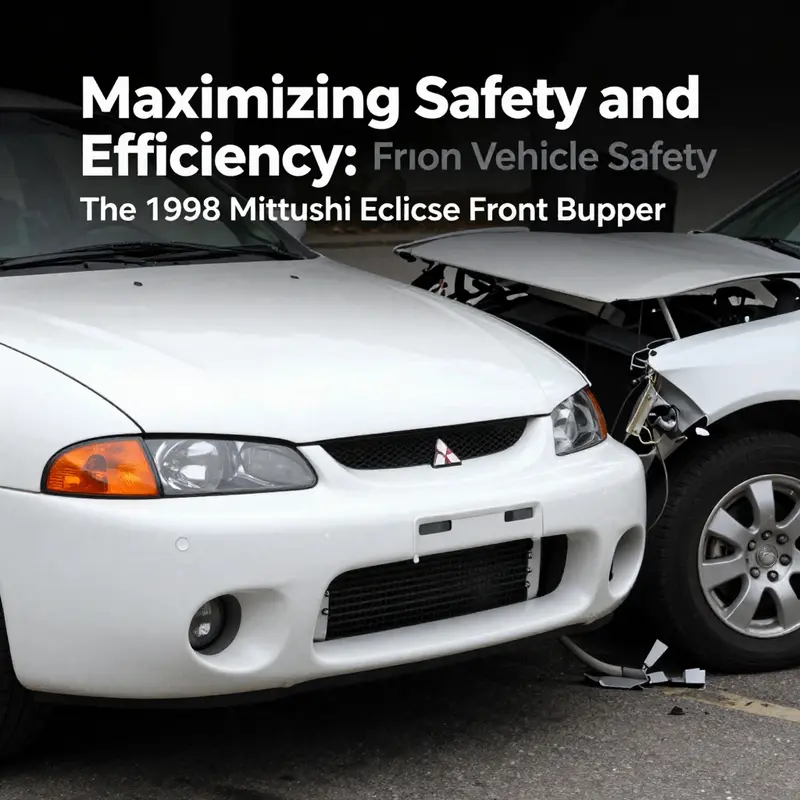

Guarding the Front End: The Safety Impact of a Late-1990s Front Bumper on a Popular Japanese Sports Coupe

On late-1990s sports coupes the front bumper served as the primary sacrificial element in low-speed impacts, designed to absorb and redirect kinetic energy before it reached the radiator, engine, and headlights. The bumper assembly—comprising the cover, an energy-absorbing element, and a reinforced support bar—was intended to deform in a predictable way, spreading load across mounting points and protecting costly or mission-critical subassemblies from concentrated blows. When intact and correctly mounted, that system reduces peak forces transmitted to the underlying structure and minimizes secondary damage that would necessitate extensive repair.

Design choices and material selection influence how effectively a bumper performs. Heavier stamped-steel reinforcements of the era traded mass for straightforward deformation paths, while evolving use of engineered plastics and higher-strength steels began to offer more controlled collapse characteristics without large weight penalties. For an aging vehicle, restoring or upgrading these components can reestablish the original energy-management behavior, provided that replacement parts honor the original geometry and mounting locations.

Installation, inspection, and maintenance are as important as part selection. Corroded brackets, fatigued absorbers, or misaligned splash panels all undermine a bumper’s ability to function as intended. Routine checks for secure fasteners, correct gap alignment, and intact mounting hardware help preserve the designed force paths; failing parts should be replaced with compatible units that maintain the same load distribution. Improper fitment or aftermarket pieces that alter approach angles or attachment points can shift loads to the frame rails or cooling components, creating a risk of larger repair bills after a minor collision.

Owners and shops choosing between OEM replacements and compatible aftermarket options should weigh fit precision, material properties, and return policies. OEM-style assemblies typically provide a close match to original mounting geometry, while carefully selected aftermarket reinforcements can offer durability or cost advantages if they respect the same energy-absorption intent. Ultimately, a well-chosen and properly installed front bumper preserves daily drivability and reduces the chance that a parking-lot bump becomes a major mechanical setback.

Final thoughts

In summary, the 1998 Mitsubishi Eclipse front bumper is a vital component that not only enhances the vehicle’s aesthetic appeal but also significantly contributes to safety. Understanding the market availability, quality considerations, and the B2B supply chain involved in these parts will empower business owners to make informed decisions. With the right front bumper, not only can vehicle functionality be improved, but the safety of drivers and passengers can also be ensured.