The Mitsubishi Evo remains an iconic performance vehicle, revered among enthusiasts. Despite the discontinuation of its production, demand for Mitsubishi Evo motors continues unabated, particularly among business owners and modifications specialists. Understanding the avenues available for sourcing these sought-after engines is essential for accessing a thriving aftermarket. This article will navigate you through the various options for finding Mitsubishi Evo motors for sale, delve into the specific technical specifications of the engine, assess how to evaluate the condition of used models, and analyze the economic trends impacting sales and pricing.

Where to Find Mitsubishi Evo Engines: Practical Options, Risks, and What to Expect

Finding the right Mitsubishi Evo engine is part detective work, part technical due diligence. With Mitsubishi no longer producing new Evo models, the market for these engines lives in the world of used units, reconditioned longblocks, and specialist builds. That creates variety and opportunity, but also traps for the unwary. This chapter walks through the realistic places you will find Evo motors for sale, the forms those motors take, the key checks to perform, and the logistics and legal issues you must plan for before purchase.

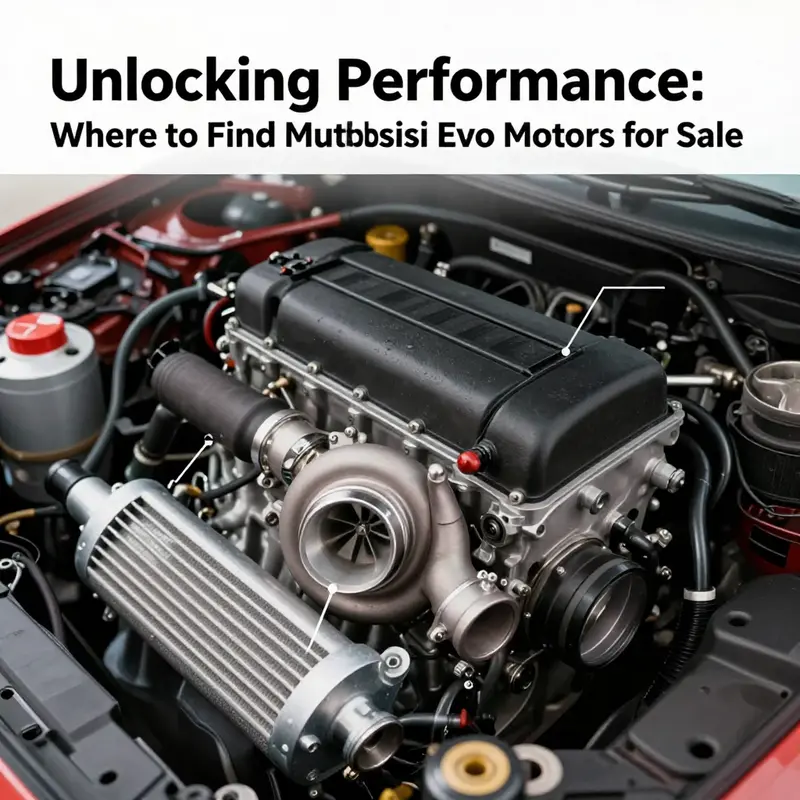

Enthusiasts and shops typically look for one of two core engine families: the older 4G63T straight-four turbo that powered many classic Evos, and the later 4B11T turbocharged four used in the final generation. Each has strengths and common failure points, and each appears in different market channels. Engines appear as complete, tested packages ready to install; as shortblocks or longblocks for rebuilds; as “halfcuts” that include engine, gearbox, wiring, and front subframe; or as individual cores for parts or machining. Knowing which form you need narrows the search quickly.

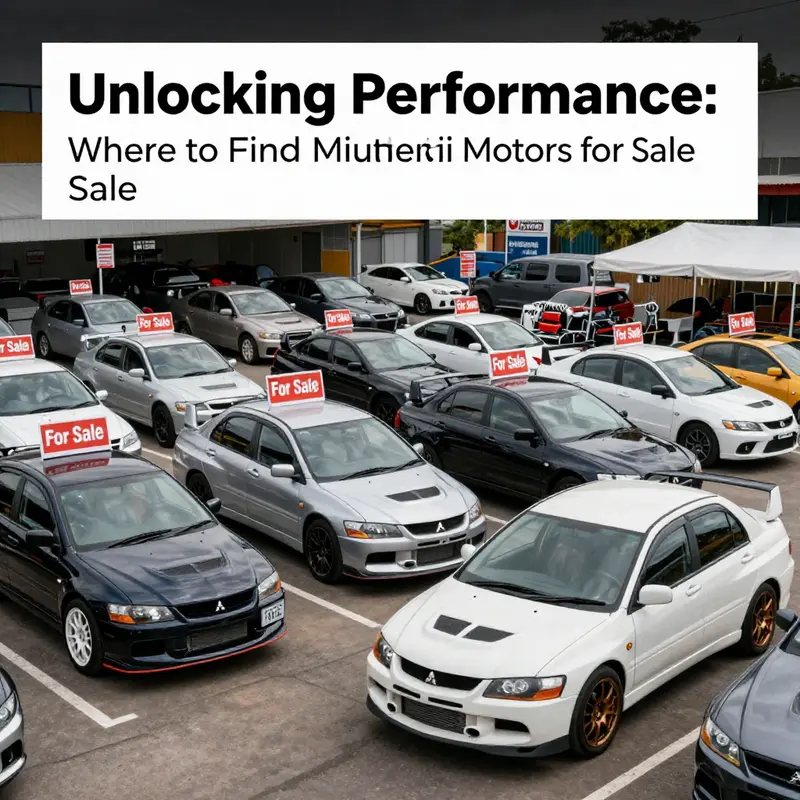

Used marketplaces are the most active hunting grounds. Large auction and classified sites host private sellers, dismantlers, and specialist resellers listing engines with varied descriptions and photos. Listings often specify mileage, included components, and whether the unit is a running motor, a crate-style tested unit, or a non-running core sold for rebuilding. Listings can give a good price baseline, but you must read every line and ask for more photos and proof of operation. Many sellers will ship nationally or internationally, but engine freight is expensive and poses additional risk—insist on a detailed bill of sale and documented packing before release.

Specialist suppliers and performance shops offer another route. These vendors often provide tested and refurbished engines, some with warranty coverage and optional component upgrades such as new turbochargers, upgraded pistons, or fresh head gaskets. Buying through a specialist tends to cost more upfront, but it reduces unknowns and can include installation support or recommended shops. For Evo X engines, some shops also offer strengthened blocks and billet components tailored for higher boost and power builds—search for listings that mention 4B11T billet block options if you intend to push power beyond stock levels. For an internal reference on strengthened block options, see this 4B11T billet block resource: https://mitsubishiautopartsshop.com/4b11t-billet-block/.

Local salvage yards and dismantlers are surprisingly useful, especially if you plan to inspect the engine in person. Salvage yards may part out a low-mileage donor or sell a low-cost core that a competent shop can rebuild. A halfcut from a salvage donor can be particularly attractive because it often includes the wiring harness, ECU, transmission, and mounting points, saving hours of integration work. However, halfcuts also add weight in shipping and can bring with them transmission or transfer case wear that must be considered.

When evaluating a listing, focus on a few non-negotiables. First, confirm the engine code and model year compatibility. The physical mounts, wiring plug types, and ECU requirements differ between generations. Second, verify whether the fuel and engine management systems are included. An engine without a matching ECU or immobilizer bypass can be difficult and costly to get running. Third, clarify what form the engine takes: is it a complete, drop-in running motor; a longblock without ancillaries; or a bare block sold for machining? The more complete the package, the more you pay—but the less planning and extra expense you will face at installation.

Mechanical condition checks are crucial. Ask for compression test results, leak-down numbers, and oil analysis if available. Compression figures tell you about valve and piston ring health; leak-down indicates head gasket and sealing condition. Photos of the oil and coolant passages help detect sludge or corrosion. Inspect the turbo for shaft play and oil leakage; turbine wear and oil seal failure are common on high-mileage turbo engines. If the seller is local or will permit an independent inspection, a visual check of the oil pan, timing cover, and cylinder head for evidence of overheating or coolant loss can save thousands.

Documentation separates professional sellers from amateurs. Look for maintenance records, service invoices, or dyno sheets if the engine has been tuned. A documented service history showing regular oil changes and no major incidents is a strong positive. Missing paperwork is not a deal-killer if the engine checks out mechanically, but it increases the need for conservative testing and, often, immediate preventative maintenance after purchase.

Legal and emissions considerations must guide your plan. Engines moved between vehicles can trigger registration and emissions testing complications. Some regions tie an engine swap to a new VIN inspection or require emissions certification to be retained. Salvage or rebuilt titles may complicate resale. Always verify local rules for engine swaps and imports before buying. If you plan to import a motor, investigations around customs clearance, import duties, and local emissions compatibility are essential. Some imported motors may require changes to meet local emissions regulations, or they may be restricted entirely.

Cost expectations vary by engine type and condition. A running longblock from a private seller will typically be less expensive than a fully reconditioned crate unit. Shop-rebuilt engines with receipts and warranty are the premium option. Factor in shipping, crate fees, and any core charges if the seller exchanges a reconditioned unit for your old core. Don’t forget the installation bill: labor rates, adapter harnesses, and any machining or tuning work can exceed the purchase price of the engine itself.

Compatibility and integration often determine the true cost of the transaction. Swapping engines within the same model family tends to be straightforward: mounts, transmission interfaces, and ECU mapping align more easily. Cross-model swaps—installing an Evo engine into an unrelated chassis—require careful planning: motor mounts, driveshafts, and cooling systems may need fabrication. When a wiring harness is not included, plan on either obtaining a donor harness or contracting an expert to adapt existing wiring. Modern engines especially rely on matched ECUs, immobilizers, and sensors, so budget for professional reflash or bypass work if necessary.

Warranties and return policies reduce buyer risk. Private sellers rarely offer returns, while specialty rebuilders may provide time-limited warranties. Understand warranty scope: does it cover internal component failure, or only the short term? Are shipping and removal covered? If buying from a marketplace, use secure payment methods and pickup-inspection windows where possible. Escrow services or payment platforms with buyer protection can limit fraud risk on long-distance deals.

If you are buying for performance rather than simple replacement, consider long-term parts availability. Even though Evos are no longer produced, the aftermarket for parts remains robust: turbos, pistons, cams, and engine management solutions are still made by third parties. When planning a build, check the availability of critical refresh items like head gaskets, timing components, and turbos for the specific engine code before committing.

Finally, practical negotiation tips can lower cost and increase transparency. Ask targeted questions about why the engine was removed, whether it was towing, raced, or sat idle, and whether any major repairs were performed. Request a short video of the engine running at idle and under revs while mounted on a stand. Ask for serial numbers or casting numbers and cross-check these against forums and parts databases. If the seller is a dismantler or shop, request a short warranty and a written description of what the engine includes.

In the current market, a well-documented, tested engine from a specialist is worth the premium if you want reliability and minimal surprises. If you have the skill to rebuild or adapt, cores and halfcuts can be great value. Across all options, prioritise documented condition, honest seller communication, and legal compliance. Treat the purchase as part of the installation project, not a one-line transaction: the right engine for your Evo project is the one that arrives with the parts, paperwork, and compatibility that match your plan.

For a snapshot of active listings and pricing that reflect the market described here, consult live marketplace entries that show mileage, included components, and seller notes. One such listing with detailed mileage disclosure is available here: https://www.ebay.com/itm/2008-2015-Mitsubishi-Lancer-Evo-X-Ralliart-Engine-2-0L-4-Cyl-Turbo-4B11-JDM-51K/393976438646

From 2.0L Turbo to Twin-Clutch Power: A Cohesive Look at the Mitsubishi Evo Motor Through Generations

The Mitsubishi Lancer Evolution, often simply called the Evo, has built its reputation on a single, defining idea: rally-bred engineering that reaches the street. The heart of that reputation is the Evo engine family, a lineage that evolved from a rugged, do-it-all turbocharged four-cylinder to a more electronically refined, performance-focused powerplant. For anyone curious about the current market for Evo motors—or for cars that carry an Evo heart—the story of these engines is more than a spec sheet. It is a narrative of reliability, adaptability, and the kind of torque that makes a straight line feel like a steep hill climb. The journey begins with the early 2.0-liter turbocharged 4G63 family and moves onward to the 4B11T that defined the final era of the original Evo concept, the Evolution X, before the line was drawn in the sand and new emissions and market realities truncated official production. In the pages that follow, the specifications tell a story about power, torque, and the technologies that made each generation distinct, while practical considerations about buying and sourcing a motor—particularly in a market for used or swapped engines—translate those numbers into real-world decisions for enthusiasts and builders alike.

The early Evolutions I through VI anchor the Evo’s reputation on a simple, robust premise: a 2.0-liter inline-four, turbocharged and headlined by the 4G63 family. Across these generations, power outputs crept upward in measured, disciplined steps. Evolution I arrived in 1992 with roughly 195 PS and about 206 Nm of torque, a figure that signaled the potential to tune and evolve without overstressing the core engineering. The momentum continued with Evolution II, which offered around 210 PS and a similar torque footprint, maintaining the engine’s friendly balance between response and endurance. The pivot point for many enthusiasts came with Evolution III and IV, where power climbed to the 247–250 PS range and torque rose into the mid-250 Nm territory. These models earned a reputation for their willingness to respond to modifications, their turbo spool becoming a defining trait, and their engines becoming a favorite for tuners who chased incremental gains with relatively predictable outcomes.

The Evolution V and VI kept that momentum rolling, but they also introduced a more refined sense of how a turbo-four could be paired with chassis tech to deliver real handling advantages. The V’s 280 PS and roughly 373 Nm of torque, in particular, coincided with added front-l axle limited-slip differential technology that helped translate power into grip more effectively through corners. That shift—where power was not just about straight-line speed but about how a car could place that power at the tire’s contact patch—would become a throughline in later generations. The Evo VI, produced at the turn of the millennium, refined the fundamentals further and kept the engine living in a realm where hardcore performance remained accessible to skilled drivers with the right maintenance regime.

As the line moved into Evolution VII, VIII, and IX, Mitsubishi carried the 4G63 legacy forward while weaving in more modern engineering sensibilities. The seventh and eighth generations retained the familiar turbocharged four, still delivering 280 PS in many markets, but the tonal shift came with the transition to the 4B11T architecture in Evolution IX. This transition was more than a badge change; it reflected a rethinking of the breathing, the turbocharging strategy, and the way the engine was integrated with the car’s all-wheel-drive system. The 4B11T, while sharing the 2.0-liter displacement with the 4G63 lineage, introduced a new generation of control systems and a newer engine block design that could sustain higher torque loads and maintain reliability under the stress of aggressive driving. In later versions, power numbers in this era were tuned to approach 300 PS in some markets, with torque figures hovering around the 382–399 Nm range. The shift to the 4B11T signified a broader industry trend: turbo engines becoming more efficient, smarter in their boost management, and more capable of delivering sustained performance without compromising daily drivability.

Then came Evolution X, the culmination of the Evo’s high-performance arc. The X, powered by the refined 4B11T, represented a major engineering step forward. It brought not only higher peak outputs—roughly 300 PS and about 399 Nm of torque—but also a fundamentally different way of delivering power. The dual-clutch transmission, marketed as a fast, seamless gear-changing solution, allowed for shorter shift times and kept the engine in the sweet spot of its torque curve more consistently. The acceleration figure—0–100 km/h in about 4.9 seconds—became a tangible demonstration of how the latest drivetrain and engine pairing could translate the Evo’s rallying DNA into a more tightly integrated performance package for the street. But the X also highlighted a broader truth about the Evo engine family: it was no longer just a high-speed power unit; it had to play well with electronics, traction control, and chassis dynamics in ways that required careful calibration and ongoing maintenance.

The spec sheet across generations tells a consistent, compelling story. The 4G63 era provided a sturdy, tunable core that could tolerate the high boost and rapid throttle inputs of a rally-inspired drive. The move to the 4B11T brought not only higher power and improved efficiency but also an expansion of the engine’s capabilities through better control strategies and more capable turbocharging. The final evolution—Evo X—paired this refined, higher-compression, more responsive powerplant with gearbox and AWD innovations that enabled sharper cornering, quicker transitions, and better off-the-line acceleration. Collectors and builders still note the 4G63’s legendary toughness, especially when matched with the right hardware and a conservative tuning approach. Yet the 4B11T’s advantages in control and reliability under higher output conditions cannot be dismissed, especially in the context of a modern engine that must work with sophisticated engine management systems and emissions requirements.

For anyone exploring the market for an Evo motor today, the numbers matter, but so do the details. The engine family’s journey—from a robust, simple, easily tunable 2.0-liter turbo to a more complex, electronically managed, higher-output powerplant—has practical repercussions for buyers. The early 4G63-based engines are renowned for broad aftermarket support and straightforward maintenance, but they demand careful inspection of wear, turbo health, and compression. A high-mileage 4G63T can still be a solid choice if the rebuild history is documented and the parts are available. By contrast, the 4B11T-era engines, while offering more modern engineering and calibration capabilities, require careful scrutiny of the engine management system, turbochargers, and associated sensors that are more integrated with the vehicle’s overall electronics suite. This is not to pin one era against another, but to recognize that the choice between a 4G63T and a 4B11T—or a complete engine transplant—depends on the buyer’s objectives, mechanical skill, and access to reliable parts.

If you are leaning toward acquiring an Evo motor for a swap, restoration, or a build that aims to preserve the engine’s distinctive character, you may find that certain variants suit your project better than others. A practical route is to seek out a specific, well-documented example with solid maintenance records rather than pursuing a raw, high-mileage unit. In this regard, the market can be favorable for engines with a documented service history and a clear lineage to a known vehicle. And when you are researching options, consider the value of a verified, low-mileage, factory-spec engine versus a lightly modified unit that may have seen more aggressive tuning. Each path has its own trade-offs in durability, reliability, and resale value.

As part of navigating this landscape, buyers frequently turn to reputable second-hand channels, auctions, or specialists who handle performance engines. These routes offer access to engines that have already endured the stress-testing that comes with spirited driving, though they require due diligence: verify mileage, confirm parts compatibility, and ensure that the engine’s intake, exhaust, and fueling systems remain within expected tolerances. A helpful touchpoint for context and potential sourcing is a genuine, older block that has a proven track record in the hands of enthusiasts who used it as the core of a dedicated build. For instance, there is value in exploring a known, factory-spec example of the 4G63T EVO-7 era, which could serve as a reference point for a swap or rebuild project. See this example listing for context: Genuine JDM low-mileage 1995-1999 Mitsubishi 4G63T EVO-7 engine.

The realities of sourcing an Evo motor for sale also reflect practical constraints beyond the engine itself. Emissions compliance, local regulations, and the need for compatible ECU and harness connections all shape what a swap or an engine replacement can entail. A 4G63T from an Evolution I–VI may still deliver thrilling performance in a dedicated project, but you will likely encounter an older ECU architecture and a simpler fuel-management setup. A 4B11T, in contrast, invites a modern integration, but it also carries with it more questions about harness routing, sensor provisioning, and software tuning that can add complexity to the purchase and installation process. In every case, the goal is to align the engine configuration with the vehicle’s drivetrain, transmission, and chassis logic so that the resulting package remains safe, reliable, and enjoyable to drive. This is where the value of professional inspection and, when possible, prior vehicle documentation becomes clear. The engine’s history—whether it has seen track days, daily commuting, or a combination of both—will shape not only the engine’s condition but the expectations for maintenance and ongoing care.

For buyers who are deep into the Evo’s lore, the market offers a spectrum of choices: complete engines, engine blocks, long blocks with accessories, and sometimes turnkey swap packages. The decision often boils down to the level of assembly required and how much of the surrounding hardware you want to preserve or upgrade. If you are assembling a project car or restoring a rare Evo variant, you may prefer a complete, ready-to-run package with an intact ECU and a documented service history. If your goal is a more customized build, you might opt for a bare engine block paired with a selective set of components chosen to optimize weight, power delivery, or reliability for your particular track or street use. In all scenarios, you will gain from a clear plan for the rebuild or swap: define the target power band, consider the fuel and ignition systems you will rely on, map the turbocharging strategy, and anticipate the cooling and ventilation needs that come with sustained high-performance operation.

The broader takeaway is that the Evo engine family remains a compelling the-market case study in how technology evolves under pressure. The 4G63 era established a robust, tunable foundation that many builders still respect for its simplicity and durability. The 4B11T brought a more modern, scalable approach to power, with better integration into electronic controls and drivetrain dynamics. The Evolution X unified these threads into a machine notable for its quickness, its grip, and its ability to deliver a racing-inspired experience on daily roads. For a potential buyer or builder, the engine’s history is not just about horsepower numbers. It is about expectations—what the engine can deliver today, what it will require to stay healthy, and how its characteristics align with the kind of driving you want to do.

In wrapping these threads together, the practical approach to purchasing an Evo motor for sale emphasizes due diligence, the right sourcing channels, and a clear plan for integration. Whether you lean toward a classic 4G63T unit that embodies the Evo’s early, raw thrill or a more contemporary 4B11T that offers modern efficiency and control, the engine’s lineage provides a roadmap for reliability and performance. The keys are to verify maintenance records, confirm compatibility with the intended installation, and understand the broader ecosystem of parts, software, and support that surrounds the Evo motor family. The market may not always have a factory-new Evo engine in stock, but it remains rich with well-documented, high-potential options for those who know what to look for and how to assess condition under realistic driving expectations. In this sense, the Evo motor is not a single product but a century-rich engine lineage that continues to inform how enthusiasts approach swaps, builds, and the very joy of driving a car whose powertrain is steeped in rally provenance.

External reference for further context on performance and specifications: https://www.caranddriver.com/mitsubishi/lancer-evolution-x

Evaluating Used Mitsubishi Evo Engines: A Practical Buyer’s Guide

Used Evo engines remain in demand even as factory production has ended. Buyers typically encounter engines from rally cars, salvage yards, or private sellers who stripped a car for parts. The key to a successful purchase is a careful inspection that blends mechanical judgment with a practical risk approach. A well informed buyer uses a disciplined checklist focusing on block construction, turbo history, and service records to gauge reliability. Start with the block itself, considering material and wear. Iron blocks are generally more durable under high load, while aluminum blocks can show wear earlier if heat and tuning are not managed. Look for uniform casting, clear numbers, and signs of prior rework. In a complete engine, the block should feel solid and unaltered, with intact coolant passages and main caps. The turbocharger setup warrants careful review as well. A known reliable turbo or a stock configuration can indicate a conservative maintenance approach, whereas a heavily modified system raises questions about oil supply heat management and compressor behavior. Check for evidence of rebuilds or replacements and inquire about the history of upgrades. Signs of oil leaks heavy shaft play or unusual endplay are red flags. After the turbo, the supporting components such as intercooler piping and wastegate control matter for reliability under boost. The overall service history provides a narrative of regular maintenance and care. Documentation of oil changes with intervals, and records of timing component service and turbo servicing help estimate future reliability. If a belt driven timing system is used a documented replacement adds reassurance. Absence of records should prompt a cautious approach and more hands on testing where possible. Physical condition can reveal usage and potential issues such as oil consumption coolant leaks or signs of head gasket problems. A compression test and a leak down test quantify health and help assess risk before purchase. Authenticity checks ensure you are buying a genuine core rather than a rebuilt or misrepresented engine. Verifying casting numbers and VIN alignment can confirm the block model and reduce misrepresentation. If possible obtain documentation that the engine is a genuine 4G63 or an approved variant. Rebuilds and modifications carry risk as well as potential cost savings. Ask for a parts list detailing gaskets pistons bearings and valve train components and request photos of internals when feasible. A well documented unit sourced from a reputable seller can reduce risk and simplify installation. For buyers seeking confidence a verified listing that provides a genuine JDM engine with a clear history can be appealing. The value lies in predictability of oil pressure boost response and long term reliability. The market includes reputable sources that offer low mileage engines with complete accessories for straightforward installation. The goal is a powerplant that behaves reliably under boost and remains dependable for miles ahead. To proceed with a purchase use a clear checklist covering block type casting numbers VIN correspondence and service history. Obtain a compression and leak down test and where possible arrange a controlled test drive to observe boost behavior. If a seller refuses to provide documentation or hesitates to disclose history, exercise caution. The best outcomes come from well documented cores with proven histories and transparent ownership records. A vetted option may include a genuine JDM 4G63T unit described in reputable listings, which can minimize compatibility risk during installation. For broader guidance on authenticity use external resources to verify red flags and common misrepresentations. With due diligence the final choice aligns with performance goals and budget expectations, delivering a reliable engine for the project.

Scarcity, Nostalgia, and Market Currents: Pricing the Legacy of a High-Performance Turbo Engine

The market for a legendary, high-revving turbocharged engine persists even after the curtain fell on its last production run. In the years since the line was discontinued, pricing dynamics have shifted from what collectors might call a curiosity premium to a more deliberate, value-driven market. This shift is not simply a reflection of rising used-car prices or a fad among enthusiasts. It is a layered story about scarcity, sentiment, and the broader macroeconomic currents that shape every corner of automotive commerce. To understand where prices stand today, one must look beyond sticker numbers and spec sheets and toward the forces that convert a once-common powerplant into a valued, often coveted, commodity in secondary markets. The result is a market that rewards maintenance history, provenance, and the ability to certify authenticity as much as it rewards performance potential straight out of the crate.

Discontinuation did not erase the engine’s appeal; it amplified it. The decision to end production did not erase demand so much as concentrate it. In the open market, there are far fewer examples of pristine, unmodified power units than there are of cars that have benefited from years of use, abuse, and careful restoration. The economics of scarcity work in predictable ways: when supply tightens while demand remains robust, buyers become more selective, and sellers discover they can extract a premium for a clean history, original components, and an absence of hidden issues. The most valuable power units are those that have clearly benefited from meticulous maintenance, documented service histories, and a clean provenance that can be traced back to the seller. In this sense, pricing becomes a narrative device as much as a numeric figure, a way for buyers to assess the reliability of a rare mechanical artifact in a market that prizes both performance capability and historical integrity.

The engine’s fate in the market is inseparable from the broader context of the brand and the segment it defined. The same nostalgia that fuels a die-hard fanbase also informs the decisions of newer buyers who want a weekend toy or a project that can be both collector-grade and road-ready. In practice, this dual appeal tends to push prices upward in two ways. First, well-maintained engines—where mileage is modest, critical parts are documented, and there is verifiable maintenance history—command a premium because buyers can invest with confidence. Second, engines that still carry a traceable, original configuration—without a long list of invasive modifications—offer a path to future value, should the next owner decide to return the unit to stock condition or to preserve its historical character. The market rewards clarity of condition as much as it rewards the raw power the engine can deliver on a dyno or in a straight line.

Across regions, price ideas diverge, driven by local supply, currency dynamics, and the relative strength of performance car communities. In markets with robust enthusiast networks, private sales and auctions tend to exhibit sharper price appreciation for engines with clean histories and minimal rust, no major accidents, and verifiable part originality. By contrast, regions with weaker aftermarket ecosystems, higher import duties on performance components, or stricter emissions regimes may see more cautious pricing behavior. Still, the overarching tempo remains clear: scarcity creates leverage, and nostalgia creates an emotional premium that can push prices above what a purely utilitarian view of a power unit might justify. For buyers, this means diligence becomes a discipline. Verifying the engine’s service records, confirming the absence of non-competitive modifications, and confirming compatibility with local regulations are essential steps toward turning a potential purchase into a sound, long-term investment.

In this landscape, the economics of the broader automotive industry cast long shadows. The research period surrounding early 2025 highlighted several macro forces that indirectly influence prices for this kind of power unit. First, the parent company has faced a mix of currency volatility and tariff pressures. In practical terms, FX fluctuations and trade costs squeeze margins across the supply chain, reducing the capacity of manufacturers to rechannel investments into new performance offerings. When a brand contends with these pressures, it tends to protect what remains valuable in its legacy portfolio, including high-demand powertrains that can still generate aftermarket interest and aftermarket sales across regions. A first-quarter 2025 earnings call noted a decline in net sales year over year, driven in part by currency shifts and tariff costs. These financial dynamics do not erase demand; they redirect it. Enthusiasts and collectors respond by seeking out the most carefully preserved examples, and the market flavors those purchases with a premium that acknowledges both scarcity and opportunity costs associated with maintaining and transporting a powered unit across borders.

Consumer preferences are another critical lever. The automotive market is in the midst of a broader shift toward electrification and efficiency, and this tilt influences the relative appeal of high-performance internal-combustion powertrains. Where a few years ago a turbocharged engine could claim a place on a wish list simply for its character and performance, today buyers weigh a broader calculus. They ask not only how much power is available but how the powertrain aligns with cost of ownership, emissions expectations, and the availability of support infrastructure. The research record notes a trend toward electrified performance and hybrid systems as plausible avenues for any potential revival. If a brand were to re-enter the segment with a modernized platform, the expectations would almost certainly include electrification or mild-hybrid architecture to balance performance with sustainability demands. In practice, this means that the existing, historically powered units do not just compete with other used engines; they compete with theoretical and aspirational future offerings that might blend heritage with contemporary technology.

For current buyers, the risk calculus centers on reliability and the cost of ownership. A used engine with a clean bill of health can be a gateway to a high-reward project, but it can also become a high-cost liability if it harbors hidden issues. Buyers must craft a thorough due-diligence plan: serialized engine checks, corroborating maintenance receipts, bore and ring measurements when possible, and a careful assessment of the engine’s past life, including whether it served in a vehicle that endured harsh climates or aggressive driving regimes. The financial logic hinges on more than the purchase price. It includes the expense of installation, tuning, and potential compatibility questions with local emissions standards or registration rules. In communities where dedicated shops understand the nuances of this power unit and where high-quality used parts are more readily available, the price of admission to a premium engine can be lower than in markets with sparse infrastructure. In other words, the geographic ecosystem for aftersales and technical support becomes a crucial determinant of the engine’s final landed cost and, ultimately, its value trajectory over time.

The narrative around pricing is not merely a reflection of supply and demand curves; it is also a mirror of how the community shapes value. In enthusiast circles, the engine represents a particular era of performance—a calibration of turbo boost, drivetrain balance, and chassis alignment that defined a generation of street and track work. This cultural halo translates into a willingness to pay a premium for a unit that embodies that era with minimal compromise. The emotional component matters: nostalgia has a tangible economic effect when a buyer contemplates long-term ownership, not just a quick flip. The more a unit carries its story—low mileage, intact original hardware, documented history—the more the price appreciation becomes sustainable rather than a speculative bubble. The market absorbs this aura into a broader thesis: preserving a legend takes work and money, and investors value that commitment as part of the asset’s worth.

A practical challenge that threads through price awareness is the heterogeneity of the available product pool. Some buyers seek complete engine assemblies ready to bolt in, while others prefer bare blocks, heads, or rebuild cores that can be tailored to a particular project. The price spectrum reflects this spectrum of needs. Core engines for partial rebuilds may trade at a different premium than turnkey, running units. Documentation matters here as well: provenance for a rebuild, the identity of the shop that performed the work, and the quality of the components used during refurbishment can all tilt price beyond the surface value of a new or used engine of similar displacement. In both cases, the market rewards buyers who approach their purchase with a clear plan for diagnostics, installation, and ongoing maintenance, rather than a quick speculative bid followed by a costly discovery of latent defects.

Within this framework, a single, well-worn but well-documented example can anchor the pricing conversation. A unit with a transparent history of regular maintenance, minimal internal wear, and a clean balance between originality and practical usability often commands a premium that outpaces the price of a comparable engine with uncertain provenance. Yet, even this premium is not a carte blanche ascent; buyers weigh the total cost of ownership, including accessories, electronics, and compatibility with modern standards. In many markets, this translates into a careful affordability threshold: a price that reflects the engine’s long-term value, not just its current performance potential. Sellers, for their part, increasingly present a complete narrative that outlines the engine’s service life, refurbishment steps, and any alignment work performed in the last few years. This transparency reduces the perceived risk for buyers and helps anchor prices at a level that supports both the seller’s expectations and the buyer’s confidence.

From a strategic perspective, the market for this powerplant lives at the intersection of heritage and modern demand. The economic environment, the state of the brand, and the shifting tide of consumer preferences all shape price evolution. While a resurgence of the original platform in a traditional form remains unlikely in the near term, the possibility of a modern reinterpretation—perhaps with electrified technology or hybridization—keeps the dialogue alive among engineers, enthusiasts, and investors. The price of admission to that conversation is measured not only in dollars but in the ability to demonstrate a clear path from purchase to reliable operation, with a well-documented chain of custody for the engine and its supporting components.

For readers who are actively navigating this market, a practical cue lies in the ecosystem of parts and provenance that surround the engine. Enthusiasts often couple the core powerplant with a curated package of authentic or carefully sourced components to preserve the engine’s character while ensuring reliability. For collectors and builders alike, authenticity is not just about the core unit; it is about the entire assembly, the way it integrates with the vehicle’s control systems, and the potential for future maintenance with parts that continue to carry a trusted pedigree. In this context, even seemingly small details—such as the availability of era-appropriate, authentic accessories—can influence a buyer’s willingness to pay a premium. A tangible example of this ecosystem can be found in the aftermarket and parts community, where the availability of genuine, period-correct components sustains interest and, in some cases, gradually elevates the price ceiling as condition and provenance improve.

As this chapter explores pricing trends and economic factors, the broader takeaway is that the market for this legendary engine is not a simple function of supply. It is a complex mosaic of scarcity, sentiment, maintenance quality, and macroeconomic context. The years since the model’s final production run have proven that the engine remains a magnet for the right buyer: someone who can appreciate its historical significance, affirm its reliability through documentation, and absorb the cost of ownership with confidence born of careful research. In a world where advancement often means replacement rather than preservation, the enduring value of this high-performance unit lies in its ability to tell a story about a specific era of automotive engineering—one that continues to captivate a dedicated community even as the market evolves toward new technologies and new forms of mobility.

For readers seeking a tangible touchstone within this evolving landscape, authentic detail remains a reliable guide to value. A way to connect with the current market while honoring the engine’s heritage is to consider not just the power unit in isolation but the full package—the documentation, the history, and the parts that allow a future buyer to recapture or maintain its original spirit. In practice, this means prioritizing engines with clean records, complete histories, and a track record of careful, quality maintenance. It also means understanding the local regulatory environment, which can influence the practicality of owning and operating a high-performance ICE powerplant in certain jurisdictions. The marriage of historical value and practical viability is what ultimately anchors the price in a realistic range that rewards both passion and prudence.

Within the broader discourse on market dynamics, the broader industry context matters more than ever. The research documents the tension between a legacy performance brand’s past successes and the influences reshaping the present and future. The market’s willingness to assign value to a discontinued powertrain depends on how well the rest of the ecosystem—maintenance providers, parts suppliers, and the community of collectors—can sustain and grow the supporting infrastructure. In other words, prices reflect not only the engine’s mechanical potential but also the strength and resilience of the ecosystem that keeps it operable and desirable. This is how a powerplant from a past era remains economically relevant in a market that increasingly prizes efficiency and new technology. The chapter’s throughline is simple: scarcity plus provenance plus a supportive aftermarket equals pricing power, even when the original production line no longer exists.

External reference: For the latest updates on corporate strategies and the broader pricing environment that frames these markets, readers may consult this earnings call transcript: https://www.mitsubishi-motors.com/en/investor-relations/earnings-call-transcripts/q1-2025.

Internal link reference: For collectors and builders seeking authenticity in restoration or specific period-correct details, one practical resource is the page on authentic parts that preserves the look and feel of classic models: authentic-jdm-evo-9-mr-taillights. This link illustrates how authenticity and provenance often translate into market value, as buyers look for components that reliably reflect the era’s original engineering and design intent.

Final thoughts

Navigating the market for Mitsubishi Evo motors involves understanding the various avenues available, the intricacies of engine specifications, and how to effectively evaluate used engines. Moreover, being aware of the current pricing trends and economic climate can help business owners make informed decisions and capital investments. As interest in performance vehicles remains strong, the availability of Mitsubishi Evo engines presents a unique opportunity for those looking to tap into this niche market. Whether looking to enhance an existing fleet or launch new projects, diligence and knowledge will serve you well in this dynamic field.