The Mitsubishi Lancer Evolution, an iconic performance vehicle, continues to captivate automotive enthusiasts worldwide. Despite its discontinuation, the demand for aftermarket parts remains robust, especially in North America, Europe, and Japan. This article aims to provide business owners with a comprehensive understanding of the Mitsubishi Lancer Evolution parts market, focusing on sourcing strategies, performance enhancements, and market dynamics. Each chapter will explore critical aspects of the aftermarket parts landscape, empowering businesses to capitalize on opportunities in this niche market.

null

null

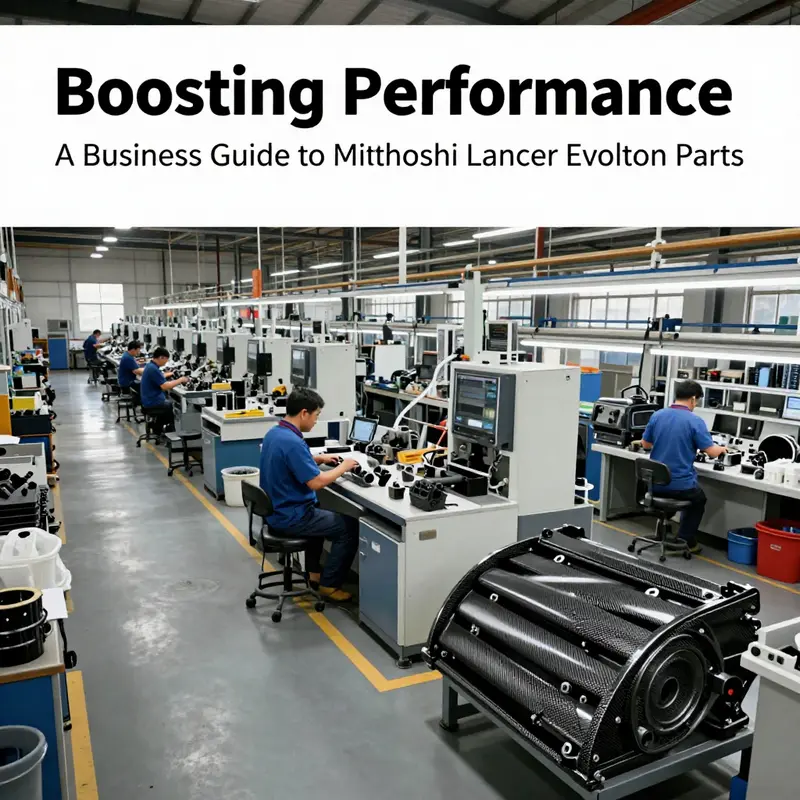

From Mainland Makers to Garage Customs: Navigating China’s Landscape to Source Quality Mitsubishi Lancer Evolution Parts

The Mitsubishi Lancer Evolution has earned a reputation not just for its rally-bred performance but for the community that keeps it alive long after the factory line has stopped rolling. Enthusiasts, tuners, and professional shops in North America, Europe, and Japan still chase high-fidelity upgrades that can sharpen power delivery, improve aerodynamics, and tighten the chassis for corner-heavy tracks or daily drivers that crave a more engaging drive. In this landscape, the sourcing of aftermarket parts has become less about chasing the lowest price and more about building a reliable pipeline of components that meet exacting standards. The rise of Chinese manufacturing as a global hub for Evo-related parts is not simply a story of factories and cheaper labor; it is a carefully tuned ecosystem where material science, production discipline, and supply-chain intelligence converge to deliver components that perform in the hands of skilled builders as much as they do in the hands of everyday enthusiasts. Guangdong and Jiangsu provinces, anchored by hubs like Guangzhou and Danyang, sit at the heart of this ecosystem. They are home to networks of small and mid-size suppliers that specialize in low-volume, high-complexity work, offering a sweet spot for parts that demand precision and customizability. This is not a landscape defined by mass production but by a modular, capability-rich supply chain that can adapt quickly to evolving tuning trends and regional preferences. The factories here excel in multi-material components—full carbon fiber panels for weight reduction, hybrids that blend carbon with reinforced plastics, and high-quality polypropylene or ABS plastics for structural or cosmetic parts. Techniques such as vacuum infusion and autoclave curing enable the layup and curing of carbon fiber parts with predictable consistency, while CNC mold creation ensures the surface finish and tolerances that professional shops expect for fitment and aesthetic alignment. These capabilities matter because Evo-oriented components sit at the intersection of form and function. A hood must not only look the part; it must sit true to the fenders, align with the hood latch, and maintain thermal performance that complements the engine beneath. A bumper or a front diffuser must survive high-speed airloads and still maintain a precise mounting interface with the frame and crash structure. The ability to deliver multi-material solutions—think a carbon surface with a polymer core or a pure carbon fiber piece paired with a composite backing—gives distributors the flexibility to meet distinct regional demands. Some markets prize maximum weight savings, while others seek a balance between stiffness, impact resistance, and cost. In practice, this means buyers can request variants that optimize downforce, reduce drag, or simply deliver a premium finish with a recognizable carbon weave. The result is a spectrum of Evo parts that reflect not just a single manufacturer’s capability but an entire network’s shared commitment to quality. Commercial buyers—distributors, workshop chains, and performance shops—approach sourcing through a disciplined three-pillar framework that moves beyond price and minimum order quantities. First is operational reliability, the backbone of any successful aftermarket program. Buyers evaluate on-time delivery rates, the capacity of production lines to scale for semi-regular spikes in demand, and the presence of robust quality control systems. A supplier that can demonstrate consistent lead times, a track record of defect-free batches, and documented traceability in their processes earns a premium in credibility even before they start talking about parts. The second pillar is technical capacity. This is where the Evo’s complexity becomes central. Sourcing teams look for partners with proven experience in the model family, with a demonstrated understanding of compatibility across generations and a focus on critical interfaces, from hood latches and mounting points to the engine bay packaging around the renowned four-cylinder powerplant. They want to know that the supplier can design for precise tolerances, handle the intricacies of carbon fiber composites or advanced plastics, and deliver parts that can withstand the heat, vibration, and mechanical loads experienced on track days and spirited street use. Third is service responsiveness. The relationship with a parts supplier is as much about communication as it is about the components themselves. Buyers assess how quickly a supplier answers queries, how effectively they handle design changes or custom requests, and what kinds of after-sales support they provide if an issue arises during fitment or after installation. A supplier that can offer design consultation, assist with prototypes, and provide clear documentation for installation will outperform a cheaper but less reliable alternative. Platforms such as Alibaba.com and GoldSupplier’s Wholesale Marketplace have emerged as essential tools in this triad, providing verified supplier profiles that help buyers identify partners with platform-verified icons and a credible track record. Yet even with these digital gatekeepers, the path from a China-based supplier to a finished Evo project in a workshop requires due diligence that blends data with hands-on scrutiny. The three pillars guide the process, but the execution rests on careful supplier evaluation, transparent communication, and a willingness to start small and scale up. A prudent buyer will begin with samples or a controlled pilot order, testing fitment, finish, and tolerances in real-world conditions before committing to larger orders. That incremental approach matters because Evo parts are frequently the final touches on builds that blend reliability with performance. In practice, the journey toward sourcing high-quality Evo parts from China begins with a clear specification—what you want the part to do, what tolerances are acceptable, and what environmental conditions it must endure. It continues with an assessment of the supplier’s operational readiness: Can they meet the required lead times? Do they have the capacity to adjust production schedules if a new variation becomes popular? Then comes the technical assessment: Will the part integrate with the vehicle’s existing systems and with other aftermarket pieces? Is the surface finish consistent enough to meet the aesthetic expectations of a premium build? Finally, the service dimension: How effective is the supplier in handling design tweaks, R&D input, or changes in packaging and shipping requirements? This is not a static checklist but a dynamic conversation that evolves as a project moves from concept to prototype to production. The allure of sourcing from a mature Chinese ecosystem lies in the ability to combine high-tech manufacturing with flexible, short-run capabilities. Lower-volume runs can be economically viable when the supplier can maintain tight process control and repeatability. The chemistry of success lies in selecting materials that align with a given performance target. Carbon fiber—whether full or hybrid—offers weight savings and rigidity that appeals to track-focused builds or weight-conscious street cars. Polypropylene and ABS plastics deliver cost efficiency for interior panels or trunk components where a high-gloss finish or a precise curvature is less critical than impact resistance and durability. In practice, a well-designed Evo project might blend carbon fiber elements with conventional plastics to achieve a balance between aesthetics, cost, and performance. The cross-border logistics of such parts are not trivial, yet the Guangdong and Jiangsu corridors are purpose-built for the kind of trade that Evo lovers require. Proximity to raw material suppliers and established logistics networks translates into shorter lead times and more predictable deliveries, even when orders require customization. Manufacturers are adept at converting complex design files into precise molds, then guiding parts through a controlled curing process that yields consistent surface quality. For buyers, this translates into a level of confidence that might have seemed unattainable a decade ago when outsourcing to distant suppliers carried more risk. Of course, no sourcing narrative is complete without acknowledging the realities that can complicate even the most well-planned acquisitions. Lead times can extend when demand spikes or when a supplier navigates supply shortages for high-grade carbon fibers or specialty resins. Quality variance, though much reduced in modern operations, remains a potential issue if QC processes are not rigorously applied or if a design change introduces new tolerances. Communication delays, misaligned specifications, or unexpected packaging requirements can derail a project if not managed with clear language, accurate 3D models, and explicit acceptance criteria. This is where the practical art of sourcing overlaps with the science of manufacturing. It is not enough to select a supplier that can produce a carbon fiber hood or a vented hood; you must partner with one that can translate an engineering brief into a reproducible part while maintaining the integrity of the Evo’s geometry and mounting interfaces. The narrative around sourcing thus becomes a story of collaboration and mutual accountability. Buyers and suppliers enter into a shared responsibility to deliver what was promised, when it was promised, and in a condition that passes the scrutiny of a discerning workshop. The end result is not simply a bag of parts but a coherent upgrade path—one that enables a project to progress from a rough concept to a refined, road-tested configuration. In this context, a practical, non-hype-driven approach to sourcing from China emphasizes three practical outcomes: reliability, fitment, and service. Reliability means consistent lead times and traceable quality, enabling a project timeline to stay intact. Fitment means parts that align with vehicle geometry and with each other, avoiding the last-mile drama of field-fit adjustments. Service means accessibility to design support, rapid responses to questions, and a willingness to adapt to evolving design requirements. When a buyer can weave these strands into a seamless procurement thread, the result is not merely access to parts but access to a capability network that can respond to the evolving tastes of Evo enthusiasts. For readers who want a tangible example of the type of component that demonstrates these capabilities, a practical entry point is the carbon fiber hood listing. This kind of part exemplifies how a supplier can combine advanced materials with precise tooling to deliver a product that meets stringent standards while offering a compelling aesthetic. carbon fiber hood listing encapsulates the dual demand for performance and appearance without compromising the engineering fundamentals that make the Evo platform distinct. The broader takeaway is that sourcing from China has matured into a disciplined practice that can yield reliable, high-performance components when conducted with rigor, cross-functional communication, and a clear-eyed view of what constitutes value beyond a rock-bottom price. This is not about chasing the cheapest option; it is about building a long-term supplier relationship that can deliver consistent quality, technical alignment with the Evo’s lineage, and responsive service that keeps a project moving forward. In the larger arc of the aftermarket, China’s role as a manufacturing hub for Evo parts is a reminder that global supply chains, when managed with discipline and transparency, can complement the ingenuity of independent builders. The tooling, materials, and process know-how exist not as isolated capabilities but as a connected ecosystem that translates advanced engineering into real-world performance. Buyers who recognize this can navigate with confidence, choosing partners who offer genuine technical capacity, dependable operations, and the willingness to work closely with customers on custom configurations. Such collaboration does more than supply parts; it creates the confidence needed to push a project from concept to track-day readiness. As the scene evolves, the narrative remains consistent: high-quality Evo parts emerge where sophisticated manufacturing meets disciplined sourcing, and the end result is a kit of components that preserves the Evo’s legacy while enabling new chapters in its ongoing story. External resource: For a broader perspective on choosing Mitsubishi Lancer auto parts and understanding practical considerations beyond price, see this guide. https://www.autocar.co.uk/car-review/mitsubishi-lancer-evolution

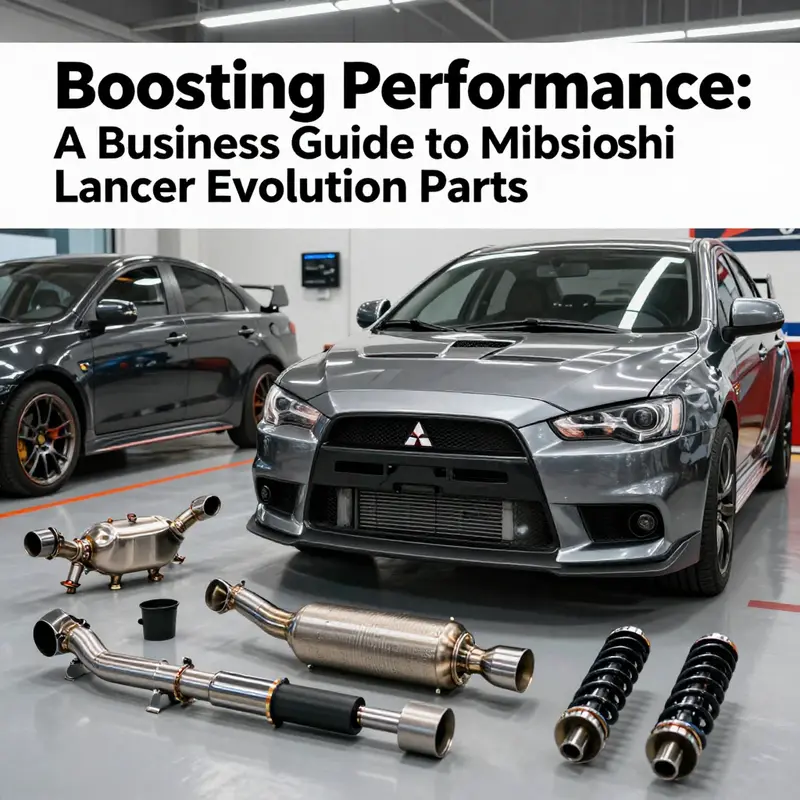

Raising the Bar: Performance Upgrades for the Mitsubishi Lancer Evolution Through Precision Parts

The Mitsubishi Lancer Evolution has long stood as a touchstone for performance enthusiasts who value a chassis that rewards precise feedback and relentless transfer of power. Even after production ceased, the aftermarket ecosystem around the Lancer Evolution has remained vibrant, driven by a global community of tuners who see the car not as a relic, but as a modular platform with enduring potential. The allure is not only in the thrill of higher speeds but in the deeper relationship between a car and the parts that shape its character. Across North America, Europe, and Japan, skilled drivers and professional teams alike pursue components that push the Evo’s performance envelope while preserving driveability and reliability. A crucial backdrop to this pursuit is the emergence of manufacturing hubs in China, notably in cities like Guangzhou and Danyang, where advanced materials and precision processes enable a broad spectrum of parts to be produced at scale without sacrificing the fine tolerances performance demands require. The story of these parts is not just about raw power; it is about how materials, manufacturing method, and a thoughtfully designed integration plan come together to deliver a coherent driving experience that remains faithful to the car’s ethos: approachable, controllable, and relentlessly capable when pushed to the limit.

Power delivery, the heart of any performance upgrade, begins with the engine bay. Engine upgrades in this ecosystem are not mere bolt-ons; they are a coordinated package that aims to improve breathing, timing, and heat management. Turbocharging remains a centerpiece in the pursuit of higher boost and more efficient air delivery. Intercoolers, intake systems, and exhaust manifolds are chosen not only for peak numbers but for their ability to maintain consistent performance across a range of operating conditions. In practice, the goal is to sustain higher charge pressures while keeping compressor surge and intake temperatures in check. The result is a broader, flatter torque curve that remains responsive from street driving to high-load track sessions. The engineered pairing of components—airflow pathways, heat exchangers, and tuned ignition strategies—tends to deliver not just more horsepower, but a more usable power band that the driver can exploit with confidence.

The integration of engine components with the car’s drivetrain and suspension is where the story of performance truly unfolds. The Evo’s reputation rests on a chassis tuned to reward precision: a balanced weight distribution, a communicative steering system, and a suspension that can be fine-tuned to align with the road or the racecourse. High-performance suspension systems—whether featuring adjustable coilovers or sport springs—are designed to lower the vehicle’s center of gravity, sharpen cornering response, and provide a broader window of control. The ability to dial in ride height and damping lets drivers tailor the balance between daily comfort and track-ready stiffness. In practice, the most effective setups preserve mid-corner stability while reducing the car’s tendency to pitch or dive under heavy throttle and braking. This is not about stiffer for stiffness’s sake; it is about distributing weight and controlling dynamic load transfer so the engine’s power translates into forward momentum with predictability.

Braking, too, takes on a strategic role in performance upgrades. Upgraded brake kits emphasize larger rotors, more thermally robust materials, and multi-piston calipers, all aimed at maintaining stopping power and pedal feel during extended high-speed runs. The heat management aspect is critical; a system that can sustain repeated high-speed deceleration without fade enables longer, more confident sessions on the track. Pedal feel and modulation matter as much as outright stopping force. The right combination of rotor surface area, friction materials, and caliper geometry yields a braking response that is linear and repeatable, giving the driver clear feedback about the tire-to-road contact and allowing for precise modulation even under braking with apexes approached aggressively. In the hands of a skilled driver, effective braking upgrades translate into shorter stopping distances and cleaner corners, enabling more aggressive line choices while maintaining control.

Aerodynamics play a complementary role, turning power into stability at speed. Aerodynamic body kits—front splitters, side skirts, and rear wings—are designed to manage airflow, reduce lift, and increase downforce. The objective is not merely to push air around the car but to shape it so that high-speed stability is preserved and high-load handling remains predictable. The modern approach often involves integrating aerodynamic elements with the vehicle’s structural components to achieve stiffness gains and air management that compliments the engine and suspension upgrades. In many scenarios, the balance achieved between front and rear downforce determines how quickly the car can turn into a corner, how the rear end tracks the front under acceleration, and how confident a driver feels when exiting a bend at the limit. The best aerodynamic packages are those that work with the car’s intent rather than merely shouting performance through an aggressive visual signature.

Within the cockpit, performance-oriented upgrades extend beyond speed to safety and driver control. Racing seats, harnesses, and roll cages are designed to secure the driver in extreme driving conditions while preserving the vehicle’s balance and geometry. The relationship between human input and mechanical response becomes more intimate with these upgrades; the seat provides precise lateral support, the harness keeps the driver anchored, and the roll cage offers a safety framework that can resist the forces encountered in high-speed cornering and potential incidents. These interior choices are pragmatic in nature. They enable the driver to exploit the chassis’ capabilities more fully while maintaining a controlled environment that prioritizes safety, especially on the track or in demanding rally environments.

The discussion above only hints at the complexity of assembling a coherent performance package. The real artistry lies in how these components are chosen to complement one another. For example, adding a high-flow intake and a larger turbocharger must be matched with an intercooler of appropriate capacity to prevent heat soak from eroding gains. The exhaust system, while enabling freer flow, must be tuned with the engine’s ignition timing and fuel delivery to avoid detonation and to ensure efficient combustion. The suspension and braking enhancements must be calibrated to work with the altered mass distribution and aero forces. The most successful builds emerge when this triad—engine, chassis, and aerodynamics—are tuned in harmony rather than as a collection of separate upgrades. The driver’s experience reflects this synthesis: smoother power delivery, more precise corner entry, more consistent braking under load, and a sense that the car communicates clearly through the steering wheel and pedals.

The market for these parts is global, but it is far from uniform. The dynamic between demand, supply, and quality creates a fertile ecosystem where distributors seek to meet the wants of performance-minded buyers while managing risk and ensuring reliability. The research landscape notes that China has emerged as a dominant hub for manufacturing aftermarket components, particularly in regions such as Guangzhou and Danyang. Here, factories excel in low-volume, high-complexity production, offering a mix of advanced materials—carbon fiber, polypropylene, and ABS plastics—that enable a broad set of product variants. This capability allows manufacturers to offer full carbon fiber components, half-carbon hybrids, and robust plastic alternatives. The proximity of suppliers to makers and the well-developed logistics networks in Guangdong and Jiangsu provinces help ensure rapid turnaround times, a crucial factor when the market requires quick response to shifting trends or new regulations. Techniques like vacuum infusion, autoclave curing, and CNC mold creation drive dimensional accuracy and surface finish, enabling components that not only look premium but also perform consistently under load. The ability to produce multi-material solutions is particularly valuable, as it gives distributors the flexibility to tailor products to different markets and budgets while maintaining a rigorous standard of quality.

From a procurement perspective, the Chinese manufacturing landscape encourages strategic supplier evaluation, risk mitigation, and data-driven sourcing models. For buyers and distributors, these practices translate into reliable access to both OEM-style replicas and more aggressive styling variants that appeal to performance-centric tuning communities. The result is an ecosystem where clever design, rigorous testing, and disciplined sourcing intersect to deliver parts that meet the expectations of serious enthusiasts. It is not merely about saving costs; it is about preserving the integrity of the driving experience through components that maintain tight tolerances, balanced weight, and predictable behavior across a wide range of operating conditions. This approach matters particularly for high-demand platforms like the Lancer Evolution, where the chassis and powertrain respond to changes in weight distribution and aerodynamics with noticeable shifts in handling balance and stability at the limit.

The practical implications for builders and racers are clear. A performance upgrade path becomes a matter of strategic sequencing: establish a solid engine foundation that can sustain higher boost and improved air management; reinforce the chassis with a suspension setup that suits the targeted environment and driving style; and finalize with brakes, aero, and cockpit upgrades that preserve safety while maximizing the dynamic envelope. The sequence is less about chasing the latest trend and more about building a coherent system in which each component supports the others. This philosophy also guides the way practitioners approach testing and validation. Rather than chasing peak numbers in isolation, they seek repeatable performance across sessions, with consistent lap times, predictable tire wear, and stable thermal management. In this context, the chapter’s guiding principle emerges: performance is a function of harmony, not a pursuit of isolated gains.

To close the loop, it is worth noting that even as the aftermarket continues to evolve, the driving force behind these upgrades remains the driver’s intent. Enthusiasts seek a car that responds with immediacy, communicates clearly through the throttle and steering, and remains controllable when the pace increases. The parts described here are tools that empower that intent. They are not magic; they are disciplined choices backed by a culture that values testing, precision, and accountability. The Evo’s enduring appeal lies in its platform’s adaptability and the way its physics reward thoughtful engineering. The result is a vehicle that can be scaled from spirited street performance to serious track readiness, all while maintaining a coherent driving experience that respects the car’s legacy.

For those looking to explore these upgrades in greater depth, the official performance resource provides a framework for component standards, testing, and application guidelines that help ensure reliability and consistency. A practical takeaway for builders is to treat the Evo as a system rather than a pile of parts. The best outcomes arise when you design for balance, validate through repeatable testing, and maintain an unwavering focus on driver feedback and safety. If you are drawn to the tactile realities of performance tuning, you will recognize that the path to real gains lies in disciplined integration and learning from each run, each lap, and each acceleration pull. The journey is ongoing, shaped by evolving materials, evolving manufacturing capabilities, and a community that continues to push the boundaries of what a legendary four-door sedan can achieve when enhanced with precision parts.

Internal link reference: for a practical example of an Evo-X body upgrade that illustrates the thoughtful balance between airflow management and heat dissipation, see the Evo-X hood upgrade. Evo-X hood upgrade.

External reference for broader context on performance standards and testing: https://www.mitsubishimotors.com/performance/

Preserving Velocity: Understanding Market Dynamics Behind Mitsubishi Lancer Evolution Parts

The Mitsubishi Lancer Evolution has settled into a status that blends myth with mechanical certainty. Even as the car line paused, the appetite for its parts did not. Across North America, Europe, and Japan, enthusiasts remain both custodians and improvisers, seeking high-fidelity replacements that preserve—or even heighten—the Evo’s distinctive balance of agility and grip. The market for genuine Evo 8 components, in particular, has shown a pronounced rise, with early-2026 data signaling a 22 percent year-over-year surge. This isnification of demand is not merely about collecting; it is a response to tightening emissions and the practical reality that older, non-compliant vehicles are becoming harder to support on the road or on the track. In this climate, the appeal of OEM parts grows as a matter of reliability, safety, and the authentic driving experience that owners crave when the tires meet the pavement at speed.

The imbalance between scarcity and desire has steered buyers toward factory-original parts, especially suspension assemblies that are precisely calibrated to preserve the Evo X’s rally-bred persona. OEM shocks, struts, sway bars, control arms, and bushings carry more than a name; they carry a geometry and damping philosophy honed by decades of homologation and competition testing. The result is a ride that remains predictably responsive, with cornering stability that doesn’t drift into the realm of guesswork. For daily driving, track sessions, or a hybrid of both, these parts offer a baseline of trust that aftermarket alternatives, regardless of clever engineering, often struggle to match when measured against the original engineering intent. The resurgence of OEM components underscores a deeper truth: for many Evo owners, performance is inseparable from the authenticity of the parts that maintain its character.

The market’s current dynamism sits at the intersection of nostalgia and genuine technical appraisal. Yet the landscape is not stuck in a single direction. While there is robust demand for authentic items, there is also a growing willingness to consider precision-engineered replicas and hybrid configurations. These options frequently leverage advanced materials and manufacturing techniques to approximate factory fitment while offering weight savings or improved aerodynamics. The reality is that modern procurement now relies as much on data-driven sourcing and supply-chain management as it does on engineering prowess. Buyers and distributors increasingly deploy risk-mitigated strategies to navigate a global ecosystem that blends OEM fidelity with the flexibility of high-performance aftermarket design.

Central to this ecosystem is a robust, globally connected manufacturing network. For many aftermarket components, especially in the upper tier of performance and aesthetics, China has emerged as a pivotal hub. Guangzhou and Danyang stand out as production centers where low-volume, high-complexity manufacturing meets close proximity to raw-material suppliers and advanced logistics. Here, engineers routinely blend carbon fiber with polypropylene and ABS plastics to create components that can be tailored to a spectrum of markets. The same facilities master processes that ensure dimensional accuracy and surface quality—vacuum infusion for multi-layer carbon parts, autoclave curing for high-temperature composites, and CNC mold creation for precise geometries. The combination of these capabilities enables the production of full carbon fiber parts, multi-material hybrids, or durable plastic variants, offering distributors the flexibility to meet a wide range of preferences without sacrificing performance or fit.

For buyers, this reality lowers the barrier to obtaining components that maintain the Evo’s identity while accommodating regional emissions standards, regulations, or budget constraints. The benefit is not simply cost; it is reliability. A carbon rear diffuser or a carbon-fiber hood, for example, can deliver measurable weight savings and improved thermal management when engineered to work with the Evo’s chassis architecture. But there is a caveat: the same complexity that makes these parts capable also creates a risk profile. The quality of multi-material assemblies depends on process controls, resin systems, cure cycles, and the fidelity of the CNC tooling used to shape components. Informed procurement, supplier audits, and clear material specifications are indispensable in reducing the risk of warpage, delamination, or surface defects that can undermine performance on the road or the track.

Distributors who master this ecosystem emphasize not just the immediate fit and finish but the long-term compatibility with the Lancer Evolution’s more sophisticated technologies. The S-AWC system, for example, remains an engineering touchstone for handling dynamics. While the branding around S-AWC is etched in Evo lore, the practical lesson remains simple: performance components must preserve the intended interaction between throttle, steering, and chassis during high-load cornering. OEM parts are often favored for ensuring this alignment, because the calibration of suspension geometry, damper rates, and bushings has been validated to integrate with the electronic stability and drive systems that evolved across generations.

This is why the discussion around the Evo market cannot be reduced to a single axis. It is not only about authenticity versus affordability; it is about the continuity of engineering philosophy as the brand moves toward electrification. Mitsubishi’s current strategy includes electrified technologies—an evolution that can inform future performance architectures even if the Evo badge itself remains in a holding pattern. The electrified direction, seen in other models through plug-in hybrids, signals a future where the core performance DNA may migrate to electric or hybrid powertrains while preserving the chassis balance and torque delivery that Evo fans expect. In that light, the ongoing demand for OEM suspension components and carefully engineered aftermarket options reflects a broader intention: to safeguard the Evo’s interactive mechanics now, even as the powertrain conversation shifts toward electrification.

The practical implications for buyers become clearer when considering the realities of sourcing, quality, and installation. OEM parts provide a leverage point for long-term reliability, repeatability, and consistency of ride height and geometry. They tend to be a prudent choice for maintainers who prize predictable behavior on the road, as well as for track enthusiasts who demand repeatable performance session after session. For distributors, the appeal lies in offering solutions that align with real-world engineering constraints—parts that fit without extensive modification and that preserve the vehicle’s intended dynamics. Yet the market’s appetite for alternatives remains healthy, driven by the desire for weight savings, corrosion resistance, and aesthetic customization. The net effect is a market that rewards technical insight, supply-chain transparency, and a willingness to invest in data-driven procurement practices that can forecast demand, price, and lead times with greater confidence.

In the middle of this evolving terrain, a single, practical decision emerges for many Evo owners: the importance of authentic fitment. The decision to source OEM-style replicas versus factory-original components often hinges on anticipated durability, warranty coverage, and the ability to maintain the car’s alignment with its original engineering baseline. It is not merely a matter of replacing a part; it is a commitment to preserving the fidelity of geometry, damping characteristics, and control feel that define the Evo’s driving experience. When a buyer chooses a component—whether it is a suspension assembly, a structural panel, or a nuanced piece of aero hardware—the choice carries implications for the car’s weight distribution, cornering response, and even brake balance. Those considerations matter because they shape how the car behaves at the edge of grip, where the line between triumph and misjudgment is thin.

The evolving market also carries a logistical and informational dimension. Given the global dispersion of both demand and manufacturing capability, buyers rely on supplier evaluations that go beyond price. They seek documentation of material specifications, curing cycles, surface finishes, and the precise tolerances that govern fitment. They demand traceability—knowing the origin of fibers, resins, and prepregs; understanding the maintenance requirements for composite parts; and having access to technical data that supports safe usage in high-stress environments. This is where the value of a data-driven procurement model becomes visible. It allows distributors and buyers to mitigate risk by aligning supplier capabilities with part requirements, ensuring that a carbon hood or a composite bumper will withstand the track’s thermal and aerothermal stresses without compromising safety or legal compliance.

Within this framework, the Evo market’s dynamics are also shaped by consumer education. Enthusiasts increasingly demand clarity about what constitutes a high-fidelity replica versus a lower-cost alternative. They want to know how a particular bumper or hood integrates with the car’s aerodynamic profile, whether the component is designed for drag reduction or downforce, and how it interacts with weight distribution at high speeds. They want to know if a component has been tuned to preserve the Evo’s precise steering geometry and whether installation can be supported by professional services that understand the car’s unique platform. These inquiries push sellers to provide transparent performance data, installation guidance, and, when possible, independent testing results. In turn, buyers grow more confident in their ability to select parts that not only look the part but perform in a way that preserves the Evo’s distinctive driving identity.

Amid this complexity, one practical path stands out for those who want to bridge authenticity with contemporary engineering: lean into components that are designed to work with the Evo’s existing architecture while offering modern manufacturing benefits. A good example is a hood or bumper that uses carbon fiber or reinforced composites to balance rigidity with weight savings, yet still adheres to the factory mounting points and sensor interfaces. Such parts reduce the likelihood of interference with active safety systems and body-in-white tolerances, making maintenance and alignment more straightforward. It is also worth noting that the ability to source multi-material assemblies expands the design space for tuners who want enhanced performance without sacrificing structural integrity. The right balance between carbon, plastics, and metal reinforcements can yield a product that improves rigidity and aero efficiency while preserving the natural motion of the Evo under load.

Readers who want a concrete touchstone for this market can explore a representative Evo-X model component that demonstrates how a modern OEM-style part might be positioned within a broader aftermarket strategy. For those who want to visualize a specific item in context, there is an Evo-X hood option described in a detailed catalog entry, which outlines the shape, finish, and mounting considerations for a phantom-black, OEM-specified hood. The linked product page provides a tangible example of how authenticity and modern manufacturing meet on the car’s surface, reinforcing the idea that the most effective Evo parts strategy blends factory history with current engineering capability. Evo-X hood OEM U02.

Of course, the broader market context continues to point toward a thoughtful, phased approach to maintaining and upgrading Evos. For many owners, this means prioritizing components whose performance benefits are demonstrable and reproducible. The suspension system, for example, remains one of the most sensitive areas for preserving steering response and cornering stability. Replacing worn components with near-identical specifications minimizes the risk of drift in handling characteristics, which is crucial when the goal is to preserve the Evo’s rally-inspired handling dynamics rather than chase a purely cosmetic upgrade. This is why many observers expect that, even as electrification takes a broader role in Mitsubishi’s lineup, the demand for high-quality, precisely calibrated suspension parts will endure. The company’s engineering ethos—evolved, now applied to different powertrains—still informs how these parts are designed, tested, and validated for performance under real-world conditions. In other words, authenticity and precision are not relics of the past; they are living principles that guide the market toward durable solutions that respect the Evo’s heritage while embracing the realities of modern manufacturing.

The market’s future will likely reflect a gradual convergence of these themes: authentic OEM fidelity where cost and availability permit, advanced manufacturing that offers weight and performance benefits without sacrificing fit, and a carefully managed transition as electrified propulsion becomes more central to Mitsubishi’s performance narrative. For buyers and distributors, this means investing in parts programs that emphasize traceable quality, clear installation pathways, and long-term support. It also means recognizing that the Evo’s legacy may evolve, but the driver’s desire for a predictable, rewarding, and communicative chassis response will remain a constant. The chapter that follows will continue to build on this foundation, examining how these market dynamics inform the choices made by enthusiasts who are balancing history, performance, and the practicalities of keeping a legendary platform on the road and on the record books.

External source: https://www.autocar.co.uk/article/mitsubishi-lancer-evolution-parts-market-2026-trends

Final thoughts

The aftermarket for Mitsubishi Lancer Evolution parts is thriving, presenting numerous opportunities for business owners. By understanding current trends, establishing effective sourcing strategies from China, enhancing vehicle performance through innovative parts, and grasping market dynamics, businesses can tap into this lucrative niche effectively. As the automotive landscape continues to evolve, staying informed and adaptable will be key in securing a leading position in the aftermarket industry.