Understanding the intricacies of the auto parts market is essential for business owners seeking to thrive in a competitive landscape. This exploration of A Plus Auto Parts provides valuable insights into two prominent entities: A Plus Auto Parts Inc in the U.S. and Aplus Auto Parts Co., Ltd in China. Each chapter will uncover critical aspects of these companies, comparing their operations, evaluating their roles in the aftermarket parts industry, and addressing future trends that can shape business strategies. From the distinctive business models to the overarching impact on global markets, this article equips businesses with the knowledge needed to make informed decisions in an ever-evolving sector.

A Plus Auto Parts Inc.: Crafting a Sustainable U.S. Network for Recycled OEM Auto Parts

A Plus Auto Parts Inc. has positioned itself as a focused U.S. distributor of recycled OEM components. The company’s model hinges on three clear commitments: sourcing accuracy, consistent customer service, and environmental responsibility. These pillars shape how the business acquires inventory, works with repair professionals, and serves individual vehicle owners.

The firm’s approach to sourcing places precision first. Each incoming part is inspected against manufacturer specifications. Fitment checks, visual inspections, and basic functional tests are routine. This reduces the risk of misidentification and improves first-time fit rates. For shops that cannot afford downtime, that reliability matters. A Plus Auto Parts Inc. uses documented sourcing processes. Those processes track provenance and condition. That documentation supports transparency and helps technicians trust recycled parts for routine repairs.

Beyond inspection, the company emphasizes OEM fidelity. When a recycled part matches the original manufacturer’s design, it typically requires less modification and offers predictable performance. This reduces installation time and minimizes surprise callbacks. A Plus Auto Parts Inc. works to maintain consistent part grading standards. That consistency supports fair pricing tiers and clear expectations. Customers know what to expect when they buy a component labeled to a given grade.

Customer service operates as a competitive advantage. The company trains staff to assist both do-it-yourselfers and professional crews. For consumers, staff explain fitment checks and advise on return policies. For repair shops, staff help locate compatible parts quickly. They will often cross-reference vehicle data, recalls, or common wear points. Quick answers prevent extended vehicle downtime. Clear communication of lead times and shipping options also reduces frustration. The company builds repeat business through honest estimates and dependable delivery.

Logistics and reliable delivery are critical in this market. A Plus Auto Parts Inc. keeps an inventory mix that balances frequently requested parts and less common, high-value components. This balance aims to minimize delays while avoiding overstock. The company leverages regional shipping networks to reach local shops quickly. Where necessary, they arrange expedited shipments. These operational choices help the distributor meet urgent repair timelines.

Sustainability is woven into the business case. Reusing quality OEM components reduces manufacturing demand. That, in turn, lowers material extraction and energy use. By extending the life of functional parts, the company contributes to a smaller environmental footprint for vehicle maintenance. For environmentally conscious consumers, this is a compelling benefit. For repair shops, it offers a cost-effective pathway to maintain vehicles without defaulting to new parts.

There are practical challenges in the recycled parts trade. Accurate part identification across model years can be complex. Variations in tooling, mid-year changes, and optional package differences complicate fitment. A Plus Auto Parts Inc. mitigates these issues with a blend of human expertise and digital support. Experienced parts specialists handle borderline cases. Digital databases help map exact part numbers and compatible model ranges. These systems shorten resolution times and reduce errors.

Quality assurance also extends to packaging and returns. Recycled parts can suffer damage in transit if not packed properly. The company uses reinforced packaging for fragile items and labels shipments with clear handling instructions. Return policies are structured to protect buyers while discouraging casual returns. That balance preserves margins while maintaining customer trust.

The distributor’s market footprint touches two core customer segments. First, independent repair shops value reliable part sourcing and predictable delivery. These shops often prefer OEM-compatible recycled parts because they match original tolerances. Second, individual vehicle owners seeking cost savings consider recycled components attractive. For both groups, the company’s reputation for precision in sourcing is decisive. A robust warranty policy and responsive support further encourage adoption.

In a marketplace with similarly named firms, clarity matters. Accurate company information and a transparent online presence help customers identify the correct supplier. A Plus Auto Parts Inc. keeps its business profile updated. That profile showcases its focus on recycled OEM components and highlights service capabilities. Clear contact points and published policies reduce confusion and prevent misdirected purchases.

Technology plays a growing role in operational efficiency. Inventory systems that support live updates, part matching algorithms, and mobile access for field technicians all enhance service speed. A Plus Auto Parts Inc. invests in tools that link vehicle identification numbers to precise part numbers. This reduces guesswork and returns. For small shops, access to such systems through a supplier can be transformative.

From a strategic perspective, the company balances short-term responsiveness with long-term supplier relationships. Building strong ties with salvage partners and dismantlers secures higher-quality inventory. In turn, those relationships yield better selection and predictable supply for replacement parts. Long-term procurement contracts and careful quality audits of suppliers help maintain standards. This supplier management discipline underpins the company’s reputation for reliability.

Pricing strategy is pragmatic. Recycled OEM parts typically cost less than new equivalents. Pricing must reflect condition, rarity, and demand. A Plus Auto Parts Inc. sets prices to be competitive for repair budgets while still covering inspection and handling costs. Special pricing or bulk discounts for regular shop customers foster loyalty. Clear grade descriptions help buyers choose the right trade-off between savings and condition.

Educating customers reduces friction. The company provides straightforward materials explaining grading, fitment confirmation steps, and estimated life expectancy for reused parts. This guidance reduces unrealistic expectations. It also empowers technicians to make informed decisions about when a recycled component is appropriate.

Looking ahead, the distributor can scale by enhancing digital reach and expanding regional logistics. Standardizing inspection protocols across partner facilities would improve consistency. Further automation in inventory updates and part matching would lower response times. Each of these improvements would deepen trust among repair professionals and consumers.

A Plus Auto Parts Inc. exemplifies how a focused distributor can deliver value in the recycled OEM market. Their emphasis on inspection, communication, and environmental benefit creates an efficient alternative to buying new. For repair shops and cost-conscious owners, that alternative often makes sense. For the wider industry, the firm’s practices illustrate how quality controls and clear processes bring recycled parts into mainstream acceptance.

More about the company’s profile and professional presence can be found on their public LinkedIn page: https://www.linkedin.com/company/a-plus-auto-llc/

From Qingdao to the Global Stage: Aplus Auto Parts Co., Ltd and the Rise of China’s Automotive Aftermarket

In the unfolding story of the Chinese automotive aftermarket, Aplus Auto Parts Co., Ltd. emerges as a notable case of how a regional player can extend its reach beyond borders while anchoring its operations in a deeply capable manufacturing ecosystem. Based in Qingdao, the company centers its business on the design, production, and global sale of aftermarket components for both passenger and heavy-duty vehicles. This triad—research and development, manufacturing execution, and robust sales channels—constitutes a cohesive engine that powers its reputation for reliability and continuous innovation. The Chinese market, long seen as a factory floor, is increasingly read as a hub of end-to-end value creation, and Aplus Auto Parts Co., Ltd. embodies that transition by aligning technical prowess with market access. The result is not merely a catalog of parts but a living system that can respond to evolving customer needs, regulatory requirements, and the pressure of global competition with equal seriousness.

The company’s strength lies in its ability to leverage China’s expansive manufacturing base and sophisticated supply chains without sacrificing clarity about what it offers. At the heart of its operations is an integrated manufacturing system that weaves research, development, production, and sales into one continuous workflow. This integration matters because aftermarket parts must move quickly from concept to mass production while preserving traceability, quality, and cost efficiency. By coordinating design iterations with production planning and market feedback, the firm can reduce cycle times and align specifications with international demand. In practice, this means streamlined prototyping, tighter tolerances, and more predictable lead times, all of which are essential in a market where buyers expect dependable performance at competitive prices. The Qingdao campus is a strategic locus, but the company’s real breadth comes from its ability to translate local manufacturing strengths into global availability. The metropolitan logistics networks, the national distribution frameworks, and the international freight corridors that run through China all feed into a system designed to deliver parts to diverse markets with consistent quality.

Quality and innovation function as mutually reinforcing pillars. In a sector where performance and safety hinge on component integrity, Aplus Auto Parts Co., Ltd. emphasizes rigorous testing, materials engineering, and process standardization. The firm’s emphasis on aftermarket parts—distinct from original equipment manufacturing—demands an awareness of aftermarket realities: compatibility across generations, quick adaptation to new vehicle platforms, and the ability to offer affordable alternatives that do not compromise safety or reliability. This is where the company’s approach to research and development proves decisive. Rather than chasing novelty for novelty’s sake, it pursues engineering improvements that translate into tangible benefits for customers around the world. Each new design is weighed against manufacturing feasibility, supply chain resilience, and serviceability in diverse regions. The result is a portfolio that can satisfy domestic demand while being packaged for international distribution, a balance that is increasingly valued in a marketplace that prizes both price competitiveness and performance assurance.

The global dimension of Aplus Auto Parts Co., Ltd.’s strategy rests on two complementary planes: breadth of offering and clarity of value. On the breadth side, the company serves domestic markets and extends outward through established export channels, leveraging China’s export infrastructure to reach customers in varied regulatory environments. On the value side, it positions itself as a reliable supplier capable of meeting both bulk procurement needs and targeted, smaller lots for regional distributors. The emphasis on transparency in product offerings—visible through the company’s listings and catalogs—helps build trust with international buyers who may be evaluating a new supplier. This transparency is not merely about documentation; it is about visible quality signals, standardized specifications, and consistent performance assurances that buyers can compare across regions. In this sense, Made-in-China’s ecosystem, including company profiles and catalog entries, serves as a bridge between manufacturing capability and market credibility. Aplus Auto Parts Co., Ltd. thus operates not just as a maker of parts but as a node in a larger network where design intent, manufacturing discipline, and customer service converge.

For readers exploring the operational philosophy behind such a model, the breadth of catalog entries in Chinese aftermarket supply networks offers a telling glimpse into the capabilities of suppliers like Aplus Auto Parts Co., Ltd. One representative entry from an industry partner catalog demonstrates how the market categorizes and presents components for global buyers. This example—while only a single catalog item—illustrates the landscape in which the company positions itself: a catalog that can span from essential structural components to accessory lines designed to meet evolving aesthetics and performance expectations. For those who want to glimpse how a supplier presents its wares to a worldwide audience, the linked catalog entry serves as a concrete reference point: brand-new-original-bbs-rims-set-of-4-r18-rims-for-lancer-sedans.

The presence of such catalogs in the broader ecosystem underscores a strategic ethos: scale without sacrificing specificity. Aplus Auto Parts Co., Ltd. aims to be more than a low-cost producer; it aspires to be a credible partner capable of meeting the unique demands of diverse markets. That means aligning product design with regulatory considerations in different countries, anticipating maintenance and service needs, and offering consistent support through multiple languages and time zones. It also implies a careful calibration of customization options. In a market that prizes both standardization for reliability and flexibility for local adaptations, the company can offer core parts that meet universal performance criteria while accommodating region-specific preferences and compliance requirements. This duality—standardization coupled with adaptable configurations—helps secure repeat business from distributors and reinforces the reputation of Chinese aftermarket suppliers as capable, reliable, and responsive.

The narrative of Aplus Auto Parts Co., Ltd. thus transcends the mere export of components. It captures a broader transition in the Chinese manufacturing story: from a focus on volume to a focus on value, from a singular domestic footprint to a transnational footprint, and from a siloed supply chain to an integrated value chain that aligns R&D, production, and aftersales support into a seamless customer experience. The company’s trajectory spotlights how Chinese enterprises are maturing in the sense that they can manage complex, technically demanding products while maintaining cost discipline and delivery reliability. In markets where customers increasingly evaluate suppliers on governance signals—traceability, quality certifications, and consistent aftersales service—the Aplus Auto Parts approach resonates as a practical model. It demonstrates that the most resilient players are those who invest in people, process, and partnerships as a unified system rather than as a loose constellation of capabilities. And in a global aftermarket that rewards speed, reliability, and clarity, the Qingdao-based enterprise positions itself to grow not just as a supplier of parts but as a trusted partner across continents.

External resource and industry context often reinforce these observations. To explore how a Chinese aftermarket supplier presents itself on international platforms and how this contributes to perceived credibility, one can consult industry directories and company profiles that curate such data for global buyers. External profile resources provide additional context about the company’s market positioning and the transparency of its catalog offerings: https://www.made-in-china.com/company/Aplus-Auto-Parts-Co-Ltd/.

Two Names, One Market: Navigating A Plus Auto Parts Across Borders in the Global Auto-Parts Landscape

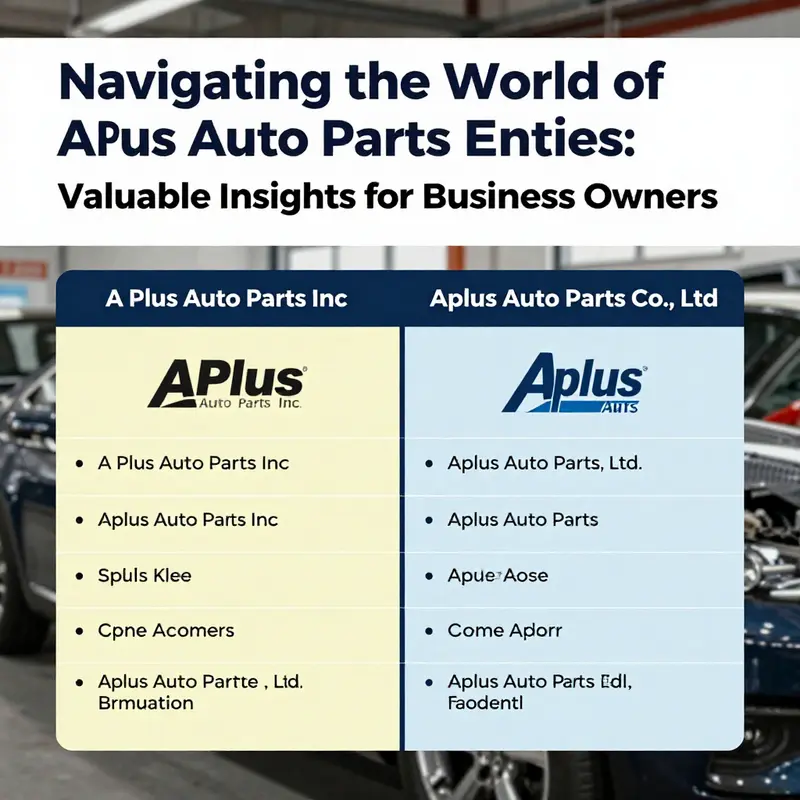

In the sprawling world of auto parts, names can travel across oceans and still land in the same headline without ever sharing a common legal footprint. The case at hand—A Plus Auto Parts—exposes a quiet but persistent challenge for analysts, buyers, and suppliers: when similar or identical names appear in different jurisdictions, how does one separate genuine brand signals from misattributed data? The material at hand presents two entities with strikingly similar appellations but different geographic roots and business models. On one side sits A Plus Auto Parts Inc., registered in New York and operating as a domestic business corporation with a stated address on Staten Island. On the other side is Aplus Auto Parts Co., Ltd., a Chinese company ostensibly focused on aftermarket and heavy-vehicle components with a global reach. The surface similarity invites a straightforward conclusion—names equal brands—but the underlying structures, markets, and intentions tell a more nuanced story. A well-anchored chapter would insist that we stay faithful to the context: who is operating where, under what jurisdiction, and with what market ambitions. Yet the available material makes clear that a clean, apples-to-apples comparison across these two entities cannot be sustained without risking conflation. What exists in the record is a cautionary tale about data purity, branding, and regional strategy within the auto parts ecosystem, a field where visibility often travels faster than verifiable truth.

What first stands out is the simple fact of jurisdiction. A Plus Auto Parts Inc. is described as a New York domestic corporation, active and registered with the state’s registry. The physical address—168 Slater Blvd on Staten Island—signals a footprint rooted in the U.S. commercial environment, with all the regulatory, tax, and reporting requirements that accompany a U.S.-based entity. The Chinese counterpart, Aplus Auto Parts Co., Ltd., aligns with the broader scope of the Chinese aftermarket sector: design, production, and sales that aim to serve a global chain of distributors and retailers. In practice, this separation matters for anyone assessing supply reliability, regulatory compliance, or even branding alignment. The two organizations inhabit different regulatory landscapes, different market expectations, and different scales of operation. The available data points to distinct business logics rather than a single, harmonized brand narrative across borders. Yet the similarity in name persists in trade databases, search results, and sponsor lists, which can mislead when one attempts a quick, surface-level assessment.

To sharpen the reader’s sense of where the evidence actually lands, the chapter must acknowledge a crucial limit in the current materials: the explicit comparative analysis of these two A Plus Auto Parts entities does not exist in the provided sources. Instead, the primary documented corporate entity in the broader materials is Advance Auto Parts Inc. (AAP), a publicly traded U.S. company with a clearly traceable market presence, data, and earnings narrative. The contrast is not simply about branding but about the availability of verifiable data. AAP provides a concrete, finance-grounded frame: stock price, market capitalization, 52-week high and low, and pre-market earnings context. These details offer a snapshot of market sentiment and company performance within the auto parts distribution arena, and they serve as a reliable benchmark for understanding the scale and volatility of managed parts supply operations in North America. However, because the sources centered on AAP rather than the two A Plus Auto Parts entities, any attempt to draw a direct, quantitative comparison would be speculative at best. The lesson is clear: in a field where data is fissured across jurisdictions and brand names collide, a precise cross-market comparison requires an independent, clearly defined data set for each entity under review.

From a practical standpoint, this misalignment between branding signals and verifiable corporate data has tangible consequences. For procurement managers, potential suppliers, and scholars of market structure, the risk is not merely catching the wrong brand in a search result. It is the possibility of attributing a given country’s regulatory posture, financial health, or supply-chain reliability to the wrong entity. When one pulls a report on A Plus Auto Parts, the reader must explicitly confirm whether the reference is to the New York-based domestic corporation or to the Chinese firm with global aftermarket ambitions. Absent that confirmation, strategic decisions—such as supplier qualification, credit terms, or compliance audits—are at risk of being misinformed. The grace note here is that legitimate due diligence practices already emphasize multiple verification layers: cross-check registration numbers with respective national registries, confirm the entity’s actual business scope, examine the corporate family tree for related entities or subsidiaries, and triangulate information with trade journals, regulatory filings, and industry directories. In the context of the two A Plus Auto Parts names, due diligence cannot rely on nomenclature alone; it must rely on jurisdictional identity and explicit corporate disclosures.

The narrative also invites reflection on the structure of the auto parts marketplace itself. The aftermarket sector—a realm where design, production, and distribution networks intersect—often features a mosaic of players who share partial overlaps in product categories, but diverge in core competencies and regional focus. A Chinese company focusing on aftermarket geometry and heavy-vehicle components may emphasize global distribution channels, manufacturing scale, and a supply chain that spans multiple continents. A U.S.-based entity registered in New York could pursue a different mix of service, branding, and regulatory alignment that prioritizes domestic distribution, compliance with American consumer protection standards, and relationships with regional distributors and repair shops. The divergence in business models matters because it reshapes risk profiles, financing needs, and strategic investments. The two entities, while sharing a naming cadence, are likely to live in different market ecosystems, governed by separate rules and shaped by distinct customer bases. This is not a trivial nuance; it is a fundamental axis along which the reliability and clarity of market information must be weighed.

The chapter’s broader significance rests in how analysts interpret market signals in light of branding ambiguity. When a name resembles another entity, the temptation to infer similar scale, strategy, or risk can be strong. Yet the evidence here cautions restraint. Market signal literacy—whether it comes from press releases, regulatory filings, or stock market data—demands that one ground conclusions in verifiable identifiers beyond the name. The Advance Auto Parts data that appears in the available materials offers one anchor: a publicly traded, widely covered U.S. company with a mature market presence. It demonstrates what a transparent, finance-informed snapshot looks like in this space. But it is a separate entity from the two A Plus Auto Parts brands under discussion. They are not interchangeable in the record, and treating them as if they were would risk misrepresenting both market position and strategic intent.

Within this frame, a practical takeaway emerges for readers who operate at the intersection of data analysis, procurement, and corporate branding. First, always verify jurisdictional identity. The New York registration signals a domestic U.S. footprint that interacts with American regulatory regimes, tax structures, and consumer-law standards. The Chinese company’s stated global aftermarket focus implies a broader international play, possibly involving cross-border manufacturing, export controls, and multi-regional distribution agreements. Second, separate the brand’s marketing narrative from the financial and regulatory reality revealed in registries and filings. A name alone does not reveal risk tolerance, creditworthiness, or operational breadth. Third, acknowledge that data gaps, such as the absence of a cross-market comparative dataset in the provided materials, require cautious interpretation. The absence is as informative as any single data point: it signals where further verification must occur and underscores the importance of building analysis around primary sources and official records rather than catalog-page impressions.

To illustrate how the industry moves beyond names into practical sourcing decisions, consider the role of catalogs and reference portals in part selection and procurement. In real-world practice, buyers rely on catalogs that organize parts by vehicle fit, compatibility, and dimension, rather than solely by brand identity. An internal resource that represents this approach would emphasize neutral navigation through parts categories, ensuring that buyers can locate compatible components without conflating distinct corporate origins. For readers who want a concrete, domain-relevant example of this approach, an internal auto-parts reference can be accessed here: internal auto parts resource. While the URL itself centers on a specific part, the anchor text remains a generic invitation to a catalog-like resource, underscoring the principle that useful market analysis leans on reliable cross-referencing rather than brand mimicry. This detour into catalogs highlights a practical strategy for practitioners facing branding ambiguity: lean on verifiable product-agnostic data points, confirm corporate status, and triangulate with independent market signals.

The broader implication for future chapters is straightforward. When two entities share a name across borders, the analytical framework must foreground jurisdiction, corporate structure, and scope of operations. It must also recognize the limits of available data and resist oversimplified comparisons. By anchoring discussions in verifiable identifiers, and by complementing branding impressions with official registers and credible market data, researchers can deliver a more robust narrative about who actually controls influence in the auto-parts landscape. In the chapters that follow, the conversation can expand to examine how regional regulatory environments shape supply networks, how branding strategies evolve in response to cross-border competition, and how investors distinguish between mere name similarity and genuine strategic parity in a market that thrives on precision, reliability, and timely service. The path from name similarity to market insight is not linear; it is iterative, data-driven, and mindful of jurisdictional nuance. The two A Plus Auto Parts identities serve as a reminder that clarity in data provenance is as essential as clever branding when mapping the auto parts ecosystem for practitioners and scholars alike.

External resource: For broader context on market analysis practices in the auto parts sector and how analysts translate brand signals into strategic insights, see https://www.investopedia.com/terms/m/marketanalysis.asp

Beyond OEM: How A Plus Auto Parts Shapes Reliability, Customization, and Speed in the Global Aftermarket

Vertical integration in the aftermarket reduces fragmentation by centralizing design, manufacturing, and quality control. A Plus Auto Parts demonstrates how controlled workflows deliver consistent parts, shorter lead times, and clearer traceability for regional distributors and workshops.

The dual-country configuration—A Plus Auto Parts Inc. in the United States and Aplus Auto Parts Co., Ltd. in China—illustrates how global reach can be aligned with local requirements while maintaining safety and performance. Through dedicated customization capabilities, batch-level adaptability, and rigorous testing, the supplier can tailor fitment, finish, and packaging to regional models and climates without sacrificing efficiency.

This approach supports cost-effective alternatives to OEM components, enabling fleets and shops to source reliable parts quickly while meeting regulatory and safety expectations. It also enables faster response to market signals, reducing minimum orders, and improving inventory turnover through scalable production and transparent documentation.

Electrify, Integrate, Sustain: Strategic Paths for A Plus Auto Parts in a Transforming Market

Electrify, Integrate, Sustain: Strategic Paths for A Plus Auto Parts in a Transforming Market

The auto parts landscape is shifting from a world of bolt-on components to one defined by software, modules, and circular processes. For a company operating under the A Plus Auto Parts name, whether a local New York supplier or a global manufacturer based in China, this shift requires rethinking product portfolios, manufacturing practices, and customer relationships. The story is not merely technical. It is commercial, operational, and cultural. Companies that treat electrification, modular integration, and sustainability as isolated initiatives will fall behind. Those that link them into a coherent strategy will capture new value and customer loyalty.

Electrification sits at the center of this change. As vehicle platforms migrate toward battery-electric architectures, the relevance of traditional engine parts declines while demand rises for electric motors, power electronics, thermal management, and battery management systems. For parts suppliers, this is both threat and opportunity. Legacy components will shrink in volume; new categories will emerge that require different engineering, testing, and regulatory know-how. A Plus Auto Parts can respond by mapping its capabilities against the EV stack and deciding where to build depth. That could mean investing in power electronic expertise. It might mean partnering with firms that specialize in battery modules, or redeploying machining and assembly capacity to produce motor housings, inverter enclosures, or battery cooling plates.

Yet electrification does not occur in isolation. It amplifies the need for modularization and system-level solutions. Original equipment manufacturers increasingly prefer to source pre-validated modules that reduce integration risk and speed time to market. For an A Plus entity, evolving from selling individual parts to offering subsystems — such as complete drivetrain assemblies or ADAS packages — creates higher margins and stickier relationships with OEMs and fleet operators. The transition demands capabilities beyond metalworking: electronics integration, systems testing, and software calibration. Building those capabilities in-house will be expensive, but selective acquisitions or long-term partnerships can shorten the learning curve and secure access to critical intellectual property.

Sustainability is another defining vector. Regulatory pressure and consumer expectations make green manufacturing a strategic imperative. Remanufacturing and component refurbishment are not just ethical choices; they are commercial levers. They lower costs, extend product lifecycles, and reduce supply volatility. For example, remanufactured units for mechanical, electronic, or structural parts can appeal to cost-sensitive aftermarket channels while supporting circular economy commitments. A Plus Auto Parts can implement closed-loop supply chains that recover cores, apply standardized remanufacturing processes, and certify refurbished items. That approach builds resilience against raw material price swings and aligns with national directives favoring green industry practices.

Digitalization underpins all these shifts. Smart factories that combine IoT, real-time analytics, and flexible automation enable rapid retooling for new product families. For smaller plants, digital twins and cloud-based process controls create scale without massive capital intensity. Predictive maintenance reduces downtime, while advanced quality analytics lower defect rates for complex electronic assemblies. A Plus Auto Parts should prioritize modular manufacturing cells that can pivot between internal combustion components and EV parts, guided by a central digital thread. This architecture supports just-in-time supply while enabling traceability, a critical factor for battery and safety-related components.

New market entrants illustrate how accessible the sector has become. Small, focused firms often enter with a niche—battery swap equipment, testing rigs, or specialized EV accessories—and expand quickly. Their example shows that agility and targeted innovation can outmaneuver scale in certain segments. For A Plus Auto Parts, this dynamic argues for combining steady improvements in operational efficiency with experimental ventures into emerging niches. A small research and development fund or an incubator partnership can surface promising technologies without exposing the core business to undue risk.

Customer expectations are evolving too. Fleet operators, aftermarket installers, and retail consumers expect faster diagnostics, over-the-air updates, and integrated service offerings. The parts company of the future will sell outcomes as much as hardware: uptime guarantees, remote diagnostics, and modular upgrade paths. Packaging mechanical parts with digital services increases lifetime value and opens recurring revenue streams. That requires new commercial models and stronger collaboration with software partners and telematics providers.

Supply chain resilience remains a practical concern. Global sourcing spreads risk but also creates complexity. A Plus Auto Parts should balance local production nodes with strategic overseas partnerships. Sourcing critical materials domestically where possible shortens lead times for high-demand items, while global partners can supply specialized components and scale manufacturing for volume runs. Inventory strategies will also evolve: fewer fast-moving legacy parts, more strategic stocks of EV modules and electronic components. Investing in supplier relationships and dual sourcing for key items like semiconductors or specialized alloys will reduce vulnerability to global disruptions.

Workforce transformation is often overlooked but crucial. The skills needed for electromechanical assembly and software calibration differ from those for traditional machining. Upskilling programs, apprenticeship paths, and partnerships with technical institutes will be essential. A Plus Auto Parts should cultivate multidisciplinary teams that combine mechanical engineers, power electronics experts, and software technicians. That cultural shift—from craft-based metalwork to integrated systems thinking—will determine how quickly new product lines reach market.

Standardization and certification also rise in importance. As parts become more integrated with vehicle-level systems, compliance with safety and interoperability standards becomes non-negotiable. Proactive engagement with standards bodies and early investment in certification processes will accelerate market access for new modules. Companies that wait for specifications to mature risk being excluded or forced into costly redesigns.

Finally, innovation pathways must include low-risk routes to market. Pilot programs with fleet operators, staged rollouts with tiered warranties, and co-development agreements with OEMs reduce commercial risk. Building modular architectures that allow incremental feature additions lowers the barrier to early customer adoption. Combining that with visible sustainability commitments and transparent sourcing will resonate with regulators and end users alike.

The path forward for any A Plus Auto Parts organization is multidimensional. Electrification creates new product categories and obliterates old volumes. Integration and modularization shift value toward systems and services. Sustainability and remanufacturing lower costs and meet policy goals. Digital factories and a reskilled workforce make these changes feasible. The companies that link these threads into a clear strategy—prioritizing targeted R&D, flexible production, strong supplier networks, and customer-centric service models—will convert disruption into advantage. Practical steps include mapping technical gaps against market opportunities, piloting modular assemblies, investing in remanufacturing processes, and building digital capabilities that enable rapid product pivots.

Examples from the market show how material innovation complements these trends. Lightweight components play a role in efficiency gains and can be pursued alongside remanufacturing and modular design; see this example of a carbon-fiber bonnet/hood that illustrates lightweight design approaches: brand-new-original-carbon-fiber-bonnet-hood-for-mitsubishi-lancer-evo-x. For a wider view of industry evolution—covering fragmentation, technology integration, and supply chain changes—authoritative analysis is available from industry advisors and research firms. (See external perspective: https://www2.deloitte.com/us/en/insights/industry/technology/automotive-industry-trends.html)

Adopting this integrated mindset will position A Plus Auto Parts to compete across markets. The company will not simply survive change; it will shape it. By aligning electrification, integration, sustainability, and digitalization into a single operational narrative, A Plus Auto Parts can become a trusted partner to OEMs, fleets, and aftermarket customers in the decade ahead.

Final thoughts

In summary, the exploration of A Plus Auto Parts and its operations in both the U.S. and China reveals significant insights for business owners in the automotive aftermarket industry. Understanding the unique characteristics of each entity, their contributions to the parts market, and the trends influencing the sector will equip businesses with the necessary knowledge to capitalize on opportunities. By staying informed about these global dynamics, businesses can position themselves effectively in an increasingly competitive landscape. The future of the auto parts industry is vibrant and full of potential, calling for proactive strategies and innovations.