Advance Auto Parts stands as a cornerstone in the automotive parts industry. For business owners looking to understand how this reputable company operates, its financial health, competitive landscape, and embracing of technology, it’s essential to delve into its multifaceted operations. The following chapters will provide a detailed exploration of each crucial aspect, from its streamlined operations to its robust financial performance, competitive positioning, innovative tech solutions, and shifting consumer behaviors in the marketplace.

The Operating Engine: How Advance Auto Parts Orchestrates a Multibrand, Multichannel Auto Parts Empire

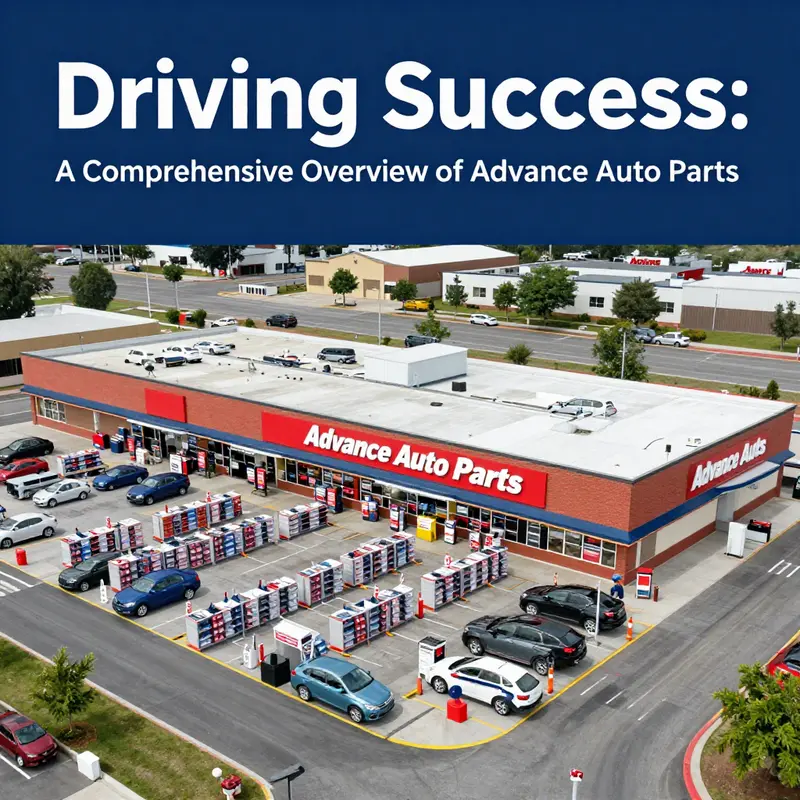

From its founding in 1929 to its current footprint across the United States, Canada, Puerto Rico, and the U.S. Virgin Islands, Advance Auto Parts has built more than a network of stores. It has engineered a resilient operating model that blends four brands, a tiered distribution system, and a digital-forward, customer-centric approach. At the center of this model is a simple but demanding objective: keep vehicles moving. Behind this objective stands a complex choreography of sourcing, inventory, logistics, and service that serves two powerful customer bases at once—professional repair businesses and individual do-it-yourself customers. The scale is substantial. A few numbers illuminate the magnitude of the undertaking: thousands of storefronts connected to hundreds of distribution centers, all synchronized to cover a broad swath of North America. But it is not merely the size that matters. It is how the components work together to deliver parts efficiently, ensure availability, and provide actionable technical support when a repair is underway. This is the essence of the operating engine that propels Advance Auto Parts and shapes its competitive stance in a crowded aftermarket landscape.

The company’s architecture rests on four core operating pillars that allow it to reach diverse customer segments with precision. In the United States, the combined strength of Advance Auto Parts and Carquest creates a broad retail and wholesale platform that captures both walk-in traffic and large, recurring B2B orders. Across the border, Carquest Canada extends the same value proposition into a distinct market with its own regulatory and logistical nuances, ensuring continuity of supply for customers who depend on a familiar service ethos no matter which side of the border they operate on. Worldpac adds a specialized dimension to the mix, concentrating on imported parts and serving professional channels with an emphasis on parts compatibility across vehicles that move through global supply chains. Lastly, the Independent channel acts as a bridge to the broader ecosystem, supporting independent repair shops and distributors who rely on the group’s purchasing power and vendor relationships to keep their own businesses competitive.

This multi-brand framework is not merely about coverage; it is about strategic alignment with customer needs. For professional repair businesses, the emphasis rests on reliability, timely replenishment, and access to a technical knowledge base that helps mechanics diagnose and source the correct components quickly. For individual consumers, the focus shifts toward accessibility, convenience, and clarity—clear pricing, straightforward returns, and the flexibility to shop online or in person with the option of immediate pickup or rapid delivery. The convergence of these two paths in one corporate structure creates a powerful value proposition: a one-stop shop that can support a repair shop’s entire parts calendar and a DIYer’s weekend project with equal reliability. The breadth of product categories—ranging from essential automotive components to maintenance supplies and a broad spectrum of tools—ensures that customers can complete most tasks without hopping between outlets or suppliers. The model is robust because it acknowledges that not all repairs are identical. Some jobs require a steady stream of consumables and diagnostic aids, while others hinge on a scarce part lookup or a special tool. The operating system behind Advance Auto Parts is designed to adapt seamlessly to these realities.

A critical enabler of this adaptability is the supply chain network. The company has invested in a sophisticated inventory management framework that provides real-time visibility across the nationwide store-and-DC network. This means that a store in a midwestern town does not have to guess what is in the other end of the chain; managers and buyers can observe stock levels, forecast demand, and orchestrate replenishments as a synchronized, data-driven process. Strategic supplier partnerships underpin this capability, delivering not just parts, but also the knowledge and quality assurance that professional customers expect. By integrating procurement with logistics, the operation can act with agility when demand spikes, seasonal trends emerge, or unexpected disruptions occur. The result is a system that reduces stockouts, shortens lead times, and enables more precise cross-store transfers. In practical terms, this translates to a repair shop receiving the right part at the right time, a DIYer completing a project within a reasonable window, and a maintenance professional managing a service schedule with fewer interruptions.

The distribution backbone of the enterprise further reinforces its reliability. The network of distribution centers distributes the load across regions, balancing the ebb and flow of demand with the breadth of the brand portfolio. This distribution thinking is complemented by a growing emphasis on omnichannel capabilities. Customers increasingly expect to blend digital convenience with the tactile experience of a brick-and-mortar store. In response, the operating model supports seamless online ordering with in-store pickup, curbside options, and rapid in-store fulfillment. This hybrid approach is not a peripheral add-on; it is embedded in the way the business plans its assortments, staffs its stores, and trains its associates to assist customers across channels. The goal is to reduce friction at every stage—from product discovery to purchase completion to after-sales support.

Even the product mix itself is a deliberate reflection of the operating philosophy. The company prioritizes breadth without sacrificing depth, offering everyday maintenance items alongside niche components that a professional shop might rely on for a specific make or model. While a general catalog draws in a broad audience, an internal focus on parts compatibility and fitment helps ensure that the right part is chosen the first time. This balance between scale and specificity is what sustains long-term relationships with repair businesses, which value dependable supply and predictable performance as much as, if not more than, the lowest price. It also supports individual customers who want guidance, whether through knowledgeable store staff or digital resources that translate complex information into actionable steps. The technical services offered—ranging from troubleshooting tips to repair guidance—further anchor the company as a trusted partner in the repair ecosystem. In an industry where a mismatch between part and vehicle can derail a project, confidence in sourcing and guidance is the invisible currency that keeps workflows flowing.

The geographies within which the company operates—across the United States, Canada, and island territories—bring both opportunities and responsibilities. The cross-border dimension of the business invites a refined approach to supply and compliance, ensuring that product availability aligns with regional vehicle fleets, weather patterns, and regulatory requirements. It also creates a broader resilience, as regional shocks in one market may be offset by steadier demand in another. In all of this, the leadership approach centers on three principles: scale with discipline, invest in capabilities that create long-term value, and maintain a customer-first orientation that permeates every interaction. The leadership team’s remit includes ensuring that every channel contributes to the overall performance narrative, not as isolated silos but as a coordinated system that can pivot in response to market dynamics. The resulting operating rhythm is what enables the firm to maintain service levels even as external conditions shift, whether due to macroeconomic cycles, supply interruptions, or evolving consumer expectations.

To understand the depth of this system, consider how a single, seemingly ordinary transaction can reveal the complexity behind the scenes. A customer walks into a store to replace a battery or a critical brake component, or perhaps orders online for home delivery with the added option of rapid pickup. The store associate, supported by a centralized inventory view, checks stock, confirms the part’s fitment, and navigates the logistics network to ensure timely fulfillment. In parallel, the Worldpac division leverages its focus on imported parts to source items that are not readily available from domestic suppliers, bridging gaps that could otherwise delay repairs. The independent channels connect smaller shops to the same procurement power, ensuring that even smaller operators can access a wide catalog and favorable terms. The outcome is a consistent, high-quality customer experience across touchpoints, backed by a scalable support infrastructure—a true demonstration of how the operating engine sustains both breadth and reliability.

The integration of digital and physical experiences is not an afterthought. It is embedded in the operating playbook, guiding decisions about pricing, promotions, training, and store-level execution. Associates receive ongoing training to interpret fitment data, troubleshoot common issues, and communicate with customers in terms that are easy to understand. The digital platforms enable faster product discovery, clearer guidance, and a more transparent shopping journey. For the customer, this means less time spent searching and more time on the task at hand, whether it is a routine maintenance project or a complex repair job.

In this sense, the company’s operational maturity reflects a broader industry shift toward integrated supply chains and customer-centric service models. The geographic reach, diversified brand portfolio, and commitment to omnichannel efficiency create a durable framework that can withstand volatility while continuing to pursue growth. The result is not merely a large retailer, but a sophisticated enterprise that aligns procurement, logistics, customer service, and technical support into a coherent operating system. The effect is a more predictable, more capable partner for repair shops and DIY enthusiasts alike, and a stronger position in a highly competitive aftermarket landscape. As vehicle technology evolves and the aftermarket market grows ever more complex, the value of such an integrated approach becomes increasingly evident. The operational philosophy is not just about stocking parts; it is about enabling repairs, sustaining vehicle uptime, and supporting the people who keep wheels turning across North America.

For readers who want to explore a concrete example of how distributed sourcing and specialized parts ecosystems coexist within a broad parts network, a practical point of reference can be found at the linked resource 03-06-mitsubishi-evolution-8-9-jdm-rear-bumper-oem (https://mitsubishiautopartsshop.com/03-06-mitsubishi-evolution-8-9-jdm-rear-bumper-oem/). This demonstrates how even niche items rely on the same core principles of supply reliability, accurate fitment, and efficient fulfillment that underpin the larger enterprise. Ultimately, the strength of Advance Auto Parts lies in its ability to harmonize these elements across four brands, multiple regions, and two major customer groups into a single, resilient operating system that keeps function and mobility at the forefront. The approach shows how a large, multi-brand retailer can maintain agility, deliver consistent value, and continue to reinvent itself in a changing market landscape.

For a broader look at the corporate profile and strategic direction, readers can consult the official corporate resource linked here: Advance Auto Parts – About Us (https://www.advanceautoparts.com/about-us).

Turning a Corner in the Aftermarket: Transformation of Advance Auto Parts

In the mid-2020s, Advance Auto Parts embarked on a deliberate transformation of footprint, cost structure, and customer experience. The company prioritized a leaner store network and a more efficient operating model to lift profitability while stabilizing the top line. In 2025 the company pruned hundreds of stores and intensified pricing discipline, inventory optimization, and a data-driven promotions program aimed at protecting margins. The result was a transition year with improving margins and progress toward positive free cash flow, even as DIY demand remained mixed. The Pro channel yielded steady growth and quicker delivery, while the DIY channel faced headwinds from macro softness. The emphasis on faster service, better stock availability, and a stronger loyalty proposition helped to reinforce customer retention and drive traffic across channels. Across capital markets, management guided toward continued profitability and positive cash flow in 2026, with mid-single-digit comp sales and a narrow adjusted operating margin band. The transformation underscores disciplined footprint management, channel differentiation, and technology-enabled pricing as core drivers of a more resilient aftermarket retailer.

Positioning in a Crowded Aftermarket: Where Advance Auto Parts Stands and How It Can Move Forward

Positioning in a Crowded Aftermarket: Where Advance Auto Parts Stands and How It Can Move Forward

Advance Auto Parts occupies an unmistakable place in the North American automotive aftermarket. Its footprint spans thousands of stores and hundreds of distribution centers, and its network serves both professional repair shops and retail customers. Yet the company’s current market position reflects more than physical scale. It captures a snapshot of competitive pressure, financial strain, and a company in the early stages of strategic transformation. Understanding that snapshot helps explain both the immediate risks and the paths available to regain momentum.

Market standing is often measured in revenue, scale of expansion, and investor valuation. On those fronts, Advance Auto Parts has trailed key rivals. Revenue and profit metrics show a company behind the leaders, while the pace of store openings reveals slower physical growth. Investors have priced these realities into a market capitalization that sits well below the industry’s largest players. That gap reflects skepticism about future growth and the company’s ability to close structural performance shortfalls.

Underneath headline numbers lie more granular signals. Profit margins have compressed, and year-over-year earnings slid significantly during a recent cycle. A modest annual net income, paired with higher operating costs and inventory complexities, reduced the company’s financial cushion. Slow store expansion magnified the issue, since new locations are one of the clearest levers for top-line growth in retail parts. When rivals expanded more aggressively, they increased market access while capturing economies of scale. Advance Auto Parts’ conservative footprint growth contributed to relative market share erosion.

Investor sentiment matters as much as operational performance. Market capitalization differences between the company and its largest peers signal prevailing views on long-term competitiveness. Large valuation gaps indicate that investors expect divergent growth trajectories and profitability cycles. For Advance Auto Parts, those gaps have narrowed at times, particularly after earnings surprised positively. Short-term rebounds in the share price suggest that the market responds to visible changes in execution. Yet sustaining investor confidence demands repeated evidence of improved fundamentals.

Encouragingly, recent quarters offered such evidence. A notable earnings beat triggered a sharp market reaction, a reminder that financial markets reward visible progress. Operational changes began to show early returns. Investments in supply chain improvements reduced stockouts and improved fill rates. Efforts to enhance customer experience—both in stores and online—raised service metrics. And the company signaled a strategic intent to modernize systems and processes to meet evolving vehicle technology demands.

Electric vehicles and changing vehicle architectures represent a sectoral shift the aftermarket cannot ignore. That transition alters parts categories, labor needs, and diagnostic complexity. For a national parts retailer, adapting to these trends means rethinking inventory mixes, technician training, and service propositions. Advance Auto Parts has identified these shifts as strategic priorities. Its plan includes targeted stocking strategies for new vehicle types, investments in diagnostic capabilities, and digital tools to help both professional and DIY customers find the right components.

The company also appears to be sharpening its business-to-business focus. The professional channel is a higher-margin segment when executed well. Strengthening relationships with repair shops through faster delivery, dedicated account teams, and integrated ordering systems helps lock in recurring demand. At the same time, maintaining a compelling retail experience remains essential. Consumers expect speed, product availability, and reliable guidance. Balancing B2B and B2C priorities requires operational excellence across logistics and store operations.

Supply chain optimization is central to any comeback. Advance Auto Parts operates hundreds of distribution centers, which can be a major advantage if configured for agility. Improvements in inventory forecasting, distribution routing, and supplier collaboration cut lead times and free up working capital. Early signs of these improvements translated into better on-shelf availability. That change supported higher transaction counts per visit and improved customer satisfaction scores. Continued focus here could translate directly into better margins and higher turnover.

Technology investment is another lever. Modern inventory systems, predictive analytics, and customer-facing digital experiences reduce friction. Digital channels can also expand reach without heavy store expansion. However, technology alone is not sufficient. It must be paired with simplified in-store processes and employee training. The company’s recent moves toward upgrading systems and streamlining user interfaces for staff and customers are steps in the right direction. When technology reduces search time and improves accuracy, conversion rates increase.

But challenges remain. Competition is intense from companies with larger margins, more aggressive expansion, or stronger investor narratives. Price competition and promotional pressure compress margins across the industry. Supply chain disruptions and macroeconomic variability can exacerbate inventory management issues. Furthermore, transitioning to serve newer vehicle types requires capital and time. Missteps in these areas would slow any recovery and risk further erosion of market share.

Strategically, several priorities must align for a sustainable turnaround. First, the company needs to continue improving operational efficiency across its network. Faster, more accurate distribution and better inventory allocation can unlock margin. Second, it must accelerate digital adoption that directly improves conversion and reduces fulfillment costs. Third, focus on the professional customer should increase recurring revenue and strengthen gross margin. Fourth, the company must articulate a clear investor narrative that links operational progress to sustainable margin expansion. Finally, disciplined capital allocation—balancing investments in stores, distribution, and technology—will be critical.

Scenarios for the next phase vary. In a favorable path, continued operational gains and successful tech rollouts close the performance gap. Improved profitability bolsters investor confidence and narrows valuation differences. In a neutral path, incremental progress stabilizes share and earnings, but growth remains slow. In a downside path, competitive pressure and execution slips force deeper cuts or strategic shifts, prolonging recovery.

The company’s current position is neither irreversible nor secure. Recent positive results show that improvement is possible when strategy, execution, and capital align. The true test will be sustaining those gains across multiple cycles. If the company can translate supply chain upgrades, digital improvements, and stronger professional relationships into durable margin expansion, it can reclaim room to grow. Investors and stakeholders will watch not for a single quarter of progress, but for a sequence of disciplined moves that demonstrate a durable change in trajectory.

For readers tracking the aftermarket, the company provides a clear case study. It shows how scale alone does not guarantee leadership. Execution, adaptation to vehicle technology trends, and the ability to convert investments into visible financial improvements all matter. The coming years will reveal whether those early signs of transformation solidify into a lasting recovery. For now, the company stands at a crossroads, with real opportunities and clear constraints shaping its future.

External reference for market data and recent financials: https://finance.yahoo.com/quote/AAP/

Building a Smarter Aftermarket: Advance Auto Parts’ Drive into Digital and Supply-Chain Technology

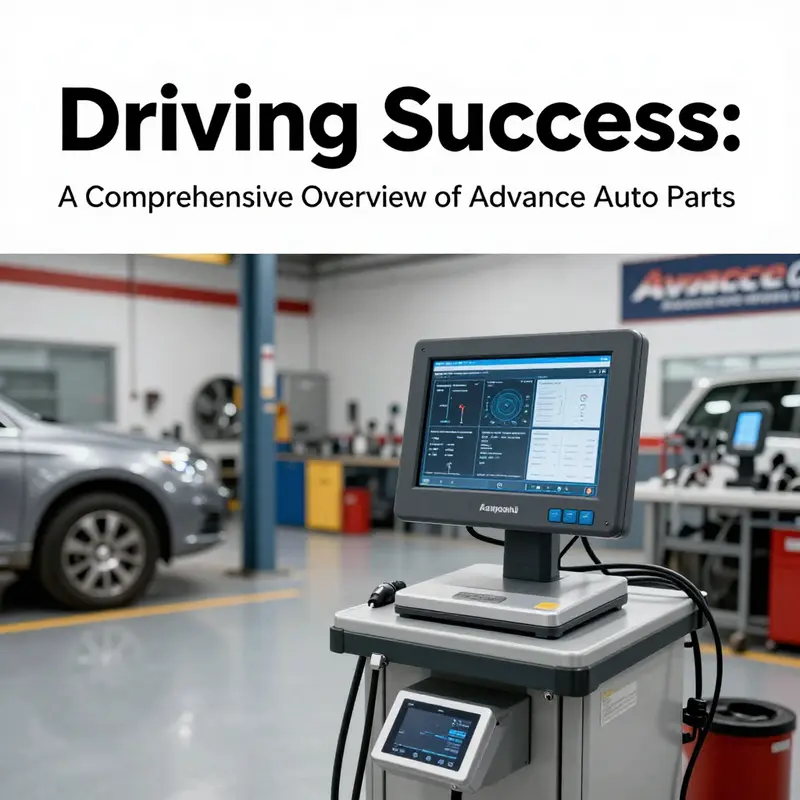

Advance Auto Parts has shifted from being a traditional parts retailer to becoming a technology-forward aftermarket leader. That transformation centers on two intertwined priorities: creating a seamless, data-driven customer experience and modernizing the supply chain that supports it. Recent leadership moves and strategic partnerships reveal how the company seeks to turn inventory and vehicle intelligence into actionable advantage across stores, service bays, and online channels.

When a new chief technology officer was appointed in early 2025, the signal was clear. The role was given to an executive with deep experience in scaling technology platforms at large retailers. That hire underscores a pivot toward enterprise-grade digital infrastructure. The emphasis is not only on replacing legacy systems. It is on building an innovation pipeline that connects product intelligence, logistics, and customer touchpoints in real time.

At the core of this strategy lies advanced data and analytics. The company now uses extensive vehicle system data and market intelligence to understand how cars evolve. These analytics cover many vehicle subsystems. Lighting, chassis, connectivity, and driver-assist technologies are measured and trended. Predictive models span more than a hundred and fifty individual components. Those models forecast demand patterns and help determine which parts to stock regionally and when to accelerate replenishment.

This level of insight changes purchasing decisions. Rather than relying solely on historical sales, planners can anticipate the rise of specific technologies in the fleet. For example, when more vehicles in a region include advanced lighting or connectivity modules, parts assortments can be adjusted proactively. That prevents stockouts of high-demand items and reduces the accumulation of slow-moving inventory. The result: higher in-stock rates for the items technicians need and lower working capital tied up in excess parts.

The company pairs predictive analytics with a more responsive distribution network. With thousands of stores and hundreds of distribution points, reducing the time between order and delivery matters. Investments in warehouse automation and routing algorithms shave hours from fulfillment cycles. They also allow for differentiated service levels. A professional repair shop demanding same-day delivery can receive prioritized handling. Individual consumers buying online can choose curbside pickup or expedited shipment from the nearest hub. That flexibility blends the convenience of e-commerce with the immediacy of a local parts store.

On the customer-facing side, digital improvements aim to remove friction. Search and recommendation engines have been retooled to match vehicle specifications precisely. Instead of guessing fitment from vague descriptions, systems cross-reference vehicle build data to surface compatible parts. That reduces returns and increases conversion rates. Personalization algorithms use purchase history, local fleet composition, and seasonal trends to suggest maintenance items like batteries and filters at the right time.

The company’s owned brand, introduced in early 2026, fits into this technological ecosystem. Data-driven assortments inform which SKUs the brand should include. Predictive fitment analytics help ensure new items match the needs of local fleets. Pricing and promotional strategies are then optimized using regional demand signals. This approach aims to deliver value and reliability while minimizing risk from introducing new lines.

Supporting technicians is another area of focus. Digital tools deliver repair procedures, parts diagrams, and compatibility notes to mobile devices in the shop. When a service provider scans a vehicle identification number, the system returns the exact parts and fluids required. That speeds diagnosis and reduces the chance of ordering incorrect components. Emerging pilots also explore augmented reality to overlay instructions during complex repairs. Such tools shorten repair times and increase throughput for busy garages.

Integration across the business demands robust APIs and a flexible platform architecture. Rather than monolithic upgrades, the company is adopting modular services. Inventory, order management, pricing, and customer profiles each expose controlled interfaces. This makes it easier to test features quickly and roll them out by region. It also supports partnerships with third parties, including fleets and repair networks, that require real-time data exchange.

Security and data privacy are treated as foundational elements of any new initiative. With connected vehicles and customer information flowing through systems, the company applies modern security practices. Encryption, role-based access, and continuous monitoring help guard against breaches. Governance frameworks ensure that shared data respects both legal requirements and consumer expectations.

The technological shift also requires cultural change. The company invests in talent recruitment and upskilling. Teams that once focused on retail merchandising now work alongside data scientists and engineers. Cross-functional squads help translate insights into operational changes. That organizational approach shortens the path from idea to implementation.

Measuring the value of these investments is pragmatic and metrics-driven. Key performance indicators include fill rates for critical parts, days-to-ship, order accuracy, and same-store sales growth for parts tied to analytics-driven assortments. For professional customers, metrics expand to include mean time to repair and repeat business from shops served through expedited fulfillment. Financially, the company monitors inventory turns and margin improvements driven by its owned brand and assortment optimization.

The company also balances innovation with risk management. Rolling out predictive inventory decisions across thousands of locations poses execution challenges. To mitigate risk, pilots start in defined regions. Results are assessed before broader implementation. This staged approach keeps disruption low while enabling rapid learning.

Looking ahead, connected vehicle telemetry and advanced driver assistance systems will reshape aftermarket demand curves. As vehicles become more software-driven, certain parts will require different support models. The company is positioning itself to be part of that transition, offering not only physical components but also the data and logistics that technicians need. Partnerships with external intelligence providers enhance situational awareness about emerging vehicle features. That helps the company stay ahead of the curve when new technologies enter the fleet.

The technology roadmap is pragmatic. It focuses on outcomes that matter to technicians and consumers. Faster fulfillment, higher first-time-fix rates, and clearer fitment guidance drive loyalty. Behind those visible improvements sit analytics engines, modular platforms, and a distribution network tuned by real-time data. Together, they form an integrated system built to serve a complex, evolving vehicle population.

Ultimately, the company’s technology investments aim to make the aftermarket more predictable, efficient, and customer-centric. By combining sophisticated vehicle intelligence with practical operational upgrades, the company reduces waste and increases responsiveness. Those gains benefit professional repairers and everyday drivers alike.

For readers interested in the type of vehicle technology insights that inform these changes, more information is available from one of the company’s analytics partners: S&P Global Mobility – Automotive Technology Insights.

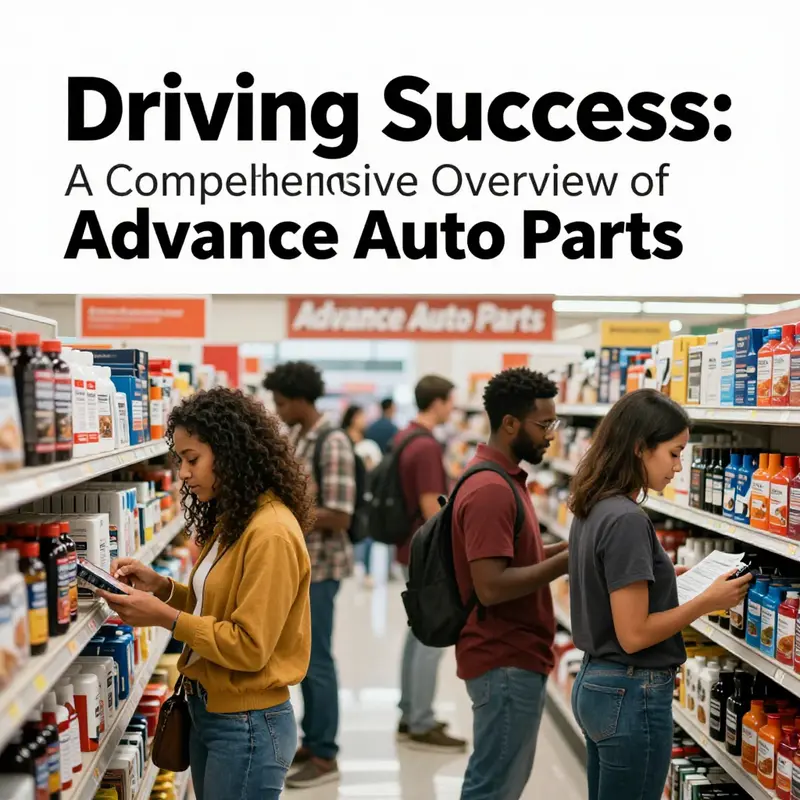

Shifting Gears in the Digital Aisle: Consumer Trends and the Evolution of Advance Auto Parts

The consumer landscape surrounding automotive parts has become more digital and interconnected, and that shift is redefining how a leading North American retailer positions itself for growth. Across markets served by Advance Auto Parts, shoppers—whether professionals who repair for a living or DIY enthusiasts who work on weekends—now navigate a blended world of brick-and-mortar stores and digital touchpoints. The online channel has accelerated, and its growth has reframed decisions around store formats, inventory strategy, and service design. In practical terms, retailers must consider how a physical network complements a dynamic digital layer to meet customers where they shop and how they shop.

What emerges from the data is a story of shifting priorities. Convenience, speed, and clear guidance in the purchasing journey now command more attention than ever. The omnichannel imperative is not a feature but a core capability: a seamless continuum where a shopper researches, checks availability, and completes a purchase through the channel that suits their timeline. Advance Auto Parts, with a broad portfolio and thousands of stores, has leaned into this transformation by aligning store capabilities with online promises, enriching digital experiences, and empowering store teams with tools that extend the reach of the brand beyond the physical aisle.

A natural question concerns how to reconcile the needs of two customer cohorts—professional repair shops and the do-it-yourself consumer—within a single omnichannel strategy. For professionals, speed, consistency, and access to a wide, dependable inventory matter most, along with reliable order management and cross-network sourcing. For DIY customers, the experience often centers on guidance, flexible fulfillment options, and confidence that the part will perform as expected in a home workshop. An integrated approach offers features like online ordering with in-store pickup, mobile inventory checks, and friction-reducing returns to serve both groups without forcing a choice between online and offline.

The store network itself is being reimagined to align with these dynamics. Footprint decisions, including selective store closures, reflect an emphasis on profitability and resource allocation while preserving essential access for communities and professional networks. A leaner network, when paired with a strong digital backbone and a robust distribution footprint, can deliver faster service without sacrificing reach. Distribution centers become hubs that feed both stores and the online channel, and real-time inventory visibility across channels increases reliability in the eyes of customers.

Technology remains a driver, but people remain the differentiator. Front-line staff who can translate product data into practical guidance, anticipate installation questions, and provide proactive support help convert a one-time purchase into a lasting relationship. Training that emphasizes digital literacy and data-driven service equips teams to act as trusted advisors across touchpoints. In this world, loyalty arises not from a program alone but from a consistently excellent purchasing experience that blends content, advice, and convenience.

The broader trend points toward a connected aftermarket service platform that harmonizes parts supply, logistics, and technical services. The online channel becomes a conduit for education and problem-solving that extends the value of every transaction, while the B2B dimension adds opportunities to serve professional partners with bulk sourcing and reliable service quality across locations. The path forward combines footprint optimization, ongoing digital investment, and a renewed focus on customer experience to create a resilient, omnichannel retailer that serves both professionals and DIY customers alike.

Final thoughts

In conclusion, Advance Auto Parts exemplifies a profound understanding of its operations, positioning within the market, and financial performance. For business owners, staying aligned with advancements in technology and shifting consumer behaviors is key to leveraging the valuable insights drawn from this industry leader. This comprehensive representation should empower entrepreneurs to strategize effectively in the evolving automotive landscape.