A Z Auto Parts, represented by Anzhi Auto Parts (Shenyang) Co., Ltd., stands as a significant player in the automotive parts industry. This article delves into the profound implications of this entity within the automotive landscape. Chapter 1 focuses on establishing the company’s context, detailing its origins, operations, and the market niche it occupies. Chapter 2 examines the economic impact A Z Auto Parts has on local markets, illustrating its contribution to community growth and employment. Chapter 3 discusses the technological innovations stemming from its manufacturing processes, showcasing how the company remains at the forefront of industry advancements. Finally, Chapter 4 explores the societal implications of A Z Auto Parts, considering its influence on safety, environmental practices, and consumer choices in the automotive sector.

Tracing A Z Auto Parts Through a Foreign-Owned Engine Room: Lessons From Anzhi Auto Parts (Shenyang)

The term A Z Auto Parts carries an air of specificity, yet in the actual records of business registries it rarely appears as a standalone company. What the research reveals is a more intricate pattern: a foreign-owned entity in one of China’s strategic industrial hubs that, for a window of years, operated under a broad umbrella of automotive components research, design, manufacturing, and trade. In this light, the closest functional cousin to the imagined A Z Auto Parts—at least in the public records and in the language of corporate life cycles—is Anzhi Auto Parts (Shenyang) Co., Ltd. A name that sounds like a translation of initials rather than a fixed brand, this company still offers a revealing case study about how foreign capital, local regulatory regimes, and the global appetite for automobile parts intersect in a dynamic market. The story that unfolds from 2018 through 2022 is not just a corporate timeline. It is a lens into the risks, ambitions, and complexities that typify the modern auto parts ecosystem, where ideas for parts, molds, and machinery must travel across borders, meet local standards, and survive in a marketplace that can be as volatile as the technology it assembles.

The Shenyang chapter began in a zone designed for rapid development and heavy industry. Anzhi Auto Parts (Shenyang) Co., Ltd. was established on February 28, 2018, in the Shenyang Economic and Technological Development Zone, with its registered address on Development Road, a place historically aligned with manufacturing expansion and export readiness. The company was a wholly foreign-owned limited liability entity, a structure that signaled both access to international capital and a distinctive set of regulatory expectations. The legal representative at inception was Andrew D. Schmidt, a name that would recur as the company’s leadership evolved. The registered capital stood at $1.05 million, fully paid, a figure that placed the venture in the category of mid-sized manufacturing cadres rather than a tiny start-up or a sprawling multinational operation. Ownership by Android Holdings Co., LLC framed the enterprise as part of a broader foreign investment strategy, one that sought to leverage Shenyang’s manufacturing infrastructure while engaging in international trade in goods and technology. These early details may appear routine, but they set a context in which a single chapter of a larger global auto parts narrative becomes legible.

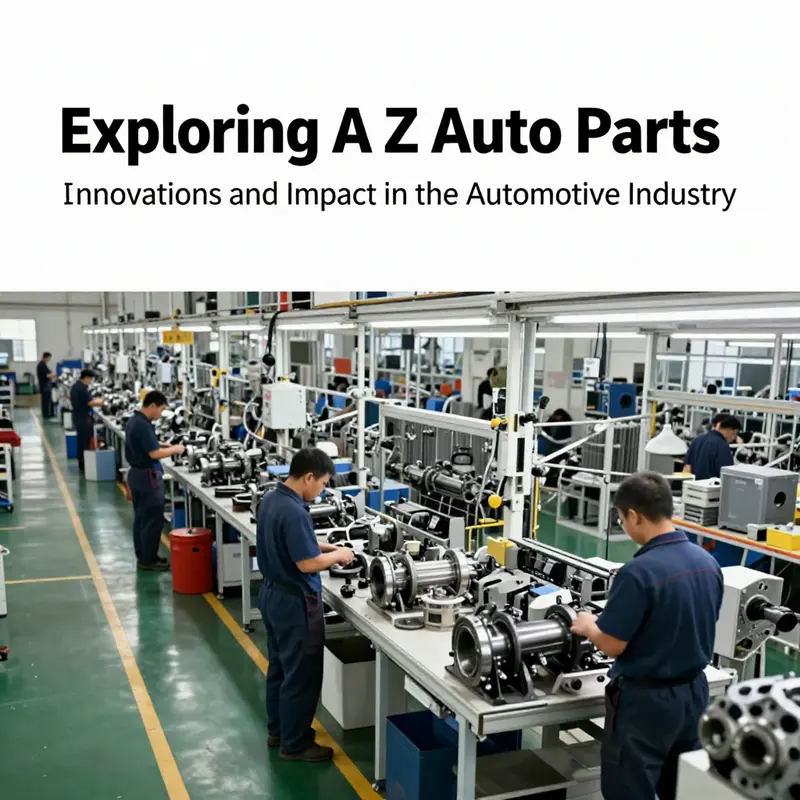

The company’s primary business activities, as documented, encompassed a spectrum that is common to modern automotive supply chains yet tightly interwoven: research, design, manufacturing, processing, and sales of automotive parts; the creation of molds and fixtures, the sale of machinery and equipment, and even tire processing and international trade. The breadth of activities signals a deliberate attempt to build a self-reinforcing loop where R&D feeds manufacturing, which in turn supports a marketplace in which parts and technologies cross borders with relative ease. In the years that followed, the scope of operations would broaden in ways that underscore a familiar tension in global auto parts enterprises: the desire to integrate design creativity with scalable production and to extend reach through export channels, while navigating the regulatory frameworks that shape what can be built, sold, or shipped.

The operational lifeblood of Anzhi Auto Parts, in the abstract, followed a recognizable trajectory of expansion and recalibration. In November 2018, the company expanded its business scope to include processing and assembly, a move that suggested a pivot toward more hands-on production work and tighter vertical integration. This shift often accompanies a push to reduce dependency on external contract manufacturers and to sharpen turn-around times for customers who demand rapid prototyping and quicker delivery. Then, in June 2019, the enterprise augmented its portfolio with sales, machinery and equipment sales, and tire processing. Accompanying these changes was a leadership transition: the change in legal representation from Keith M. Masserang to Andrew D. Schmidt, reinforcing the sense that the company sought a more centralized leadership model aligned with its broader strategic ambitions. A year later, in June 2020, the firm secured an administrative permit for an annual production capacity of 60,000 noise-reducing tires. The inclusion of tire processing—paired with practical capacity planning—reflected a willingness to exploit niche but technically demanding segments within the auto parts spectrum, where performance requirements and regulatory considerations frequently intersect.

Leadership and governance continued to evolve. In May 2021, Sergio Jose Castillo Marcano joined as a director, which can be read as part of a broader pattern in foreign-owned ventures where governance structures are expanded to manage risk, compliance, and international collaboration. By June 2022, the company had officially entered a deregistration process, and by August 29, 2022, its business status was formally changed to deregistered. The arc from launch to deregistration is not merely a record of failure or success; it is a narrative about volatility, market pressure, regulatory scrutiny, and the strategic recalibration that often accompanies cross-border manufacturing ventures. It is a reminder that the lifecycle of a foreign-owned auto parts company can be as contingent as the microeconomic currents that shape supply chains, tariffs, and demand cycles. For researchers and practitioners alike, the deregistration moment invites a careful read of why a venture with a seemingly solid product scope and regulatory permits would retreat from the stage. Was it a strategic retreat, a rebranding, a reorganization under a new corporate name, or a decision to consolidate resources elsewhere? The public record stops short of definitive answers, but it provides a sober lens through which such questions can be asked.

From a broader perspective, this case highlights several enduring themes in the auto parts world. First, the fusion of research and manufacturing capability with international trading activity remains a central pillar of modern value chains. When a company claims to engage in both “research, design, manufacturing, processing, and sales,” it is signaling an intention to bridge the gap between ideas and markets. The creation of molds and fixtures points to a domestic, hands-on capability that can shorten development cycles and tailor products to local demand, while the sale of machinery and equipment suggests a parallel revenue stream that depends on a sophisticated understanding of production economics. Tire processing is a further reminder that even within a single firm, the parts ecosystem spans multiple specialized domains, each with its own regulatory and technical requirements. The capacity to add an administrative permit for a defined production volume clarifies how regulators calibrate expectations for output, environmental impact, and workforce engagement. In short, the Anzhi case demonstrates the complexity of turning a foreign investment into a durable domestic presence that can navigate the shifting tides of technology, policy, and global demand.

This narrative also speaks to a critical, practical concern for readers who are following the thread of A Z Auto Parts as a broader topic. Brand names can be seductive in telling a story, but the engine behind any such brand—the corporate entity, its governance, its permits, and its lifecycle—often proves more decisive in determining whether parts reach the market, how they are priced, and how resilient the supply chain remains under stress. A brand may traverse a global circuit, yet the fate of its individual manufacturing affiliates depends on regulatory alignment, capital structure, and strategic clarity. When a venture like Anzhi Auto Parts terminates its active status, it invites questions about the distribution of parts within the aftermarket, the location of design expertise, and the subsequent paths for employees, IP, and supplier contracts. These are not abstract concerns; they are the operational realities that professionals in procurement, engineering, and logistics must anticipate when they plan inventory, forecast demand, or evaluate potential partnerships. The lifecycle of such an entity becomes a microcosm of the larger auto parts economy—a system in which global ambitions must be matched by local compliance, efficient production, and adaptable go-to-market strategies.

Within this context, it is useful to acknowledge the parallel currents in aftermarket discourse, which continually wrestle with cataloging, compatibility, and the hard economics of supply. The auto parts world exists not merely as a set of sunlight-lit product pages but as a sprawling network of design studios, mold shops, machine shops, and trading desks that must align across borders. The Anzhi narrative—its expansion, leadership shifts, and eventual deregistration—offers a concrete reminder that even ventures backed by substantial capital can hinge on complex constellations of regulatory permissions, market timing, and strategic focus. It also underscores the importance of due diligence for stakeholders who may encounter the A Z Auto Parts label in business directories, procurement briefs, or cross-border tenders. The cautionary tale is not about fear of risk but about the disciplined practice of verifying corporate identities, understanding the scope of operations, and recognizing how a brand’s public face relates to its organizational skeleton.

For readers seeking to situate this discussion within the wider literature on automotive parts, a useful bridge can be found in industry discussions about how cataloging, compatibility, and supply chain transparency shape consumer and professional experiences alike. A single listing or article in a parts database can illuminate the practical challenges of matching components to vehicles, while a corporate counterpoint—the record of a foreign-owned enterprise in Shenyang—illuminates the business and regulatory realities that ultimately determine whether such components reach end users. In this sense, the Anzhi case, though specific, resonates with broader themes of cross-border manufacturing and market access that shape the discipline of auto parts globally.

To connect these strands further, consider the way industry participants navigate the tension between customization and standardization. The research, design, and tooling capacities suggested by Anzhi’s portfolio imply a readiness to tailor products for particular markets or vehicle families. Yet the tire processing and assembly components imply standard-setting activities that cross borders and standards regimes. The balance between bespoke capability and scalable production is a persistent challenge for any company seeking to translate initial R&D investments into sustainable revenue streams. That balance, in turn, informs how buyers, suppliers, and regulators assess risk, and how they plan inventory, service networks, and regulatory compliance programs. In short, the A Z Auto Parts label, though not a fixed corporate identity in the public record, serves as a prompt to interrogate how foreign ownership, local capability, and global demand converge—and sometimes diverge—in the modern auto parts marketplace.

As you move through this chapter and into the chapters that follow, keep in mind the core insight: a company’s name is only a first clue. The true determinants of value in auto parts lie in the sophistication of its design and manufacturing capabilities, the integrity of its governance, and the clarity of its regulatory footprint. The Anzhi case, with its 2018 emergence, strategic expansions, and 2022 exit, offers a compact, instructive exemplar of how such dynamics play out in one of the world’s most competitive sectors. For those charting a path through the global auto parts landscape, this example underscores the imperative of aligning brand narratives with robust corporate structures, ensuring that the story told by the market matches the terms laid out in the official filings, permits, and lifecycle stages that truly govern access to customers and markets. It is a reminder that the journey from concept to commerce in auto parts is rarely linear. It is a circuitous route shaped by capital, code, and the quiet, meticulous work of turning ideas into durable, tradable components.

Internal reference note: in the broader ecosystem of automotive parts discourse, detailed product catalog discussions and compatibility notes remain a recurring theme for collectors, engineers, and buyers alike. For a practical sense of how specific part discussions materialize in the aftermarket, see this listing, which demonstrates how cataloging and cross-referencing operate in real-world contexts: Mitsubishiautopartsshop listing. This link serves as a concrete example of how parts are organized, described, and linked to vehicles in the aftermarket arena. https://mitsubishiautopartsshop.com/03-06-mitsubishi-evolution-8-9-jdm-rear-bumper-oem/

External resource: for official regulatory records that underpin corporate histories like the one described above, consult the National Enterprise Credit Information Publicity System, which hosts authoritative filings and status updates. https://www.gsxt.gov.cn

From Parts to Prosperity: Tracing the Local Economic Footprint of A Z Auto Parts

In the map of a regional economy, A Z Auto Parts may look like a single storefront, a line item on a balance sheet, or a warehouse with pallets and invoices. Yet the deeper narrative suggests it operates as a catalyst that reverberates through employment, procurement networks, and public finances. The research landscape points to the closest observable proxy for the A Z Auto Parts archetype as Anzhi Auto Parts (Shenyang) Co., Ltd.—a foreign-invested, locally rooted enterprise established in 2018 with a formal commitment reflected in its registered capital. While the names are not identical, the structural footprint—a company focused on automotive parts, embedded in a local economy, and connected to a broader international context—helps explain why such players matter for regional prosperity. This chapter thus follows the thread from job creation to tax revenues, from supplier networks to workforce development, presenting a cohesive view of how an aftermarket parts firm can reshape the economic texture of its surrounding markets.

First and foremost, the most visible impact arises from direct and indirect employment. An expanded aftermarket operation needs technicians, warehouse staff, drivers, inventory managers, and maintenance personnel. Each new role adds to the payroll, but the influence extends beyond the steel-and-shelves realities of the company’s doors. When A Z Auto Parts grows, it typically triggers a cascade across the supply chain: packaging firms, regional logistics providers, distributors, and local repair shops experience higher demand for inputs and services. In a cluster of small to mid-size enterprises, this is not a flat uptick in activity; it is a multiplication of opportunities that translates into more hours, steadier incomes, and greater consumer spending power in the community. The effect is amplified when procurement strategies emphasize local sourcing. By directing a portion of purchases to nearby metal shops, plastics fabricators, logistics outfits, and IT services, the company keeps capital circulating closer to households. The resulting economic engine nourishes local bankers, accountants, and service firms that support growth in ways not always visible in quarterly reports.

The procurement dimension deserves emphasis because it touches both the micro and macro levels of a local economy. When a regional parts business chooses to source locally where feasible, it helps stabilize supplier cash flows, reduces transportation risk, and builds a more resilient ecosystem for repairs and maintenance. The logic extends beyond the immediate needs of the company; it shapes how other businesses plan, invest, and compete. In practice, that means more reliable delivery timelines for workshops and fleets, better pricing leverage for small retailers, and a more predictable environment for capacity planning. A region with a robust aftermarket network can absorb demand shocks more gracefully. Think of the maintenance cycles for agricultural fleets, construction equipment, and delivery trucks; these are sectors where uptime is not just a convenience but a necessity for productivity. When downtime costs are minimized through reliable parts supply, the local economy experiences steadier output, a greater ability to meet project deadlines, and a stronger basis for wage growth across the service and manufacturing spectrum.

Taxes and public finance, often less visible than jobs or inventories, play a critical role in sustaining regional infrastructure. The presence of a thriving auto parts ecosystem contributes to corporate, sales, and property tax revenues. Those streams feed road maintenance, school programs, and municipal services that create a more attractive operating environment for firms and families alike. In regions where investment in infrastructure and human capital is linked to the health of the private sector, the multiplier effect of aftermarket activity becomes a tangible driver of long-term capability. A Deloitte Insights analysis, cited in discussions of the automotive value chain, underscores the multiplier mechanism by which regional activity expands through linked industries and consumer spending. The practical implication is that A Z Auto Parts does not simply add value in isolation; it enlarges the pool of resources available for community investments, education, and public goods that sustain growth and social well-being.

Efficiencies generated within the network also fuel productivity gains across the ecosystem. The rise of digital inventory management, demand forecasting, and just-in-time delivery models within and around aftermarket networks reduces waste and lowers operating costs. For repair shops and fleets, improved service levels and shorter turnover times translate into higher throughput without a proportional increase in fixed costs. The ripple effects extend to distributors who can optimize routes, warehouses that achieve higher utilization, and suppliers who invest in quality control and process improvement to remain competitive. In a region where multiple players operate in concert, the cumulative gains in efficiency accumulate into a more competitive local economy. Prices become more stable, service levels more dependable, and the overall business climate more inviting to new entrants who bring fresh ideas and capital.

The social dimension of this economic activity should not be overlooked. A Z Auto Parts often serves as a bridge between employers and the labor market, helping to align training with the concrete needs of the aftermarket. Through partnerships with vocational schools and technical colleges, the company helps craft a pipeline of technicians, inventory specialists, and supply chain professionals. This is not a one-off training grant or a short-term apprenticeship; it is a sustained investment in human capital that pays dividends as EVs and ADAS technologies increasingly reshape maintenance workflows. A region that cultivates this talent pipeline gains a flexible workforce capable of adapting to evolving diagnostic systems, advanced sensing technologies, and digital repair ecosystems. The value of such initiatives is measured not only in the immediate hiring numbers but in the resilience of the local economy in the face of structural changes in the auto sector.

Beyond the walls of the company and its immediate suppliers, the broader economic fabric is strengthened by the presence of an integrated regional supplier base. A well-connected network of manufacturers, distributors, retailers, and service providers enhances the region’s competitive stance by keeping parts and repairs accessible, affordable, and timely. When fleets require frequent maintenance and households demand reliable vehicles, the aftermarket sector becomes a steady anchor of economic vitality. In such environments, private investment—whether in plant modernization, logistics capacity, or digital platforms—tends to be more robust, secure in the knowledge that demand is underpinned by a diversified network rather than a single line of business. The Deloitte perspective on the auto industry’s macroeconomic impact reinforces this, highlighting how the value chain’s breadth contributes to broader regional development and social outcomes. This framing helps explain why a regional hub for auto parts is more than a business cluster; it is a backbone for inclusive, sustainable growth.

Within this narrative, the exchange between local opportunity and global supply chains becomes a defining feature. A Z Auto Parts does not exist in isolation; it participates in an ecosystem where suppliers, distributors, and retailers coordinate to fulfill demand. The interconnected nature of this ecosystem means that improvements in one segment—say, a distributor’s inventory accuracy or a garage’s turnaround times—propagate through the network, producing measurable benefits for end-users, whether they are individual vehicle owners or commercial operators. When a region fosters such a system, it also invites more sophisticated market participation: investment capital, entrepreneurship, and technology adoption that collectively raise the standard of living and the capacity for shared prosperity. The macroeconomic lens provided by industry analyses helps quantify what local observers have observed for years: the health of the aftermarket is a reliable barometer of regional economic strength, and a stable, well-functioning supply chain reduces the friction costs that typically gnaw at the margins of small and medium-sized businesses.

In sum, the economic footprint of an aftermarket firm like A Z Auto Parts extends far beyond the ledger. It shapes the employment landscape, nurtures supplier networks, enriches public finance, and accelerates productivity through smarter logistics and inventory practices. It supports a workforce equipped to navigate a rapidly changing technology terrain, while also contributing to broader social objectives—better infrastructure, higher skill levels, and more resilient communities. The chapter’s synthesis aligns micro-level business decisions with macro-level economic outcomes, illustrating how a regional auto parts hub can become a durable engine of growth. The takeaway is not simply that such a firm matters, but that its success—and the success of its suppliers and partners—translates into a more dynamic regional economy where mobility, opportunity, and shared prosperity are linked in a single, ongoing cycle. For readers seeking a broader frame of reference on the economic reach of the auto industry’s value chain, Deloitte’s insights offer a detailed, data-driven perspective on how every dollar spent in this sector can yield a cascade of additional activity: https://www2.deloitte.com/us/en/insights/economy/economic-impact-of-the-auto-industry.html

And to connect this chapter with practical industry experiences, consider how supply networks in the aftermarket connect producers, distributors, and retailers through real-world channels—illustrated in industry pages that showcase the breadth of parts and components available to local shops and consumers. A practical example of such direct linkages can be found on a product-focused retailer page such as brand-new-original-carbon-fiber-bonnet-hood-for-mitsubishi-lancer-evo-x. This page, while one among many, epitomizes how specialized retail interfaces support the broader regional system by aligning demand signals with precise, timely supply.

Smart by Design: Redefining A Z Auto Parts Manufacturing Through AI, Robotics, and Green Prototyping

The manufacturing landscape for auto parts is no longer a sequence of isolated machining steps. It is becoming a living system, an intelligent fabric where data, intelligence, and material flow weave together to form a resilient, adaptable factory floor. In this convergence, A Z Auto Parts stands as a compelling case study of how a modern parts producer can move beyond traditional efficiency to achieve a broader transformation: one that blends predictive insight, precise automation, and sustainable practice into a single, coherent production philosophy. The narrative around this transformation begins with the way advanced technologies reframe the very concept of manufacturing work. Artificial intelligence is no longer a distant dream of optimization; it operates at the edge of the factory, predicting equipment fatigue, balancing energy use, and guiding maintenance before a fault becomes visible. In practical terms, AI-supported systems watch sensor streams from machines, tools, and conveyors, learning how each component interacts with others in real time. This allows managers to shift from a schedule-driven, reactive approach to a demand-driven, proactive one, reducing downtime and extending equipment life. When combined with high-precision robotics, those gains become more tangible still. Robotic arms, guided by robust vision systems, perform intricate assembly and inspection tasks with sub-millimeter accuracy. They handle repetitive operations with unwavering consistency, while human workers focus on tasks that demand judgment, creativity, or nuanced problem-solving. The combination of AI and robotics brings a new cadence to production—one where speed and precision reinforce each other rather than compete, and where throughput climbs without sacrificing quality. It is a shift from the old image of a factory as a simple assembly line to a networked, adaptive system that can reconfigure itself in response to changing orders, part variants, or quality signals. This adaptability is particularly meaningful for a parts producer navigating the realities of a global supply chain and diverse customer requirements. The evolving factory becomes a living organism with digital nervous systems: sensors, controllers, and analytics that coordinate motion, force, and timing with unprecedented clarity. In such a system, the slightest deviation in a machining parameter or a tool wear rate can be detected and corrected in near real time. The result is a tightening of process windows and a reduction in scrap, with the added benefit of better traceability for every component and batch. On the frontier of manufacturing, additive processes are not mere prototypes but enabling tools for rapid prototyping and on-demand production of complex components. Three-dimensional printing technologies enable designers to test new geometries, optimize material usage, and iterate rapidly without the heavy commitment of traditional tooling. In an industry where changes in design and demand can occur quickly, the ability to translate a concept into a physical test part within days rather than weeks becomes a powerful competitive lever. The downstream impact is clear: shorter lead times, lower inventory risk, and a more responsive supply chain that can keep pace with evolving consumer expectations and regulatory demands. The advantage is not merely time savings but the liberation of design experimentation. Engineering teams can push iterations, validate fit and function, and, crucially, observe how a part behaves in an assembly or in service, all within a controlled digital and physical loop. Yet the elegance of this technological trifecta—AI, robotics, and 3D printing—depends on a shared data backbone. Digital twins, which replicate the behavior of physical assets in a virtual space, become indispensable. They enable scenario testing, decouple design choice from expensive physical trials, and help plan maintenance schedules around actual usage rather than generic calendars. The concept of a digital twin underpins broader process optimization: it aligns tool wear models, energy usage, vibration profiles, and quality outcomes across multiple machines and lines. In practice, this means that a factory can optimize energy consumption across shifts, route parts through the most efficient paths, and ensure that quality gates respond to real-time signals rather than static expectations. The synergy between these technologies is not an abstract ideal. It translates into meaningful environmental and financial benefits. A rising strand of the modern auto parts plant is its commitment to cleaner, smarter manufacturing. The environmental dimension has become inseparable from productivity. A striking example of this trend is a breakthrough reported by a leading metalworking entity in China, where a patented method for debris collection and processing in automotive parts operations was developed. The technology focuses on capturing and recycling metal shavings and swarf generated during machining, addressing a long-standing challenge in metalworking: hazardous waste streams and material losses. By efficiently collecting debris and reclaiming metal, the system reduces pollution, improves waste handling, and lowers material costs. While this particular innovation originates from a specific enterprise, its implications are universal for any factory that seeks to reduce waste, reclaim value, and comply with tightening environmental standards. In the broader context of policy and market demand, such debris management capabilities align well with the trajectory of new energy vehicle policies and the intensifying emphasis on sustainability as a competitive differentiator. For manufacturers, this means not only meeting stricter emissions and resource-use standards but doing so in a way that supports lower total cost of ownership and greater supply chain resilience. In a global market where customers increasingly demand responsible products, producers who can demonstrate material efficiency and waste reduction gain trust and preferred status, even when they compete on price and performance.

The technological evolution described here also speaks to a fundamental shift in how manufacturers view their relationships with suppliers, customers, and regulators. The factory floor becomes a data-rich environment where supplier inputs are tracked, batch histories are verified, and end-to-end traceability is ensured by design. Quality is no longer something that is tested after a part is produced; it is a property engineered into the production process through feedback loops, statistical process control, and automated inspection integrated at multiple stages. Such integration strengthens the entire ecosystem, enabling faster recalls or adjustments should a signal indicate deviation from spec. It also supports a more collaborative supplier network where data sharing and standardization of interfaces streamline problem solving and reduce time-to-market for new components and variants. Within this broader ecosystem, the role of international collaboration cannot be overlooked. Foreign-invested entities operating within the region bring with them not only capital but also a set of global practices in lean manufacturing, digital governance, and cybersecurity. This cross-pollination accelerates capability development and encourages the adoption of standardized data models, interoperable systems, and scalable automation platforms. The result is a more robust, transparent, and synchronized production network that can respond quickly to shocks, whether from supply disruptions, tariff changes, or sudden shifts in demand for certain part families.

The strategic implications extend into workforce development as well. A modern auto parts plant prioritizes upskilling and ongoing learning. Operators, technicians, and engineers are not merely performing tasks but engaging with intelligent systems that guide decisions and expand their problem-solving horizons. Safety becomes a shared responsibility between human workers and automated assets, and new training pathways emerge that emphasize data literacy, maintenance planning, and systems thinking. This fosters an environment where workers stay engaged, grow in capability, and contribute to continuous improvement in ways that preserve quality and efficiency. In this light, the story of a factory like A Z Auto Parts is not about replacing people with machines but about elevating the capabilities of the workforce through intelligent automation and data-driven decision making. The factory becomes a laboratory for experimentation, where small, incremental changes accumulate into meaningful gains in throughput, quality, and sustainability.

A note on scope helps ground this discussion. While the specifics of equipment brands and product lines are diverse, the underlying architecture of modern manufacturing remains consistent: intelligent sensors and interfaces, real-time analytics, adaptive control, and additive manufacturing that enables rapid iteration. The promise lies in the seamless integration of these elements into a production system that can learn, adapt, and improve autonomously within the bounds of safety and governance. This is not a distant fantasy; it is the present reality of leading facilities that have embraced a holistic approach to industrial intelligence. For A Z Auto Parts, the path forward includes continuing to invest in digital infrastructure, expanding the reach of predictive maintenance, and deepening collaboration with partners who share a commitment to green manufacturing and responsible stewardship of resources. The result is a production paradigm that balances precision, speed, and sustainability in a way that resonates with customers, regulators, and the communities where manufacturing takes place.

In sum, the convergence of AI, robotics, and additive manufacturing is redefining what it means to produce auto parts. The gains are multifaceted: higher throughput, lower scrap, improved quality, and a smaller environmental footprint. The most effective factories are the ones that treat technology as an integral part of their culture, not as a separate toolkit. They nurture a data-driven mindset, cultivate adaptable processes, and align every level of the organization—from shop floor operators to executive leadership—around a shared vision of intelligent, responsible production. In this vision, A Z Auto Parts embodies a forward-looking approach that recognizes the value of continuous learning, the necessity of sustainable practice, and the power of intelligent systems to unlock new possibilities for what auto parts manufacturing can become. The future belongs to producers who can fuse speed with precision and responsibility, delivering components that meet exacting specifications while also advancing broader environmental and social goals. The journey is ongoing, and each technological milestone strengthens the chain that connects design to delivery, supplier to customer, and factory to market.

External reading for further perspective on innovation synergy in the automotive sector: Blending Tech and Industry: Innovation Synergy in the Automotive Sector. https://www.researchgate.net/publication/396875432BlendingTechandIndustryInnovationSynergyintheAutomotiveSector

From Local Workshops to Global Webs: The Societal Ripple of A Z Auto Parts in Modern Mobility

The story of A Z Auto Parts is less a tale of a single brand than a mirror held up to the broader transformation of how society builds, maintains, and moves with its vehicles. In the gaps between the old, centralized supply chains and the new, digitally enabled marketplaces, a mosaic of small and medium enterprises has begun to reconfigure who creates value, who bears the costs, and how communities participate in the future of mobility. The closest identifiable thread to the name “A Z Auto Parts” points to a lineage of automotive-parts ventures in China, notably Anzhi Auto Parts (Shenyang) Co., Ltd., a company founded in 2018 that embodies a certain archetype: foreign investment in a local manufacturing and trading ecosystem, lean capital, and a readiness to engage across borders through imports and online sales. The broader implication is not merely economic; it is deeply social. As these firms multiply, they redraw the map of consumer access, job opportunities, environmental stewardship, and the pace at which new technologies diffuse into everyday life. In this light, A Z Auto Parts becomes less a brand and more a signal of how the aftermarket—traditionally a patchwork of repair shops and generic parts suppliers—is being reorganized around transparency, adaptability, and resilience.

From a consumer standpoint, the diversification of small and midsize entrants into the auto-parts arena translates into tangible relief from long-standing frictions. Repair shops have long exercised substantial influence over pricing, sometimes presenting a top-end, opaque markup that leaves vehicle owners uncertain about the true cost of maintenance. The proliferation of online catalogs and direct-from-manufacturer channels linked to regional distributors reshapes this dynamic. It introduces a different calculus for price, quality, and timing. A car owner might compare a range of options for a brake component, not only by price but by provenance, compatibility, and the ability to track the component through a digital trail. In effect, the aftermarket becomes more like a transparent marketplace rather than a black box of part numbers and shop estimates. This democratization is particularly meaningful for owners in smaller cities or rural areas, where access to genuine parts or timely repair can be limited. The architectural change is subtle but consequential: when consumers can reliably source parts online, the friction of maintenance drops, and the ownership experience becomes more predictable and less stressful.

The social fabric also evolves as these SMEs anchor local economies. The case studies behind these emerging players—ZhiJie Auto Parts in Danyang and Huihong Auto Parts in Qinghe County, among others—illustrate how the new wave of parts suppliers contributes to regional development. They bring manufacturing, logistics, and digital commerce into communities with established industrial bases, expanding local employment beyond assembly lines to warehousing, data analytics, customer service, and cross-border trade operations. The geographic concentration of such activities in hubs like Qinghe County, renowned for its mature supply chains and manufacturing know-how, demonstrates a pattern: when regional ecosystems harness the leverage of small, agile firms, they can attract ancillary investment, build robust supplier networks, and cultivate a workforce adept at navigating both physical and digital logistics. The effect is twofold. First, it reduces economic dependency on large metropolitan centers, spreading opportunity more equitably. Second, it cultivates localized competencies—from parts sourcing and quality assurance to multilingual customer engagement and post-sale service—that empower communities to participate in international trade dynamics without relinquishing sovereignty over their local economies.

Environmental considerations increasingly shape strategic choices in the aftermarket. The integration of renewable resource recycling into the business models of new entrants signals a broader commitment to sustainable practice. Firms that align their operations with green policies—notably in the recycling and reuse of materials and in more energy-efficient production processes—contribute to a cleaner industrial footprint. Across the sector, recycling initiatives have proven resilient, expanding at a pace well above traditional manufacturing cycles and becoming a lever for reducing waste and conserving resources. This shift dovetails with national and regional ambitions to promote a circular economy, where the end-of-life phase of a part becomes a new beginning for its materials. In the long arc, such environmentally conscious approaches help mitigate the automotive sector’s footprint, complementing broader decarbonization efforts without compromising the reliability or availability of parts to keep vehicles safe and roadworthy. These green pathways reveal how the aftermarket can actively participate in climate strategy rather than merely reacting to regulation.

The emergence of a vibrant NEV ecosystem within the aftermarket further underscores the societal shift propelled by A Z Auto Parts and its peers. As governments and industries push toward zero-emission mobility, suppliers of electric accessories and related components become critical facilitators of adoption. The enabling role of aftermarket firms extends beyond mere parts supply; it encompasses the logistical orchestration, compatibility testing, and after-sales support that together lower the barriers to electrification. When a supplier can offer a coherent mix of components tailored for NEVs, provide real-time availability data, and maintain robust service channels, vehicle owners experience a smoother transition to cleaner transportation. This aligns with broader research on the co-benefits of zero-emission vehicles in freight and passenger contexts, which suggests that cleaner fleets do not just reduce emissions but also reshape labor markets, health outcomes, and urban livability by enabling more predictable and quiet urban spaces, among other gains.

Innovation and resilience are the through lines that connect these societal shifts. The new class of auto-parts firms often operates under what observers call a “light asset” model. With less capital tied up in heavy machinery and more in digital platforms, sourcing networks, and flexible logistics, these companies can pivot quickly in response to demand signals, supply disruptions, or regulatory changes. The digitalization of sales, the modularization of product families, and the integration of IoT-enabled components illustrate a broader Industry 4.0 trend within the aftermarket. This adaptability translates into tangible social benefits: a more resilient supply chain that can weather global shocks, quicker product updates in response to new vehicle architectures, and the capacity to serve niche markets that traditional mass producers might overlook. When a region experiences a sudden shift—perhaps a surge in NEV-related component demand or a need for affordable repair options after a natural disaster—the nimbleness of these SMEs enables continuity of service and maintenance, which is essential to community well-being and to the credibility of mobility systems.

What does this imply for the future of mobility as a social project? The answer lies in recognizing that the aftermarket is not a peripheral appendage to vehicle technology but a central arena where access, equity, and innovation converge. As a broader set of players—small manufacturers, cross-border traders, digital marketplaces, and logistics specialists—participate in the supply chain, maintenance costs are more competitive, options for genuine parts become more abundant, and the transparency that customers crave becomes the norm rather than the exception. The social value of such a transformation cannot be reduced to dollars saved at the shop counter. It extends to how communities can sustain their local economies, maintain safer and more reliable transportation networks, and participate in the transition to a cleaner, more connected, and more resilient mobility system.

To offer a practical sense of how these dynamics play out in the marketplace, consider the online catalogs that connect buyers with parts across regions. Such platforms illustrate a core mechanism by which access is broadened and price pressure is distributed more evenly. They also reveal a tension worth watching: the balance between speed, cost, and authenticity. Online marketplaces can lower prices and shorten repair cycles, yet stakeholders must safeguard the integrity of the supply chain, ensuring compatibility and quality across diverse vehicle makes and models. The regional SMEs at the heart of this story—whether in Danyang, Qinghe, or Shenyang—are not passive recipients of global forces. They actively curate their own networks, translate global demand into local capability, and, in doing so, reconfigure how ordinary people experience mobility. The trajectory suggests a future where maintenance is less a discretionary burden and more a routinely managed aspect of responsible car ownership, enabled by a robust, diverse, and environmentally mindful aftermarket.

For readers who want to explore a concrete example of how online access to parts can shape purchasing behavior, a representative catalog page from a well-known online parts repository offers a snapshot of how such markets operate in practice. See the catalog page here: 08-15-mitsubishi-lancer-evolution-evo-x-hood-phantom-black-oem-u02.

In sum, the societal implications of A Z Auto Parts and its peers extend far beyond the balance sheet. They touch the daily lives of vehicle owners, the job prospects of communities, and the environmental footprint of the automotive industry. They illuminate a path where local strengths—manufacturing know-how, logistics finesse, and digital literacy—are harnessed to create a more inclusive, sustainable, and innovative mobility system. The chapter’s arc points to a future in which the aftermarket is as central to social progress as it is to vehicle performance: a space where access, fairness, and ecological responsibility advance together, driven by a network of nimble, purpose-driven firms that embody the evolving ethos of modern mobility. As policies continue to favor cleaner transport and as consumer expectations sharpen around transparency and value, the role of A Z Auto Parts and similar enterprises will likely become more prominent, not only in shaping markets but in shaping how people live with their cars—carefully, affordably, and with an eye toward long-term stewardship of resources.

External resource for further context on the societal co-benefits of zero-emission vehicles in freight and related mobility systems: https://pubs.acs.org/doi/10.1021/es503786a

Final thoughts

A Z Auto Parts, represented by Anzhi Auto Parts (Shenyang) Co., Ltd., is more than just an automotive parts manufacturer. It plays a pivotal role in influencing local economies, driving technological advancements, and contributing to societal well-being. Through its commitment to innovation and manufacturing excellence, the company significantly shapes the automotive landscape. Recognizing these connections can inspire business owners and stakeholders alike to leverage such partnerships for greater collective impact in the industry.