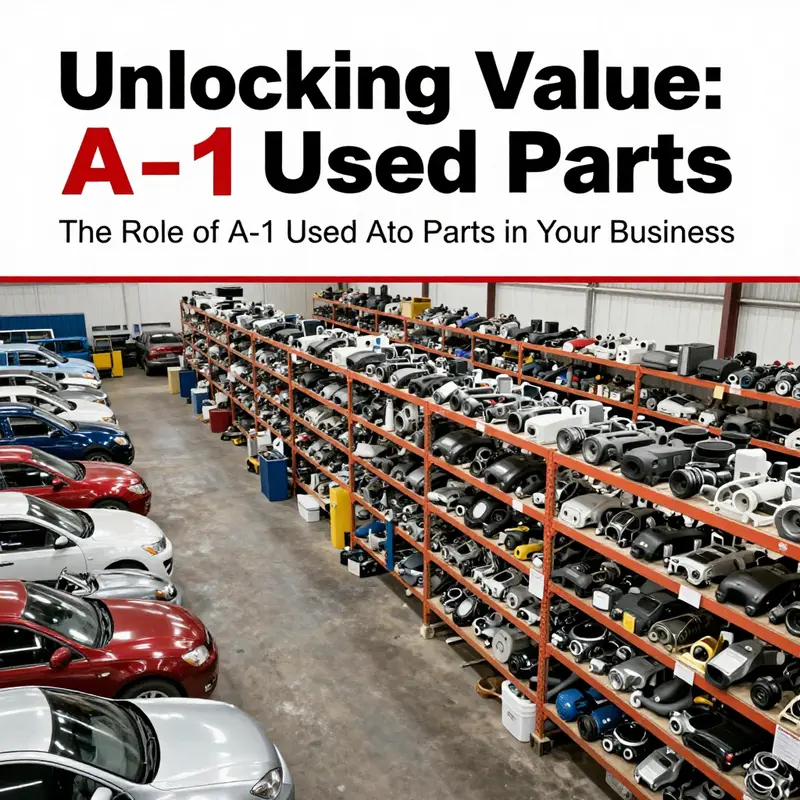

A-1 Used Auto Parts is a beacon of quality in the automotive parts industry, especially for business owners seeking reliable, cost-effective solutions. With a family-owned foundation established in 1997, this Moore Haven, Florida-based company offers a vast inventory of new and used auto parts across 25 acres. This article delves into three key areas that underscore how A-1 Used Auto Parts can be an invaluable resource for business owners: quality and variety of inventory, economic impact on local and national markets, and their sourcing and distribution strategies in the global market. Each chapter will illuminate the significant advantages A-1 provides, encouraging business owners to connect with this resource for their automotive needs.

Quality and Variety Across the Yard: How a Family Inventory Builds Reliability and Reach in Used Auto Parts

In the long arc of automotive repair and restoration, few facets prove as decisive as the quality and variety of the parts that fuel every fix. The yards and warehouses that stock used auto parts are, in effect, libraries of second chances for vehicles in need. This chapter follows the thread that runs through a family-owned operation with more than two decades of dedicated service, a sprawling catalog of parts, and a network that stretches across thousands of salvage yards nationwide. It is a story of how breadth and care converge to deliver reliability, cost efficiency, and sustainability for customers who repair, restore, or simply keep their wheels on the road a little longer. The heart of this story lies in how a large, diverse inventory is sourced, inspected, and graded, then carefully matched to the exact needs of a wide range of makes and models. A yard that pours energy into both quantity and quality becomes a practical partner in maintenance and restoration, not a mere supplier of odds and ends. As the automotive aftermarket has evolved, the importance of a well-curated stock has moved beyond the old notion of swapping one worn part for another. Today, professionals and do-it-yourselfers alike seek assurance: will a used component perform as intended, and for how long? The answer rests on how the inventory is built and governed. The central premise is straightforward: quantity matters because it widens the pool of potential fits, reduces wait times, and increases the odds that a vehicle can be repaired with a part that is compatible and affordable. Yet without rigorous quality control, breadth can become a liability. A large stock that drifts into disrepair or misclassification undermines trust and can leave technicians with parts that fail under load, degrade performance, or create safety concerns. The delicate balance between scale and discipline is what differentiates a dependable source from a convenience store for car parts. A well-managed inventory begins with a robust sourcing network. In practice, this means access to the inventories of thousands of salvage yards across the country, a reach that a family-owned business has cultivated over many years. When a buyer from a distant state needs a part for a specialty application, the yard’s ability to pull from multiple sources minimizes the time to delivery and maximizes the chance that the exact specification is available in good—or at least usable—condition. This is not a mere matter of collecting components; it is an orchestration. Each potential candidate for resale is subjected to a methodical evaluation that weighs function, compatibility, durability, and value. The process borrows methods familiar to engineering shops and plant floors. Parts are tested, measured, and graded to standard descriptors that help customers make informed choices and protect them from unwelcome surprises. This grading system—often including ranges from like-new to repaired to salvage—serves as the customer’s compass. It translates a dealer’s subjective assessment into objective expectations. The grades allow a buyer to tailor choices to the project at hand. A budget-conscious restoration may favor a salvaged body panel that has a solid foundation but minor surface imperfections, while a performance rebuild might demand components with higher integrity or shorter service histories. This nuanced approach to quality is complemented by rigorous testing and certification procedures. Each used part undergoes evaluation to confirm safety and performance benchmarks before it finds a home in the active stock. The testing protocols may incorporate modern diagnostic tools and, where appropriate, reverse engineering techniques that help verify compatibility beyond the original part number or vehicle designation. In that sense, the inventory is not just a collection of parts but a curated set of options that can be confidently recommended by technicians, shops, and enthusiasts who demand reliability. The practical payoff for engineers and mechanics is substantial. When a part has been tested and graded, it becomes a cost-effective alternative to new equipment that can still deliver the required performance. Even for complex assemblies, the availability of high-quality used components reduces downtime and lowers repair costs without compromising safety or durability. This is particularly valuable in the realm of engines, transmissions, drivetrain components, and body panels—categories where a precise match can be crucial. In many vehicles, components wear in tandem or have unique tolerances tied to model year and trim. The ability to source a compatible used alternative from a broad network matters as much as the part’s physical condition. The use of advanced diagnostic tools in the inspection process helps ensure that a part’s electrical, mechanical, and thermal characteristics align with what the vehicle requires. When a part looks good on the shelf but fails in function, it erodes trust and raises questions about the value proposition of used parts. A modern inventory counters this risk by insisting on a rigorous, documented evaluation that aligns with safety and performance standards. This disciplined approach also facilitates a smoother alignment between the part and the vehicle’s systems. Compatibility extends beyond the immediate fit. It includes verifying how a component interacts with sensors, actuators, and control modules, especially in newer or more complex electrical architectures. In practice, this means that a used part is not simply the same size or shape as the original; it behaves as the vehicle requires, within the tolerance bands and software expectations built into the car’s design. That level of assurance matters profoundly when a customer is relying on the repair to preserve safety, reliability, and resale value. The result is a catalog that is rich in variety yet consistent in quality. The inventory covers a spectrum of makes and models, reflecting the diverse needs of customers who own older classics, mid-life commuters, and late-model vehicles alike. A broad stock of engines, transmissions, and driveline components stands alongside a generous array of body panels and replacement parts that restore aesthetics and function. The breadth of the catalog—paired with careful grading and testing—empowers customers to find exactly what they need, even when the search crosses brand lines or model generations. The practical advantage of such variety is equally evident in how the business communicates with customers. A direct approach—encouraging buyers to contact the yard when they locate a needed part—fosters a collaborative search process. The yard can leverage its network to source hard-to-find items, tapping into salvage yards and distributors that lie beyond its immediate physical footprint. The result is a seamless, nationwide capability that translates into faster repairs and less downtime for vehicles in service, restoration, or hobby projects. The human element remains central to the success of this approach. Family ownership and a long-standing presence in the community anchor the operation in reliability and accountability. The owners’ ongoing involvement signals a steady commitment to quality and customer service, two attributes that mean more than just a favorable price. In a business where the difference between a successful fix and a failed one can be a single component, trust is built through transparent processes, consistent performance, and a steady supply chain. Trust, in turn, supports sustainability. The reuse of parts reduces waste and the demand for new materials, aligning repair practices with broader environmental goals. For professionals who work on old projects or high-mileage fleet vehicles, reuse is not a compromise but a pragmatic strategy that respects budgets while upholding safety and performance. The sustainable dimension of quality and variety is reinforced by the sheer geographic reach of the inventory network. A nationwide shipping capability means that a part needed in a distant city can be procured and delivered with reasonable lead times. This is not a minor convenience; it is a strategic capability that helps shops manage supply chains, maintain workflow, and meet customers’ deadlines. It also amplifies the value of a local yard beyond its community borders. Customers who value both speed and dependability come to rely on a yard that can orchestrate the movement of parts from dozens of sources to a single, clear specification. In this sense, the inventory becomes a dynamic ecosystem rather than a static pile of components. The ecosystem thrives on disciplined grading, robust testing, and a proven sourcing framework. The combination of these elements—breadth, reliability, and responsible reuse—offers a compelling case for the use of quality-used parts in repairs and restorations. When a technician or a hobbyist weighs options for a repair, the decision often hinges on more than upfront cost. It involves evaluating long-term performance, compatibility with other components, risk of premature failure, and the potential for future needs. A well-curated inventory answers these questions with data-driven clarity. It provides a spectrum of choices that can be matched to the project’s objectives: restore, maintain, or upgrade within a defined budget and timeline. The final layer reinforcing the value of such an inventory is the customer experience. Availability of parts across a broad catalog, transparent grading, and predictable delivery times transforms an often stressful process into a collaborative, methodical exercise. Buyers know what to expect and can plan repairs with greater confidence. The yard’s ability to support nationwide shipping and direct customer outreach further enhances this experience. Rather than passively listing parts, the business invites dialogue, which in turn improves fit, reduces returns, and strengthens the reputation for reliability. A well-run operation thus becomes more than a place to buy parts; it becomes a partner in sustainable repair. For readers who want a concrete sense of how grading translates into practical decisions, consider an example from a popular category where matching accuracy matters most: a rear body component for a high-demand performance model. While the precise identification and naming of certain parts can vary, the principle remains the same. A part graded as suitable for a particular level of use is more than its physical dimensions; it carries with it a documented expectation of performance, compatibility, and durability. The evaluation framework informs not just what is in stock, but what can be recommended for a given repair scenario. The smooth functioning of such a system depends on more than well-meaning intentions. It requires disciplined operations, clear documentation, and continuous learning. As new vehicle generations enter the market and older vehicles remain on the road, the knowledge base behind a large used-parts inventory grows in tandem with the catalog. Specialists involved in grading, testing, and sourcing stay current with evolving standards, new diagnostic approaches, and the subtleties of cross-brand compatibility. This ongoing investment in capability is what keeps the inventory relevant and trustworthy for years rather than months. In sum, quality and variety are not merely attributes of a used auto parts inventory. They are the operating principles that drive reliable repairs, sustainable practice, and efficient service across a nationwide network. The blend of a substantial yard footprint, a carefully managed grading system, rigorous testing, and an expansive sourcing web creates a practical engine for repair professionals and DIY enthusiasts alike. It enables faster, more predictable repairs while maintaining high safety and performance standards. It also illustrates a broader truth about the used-parts market: when an operation treats inventory as a living system—one that is continually sourced, inspected, and matched to real-world needs—the result is not a set of odds and ends, but a curated ecosystem that empowers people to keep vehicles on the road with confidence. For readers seeking a tangible example of how grading and compatibility considerations can be framed in a real listing, see this item detailing an OEM rear component for a well-known performance model: OEM rear bumper for a Mitsubishi Evolution 8-9. While the specific part is just one node in a vast network, it helps illustrate the careful alignment of form, function, and fit that characterizes high-quality used parts offerings. External resources also illuminate the evolving frameworks that underlie grading systems in the industry. For readers who want to delve deeper into how grading, properties, and practical industrial uses are defined and applied, a detailed discussion is available here: https://www.a1importautoparts.com/grades-properties-industrial-uses. This external perspective complements the chapter’s center on how a family-owned operation maintains quality across a broad, nationwide inventory. As the chapter closes, the overarching message is clear: a used auto parts inventory is most valuable when it is both broad enough to fit diverse needs and disciplined enough to guarantee performance. When a family yard with deep community roots and expansive sourcing can couple that breadth with rigorous testing and clear grading, it offers a dependable path to repair, restoration, and reuse that serves customers, communities, and the environment alike.

The Ripple Economy of a Used Auto Part: Local Resilience, National Markets, and the Circular Automotive Future

When a single used auto part leaves the vehicle it once powered, it begins a journey that many readers might not notice. That part travels from a wrecked or decommissioned car to a salvage yard, where it is assessed, tested, and cataloged for resale. What follows is not just a transaction; it is an intricate ripple through local economies and, more broadly, the national automotive aftermarket. This ripple shapes the fortunes of repair shops, independents, and small business owners who seldom appear on the front page, yet whose daily operations hinge on the availability and price of affordable components. In a landscape where maintenance can be a household concern or a small shop’s livelihood, the reuse and resale of parts become a lever for resilience. A family‑owned used auto parts operation in the Southeast, with a sprawling inventory and a nationwide sourcing network, provides a real‑world example of how one item can stimulate local employment, support repair ecosystems, and contribute to broader industrial dynamics that keep people on the road at a price they can afford. Yet the story extends beyond a local lifeline; it anchors a national market whose size, structure, and behavior depend on the same forces that govern other forms of reuse and recycling. The local and the national are not distinct silos here. They braid together in a continuous loop where inventory, price, and trust travel across miles and states, driving decisions at every link in the chain from the salvage yard to the repair shop, to the consumer choosing between a new part and a used alternative, and back again as another vehicle joins the fleet of those who reuse and repair rather than replace outright.

From a local vantage point, the act of reselling a used part can spur a cluster of economic activity around it. Salvage yards become hubs of opportunity, attracting yard workers, technicians, and logisticians who specialize in testing, labeling, and packaging components to ensure they meet the needs of customers who must turn around repairs quickly. Independent repair shops, often operating on tight margins, gain access to affordable components that enable them to service vehicles in a price range that many households deem reasonable. The availability of reliable used parts reduces downtime for vehicles in a neighborhood, which translates into steadier incomes for shop owners and more predictable schedules for technicians. The effect may seem modest in isolation, but it compounds when dozens or hundreds of local businesses participate in this recycling economy. For the individual consumer, the savings can be meaningful. A repaired vehicle remains in service longer, slowing the drift toward higher new‑parts bills and, in some cases, making repairs a matter of necessity rather than a luxury.

The local layer feeds into a national mechanism that sustains a sprawling aftermarket worth hundreds of billions of dollars in the United States alone. A network that spans thousands of salvage yards and hundreds of repair outlets across the country creates a supply chain that can respond to diverse needs—from older, out‑of‑production models to newer vehicles with compatibility requirements that still permit reuse of certain components. The density of supply across the country matters as much as the price. A part sourced in one region can become a solution for a distant customer who faces long delays or higher costs chasing new equivalents. The capacity to source parts nationwide means that a small yard in a sparsely populated area can participate in a broader market, leveraging relationships with wholesalers and other yards to locate items that would otherwise be scarce. This geographic reach also supports price competition, which helps keep maintenance affordable and sustains consumer demand. When a customer sees a reasonable price for a used component, it can unlock a maintenance decision that otherwise might be delayed, creating a chain reaction through local auto service ecosystems and, ultimately, through national retail channels that rely on sustained aftermarket activity.

The economic significance of used auto parts extends into how households manage budgets and expectations about reliability. For many families, vehicle ownership is essential to daily life, providing access to work, schooling, healthcare, and essential services. When a used part offers a viable alternative to a new, often higher‑priced component, it preserves mobility without compromising safety or reliability. This is not merely a convenience; it is a form of financial elasticity. Individuals on tighter budgets can allocate scarce resources to multiple essential needs while still keeping their vehicles functional. In this sense, the reuse economy operates like a social insurance mechanism, buffering households from the shocks of rising maintenance costs and helping to stabilize consumer spending, which in turn supports broader economic activity. The link is simple but powerful: affordable parts enable ongoing consumption in other sectors, preserving the flow of goods and services that define a healthy economy.

Beyond the wallet, the environmental logic of the used parts market strengthens the case for a circular economy in transportation. Extending the lifecycle of automotive components reduces waste and curtails the demand for raw materials and the energy needed to manufacture new parts. Each part that finds a second life displaces the need for raw extraction, processing, and fabrication, with tangible reductions in emissions and water use across the supply chain. This environmental dividend resonates with broader policy priorities around sustainable growth and green infrastructure investments. While a single part’s reuse might seem like a small numerator in a large ledger, the cumulative effect across millions of parts annually becomes substantial. Environmental benefits feed back into the economy through reduced disposal costs for scrap yards, lower long‑term energy use, and the creation of markets for refurbished components that further spur innovation and competition in the parts ecosystem.

The narrative of the used parts market also intersects with questions of quality, trust, and risk management. For local shops and buyers, the reliability of a used component depends on standardized testing, accurate remanufacturing practices, and transparent warranties. These factors shape consumer confidence, which in turn influences demand and retention of customers. A robust ecosystem relies on reputable yards that employ consistent quality checks, a disciplined inventory approach, and a willingness to stand behind the items they sell. In a mature market, buyers learn to assess compatibility, condition, and fitment with the same care they would apply to a new part. The risk of counterfeit or misrepresented components is real, which is why the sourcing network, the documentation that accompanies each item, and the recourse available to buyers are critical components of the system’s integrity. When these elements align, the used parts market becomes more than a price point; it becomes a durable channel for maintaining vehicle fleets. This, in turn, feeds into the broader national economy by preserving consumer purchasing power and keeping service businesses solvent during periods of economic stress.

The dynamic also includes a subtle interplay with the design and availability of new parts. While many consumers seek the affordability of used components, others are drawn to combinations of new and used components that optimize performance, safety, and longevity. A nationwide network of salvage yards and wholesalers can supply a spectrum of options, which encourages repair shops and end users to evaluate total cost of ownership rather than upfront price alone. In practice, this means that a repair job may involve sourcing clean, tested used parts for most of the repair while potentially reserving a new component for a critical system that demands the highest reliability. This balancing act fuels a diversified market where both new and used parts coexist and compete, pushing suppliers to improve inventory management, testing protocols, and logistical efficiency. The result is not a zero‑sum game but a more nuanced ecosystem in which price, reliability, and availability co‑evolve.

A further dimension of the economic impact lies in the way the used parts sector interacts with consumer trends and interests in vehicle customization. Enthusiasts who pursue performance upgrades or distinctive aesthetics often look for components that may be scarce or specialty in the new‑parts market. The sale of used parts in a nationwide network can meet these demands by offering affordable options for configurations that would otherwise be financially out of reach. This is not just about nostalgia or status; it is about enabling creative expression within the constraints of a budget. When a consumer can source a compatible used manifold, a tested transmission component, or a body panel through a broad network, their project becomes more feasible and their vehicle remains an extension of personal identity. Even in this space, the economic logic remains consistent: broader access translates into more possibilities, greater consumer engagement, and a more robust aftermarket that can weather fluctuations in supply and demand.

That said, the narrative is not without its complexities. The growth of the used parts market depends on robust logistics, transparent information flows, and a healthy regulatory environment that supports safe reuse practices. Inventory visibility—knowing what is in stock, what is tested, and what is compatible with various makes and models—reduces friction for buyers and speeds up repairs. Logistics networks must be able to move parts quickly across state lines, with standardized handling to ensure safety and compatibility. And as the market scales, the role of local businesses becomes even more critical: they are the touchpoints where customers first learn about options, compare costs, and develop trust in the parts they buy. A geographically dispersed ecosystem can only flourish if it is anchored by dependable local partners who understand the needs of their communities and can translate that knowledge into reliable service and predictable pricing.

From a macroeconomic perspective, the case for supporting a strong used parts market rests on its potential to stabilize mobility, spur entrepreneurship, and contribute to long‑term systemic resilience. By sustaining repair activity and extending vehicle lifespans, the sector dampens the need for new vehicle purchases, which has implications for manufacturing demand and employment in the broader economy. The circularity embedded in this market aligns with national trajectories toward sustainable growth and resource efficiency. Governments and industry players increasingly recognize that extending the useful life of durable goods, including cars, is a prudent strategy for reducing environmental impact while preserving economic activity. In this context, the used parts market becomes a practical instrument of policy in addition to a commercial channel: it channels existing assets back into service, reduces waste, and preserves the human capital involved in repair work, logistics, and parts verification.

The interplay between local vitality and national scale is perhaps best understood through the lens of practical outcomes. When a single part is reintroduced into service, it often triggers a cascade of benefits: a repair shop preserves revenue and employment; a consumer maintains mobility and avoids additional debt; a salvage yard preserves a stream of income that supports its staff and its community; and a regional distributor enhances its capacity to meet demand across a broad footprint. The combined effect of thousands of such parts moving through the system is a resilient, low‑cost, and environmentally friendly model of automotive maintenance. This is the kind of economy that grows not from grand policy statements alone but from steady, reliable practices—quality testing, honest pricing, and trustworthy service—that turn a used part into a dependable option for millions of vehicle owners.

For readers who want to explore how macroeconomic trends shape the used auto parts landscape, the U.S. Bureau of Economic Analysis provides contextual automotive industry data that informs these conversations. While the specific dynamics of a single yard, a regional repair shop, or a national network will vary, the broader pattern is clear: the aftermarket remains a critical, forward‑leaning component of the economy, capable of driving growth, supporting households, and advancing sustainable practices. The data illuminate how consumer demand, investment in repair ecosystems, and evolving regulatory frameworks interact to frame the opportunities and challenges facing the used parts market in the years ahead. As momentum builds around circular economy models and green growth, the narrative of the used auto parts sector becomes part of a larger story about value retention, mobility, and economic stability in a changing world. External readers seeking a macro view can consult BEA’s automotive industry data for deeper context and trends that influence how local salvage yards connect to national markets and how those connections shape the future of vehicle maintenance and ownership.

Alongside policy and macro data, the human element remains central. The technicians who test a used part, the shop owner who negotiates a fair price, the customer who walks away with a repair that keeps their vehicle on the road—that human fabric is the backbone of this economy. The trust built through consistent quality, accurate descriptions, and dependable warranties makes the used parts market more than a transaction; it becomes a community of practice where knowledge travels quickly from yard to shop to customer. When this trust is present, the market can expand its reach, attract new participants, and push toward greater transparency across the supply chain. The result is a more robust ecosystem that can withstand shocks—whether those shocks come from economic downturns, supply chain disruptions, or shifts in consumer preferences—while continuing to deliver value on the ground where people live, work, and depend on their cars.

As the chapter closes on this landscape, the central idea comes into sharper focus: a single used auto part is not merely a component in a vehicle. It is a node of economic activity with local roots and national reach, capable of supporting jobs, saving families money, and contributing to environmental stewardship. Its journey—from salvage to service, from yard to repair shop, from budget constraint to mobility enabler—embeds it in a broader narrative about how communities maintain resilience and how markets adapt to circular principles. The next chapter will likely probe more deeply into specific supply chain mechanisms, or perhaps examine consumer attitudes toward used parts in different regions. Yet the thread that runs through this discussion remains constant: the reuse and resale of automotive parts create value by extending lifecycles, sustaining livelihoods, and aligning with a growing commitment to sustainable growth that preserves both the planet and the people who depend on it. For readers curious about practical examples that connect micro decisions to macro outcomes, the journey of a single part offers a compelling, tangible illustration of economic interdependence in the modern automotive era.

External resource: For macroeconomic trends in the automotive sector, see the U.S. Bureau of Economic Analysis automotive industry data: https://www.bea.gov

Internal reference (example): For enthusiasts looking for a practical example of how part sourcing intersects with car customization, you can explore a catalog page such as the carbon fiber bonnet hood for Mitsubishi Lancer Evo X, which illustrates how contemporary parts ecosystems connect performance curiosity with reuse and affordability. carbon fiber bonnet hood for Mitsubishi Lancer Evo X.

Global Pathways for A1 Used Auto Parts: How Parts Move, Where to Source Them, and What Matters

Sourcing and distributing used parts for a compact premium hatchback demands practical knowledge and strategic choices. This chapter traces the main flows that move parts from retired vehicles to the hands of repair shops, resellers, and owners. It explains the channels most relied upon worldwide, the logistical and regulatory hurdles to expect, and the quality, fitment, and pricing trade-offs that shape decisions. The narrative follows a single part class through the system — from authorized factory sources to regional salvage yards and digital marketplaces — and highlights how scale, geography, and specialization change the rules.

A handful of channels supply used components at scale. Authorized dealer service networks offer new, certified items with predictable fit and warranty coverage. Aftermarket suppliers and remanufacturers supply alternative new parts or rebuilt units. Salvage and dismantling operations harvest reusable components from end-of-life and damaged vehicles. Regional distribution hubs and cross-border traders knit these sources together. Each channel differs in cost, lead time, risk, and availability. Choosing among them is a function of part rarity, buyer risk tolerance, and the patchwork of regional infrastructure.

Authorized networks remain the go-to for complex assemblies and electronic modules. They ensure parts match serials, software, and specifications. When compatibility requires precise calibration, these networks reduce risk. That reliability comes at a premium. For maintenance shops focused on warranty-safe repairs, the higher price is often acceptable. For cost-sensitive repairs, many buyers turn to alternatives.

The independent aftermarket offers a competitive, lower-cost option. Suppliers here produce new replacement parts or remanufacture used units to a standard. These businesses rely on economies of scale and supplier relationships. Pricing is more aggressive than authorized channels. Coverage and fitment can vary, however. Independent suppliers may provide parts designed to meet or exceed original tolerances. Buyers must weigh the reputation and warranty terms of the supplier. In well-developed markets, aftermarkets are mature and well-regulated. In emerging markets, quality variance can be wider.

Salvage yards and dismantlers are central to the used parts economy. Vehicles that are written off after accidents, damaged by weather, or retired are stripped for usable components. Those parts include body panels, interior trim, mechanical assemblies, and many electrical items. The process is straightforward in concept but complex in execution. Dismantlers inspect, test, clean, and catalog parts. Some items receive light refurbishment. Others are sold as-is with condition notes. Experienced dismantlers use VIN decoding and part-number crossreferencing to match parts accurately. For rare parts, a well-run salvage yard can be the only practical source.

Regional distribution centers and logistic nodes bridge sellers and buyers. In markets where a model has high local penetration, regional hubs accumulate inventory efficiently. Parts flow quickly between dismantlers, distributors, and repair shops. In contrast, markets with low local vehicle numbers depend on imports. For the compact premium hatchback, demand concentrates heavily in its principal sales region. That keeps parts plentiful and prices stable. In regions with low vehicle volume, sourcing often involves cross-border shipping and longer lead times.

The web and digital marketplaces transformed sourcing. Buyers now search global inventory with VIN-level filters and fitment checks. Online catalogs consolidate data from thousands of dismantlers and distributors. That transparency lowers search costs and widens options. However, the rise of online trade also increases the importance of accurate part descriptions and images. Sellers who provide clear testing records and photographic proof usually move inventory faster.

Cross-border trade of used parts is a major trend. Vehicles and parts now flow along new corridors. High-surplus regions export end-of-life vehicles, while parts and whole cars find buyers in regions with growing vehicle fleets. This creates opportunities for distributors who can manage customs, compliance, and logistics. Successful exporters bundle paperwork, provide export-compliant documentation, and establish relationships with local brokers. Such capabilities reduce delivery surprises and support predictable pricing.

Regulation and environmental policy shape dismantling and distribution. In many jurisdictions, end-of-life vehicle rules govern the treatment, disposal, and reuse of parts. These regulations encourage recovery of reusable components and proper disposal of hazardous materials. Compliance adds cost and complexity. Conversely, clear regulation can stabilize markets by reducing the legal risk of buying recycled components. Understanding local waste and safety rules is essential for anyone building a cross-border parts business.

Quality assessment is a daily operational challenge. Buyers need reliable, repeatable inspection practices. Simple cosmetic checks are not enough. For mechanical and electronic items, functional tests create confidence. Many dismantlers create multi-point inspection forms and record test results alongside photos. Reputable sellers will grade parts and describe wear, modifications, or damage. A consistent grading system reduces disputes and returns. For high-value electronics, sellers may provide short-term warranties, which give buyers breathing room to test fitment and performance.

Compatibility and identification hinge on part numbers and vehicle identification numbers. VIN decoding is a skill that pays. It helps match production options, model years, and equipment packages. Parts that look identical can differ in connectors, gear ratios, or software. For buyers, asking for the donor vehicle’s VIN and the part number minimizes mismatch risk. Where data is incomplete, technical diagrams and exploded views aid cross-referencing. That diligence saves time and prevents costly returns.

Logistics decisions determine final cost and service level. Small, heavy parts like transmissions incur high freight costs. Bulky body panels require careful packing and increase damage risk. Sellers develop standard packaging methods and negotiated carrier rates. For cross-border shipments, consolidation and palletization reduce per-item costs. Expedited shipping remains an option for critical repairs, but expense rises fast. Many buyers manage costs by keeping a small local stock of high-turn items while ordering rare parts on demand.

Pricing dynamics vary with part type. Common wear items generally trade at predictable prices. Structural parts from commonly salvaged vehicles are cheap relative to new replacements. Rare trim pieces command premium prices, especially if they are discontinued. Electronic modules with software locks can be very costly to source used. The mix of local supply and import competition defines the market price. Where supply is tight, buyers may accept longer lead times or pay higher fees for procurement.

For small independent resellers, building procurement networks matters most. Relationships with reputable dismantlers and regional distributors provide regular access to inventory. These buyers often cultivate exclusive sourcing agreements or preferred-customer status. That yields earlier access to high-demand parts. Transparency in accounting, timely payments, and clear returns policies help secure favorable terms from suppliers.

Large-scale operations rely on inventory management systems. Software that tracks parts by condition, origin, and test status reduces waste. Good systems support dynamic pricing and multi-channel sales. They also enable efficient cross-docking when parts move quickly. Investing in such systems pays off where volume and SKU counts are high.

Emerging markets present unique sourcing puzzles. Low local vehicle numbers often mean spare parts must be imported. That adds cost and complicates warranty claims. For complex electronic items, compatibility with local service networks matters. In many of these markets, refurbished parts are more acceptable. Local workshops may prefer parts that can be serviced in-country. Exporters targeting these markets tailor their offerings accordingly.

The rise of electrified vehicles affects used parts flows. Battery packs and high-voltage components need specialist handling and safety protocols. As vehicle fleets change, demand patterns shift. Routine mechanical parts remain in demand, but some assemblies become less relevant. Dismantlers and distributors who invest early in training and equipment for high-voltage systems gain a competitive edge.

Sustainability and circular-economy thinking are shaping buyer behavior. Recycling and reuse reduce the environmental footprint of vehicle maintenance. Many buyers now prefer reused components when they offer cost savings and equivalent performance. That cultural shift supports the business case for investment in refurbishment and testing. It also encourages the formalization of secondary markets.

Risk management includes legal, operational, and market measures. Sellers reduce legal exposure by documenting chain of custody and ensuring compliance with export rules. Operationally, redundancy in logistics partners prevents single-point failures. Market risk is mitigated through diversified inventory and flexible pricing.

For consumers and small shops, best practices improve outcomes. Verify fitment with VIN and part number. Request condition photos and test records. Ask about return windows and warranty terms. When buying online, prefer sellers who publish clear grading criteria and who communicate shipping methods. For critical systems, insist on tested parts or consider remanufactured alternatives.

For distributors and dismantlers, differentiation matters. Clear grading systems, consistent testing procedures, and transparent photography accelerate turnover. Investing in efficient packing and return logistics lowers damage losses. For exporters, mastering customs paperwork and export compliance is a competitive advantage.

Technology continues to reshape sourcing and distribution. VIN decoding tools, automated part-number matching, and augmentedreality fitment aids reduce guesswork. Inventory marketplaces aggregate stock and expose long-tail availability. Data analytics optimize pricing and reorder points. These tools level the playing field for smaller operators.

The global market offers both opportunity and complexity. Where volumes of a given compact premium model are high, parts are abundant and distribution is efficient. In peripheral markets, procurement requires planning, cross-border logistics, and patience. Buyers who combine careful inspection, VIN-based matching, and reliable shipping reduce risk and cost. Sellers who invest in testing, grading, and clear communication win trust and repeat business.

To navigate this landscape, treat sourcing as a supply-chain problem. Map where the vehicle fleet is concentrated. Identify reliable dismantlers and regional hubs. Understand local regulations and shipping realities. Use technology to match parts and to manage inventory. Value transparency in condition reports and documentation. With disciplined practices, the used parts market becomes a predictable, cost-effective resource for keeping vehicles on the road.

For further reading on market dynamics and industry trends in the global automotive aftermarket, see this authoritative resource: https://www.autocar.co.uk

Final thoughts

A-1 Used Auto Parts emerges as a critical player in the automotive parts market, offering quality and variety that cater to the diverse needs of business owners. The company not only strengthens local economies but also contributes significantly to national markets, proving that a well-established inventory can drive economic health. Additionally, their global sourcing and distribution strategies enhance accessibility to needed parts, ensuring that businesses can operate efficiently. Engaging with A-1 Used Auto Parts means investing in quality, cost-effectiveness, and a support network dedicated to the automotive industry.