Understanding the pivotal role of A&B Auto Parts within the automotive sector is essential for business owners looking to leverage advanced manufacturing innovations. This company operates at the intersection of non-standard automation equipment manufacturing and automotive production, providing tailored solutions that promote efficiency and productivity. Each chapter of this article unpacks different facets of A&B Auto Parts, from its integration of intelligent machinery in automotive production to its impact on the economic landscape and technological innovations. By the end of this piece, readers will have a solid grasp of how A&B Auto Parts is shaping the future of automotive manufacturing and what that means for business operations in the industry.

Smart Lines and Tailored Machines: How A&B Drives Auto Parts Production with Non‑Standard Automation

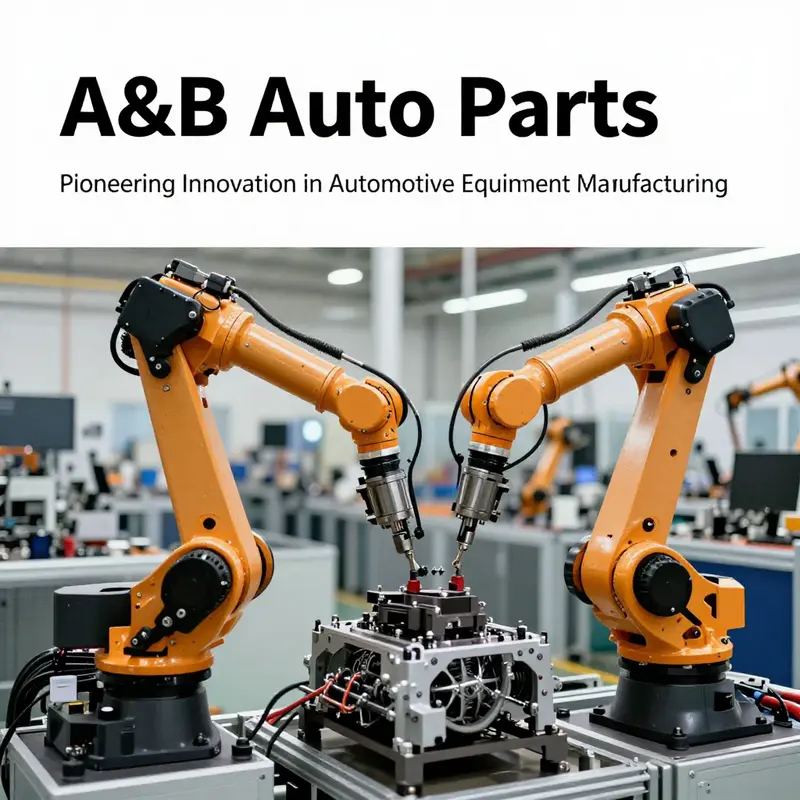

A&B Intelligent Equipment Manufacturing has spent decades translating bespoke production challenges into robust, automated systems that serve auto parts makers. Its focus is not on mass-market machines. Instead, the company builds custom solutions for complex, niche, or evolving production needs. That emphasis makes A&B a vital bridge between design intent and consistent, high‑quality output for component suppliers across the automotive supply chain.

Manufacturing auto parts today demands more than speed. Suppliers must combine precision, flexibility, and traceability. A&B approaches these demands through full lifecycle engagement. That begins with factory planning. Engineers map material flows and takt times. They model part variants, work cell layouts, and operator interfaces. Early planning reduces rework and maximizes floor efficiency. From there the process moves into intelligent equipment design. Each machine is conceived to solve a defined production problem, not to sell a standard SKU. The result is equipment that fits a product family, production volume, and quality target with minimal compromise.

Non‑standard automation means many forms. For some clients, it is an automated assembly line that sequences and orients dozens of small fasteners within tight tolerance. For others, it is a test station that cycles parts through multi‑axis inspection while recording measurement data. A&B supplies conveyors, handling robots, press stations, and inspection rigs, then integrates them into coherent production cells. That integration includes controls architecture, HMI design, error handling, and communication with higher‑level systems. The company favors modularity. Modules can be rearranged to match a new product line or to scale capacity without wholesale replacement.

A key advantage of tailored systems lies in quality assurance. Auto components often fail when tolerances drift, or when a manual step introduces variability. Custom automation reduces such risks. Fixtures and gaging are designed for the specific geometry of a component. Vision systems are tuned to detect relevant defects, not generic blemishes. Test stations simulate end‑use conditions to catch functional failures early. Moreover, A&B links inspection results to traceability records. Each part can carry a digital history of operations, measured values, and process parameters. That traceability supports warranty claims, supplier audits, and continuous improvement efforts.

Flexibility is another major benefit. Vehicle programs constantly evolve. New variants, material changes, and shifts to electrified architectures force suppliers to adapt. Off‑the‑shelf equipment seldom offers the nimbleness required. A&B’s non‑standard approach enables reconfigurable tooling and software that handle variant mixes. Quick‑change fixtures, programmable motion profiles, and modular conveyors let production lines switch between parts with limited downtime. For suppliers who serve both legacy models and new electric platforms, that adaptability translates into lower capital risk and faster time to market.

Throughput and efficiency improvements follow from holistic design. Instead of optimizing an isolated machine, A&B engineers balance cycle times across the line. They look at upstream and downstream buffers, part feeder reliability, and maintenance access. This systems thinking reduces bottlenecks and aligns takt with demand. The company also embeds predictive maintenance features. Sensors monitor vibration, temperature, and cycle counts. When a parameter moves outside its normal range, the system flags the issue and schedules service before a failure halts production. Lower downtime and predictable maintenance windows improve overall equipment effectiveness.

Skilled teams matter in bespoke automation. A&B’s multi‑generational workforce blends hands‑on technicians with seasoned mechanical and electrical designers. This mix yields practical, maintainable solutions that withstand the shop floor. Designers understand fabrication limits and assembly challenges. Technicians provide feedback that informs successive revisions. Such collaboration shrinks the gap between prototype and production. It also ensures that after‑sales support is not an abstract promise. Service technicians can diagnose problems remotely or on site, guiding plant personnel through corrective steps or carrying out repairs when needed.

A&B’s scope reaches beyond traditional internal combustion engine parts. The firm serves small appliances, electric tools, agricultural machinery, and emerging electric vehicle components. That broad exposure enriches the company’s problem database. Techniques from one sector often transfer to another. A force‑measuring test developed for a power tool can adapt to a motor mount in an EV. A custom palletizing strategy for small home appliances can scale to larger assemblies. Cross‑industry experience accelerates innovation and reduces development time for customers with hybrid product lines.

Sustainability and resource efficiency also shape design choices. Tailored automation can reduce material waste by enforcing precise joins and repeatable weld patterns. Energy recovery strategies for pneumatic systems and smarter motion profiles cut power consumption. Packaging automation minimizes void space and uses standardized pallets to streamline logistics. These optimizations reduce both cost and environmental footprint across the supply chain.

Global deployment is part of A&B’s competence. Projects may start in China and expand to international sites. The company supports localization, adapting designs to regional standards or supplier ecosystems. It provides documentation and training in multiple languages. For global tier suppliers, that consistency matters. When identical lines run in different countries, quality and throughput remain comparable. A&B also assists with commissioning and pilot runs to validate system performance under real production conditions.

The business case for non‑standard automation centers on measurable gains. Suppliers typically evaluate cost per part, scrap rate, and uptime. Custom automation reduces cycle variability and scrap, while improving yield on critical operations. It can shorten lead times and increase first‑pass yield by catching defects earlier. These benefits compound over production volumes and program lifetimes. A&B supports customers by modeling return on investment and aligning milestones to production ramp schedules.

Collaboration is essential. Successful projects require early alignment on product tolerances, expected volumes, and supply chain realities. A&B works alongside design and manufacturing teams to clarify assumptions and test prototypes. Rapid prototyping and small‑batch pilot installations help validate concepts without major capital exposure. After a line is in production, A&B continues to refine software and tooling in response to field data. This continuous improvement loop ensures the system remains tuned to evolving needs.

To explore typical system examples and technical capabilities, companies often study real component cases. For suppliers seeking context on engine and drivetrain parts, a practical reference is a curated listing for a well‑known engine family, which illustrates the types of components that benefit from automated assembly and testing. A relevant internal reference is the genuine JDM low‑mileage 4G63T engine listing, which highlights the variety and complexity of parts that automation must handle: https://mitsubishiautopartsshop.com/genuine-jdm-low-mileage-1995-1999-jdm-mitsubishi-4g63t-2-0l-dohc-turbo-engine-evo-7-bolt-eclipse-talon-awd-automatic-transmission-and-ecu-attached/

For engineers and procurement teams evaluating partnerships, A&B’s official site provides detailed catalogs and case studies that illustrate the firm’s end‑to‑end capabilities. The site is a resource for technical specifications, contact points, and examples of deployed systems: https://www.abautomation.com.cn/

By focusing on non‑standard automation, A&B helps auto parts suppliers meet modern production demands. Its one‑stop approach reduces integration risk and shortens launch cycles. The combination of tailored design, modular hardware, data‑driven maintenance, and cross‑industry know‑how supports consistent part quality. For suppliers navigating variant-heavy programs and electrification, A&B’s model offers a pragmatic path from engineering intent to repeatable production.

Smart Lines, Precise Parts: The Integration of Intelligent Machinery in Automotive Production

The story of modern auto parts manufacturing is inseparable from the rise of intelligent automation that can bend to nearly any factory shape and any volume requirement. In this landscape, a company like A&B Intelligent Equipment Manufacturing (Zhejiang) Co., Ltd. has grown from a traditional engineering shop into a turnkey partner for automotive producers seeking smoother, safer, and more adaptable production lines. With more than three decades of history, the company has built its reputation not merely by supplying equipment, but by composing an orchestration of devices and processes that together form a living factory floor. Their focus on non-standard automation equipment means they tailor systems to the unique geometry of each product family, rather than forcing a one-size-fits-all solution. This thoughtful flexibility matters in a sector where every part line must remain responsive to shifting engineering demands, changing models, and the emerging criteria of sustainability and safety.

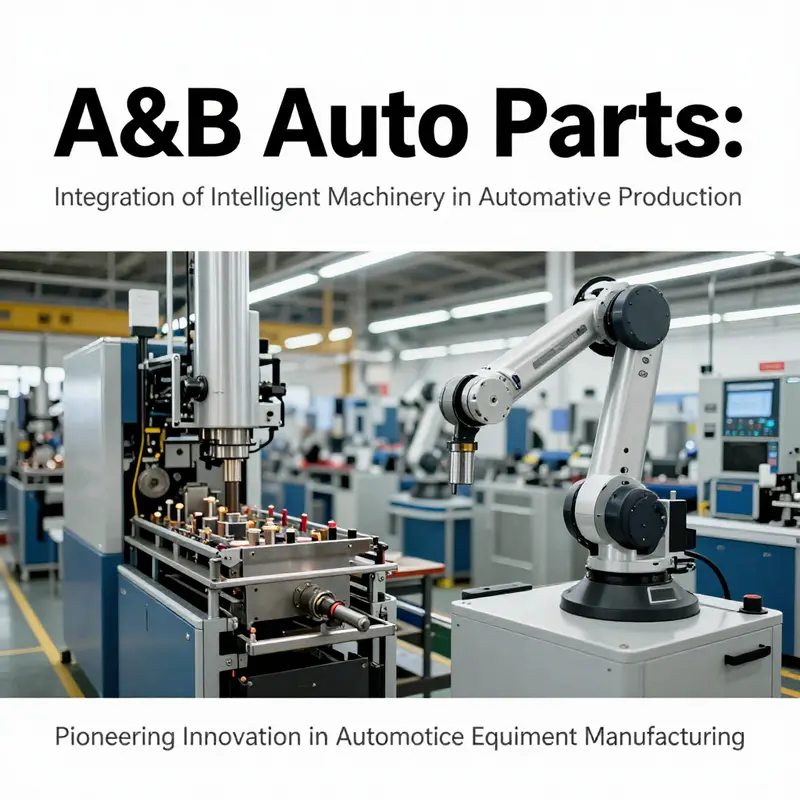

In automotive production, the flow from components to finished vehicles is a complex choreography. A&B structures its services around five interconnected domains that together support this flow: factory planning, intelligent design, manufacturing processing, production installation, and commissioning with after-sales service. The emphasis on planning and design is not cosmetic; it underpins the ability to reduce lead times, minimize waste, and maintain consistent quality across shifts and lines. Smart factory thinking begins long before a single bolt is inserted. It starts with an accurate map of the value stream and a design mindset that anticipates bottlenecks, accommodates product variance, and foresees maintenance needs. When this groundwork is paired with intelligent design, the resulting equipment not only fits the current product family but also adapts to future variants with minimal reconfiguration. In practice, this means a factory can pivot from a compact, efficient assembly flow to a more expansive line capable of higher throughput without sacrificing safety or reliability.

A core strength of the A&B approach is the full-chain integration of non-standard automation equipment. The company speaks in the language of conveyors, assembly stations, testing apparatus, inspection machines, gripping and handling devices, and specialized presses—yet it does so with an eye toward cohesion rather than a collection of isolated systems. Each element is conceived as an interoperable module, designed to exchange data, align with a common control philosophy, and support a unified operator experience. There is a quiet sophistication in this integration: sensors report real-time status, vision systems validate alignment and fit, and actuators respond with precise motion aligned to the timing of upstream and downstream processes. The result is a production ecosystem in which problems become visible sooner, decisions become data-driven, and defects do not propagate through the line.

This seamless interoperability matters especially when the production line is tasked with diversified outputs—ranging from engines and electric propulsion components to broader auto parts ecosystems. The intelligent systems maintain coordination across stations, ensuring that parts move with purpose rather than through guesswork. A&B demonstrates this capability through automated lines designed to handle lightweight vehicle components and, at the same time, robust equipment for more demanding engine-related assemblies. The company’s emphasis on intelligent production processes means that the factory floor is not merely a place where machines perform repetitive tasks; it becomes a living network where information flows, checks are executed, and corrective actions are triggered automatically when deviations appear. In this sense, the line becomes smarter not because it speaks to a single subsystem, but because it harmonizes every subsystem around a shared objective: consistent quality, traceable outcomes, and safer work conditions for employees.

The footprint of intelligent automation extends beyond speed and accuracy. It touches strategic concerns that have become central to modern automotive manufacturing—flexibility, resilience, and sustainability. Flexible lines can reconfigure to accommodate new models or revised specifications with less downtime, preserving capital investment in equipment and reducing time-to-market. Resilience emerges as a natural outcome of modular design and robust sourcing; when one module requires maintenance or upgrade, the overall line does not grind to a halt. And sustainability takes hold through intelligent energy management, waste reduction, and process optimization that minimizes unnecessary movements and machine idle time. The net effect is a factory that behaves less like a collection of machines and more like an adaptive organism that can sense, respond, and improve continuously.

One of the central ideas behind A&B’s practice is the belief that collaboration creates better automation outcomes. The equation Your ideas A+B Our expertise = Your intelligent automation equipment signals a shift from vendor-driven delivery to co-creation with the customer. This mindset invites engineers, operators, and managers to contribute domain knowledge, while the equipment designer translates that knowledge into practical, reliable, and scalable hardware and software solutions. It is a form of partnership that recognizes the uniqueness of every production challenge and treats customization as a feature rather than a complication. In a sector where a small improvement in cycle time or defect rate can yield outsized gains, this collaborative approach becomes a competitive differentiator. The company’s long history in areas such as electric tools, motors, and engines—along with experience in agricultural machinery and broader industrial applications—creates a reservoir of cross-domain insights that inform every new project. Such breadth allows the team to anticipate how a change in one subsystem might ripple through the entire production sequence, enabling more precise design choices and fewer retrofit surprises later.

The practical upshot of this intelligent integration is visible in the way lines operate and improve over time. Conveyors keep pace with assembly operations, reducing travel distance and handling time. Automated inspection and testing stations validate tolerances and performance early in the process, catching issues before they cascade into expensive rework. Gripping and handling devices maintain consistent grip force and motion profiles, minimizing product damage and operator fatigue. In some applications, even the presses and specialized machinery are configured to accommodate variable part sizes and geometries, maintaining throughput without compromising safety margins. The combination of real-time monitoring, synchronized motion, and standardized control logic gives managers a powerful toolkit for optimization: dashboards that reveal line health at a glance, alarm systems that prioritize issues by impact, and data that supports continuous improvement cycles.

A&B’s projects also reflect a broader Canadian and domestic market reality: the ascent of new power and traditional manufacturers toward智能制造, or intelligent manufacturing. The shift toward smarter factories aligns with national ambitions to strengthen domestic automotive production, improve safety outcomes for workers, and lower operational costs through better process control. The company’s capability to tailor solutions for both traditional components suppliers and newer players in the automotive ecosystem positions it as a bridge between established practices and emerging business models. As vehicles become more complex and software-driven, the demand for adaptable automation grows, and the ability to integrate across disciplines—from mechanical design to electrical engineering and software development—becomes essential. In this light, A&B’s approach makes sense not as a single project, but as a strategic framework for sustaining productivity in an evolving industry landscape.

The human element remains central to the success of intelligent automation. While machines and sensors generate streams of data and responses, skilled technicians still guide implementation, interpret diagnostic signals, and ensure that the system evolves with changing production goals. Training, knowledge transfer, and disciplined maintenance planning are not add-ons; they are integral to realizing the full potential of automated equipment. Safety considerations, too, are embedded not as afterthoughts but as guiding principles in both design and operation. When operators can interact with a predictable, transparent system, risk is reduced and confidence grows. In the end, the factory floor becomes a collaborative space where people and machines complement each other, delivering higher quality parts with greater consistency and a lighter environmental footprint.

For readers seeking a practical gateway to related contexts in automotive parts and manufacturing, a companion resource can be found at mitsubishiautopartsshop.com. The site offers tangible case studies and product histories that illuminate how automotive components are discussed and positioned in real-world discourse, reinforcing how integrated automation supports the broader lifecycle of parts production. This connection between the shop-floor realities and the part-level narratives helps underscore the continuum from intelligent machinery on the line to the finished components that travel through supply chains and into vehicles.

Looking ahead, the enduring value of intelligent automation in automotive production rests on embracing customization as a continuous capability. A&B’s philosophy—Your ideas A+B Our expertise = Your intelligent automation equipment—invites ongoing collaboration, not a one-off installation. The outcome is a factory that learns, adapts, and scales, ready to respond to shifts in demand, regulatory requirements, and the ascent of electrified propulsion. It is not a dream of the future but a present practice that redefines what a line can achieve: more parts produced per shift, fewer defects per part, and safer working conditions that empower teams to innovate rather than endure repetitive strain. As the industry consolidates around these principles, the integration of intelligent machinery in automotive production will continue to mature, turning each plant into a model of efficiency, resilience, and sustainable growth. External resource: https://www.ajiab1788.com

A&B Auto Parts and the Automation Engine Redefining Vehicle Production

A&B Auto Parts and the Automation Engine Redefining Vehicle Production

Automotive manufacturing has evolved from segmented craft into a highly integrated, data-driven industry. For suppliers and makers of parts, the shift matters deeply. Whether a business identifies as A&B Auto Parts or another supplier, the practical requirements are the same: parts must meet tighter tolerances, be produced faster, and integrate into flexible lines that respond to changing vehicle architectures. The most advanced automation players now provide solutions that span the entire production lifecycle. That breadth matters because automotive processes are interdependent. A change in stamping affects body alignment and assembly. Paint choices alter downstream quality checks. Component suppliers who understand this interconnected reality gain a decisive advantage.

Automation is no longer limited to isolated tasks. Modern systems connect stamping presses, welding cells, paint booths, and final assembly into a continuous, synchronized workflow. Robots handle high-speed forming and bending with precision that hand operations cannot match. This precision improves first-pass yield for stamped parts. Reduced rework in stamping yields fewer bottlenecks at the body shop. When parts arrive within tighter tolerances, body-in-white operations become more predictable. Welding robots maintain consistent seam quality and repeatability, lowering inspection costs and warranty risks.

Painting, often a costly and wasteful process, illustrates the compound benefits of integrated automation. Advanced applicators and motion control reduce overspray and ensure uniform coating thickness. The result: less material waste and more consistent appearance across vehicles. This consistency translates to downstream savings in rework and touch-up labor. For parts suppliers, it means finished components that better meet finish and acceptance criteria on first pass.

Beyond individual cells, the prevailing trend is to create flexible production lines that adapt to multiple vehicle variants. Electric vehicle architecture, for example, changes where and how components are mounted. Parts manufacturers must supply components that work across platforms. To meet that need, automation lines are designed for rapid changeovers. End-of-line tooling, quick-change fixtures, and modular robot cells allow a plant to switch from one vehicle family to another with minimal downtime. For A&B Auto Parts, adopting or partnering with integrators who deliver such modularity reduces risk. It enables smaller batch sizes and supports just-in-time supply models. In markets where demand shifts quickly, that flexibility becomes a competitive necessity.

Connectivity is the design principle that makes these systems intelligent. Sensors, vision systems, and advanced controllers provide real-time feedback. When a sensor detects variation in a stamping die, the control system can adjust robot paths or press forces downstream. This closed-loop control reduces scrap and preserves throughput. Data collected at each stage also feeds predictive maintenance models. When vibration or heat trends deviate from normal, maintenance can be scheduled before a failure occurs. For parts suppliers, this reduces unexpected production stoppages and ensures deliveries meet schedule commitments.

Sustainability objectives dovetail with efficiency goals. Reducing material waste, minimizing energy use, and optimizing paint consumption all decrease a plant’s environmental footprint. Automated processes consume energy more predictably, which enables targeted energy management strategies. Replacing manual, variable tasks with machine-driven ones often leads to lower emissions per part. For companies like A&B Auto Parts, communicating a lower micro-level carbon intensity can be a market differentiator when automakers prioritize greener suppliers.

Human-robot collaboration has also matured. Collaborative robots now handle assembly tasks previously too delicate or ergonomically challenging for humans. They take over repetitive, strenuous actions and free operators to focus on inspection, programming, and process optimization. This shift elevates the workforce profile and reduces turnover related to monotonous labor. Training evolves, too, emphasizing monitoring, data interpretation, and systems integration skills. Suppliers who invest in workforce development alongside automation investments see better long-term returns.

Localization and rapid support matter in large markets. When automation providers localize engineering, manufacturing, and service, they reduce lead times and improve responsiveness. For suppliers, local partnerships mean faster commissioning and quicker updates to line logic. In regions with concentrated automotive ecosystems, close proximity to integrators and service centers can be decisive during scale-ups.

The move to electric vehicles amplifies several trends. EV platforms reduce mechanical complexity in some areas but introduce new needs in others, notably battery enclosure manufacturing and thermal management components. Automated lines must accommodate different joining techniques, such as adhesive bonding or structural adhesives, and more precise assembly for battery modules. Parts suppliers must be ready to produce components with tight electrical and thermal specifications. Automation systems designed with this in mind expedite validation and speed time to market for new EV designs.

For suppliers of specialty components, automation brings opportunities and responsibilities. Consider exterior lightweight panels made from composites. Producing these parts consistently at scale requires precise layup, curing, and trimming operations. Automation reduces cycle variance and improves dimensional stability. It also lowers the labor intensity of complex processes, making production more predictable. A practical example is the demand for aftermarket and performance parts, such as carbon fiber hoods. These parts benefit from repeatable, high-precision processes that preserve structural and aesthetic quality. Companies that align production methods with automated best practices can deliver premium parts at competitive costs. See an example of a carbon fiber bonnet product that illustrates this demand and how parts tie into broader manufacturing workflows: carbon fiber bonnet for Lancer Evo X.

Integration of enterprise systems with shop-floor automation is the final piece. ERP and MES systems coordinate material flow, production sequencing, and quality records. When these systems link to robot controllers and inspection stations, operations run with less intervention. Traceability improves because each part carries a digital record of its journey. For suppliers, this traceability simplifies audits and proves compliance with stringent standards.

The industry is moving toward a model where supplier innovations and integrator capabilities create system-level value. Automation providers that offer full-process coverage help suppliers plug into ready-made ecosystems. For A&B Auto Parts and peers, standing at the intersection of parts design and automated production opens new possibilities. It permits more complex geometries, tighter tolerances, and faster scaling while preserving margins.

Adopting automation is not merely a technological decision. It is strategic. Companies must evaluate the interplay of capital investment, workforce transformation, supply chain readiness, and long-term market positioning. The winners will be those who see automation as a continuous capability rather than a one-time upgrade. By building flexible, connected, and sustainable production systems, parts suppliers can meet the demands of modern vehicle programs and position themselves as indispensable partners to vehicle manufacturers.

For further context on how integrated automation supports the automotive sector at scale, consult this industry resource: https://new.abb.com/industries/automotive

In the Fast Lane: The Economic Ripple Effect of A&B Auto Parts Manufacturing on Global Supplier Networks

The production ecosystem that underpins modern automotive manufacturing is a living web of commitments, capabilities, and timing that travels across borders with astonishing speed. At the center of this web sits A&B Intelligent Equipment Manufacturing (Zhejiang) Co., Ltd., a company that operates not merely as a machinery supplier but as a facilitator of a broader supplier network. Its influence extends beyond one plant, shaping demand, elevating standards, and accelerating the diffusion of advanced manufacturing practices across regional clusters. When a plant commits to an automated line, it signals to tooling, control systems, testing rigs, and service providers to align with a shared schedule and quality bar. A&B’s work thus plays a strategic role in sourcing, logistics visibility, and supplier development, helping synchronize the supply base with just-in-time production demands and reducing volatility in cash flows for networks exposed to global trade and regulatory shifts. The result is a more resilient ecosystem in which suppliers invest in process improvements, digital tracking, and capability upgrades that pay dividends across the chain.

Smart Fabrication: How A&B’s Equipment Redefines Precision, Flexibility, and Sustainability in Auto Parts Production

Smart Fabrication: how A&B’s equipment redefines production

The manufacture of auto parts is shifting from rigid, high-volume lines to intelligent, adaptable systems. For companies that design and build production equipment for the automotive sector, this change demands a new set of capabilities. A&B’s core offerings—assembly lines, conveyors, and test stations—are no longer judged only by throughput. They are now measured by how well they enable precision, customization, and efficient resource use across diverse vehicle platforms.

A&B’s equipment philosophy centers on three interdependent pillars: digital control, collaborative automation, and materials innovation. Digital control brings together sensors, edge computing, and cloud analytics. Sensors capture vibration, temperature, and force at the part level. Edge processors filter and preprocess those signals. Cloud platforms aggregate data across shifts and sites. Together they create a feedback loop that tightens tolerances while reducing scrap. When a stamping press or welding cell drifts, the system flags trends, isolates root causes, and can even apply corrective recipes automatically. That reduces unplanned stops and preserves part quality.

Collaborative automation has reshaped factory ergonomics. Modern lines blend industrial robots with collaborative arms and guided tools. Collaborative devices handle precision tasks that once required specialized jigs. Human operators now focus on oversight, exception handling, and processes that require dexterity or judgment. This pairing extends the reach of experienced technicians and reduces repetitive strain injuries. Safety is preserved through force-limiting actuation, vision-based intrusion detection, and defined interaction zones. The result is a production floor where humans and machines amplify each other’s strengths.

Materials innovation unlocks lighter, stronger, and more complex components. Additive manufacturing allows internal lattices and topology-optimized shapes that were impossible with conventional tooling. For some components, additive methods shorten lead times by collapsing mold and machine programming cycles into direct fabrication steps. For composite parts, automated layup and cure stations ensure consistent fiber orientation and resin distribution. These advances improve part performance while reducing weight—an outcome that benefits fuel efficiency and emissions across vehicle types. A practical instance of this movement is the trend toward lightweight exterior components, such as carbon fiber bonnets, that require specialized handling and finishing processes during assembly. See an example of a carbon fiber bonnet designed for a performance model here: brand-new-original-carbon-fiber-bonnet-hood-for-mitsubishi-lancer-evo-x.

Digital twins and AI tie these pillars together. A digital twin mirrors a cell or an entire line in software. It models kinematics, thermal behavior, and process variability. Engineers can run virtual trials to validate changes before touching hardware. AI models trained on historical process and quality data then predict deviations and propose corrective actions. Predictive maintenance algorithms schedule repairs based on wear indicators, not fixed intervals. That reduces parts consumption and prevents costly breakdowns. When a spindle shows early signs of imbalance, the system schedules a brief, targeted intervention instead of a full-line shutdown.

Integration is an engineering challenge and a strategic necessity. A&B’s systems are designed to be modular. Modules can be recombined to support different part families without full retooling. Standardized communication protocols and open interfaces allow third-party tools to plug in. This modularity supports flexible, small-batch production—a growing requirement as automakers offer more variants and custom options. The ability to reconfigure a workstation in hours rather than weeks reduces downtime and responds to market shifts faster.

Energy and material efficiency are primary design targets. Drives and actuation systems employ regenerative techniques that recover energy during deceleration. Thermal management schemes reuse residual heat where feasible. More importantly, process controls aim to reduce off-cuts and rejects through tighter control and smarter nesting. Additive processes contribute by using only the material required for the part geometry. When paired with lifecycle analytics, these gains become measurable reductions in carbon footprint and operating cost.

Testing and validation have evolved along with manufacturing. Inline non-destructive inspection uses machine vision, ultrasonic probes, and laser scanning to verify dimensions and surface integrity. These systems operate in milliseconds and provide traceable records for each part. End-of-line testing shifts from batch sampling to per-unit verification, enabled by faster sensors and smarter controllers. For safety-critical parts, the trace from raw material to finished component is preserved digitally, so a single failed assembly can be traced to its source and remediated quickly.

Human factors remain central. Training ecosystems that combine simulation, augmented reality, and structured hands-on modules accelerate the adoption of new equipment. Augmented reality can overlay assembly instructions or maintenance steps directly on a worker’s field of view, reducing errors during transitions. Simulators allow operators to rehearse changeovers and maintenance procedures virtually. These tools shorten ramp-up times when new models or processes are introduced.

Strategic adoption of technologies requires discernment. Not every innovation produces value for every operation. Leaders in equipment design help customers evaluate where robotics or additive methods create measurable gains. They prioritize that which improves quality, resilience, or cost position. A considered roadmap balances quick wins—improvements that reduce downtime or waste immediately—with longer-term investments that position a factory for more complex, electrified, or composite-heavy platforms.

Regulatory and supply-chain realities influence equipment choices. Traceability requirements, emissions standards, and material restrictions shape the configuration of production cells. Equipment must be adaptable to new inspection criteria or material substitutions. Connectivity also plays a role: secure, standardized networks allow suppliers, system integrators, and manufacturers to collaborate without exposing critical assets. This blend of openness and control supports a resilient supply network while protecting intellectual property.

The outcome for companies that integrate these capabilities is a production base that is faster, more precise, and more sustainable. Equipment designed with modularity, digital feedback, and human-centered interfaces expands what auto parts manufacturers can deliver. It enables short runs, complex geometries, and individualized solutions without the cost of traditional bespoke tooling. For A&B and similar equipment builders, the imperative is clear: design systems that turn technological potential into predictable, repeatable value for customers.

For a practical view of how industrial automation and robotics reshape automotive manufacturing, see this overview by a leading industrial automation provider: https://new.abb.com/products/robotics/industrial-robots/automotive-manufacturing

Final thoughts

A&B Auto Parts stands as a beacon for innovation in the automotive manufacturing landscape. Through the meticulous integration of non-standard automation equipment, the company not only enhances production efficiency but also sets important trends that other industry players must follow. Business owners who are keen to stay ahead must consider the implications of these advancements, as A&B Auto Parts illustrates the significant potential of blending intelligent machinery with manufacturing. As we continue to embrace technology, the economic and operational benefits of adopting such innovations will be increasingly vital in the pursuit of competitiveness and sustainability in the automotive sector.