Discover the integral role of A&D Auto Electric Parts in the automotive industry. This Florida-based supplier specializes in a vast array of electrical components crucial for automotive repairs. Each chapter of this article delves into different aspects of the company—from its operational framework to product offerings, customer service, market positioning, and future prospects—providing valuable insights for business owners who depend on reliable suppliers for success in automotive services.

A&D Auto Electric Parts: Local Power, Local Trust

A&D Auto Electric Parts sits in Homestead as a compact hub for automotive electrical components, serving DIY enthusiasts and professional mechanics alike. This shop emphasizes accurate part matching, clear guidance on fitment, and quick access to commonly used items, with a friendly staff that verifies numbers and explains how a component fits into a vehicle’s charging, ignition, and sensing systems. The address and phone number (786) 504-2648 connect customers directly with knowledgeable staff who help avoid costly misfits and returns. Open Monday through Saturday from 8:00 AM to 6:00 PM and closed on Sundays, the store aligns with the practical rhythms of local life, delivering reliability when a car needs a component the same day. In a region with hot weather and heavy driving, A&D prides itself on durable parts, patient explanations, and a community-focused approach that treats every repair as a collaborative effort between customer and parts expert.

Wired in Homestead: Charting A&D Auto Electric Parts and the Local Electric-Parts Ecosystem

In Homestead, Florida, the hum of daily life sits beneath palms and bright sun, and a small storefront at 5 NE 3rd Rd acts as a steady current in the local automotive grid. A&D Auto Electric Parts operates from this address, opening its doors the same way a relay clicks to life when a circuit completes: quietly, reliably, and with a clear expectation that a driver will need something specific to keep a car alive on the road. The business hours—Monday through Saturday, from early morning until early evening, with Sundays off—frame a rhythm that fits the demands of a community that relies on practical, immediate solutions. A customer arrives seeking a battery, a relay, or a headlight; another calls ahead to confirm stock or compatibility; a repair shop nearby might swing by to fetch a batch of fuses or a diagnostic adapter. This is a scene that many independent auto electrical parts suppliers in coastal and humid climates would recognize: a dependable hub where people come not only to buy parts but to enlist guidance, confirm fit, and secure what can otherwise become a time-consuming scavenger hunt across the region. The Yelp entry updated in February 2026 solidifies this impression, signaling ongoing engagement with customers and a willingness to adapt to the changing landscape of automotive parts and services. The note to contact the store directly or visit an online platform to obtain the latest updates underlines a core truth about independent shops in an era of rapid inventory shifts: access to current stock, pricing, and availability often hinges on direct communication rather than a static storefront listing alone. This is the core value proposition of A&D’s local presence, a combination of physical accessibility and personal service that larger, more impersonal chains sometimes struggle to deliver with the same degree of nuance and speed.

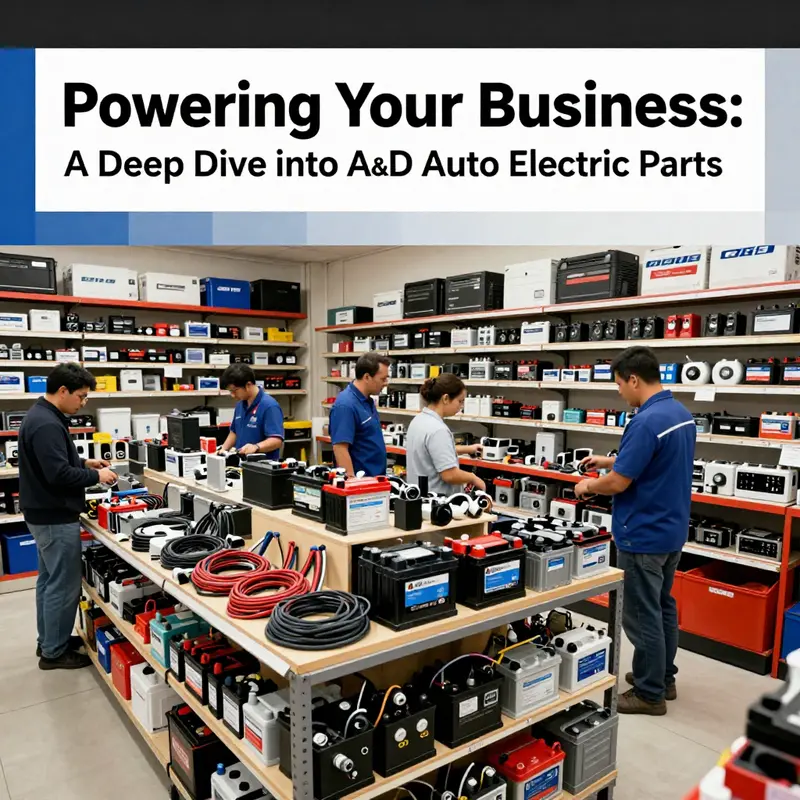

If one steps back from the storefront’s specifics, the wider environment of automotive electrical parts in the United States reveals a landscape where equipment must withstand a harsh, humid climate and the steady demand of everyday drivers. The components that powers a vehicle’s brain and heartbeat—charging, starting, sensing, lighting, signaling—form a broad ecosystem. A&D’s local footprint situates it at the intersection of repair work, maintenance, and DIY enthusiasm. Even in the absence of a published catalog in the available materials, this setup suggests a common but essential range of offerings. Batteries that endure heat and vibration, starters and alternators built to stand up to Florida’s long summer days, wiring harnesses that route power safely through cramped engines, relays, fuses, and a spectrum of sensors that translate mechanical actions into electrical signals. Lighting components, switches, connectors, and the occasional repair kit to salvage a wiring harness mid-repair all belong to the same family of parts that keeps a vehicle from sitting idle. The categories are familiar to anyone who has navigated a modern auto parts counter: the parts necessary to restart a car, keep it running, and illuminate its world under a streetlamp or a garage lamp.

What a local supplier can offer beyond the obvious catalog of parts is equally important. A&D’s role in the community likely extends to expert guidance on fitment and compatibility, a critical service when a vehicle’s electrical system must be matched not only to the model year but to the specific trim, engine, and even regional variations. This is not merely about finding a number that matches a schematic; it is about understanding how a part behaves in the real world—the way a harness can thread through a tight firewall, how a connector is designed to resist corrosion in humid air, or how a headlamp assembly must align to prevent glare and ensure visibility. While the precise catalog remains undocumented in the current materials, the functional expectations of a shop in this niche are clear: customers turn to the counter for parts that fit, work, and endure in the local climate, and they seek reassurance that what they buy will perform when the ignition key turns and the dashboard lights up.

In this sense, a local auto electric parts shop acts as both supplier and advisor, a bridge between the broad, standardized world of aftermarket parts and the particular realities of day-to-day vehicle repair. The broader industry landscape features national retailers with expansive inventories, which can offer scale and standardized warranties, alongside independent stores that cultivate hands-on know-how and a flexible stock approach based on local demand. The presence of a major national player in the United States, as referenced in related research, underscores the dual nature of the market: scale and accessibility on one side, speed and local expertise on the other. A&D’s local focus, then, sits within a larger ecosystem where nearby repair shops, roadside needs, and personal projects converge. The question of product range, while not precisely documented for A&D, can be inferred from the shop’s function: a broad but curated selection of electrical components and related accessories designed to support quick repairs, ongoing maintenance, and the comfort of a customer who prefers to handle a problem without visiting multiple suppliers.

From a customer experience standpoint, the accessibility of a shop like A&D is valued by both professional technicians and car enthusiasts who work on their own vehicles. The practical advantages are evident: the ability to speak directly with a knowledgeable counterperson who can interpret a wiring diagram, explain the implications of a poor ground, or suggest a compatible replacement for a fatigued sensor. In communities where vehicles age and streets bear the heat and humidity of the region, the reliability of such a local source becomes a kind of community resilience. The street-level interaction—checking stock at the counter, asking about return policies, or verifying whether a part is interchangeable with a similar model—represents a holistic service that many drivers prize. This kind of hands-on assistance can reduce the downtime of a vehicle and shorten the repair cycle, particularly when the vehicle in question has niche electrical components or when a part’s compatibility depends on subtle variances between production runs.

An additional layer of context comes from considering the online dimension of auto parts commerce. The materials indicate a push toward online availability and updates, a trend that reshapes how local inventories are perceived and accessed. A consumer can call the shop for confirmation, check a digital listing, or even place a hold for pickup. In the modern auto parts economy, this blend of in-person service and digital connectivity is more the rule than the exception, especially in regions where weather and driving conditions make timely maintenance essential. The ecosystem thrives when customers can quickly cross-reference a part’s compatibility with their vehicle and then receive guidance on installation or safety considerations. In this sense, A&D’s operational model likely leverages both its physical storefront and its digital channels to support a steady flow of parts and information.

To illustrate how these components fit into the broader picture of electrical parts, consider the more specialized, model-specific categories that help customers visualize the scope of what a shop might carry. Even without a published catalog for A&D, the existence of model-focused parts across the aftermarket demonstrates the demand for precise, compatible components. Take, for example, headlights and lighting assemblies—items that are as much about electrical functionality as they are about visibility and safety. The Mitsubishi Evo X, a popular model among enthusiasts, features components that highlight the importance of precise fitment and electrical integrity. A reference point for understanding how a shop might approach such a category can be seen in model-specific headlamp offerings, such as those available for the Evo X. This example, while not a direct representation of A&D’s stock, helps explain why a local supplier would emphasize compatibility, mounting hardware, and lighting performance in its everyday practice. For readers curious about this particular lighting category, a specific example can be explored here: headlights for Mitsubishi Lancer Evo X.

Ultimately, the value of a shop like A&D Auto Electric Parts lies in its ability to translate a vast universe of electrical components into a tangible, reliable inventory for a local customer base. The absence of a publicly documented catalog should not obscure the practical importance of such a business: it provides the timely parts a vehicle needs to stay on the road, assembles the right components for a given model, and offers the expertise that helps a repair job move from assumption to confirmation. In a climate that challenges electrical systems and in a market that rewards both speed and trust, the local auto electric parts shop stands as a vital node in the supply chain. It is a place where a driver, a DIY mechanic, and a professional technician can converge, guided by knowledge and a commitment to keeping wheels turning, one part at a time. The chapter ahead will continue to explore how such local suppliers interact with larger networks, influencing the quality of repairs, the pace of maintenance, and the everyday experiences of drivers who rely on electrical systems to power their journeys.

Wired for Help: The Subtle Craft of Customer Service at A&D Auto Electric Parts

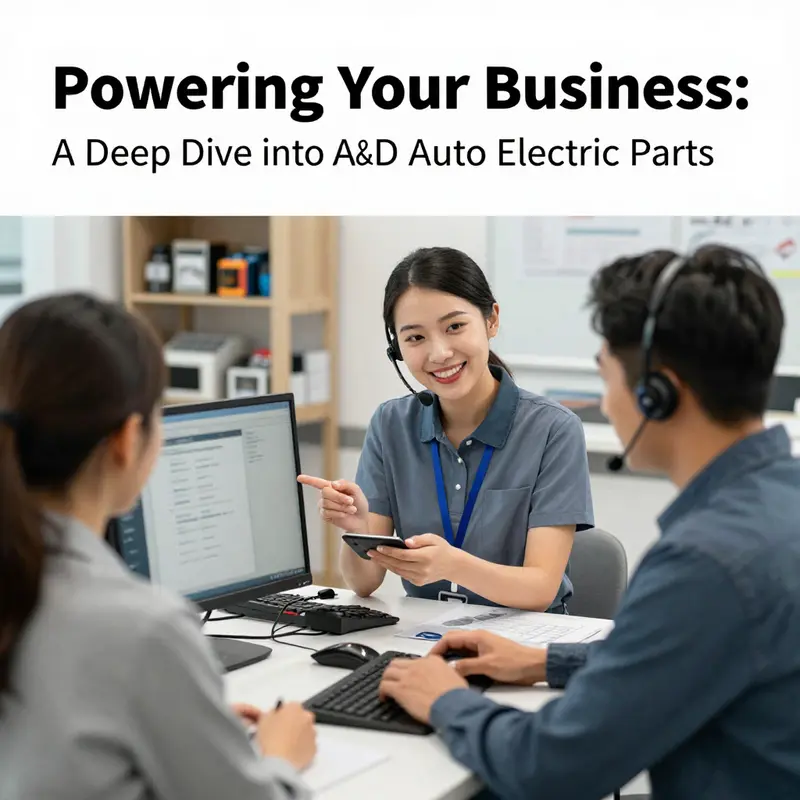

In the world of automotive electrical parts, the value of true, working customer service often outpaces the inventory itself. The most durable impression a shop makes comes not from the breadth of parts on the shelf, but from the clarity of guidance, the speed of response, and the reliability of the people behind the counter. For a local shop serving a community like Homestead, Florida, where vehicles are essential to daily life and work, customer service is more than a courtesy; it is a practical, ongoing service that keeps engines running, projects moving, and small businesses and DIY enthusiasts confident that a part will fit, function, and last. The scenario sketches a familiar picture: a shop with a visible location at 5 NE 3rd Rd, a steady weekday rhythm that invites customers from early morning into the early evening, and a willingness to answer questions that straddle both hardware and software of modern vehicles. The hours—Monday through Saturday from 8:00 AM to 6:00 PM, with Sundays closed—signal a readiness to assist serious shoppers who maximize their weekend time, whether they are professional installers or hobbyists tackling a weekend repair. A contact number, (786) 504-2648, sits at the ready, a lifeline for those who need immediate information about stock, compatibility, or backorder expectations. And while public-facing details anchor this narrative, the larger arc is a deeper, often unspoken ethos: in auto electrical parts, customer service is about making the complicated feel simple and the unsure feel supported.

What elevates service in this field is the ability to translate vehicle details into precise part decisions, and to do so with a cadence that respects the customer’s time and the vehicle’s safety. In a typical shop embedded in a tight-knit community, the conversation begins with listening. A customer may arrive with a vehicle in the shop’s lane and a question about a mysterious electrical hiccup or a stubborn unavailability reported by a vehicle’s on-board diagnostic system. The first impression—whether interaction happens in person or via phone—sets the tone. Knowledgeable staff will ask targeted questions: What is the vehicle make, model, and year? Are there any part numbers or engine codes the customer has access to? Can the customer share symptoms, recent repairs, or a diagnostic readout? Each answer narrows the field from an overwhelming universe of electrical components to a curated shortlist of possibilities. In this context, the staff’s role is almost like that of a translator, bridging the language of symptoms and the language of catalogs and catalogs are not only physical shelves but digital databases, vendor catalogs, and cross-reference tools. The ability to confirm compatibility between a part and a specific vehicle variant becomes a central pillar of trust.

A practical dimension of service emerges in the order-fulfillment process. When a customer asks for a part, the staff’s response hinges on stock visibility and procurement acumen. In a shop that combines traditional storefronts with online updates, there is a dual obligation: deliver quickly from on-site stock when possible, and manage expectations when the exact item is not immediately available. The promise of same-day pickup or rapid shipping can be a differentiator, particularly for urgent repairs. Yet speed cannot outpace accuracy. Here, the discipline of careful verification matters. The staff cross-checks the vehicle details against part numbers, aligns with catalog descriptors, and confirms any versioning signals that may indicate a difference in fitment or function. This is where a nuanced understanding of part evolution becomes essential. In some spheres, part naming carries subtle suffixes or versioning to distinguish variations that fit different engine families or manufacturing runs. A customer may encounter such codes in a catalog, and the staff must interpret them with confidence, guiding the customer toward the correct selection and avoiding the costly misstep of an ill-fitting component.

This attention to accuracy dovetails with the social contract of local service. If a customer leaves with the wrong part, the path back to satisfaction can involve a straightforward exchange or an efficient backorder process, but it also requires transparency about timelines, restocking expectations, and any return policies. The best shops lay out these policies in plain language at the outset, reducing friction should a mismatch occur. Clarity about returns, restocking fees, or exchange windows is not merely a policy; it is a signal that the business respects the customer’s time, money, and trust. In practice, it means staff members who can calmly explain the steps: verify the order, check the stock, propose a compatible alternative if applicable, and coordinate a return or exchange without making the customer feel rushed or overlooked.

A critical but often underappreciated facet of customer support in auto electrical parts is technical guidance. Electrical systems are a network of modules, sensors, harnesses, and connectors. The shop’s value proposition hinges on more than listing compatible numbers; it rests on the ability to discuss, at a practical level, how a part functions within a vehicle’s electrical ecosystem. This does not require the consumer to be an expert, but it does demand a certain level of competence. The staff can help customers understand whether a replacement is a direct OEM-type substitute or if an aftermarket alternative is viable, what implications that choice may have for warranty or performance, and how to identify signs of a failing component beyond the obvious symptom. In this way, customer service becomes a collaborative process, not a one-off sale. The team may also guide DIYers through basic diagnostic steps that do not replace professional service but can prevent unnecessary trip-back costs. For professionals, the guidance extends to technical compatibility, cross-reference options, and the coordination of parts with other ongoing repairs, illustrating the shop’s role as a partner rather than merely a supplier.

The data available about A&D Auto Electric Parts emphasizes a physical footprint and a conventional business cadence—the Homestead location, the visible hours, and the invitation to inquire and purchase in person or through an online channel. Yet the integrity of customer service is often shaped by the quality of the staff’s questions, the speed of responses, and the willingness to go beyond the obvious. In practice, this means listening for the unspoken constraints behind a purchase request. A customer may be balancing cost against the risk of downtime, seeking a reliable part well before a project deadline, or needing an item that can be back-ordered with confirmed arrival windows. The store’s approach to such scenarios—offering alternatives, setting realistic timelines, communicating when an item is out of stock, and following up with updates—turns a transactional moment into a predictable experience. The positive effect of this can be substantial. A customer who leaves with confidence in the support they received is far more likely to return for future needs and to recommend the shop to peers who also rely on electrical components for vehicles.

In addition to in-person and phone-based support, the existence of an online platform for updates represents a meaningful channel for ongoing customer engagement. A shop that recognizes the value of digital touchpoints typically offers stock checks, order status notifications, and perhaps access to manuals or catalogs that assist customers in validating fitment before making a purchase. The promise of consistent, accurate information across channels is essential for building trust with both professional installers and individual customers who may be coordinating complex repair projects. It also lowers the barrier to entry for those newer to car maintenance, who otherwise might feel overwhelmed by the breadth of parts and the jargon that accompanies electrical components. When a customer can begin a dialogue online and then bring that dialogue into the store with a clear reference, the entire experience accelerates. The continuity from online inquiry to in-store pickup reinforces the message that the business respects the customer’s time and respects the customer’s prior research.

An often-overlook aspect of quality service concerns the subtle education that staff can offer about part terminology and compatibility. Even a shopper who is not ready to purchase benefits from a conversation that demystifies the process. For instance, a staffer might explain how part numbers can indicate different generations or versions of a component and why a particular suffix might matter for a specific engine family. While not delving into product marketing or naming, such explanations reduce the risk of errors and empower customers to request the precise item from future purchases or replacements. This kind of educational support—delivered with patience, clarity, and accessibility—has a compounding effect. It converts one successful interaction into multiple future interactions, each built on the foundation of trust and competence.

Together, these threads—accessibility, accuracy, guidance, and continuous engagement—form a cohesive picture of customer service that can distinguish a local auto electrical parts shop in a crowded market. They reflect a dedication to the customer’s success, whether the user is a professional technician for whom speed and precision translate directly into profitability, or a weekend enthusiast who values guidance that makes a complex task feel manageable. The Homestead shop’s physical presence, the clear operating hours, and the invitation to connect via a phone line or online portal all contribute to a service ethos that prioritizes dependable, respectful, and informed assistance. In this context, the customer is not simply purchasing a component; they are entering a relationship with a shop that accepts responsibility for helping them complete a repair, a project, or a maintenance milestone with confidence.

For readers exploring the broader landscape of A&D Auto Electric Parts or similar suppliers, consider how the principles described here translate into everyday practice. The forms of service described—prompt replies to inquiries, precise and thoughtful guidance on compatibility, transparent stock information, and a steady commitment to after-sales support—are foundational elements of modern automotive parts retail. They also connect to the wider ecosystem of community-based automotive repair. When technicians and hobbyists alike encounter a shop that treats their time and safety with respect, the relationship becomes symbiotic: the customer gains reliability, and the shop gains loyalty, referrals, and a sustainable business model that can weather fluctuations in supply chains and demand.

To see how a broader spectrum of parts communities discusses these themes, readers can explore related parts conversations that surface around wheels and other components, which often surface in vendor catalogs and community forums. For example, this reference demonstrates the kind of range enthusiasts seek when they look for compatible, performance-oriented parts in a marketplace. brand-new-original-bbs-rims-set-of-4-r18-rims-for-lancer-sedans.

In sum, the chapter’s throughline rests on a simple premise: great customer service in auto electrical parts is a disciplined blend of listening, precise guidance, transparent processes, and ongoing engagement. It recognizes that every part is part of a larger system and that each customer carries a unique combination of timing, budget, and risk tolerance. When a shop can meet those varied needs with clarity and care, it earns a place not just on a map of local businesses, but in the daily routines of drivers who rely on dependable electrical systems to keep moving forward. The next chapter will turn toward the operational side of the business—the sourcing, inventory management, and supplier relationships that enable the service described here—exploring how a shop maintains stock, negotiates with distributors, and uses technology to sustain the human-centered experience that customers value so highly.

In the Local Circuit: How A&D Auto Electric Parts Carves Its Niche in Homestead’s Automotive Electrical Market

The market for automotive electrical components in a tight-knit community like Homestead unfolds with a cadence that suits both the everyday driver and the weekend mechanic. A&D Auto Electric Parts sits at the center of that rhythm, a small but steady presence that locals rely on for everything from essential batteries to the more finicky sensors that keep modern vehicles running smoothly. The shop’s footprint is modest, but its location at 5 NE 3rd Rd places it within easy reach of customers who value face-to-face interaction as part of a broader service experience. With hours that stretch from Monday through Saturday, everyone from shift workers catching a late afternoon stop to hobbyists who tinker on weekends finds a window to connect with a knowledgeable staff. The absence of Sunday hours in a market that often produces last-minute needs underscores a clear, practical approach: this is a shop built around dependable access rather than flash and rapid-fire online sales alone. The Yelp page—updated in February 2026—frames A&D Auto Electric Parts as a retail specialist in automotive electrical components, a designation that foregrounds a focused competency rather than a sprawling, generalized inventory. In a sector where a single bad alternator can strand a family, the local shop’s emphasis on reliability, accessibility, and direct customer care becomes a meaningful differentiator.

The market position that emerges from this setup is one of steady presence rather than market dominance. A&D Auto Electric Parts operates with a B2C model that speaks directly to car owners who need to replace or upgrade electrical components without layers of bureaucratic friction. The inventory is guided by what local drivers actually require: batteries for Florida’s heat and humidity, starters and alternators that endure steady use, sensors that can be finicky and expensive to replace, and the basic electrical fittings that keep a vehicle’s systems communicating. This is not a high-volume, discount-led play; it is a tuned, practical service model that prioritizes quick access to parts, sound advice, and a willingness to stock items that keep residents on the road rather than waiting for an online parcel that may arrive days later. In this light, the shop’s market position rests on two interlocking pillars: dependable local presence and the trust that grows from consistent, in-person engagement with technicians who understand both the components and the ways they fail in a Floridian climate.

Yet the Homestead market is not isolated from larger competitors. Across the street from a neighborhood block, one can imagine the shadow of national chains—well-known names that sweep broad inventory with standardized pricing and expansive online catalogs. These larger players can leverage scale to offer broad assortments and sometimes lower sticker prices on common items. Online retailers extend that reach even further, presenting a temptation to skip the storefront and order with a few clicks for delivery to your door. In this competitive environment, A&D Auto Electric Parts does not pretend to outpace the giants on every axis. Instead, it leans into attributes where local shops often outperform even the best online storefronts: speed of retrieval, tangible expertise, and a relationship-based approach that makes the customer feel known rather than anonymous. A local retailer can call a customer by name, recall previous issues, and propose practical, context-specific solutions that resonate with the way people live and drive in Homestead.

The narrative of competition, then, centers on how convenience, service quality, and community ties translate into ongoing patronage. A&D Auto Electric Parts has cultivated visibility in the local market, a critical factor in a business where proximity matters as much as product selection. The business’s Yelp presence, a page replete with detailed images of the store and its shelves, reinforces a perception of transparency—customers can visually verify what they are buying and gauge the store’s scale before entering. The photos, numbering in the dozens, function as a soft marketing tool that invites potential customers to discover a well-organized shop with a clear sense of its own inventory. It’s the sort of online signal that complements the in-person experience, reassuring shoppers who might otherwise head to a bigger chain simply because they are unsure of what a smaller shop carries.

From a strategic vantage point, the competitive landscape for A&D Auto Electric Parts rests on combining core advantages with selective enhancements. The local convenience advantage is not merely physical; it translates into a more nuanced capability to address a customer’s immediate electrical needs. Consider a person who discovers a dead battery just before a commute. In Homestead, the ability to drop by, test components, and obtain a compatible replacement can save hours of downtime. The staff’s willingness to offer guidance—explaining how alternators behave under heat, or why a particular sensor might trigger a check-engine warning—turns a transactional purchase into a consultative experience. This is the essence of durable differentiation in a market fractured by online volume: the human element, when paired with solid stock and reliable hours, becomes a powerful value proposition.

But there is more to the story of competition than the strength of local service. The broader market pressurizes every independent retailer to augment its offering with value-added services that online channels cannot easily replicate. In practical terms, this means developing an inventory mix that emphasizes high-turn items and hard-to-find parts that local technicians routinely need. It also involves proactive stock management—keeping a ready supply of batteries suitable for Florida’s climate, for instance, and maintaining a steady roll of alternators and sensors that are frequently requested by car owners who prefer to shop in person rather than wait for a shipment. For a community-based retailer, it also means building relationships with local repair shops, installers, and even roadside assistance providers. Such partnerships create a network effect: a steady stream of referrals and the chance to offer bundled services that combine parts with installation or diagnostic checks. When a customer trusts the store for both parts and advice, loyalty follows naturally.

The competitive advantages that sustain A&D Auto Electric Parts—convenience, personalized service, and community ties—are not static assets. They require ongoing attention and adaptation to shifting consumer expectations and the evolving spectrum of automotive electronics. As vehicles become more complex, even simple components can require specialized knowledge or diagnostic tools. The local shop that maintains current expertise and demonstrates a willingness to guide customers through troubleshooting gains a reputational edge that price-sensitive shoppers may overlook. In practice, this translates into a service ethos: respond quickly to inquiries, stock the right mix of items that meet local demand, and offer honest, straightforward guidance about fitment and compatibility. The outcome is a relationship built on trust rather than a one-off transaction, a dynamic particularly valuable in neighborhoods where people rely on their vehicles for daily errands, school runs, and family obligations.

The chapter that follows in this article framework will explore how a business of this size can sustain momentum amid the pressures of omnichannel retail. For A&D Auto Electric Parts, the path forward lies in strengthening the unique advantages that a local retailer can uniquely offer while embracing practical enhancements that keep pace with customer expectations. This means maintaining a reliable footprint with clear hours and accessible contact information, continuing to build a visually verifiable presence online, and expanding the lineup of services that add tangible value for the everyday driver. It also means recognizing the power of community engagement—participation in local events, partnerships with nearby repair shops, and an active stance on customer education about electrical components and their maintenance. All of these elements are part of a broader strategy to keep the shop relevant in a market where competition comes from both the neighborhood and the globe.

For readers curious about the scope and texture of the product landscape that supports local auto electrical retailers, a nearby example from the broader parts ecosystem offers a sense of the kinds of items professionals expect to find in a well-stocked shop. This reference illustrates how specialized components, when thoughtfully organized and readily accessible, can become a crucial differentiator in a local market. brand-new-original-carbon-fiber-bonnet-hood for Mitsubishi Lancer Evo X serves as a reminder that even niche parts demand reliable availability and knowledgeable guidance—qualities that the homegrown retailer can deliver with efficiency and care. In this sense, the Homestead shop’s competitive position is not about trying to outprice the largest chains on every line item; it is about owning the parts, the know-how, and the accessible, human-centered service that families and local fleets keep returning for.

As the automotive landscape continues to evolve, the interplay between local authority and national reach will define the future for independent parts retailers. A&D Auto Electric Parts stands as an example of how a modest, well-positioned storefront can maintain relevance by leaning into its enduring strengths. The blend of convenient location, dependable hours, knowledgeable staff, and a community-oriented approach produces a compelling proposition for customers who value certainty and personal service. The chapter that follows will build on these insights by examining how such retailers can further monetize their local advantage—without losing the authenticity that makes them trusted partners in the neighborhoods they serve—and how this approach can be harmonized with the broader shifts toward online shopping and digital support.

External resource: https://www.statista.com/topics/1076/auto-parts-stores-in-the-us/

Electric Currents of Growth: A&D Auto Electric Parts and the Future of Automotive Electrical Supply

A&D Auto Electric Parts sits in the steady heat of Homestead, Florida, a neighborhood where the rhythms of daily life pulse with commerce and service. The shop’s footprint—5 NE 3rd Rd, its doors open from early morning into the early evening on most days—speaks to a business model built around reliability and accessibility. In February 2026, local customers could count on a familiar cadence: a welcome space where technicians, DIY enthusiasts, and professional repair shops alike could find the electrical components that keep engines singing and dashboards lit. The value of such a local anchor is not measured only in inventory or price, but in continuity. When a car’s electronic systems demand the right part at the right time, the ability to reach a dependable, nearby source becomes a strategic advantage, especially in a market that is gradually shifting from purely mechanical fixes to electronics-driven diagnostics and repairs. A&D’s ongoing presence in Homestead signals more than retail resilience; it signals a regional readiness to adapt as the automotive landscape evolves toward greater complexity and broader energy diversity.

Market dynamics in North America have long favored strong, steady regional players who understand the needs of repair ecosystems, independent shops, and the increasingly digital expectations of customers. While there is no publicly published, step-by-step roadmap from A&D for future growth, the observed stability of its operation and the depth of its local ties create a solid platform for expansion. In the broader context, the aftermarket for automotive electrical parts is expanding as vehicles incorporate more sensors, control modules, and connected networks. Even as traditional gasoline-powered cars remain on streets and highways for years to come, the market demands more from their electrical systems: diagnostic interfaces that can interpret a mosaic of data, reliable power distribution for lights and sensors, and components that endure the vibrations and temperature swings of daily driving. The convergence of these needs places A&D in a position where its local roots could anchor broader regional service capability, especially if the business embraces the opportunities that digital channels and smarter sourcing can unlock.

The trends shaping modern automotive electricals point to an era of increased specialization and greater speed in service delivery. Vehicle electronics are not a niche feature; they are the backbone of performance, safety, and efficiency. The rising complexity of systems—from battery management to telematics, from power distribution networks to onboard charging interfaces—means that consumers increasingly expect parts suppliers to offer not just parts, but guidance, compatibility assurance, and rapid fulfillment. In this environment, the potential for a regional supplier to grow through enhanced digital platforms and stronger local partnerships becomes tangible. A&D’s stability thus becomes not a static condition but a doorway to strategic evolution. The shop can serve as a touchstone for trusted sourcing while also acting as a bridge to new energy vehicle (NEV) components that will become more commonplace on the road as the transition accelerates.

A practical path for this evolution begins with strengthening online channels. An omnichannel approach can transform how customers discover, compare, and obtain parts, particularly for professional shops that need reliable lead times and accurate compatibility information. A&D could benefit from a well-integrated e-commerce experience that combines intuitive search, clear product data, and real-time stock visibility. When a technician in Homestead or a nearby town needs a specific electrical component, the ability to verify part compatibility, view cross-reference options, and place orders with predictable delivery windows can reduce downtime and improve shop throughput. A digital platform designed for ease of use aligns with how the market increasingly shops for parts: on mobile devices, in the shop, or from a remote workshop. Such a transformation is not purely a digital luxury; it is a logistical necessity in an industry that moves quickly and hinges on precise electrical specifications. As a model for how a traditional parts supplier can adapt, one might consider the kind of online catalog experiences found in neighboring automotive catalogs, where customers expect seamless navigation and dependable fulfillment.

Another pillar for future growth lies in expanding the product line to accommodate NEVs and the evolving energy mix on today’s roads. The shift toward electrified propulsion and the accompanying electrical architectures will demand components that can withstand higher charging cycles, manage more complex power electronics, and interface with advanced driver-assistance systems. For a local supplier, this means shifting from a purely traditional parts assortment to a curated set of NEV-relevant electrical components, harnessing suppliers who can reliably meet the quality and safety standards expected by professional service providers. It also implies developing strong support materials—clear compatibility notes, diagnostic guidance, and maintenance checklists—that help customers navigate the new electrical ecosystems without sacrificing speed or accuracy. The strategic logic is straightforward: as NEVs become more common, the need for a trusted, local partner to source NEV-compatible electrical parts will grow. A&D can respond by building supplier relationships with NEV-focused portfolios, while maintaining the breadth needed to serve gasoline-powered vehicles that still dominate local streets.

In tandem with product diversification, deepening local partnerships can bolster resilience and growth. Collaboration with independent repair shops, service centers, and fleet operators can create a more predictable demand stream and improve customer loyalty. Partnerships of this kind extend beyond transactional supply; they include training, knowledge sharing, and a mutual commitment to resolving vehicle electrical challenges quickly. By offering technical insights, diagnostic tips, and rapid access to required components, A&D can position itself as a trusted facilitator of maintenance and repair journeys. The result is a networked ecosystem in which the shop becomes not only a source of parts but a hub of practical expertise and dependable service logistics. Such a model resonates with a broader industry movement toward regional specialization, where local shops integrate digital tools, supply chain optimization, and hands-on know-how to stay competitive as vehicle technology becomes more intricate.

Industry trends reinforce the sense that the path forward is a blend of digital adaptation and relational strength. The trajectory toward more sophisticated electrical systems increases the importance of accurate data, reliable availability, and speed of delivery. Suppliers who invest in digital catalogs, seamless ordering, and clear technical documentation stand to gain a competitive edge. At the same time, the local, in-person accessibility that A&D offers—its storefront presence, staff knowledge, and neighborhood familiarity—remains essential. The dual emphasis on digital convenience and human-centered service mirrors the evolving profile of automotive aftermarket commerce: a hybrid model that leverages data-driven processes while preserving the trust and speed that customers expect from nearby, accessible providers. In such a landscape, A&D’s established market position, coupled with a readiness to innovate, can translate into meaningful growth without abandoning the core strengths that have sustained its local customer base.

The broader market also calls for supply chain mindfulness and operational agility. Digital transformations empower more precise inventory management, better demand forecasting, and faster restocking cycles. For a regional business, these capabilities reduce stockouts, lower carrying costs, and shorten the time to fulfill urgent customer needs. They also open opportunities to optimize logistics, offering more reliable delivery windows and even local pickup options that align with the busy schedules of workshops and fleets. The combined effect is a business that can respond to market fluctuations with greater speed and fewer frictions, an advantage that matters when every hour of downtime translates into lost revenue for a repair facility and its customers. In such a setting, A&D’s ongoing stability across multiple years offers a platform for calculated experimentation, allowing the company to test digital tools, expand product categories, and refine partner programs before implementing broad-scale rollouts.

A final thread worth noting is the importance of consistent customer experience. As NEVs and advanced electronics become more prevalent, customers will seek reliability across every touchpoint—from answering a call to tracking an order to the receipt of the right component in a timely fashion. The ability to deliver on that promise depends as much on process discipline as on product availability. A&D, rooted in a community with long-standing customer relationships, can leverage this trust to trial new channels and services. The business can, for instance, pilot a curated NEV-compatibility guide on its online platform, supported by staff training and accessible technical notes. In practice, such initiatives would be embedded within the daily rhythms of the shop, ensuring that every order is not only filled but understood—how it integrates with a vehicle’s electrical architecture, how long it should last under typical Florida operating conditions, and how it should be maintained for peak performance. This is the kind of knowledge-sharing culture that can differentiate a local supplier in a crowded market.

To illustrate how digital catalogs and part discovery are already shaping the ecosystem, consider a nearby example of an online catalog page that organizes a wide range of components by vehicle model and generation. The page demonstrates how catalogs can support efficient sourcing and accurate compatibility checks, a model that aligns with what A&D could implement to strengthen its online offering. For readers curious about a catalog-driven approach, one example of the digital catalog format can be explored here: 03-06-mitsubishi-evolution-8-9-jdm-rear-bumper-oem. While this specific page focuses on a particular part line, it epitomizes the practical benefits of an well-structured digital catalog in reducing guesswork and expediting fulfillment—a principle that can underpin A&D’s planned online expansion and NEV-focused assortment.

As the chapter of automotive electrics continues to unfold, A&D Auto Electric Parts stands at a crossroads where local presence, digital capability, and a thoughtful expansion into NEV-adjacent components can coalesce into sustainable growth. The strength of its community ties, the predictability of its schedule, and the potential to leverage modern inventory and order management systems create a credible path forward. The future of the business may well hinge on how deftly it can translate market signals into tangible offerings: a broader, more compatible product range; a clearer, faster online buying experience; and a collaborative network with repair shops that extends beyond mere transaction to shared expertise and reliability. If these elements come together, the Homestead shop could anchor a regional chain of responsive electrical parts supply that serves not only today’s vehicles but the next generation of electrically driven mobility. The journey from a stable, local storefront to a small-scale regional hub is not guaranteed, but it is a plausible trajectory for a company anchored in reliability and ready to marry traditional service with a digitally enabled, NEV-aware future.

External resource: https://www.yelp.com/biz/ad-auto-electric-parts-homestead

Final thoughts

A&D Auto Electric Parts not only supplies automotive electrical components but also serves as a beacon of reliability and support for automotive businesses. Understanding its overview, product offerings, customer service, competitive landscape, and future directions equips business owners with insights essential for strategic partnerships. As the automotive industry evolves, establishing a relationship with suppliers like A&D Auto Electric Parts can be pivotal in ensuring stock readiness and service excellence. A clear focus on quality parts and customer engagement positions A&D as a key player in enhancing operational efficiencies and driving business growth.