De La Huerta Auto Parts has been a cornerstone of the used auto parts industry since 1971, especially for European vehicles. This article delves into the historical journey, specialized product range, operational dynamics, and community impact of De La Huerta Auto Parts. Each chapter provides insight into how this influential business not only serves its local market but also extends its reach to a broader clientele, emphasizing its role in the automotive sector and beyond.

Tracing the Duarte Fixture: The Enduring Story of De La Huerta Auto Parts in the American Used-Parts Landscape

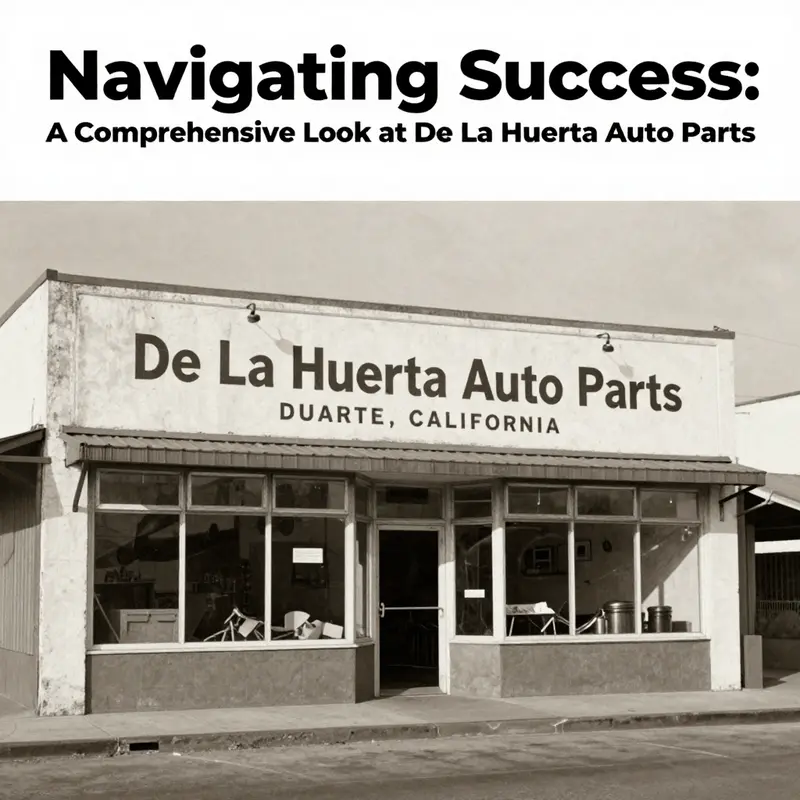

In Duarte, California, a modest storefront and a weathered yard host more than spare parts. They hold a quiet continuity in a landscape that is often defined by volatility—economic shifts, changing car technologies, and the constant churn of supply and demand. De La Huerta Auto Parts sits at 852 Alpha St, a waypoint for local drivers and a crossroads for regional repair shops that rely on late-model salvage as well as long-lived components from older vehicles. The chapter weaves a thread through time and trade, even as a formal historical account remains elusive. What is known, and what locals have passed along through memory and practice, is that this shop has endured since the early 1970s and has become a fixture in the community’s automotive ecosystem. The absence of a published chronicle does not erase the sense of continuity that a decades-long operation can project; rather it invites a different kind of history, one told through shelves that keep turning, and through customers who return because a part they need is still out there somewhere, waiting to be found.

Used auto parts markets like the one De La Huerta occupies are, at their core, about reuse and resilience. The logic is straightforward, even if the practice is complex: when a vehicle is retired, its life does not have to end in a scrapyard. Systems built for durability can be reimagined, retooled, and reinstalled in another machine. This circular life is not just an economic impulse; it is also an environmental one. Fewer perfectly good components end up as waste, fewer new parts are manufactured to replace them, and communities can sustain their transportation needs with a smaller environmental footprint. In a way, shops such as De La Huerta act as stewards of this circular economy. The local customers—DIY enthusiasts, independent repair technicians, and everyday drivers—rotate in and out of the aisles, scanning the metal and plastic for that exact fit, that elusive compatibility, or that spare that will keep a vehicle rolling without the need for a fresh, new part. The manga of inventory is not a simple ledger; it is a living map of what older vehicles can still offer to modern drivers.

There is a particular sensory texture to a store like De La Huerta Auto Parts. The air smells faintly of metal and oil, and the hum of a compressor or the distant murmur of airways from a nearby shop sometimes threads through the open doors. The shelves bear the weight of years, and each part has a story—of the car it came from, the mechanical challenge it solved, the person who found it, or the workshop that installed it. In this sense, the store is a repository of practical history. The people who work there—cashiers, yard staff, counter technicians—become keepers of that history, narrators of how vehicles age, how components wear, and how a good match can extend a car’s usable life. The absence of a formal founding narrative in public records does not diminish the fact that the business has a lineage—anchored by the known datum that it has operated in Duarte since the 1970s. Local lore, customer anecdotes, and the observable continuity of the storefront all contribute to a working chronology that is as important as any printed date.

The focus on European brands, and particularly Volvo, marks another distinctive thread in De La Huerta’s catalog. European vehicles—with their emphasis on engineering nuance, maintenance cycles, and specific componentry—have long attracted a particular kind of salvage interest: parts that fit with a precision that is not always found in more mass-market platforms. Volvo, with its reputation for longevity and the intricacies of its electrical and mechanical systems, is representative of the kind of demand that a durable used-parts operation can satisfy. For customers, this means a better chance of locating a compatible powertrain component, a critical engine piece, or a body part that can preserve a car’s safety and performance profile without resorting to a costly new purchase. It also signals a broader diagnostic approach: when the inventory includes items from older or more specialized makes, technicians must be adept at cross-checking fitment and compatibility, often relying on experience and cross- reference charts rather than just a model-year match. The resulting exchange is more than a sale; it is a transfer of tacit knowledge about which components can be coaxed back into service across generations of vehicles.

This is not merely a local phenomenon. The broader used-parts market thrives on paths that connect small, independent shops to a national network of dismantlers, yard operators, and salvage yards. In Duarte, De La Huerta acts as a node in that network by receiving vehicles, sorting salvage, and distributing parts to customers who then potentially serve as the final link in a long chain of reuse. The practical reality of this chain is shaped by logistics, pricing, and the condition of parts recovered from donor vehicles. Some components survive in near-pristine form, while others arrive as cores requiring refurbishment. The store’s ability to price, assess, and guarantee basic feasibility of fit is as important as its knack for locating unusual pieces. The economic logic undergirding this process is straightforward: a well-curated inventory reduces waste, extends the useful life of vehicles, and provides cost-conscious options for a broad swath of customers who otherwise might be priced out of essential repairs.

An undercurrent in any discussion of long-standing, locally anchored auto-parts businesses is the human element—the relationships that arise from repeated interactions and the trust that builds over time. De La Huerta’s customers are not merely buyers; they are partners in a shared problem-solving process. A mechanic may walk in with a tight deadline, explaining the symptoms of a failing wheel hub or an aging electrical module, and leave with a few compatible options that grant a practical solution. A weekend enthusiast might search for a dashboard instrument cluster or a cooling component to complete a restoration. In each case, the staff’s expertise helps translate a potential mismatch into a pragmatic match. The reciprocal relationship is not incidental; it is the bedrock of how a used-parts business survives. Customers bring in vehicles for salvage, share what they know about the source of a part, and depend on the shop to provide an honest assessment and timely service. In turn, the shop gathers feedback, refines its understanding of which salvage streams bring the most reliable inventory, and calibrates its operations to meet the evolving needs of the community.

The absence of a formal, published history does not mean the shop has no story to tell. It simply means the story lives in a different medium: the quiet confidence of returning customers, the careful organization of the yard, the way a part moves from dusty shelf to a bench in a working garage. And the story expands beyond Duarte, as the store’s inventory and expertise touch a broader network of buyers who understand the value of salvage and reuse. To the casual observer, the business may look like a typical salvage shop; to those who understand the motion of used parts, it becomes a cog within a larger machinery of repair, reuse, and resilience. In this sense, the historical arc is not a single line; it is a web of interactions, decisions, and practical trades that have shaped the shop’s endurance and relevance.

The store’s online footprint adds a modern dimension to this traditional enterprise. A digital channel exists to present available inventory, answer inquiries, and connect with customers who may not be able to visit in person every day. The online presence is not merely an accessory; it has become a bridge that keeps the store threadbare and intact between the plate-glass display of the shop and the wider world of car enthusiasts and professional technicians. The Yelp page, referenced in the broader material, offers a reader a glimpse of customer feedback and practical experiences that illuminate the day-to-day realities of working with a used-parts shop in this region. While ratings and reviews can fluctuate, the underlying message remains clear: the value of such a shop is measured not only by the parts it holds but by the reliability, honesty, and practical knowledge it provides to those who come seeking help for their vehicles.

Within this ecosystem, De La Huerta’s associations with other entities—such as Frigorizados la Huerta, S. A., and INL, S. A.—are a reminder that the business operates within a broader economic tapestry. These associations point to a network of regional operations across borders, where the same family or corporate identities may move through different sectors. In Duarte, however, the impact on daily operations is limited to the fact that these affiliations exist, offering context for the kind of cross-border or cross-sector economic activity that can influence supply chains, labor markets, and business models in surprising ways. The key takeaway for readers focused on the local story is that the Duarte shop remains a locally oriented enterprise with a deep commitment to serving its customers, even as it sits within a wider web of economic relationships.

What does this mean for the modern driver who seeks an economical, reliable path to vehicle maintenance? It means a continued option for repairing and extending the life of a car when new parts are not economically viable or readily available. It means confidence for a DIY mechanic that there are genuine salvaged components that can fit within the constraints of older or special-issue European makes. And it means a reminder that the health of a neighborhood economy can hinge on the quiet steadiness of these stores—places where experience counts as much as stock, and where the act of recycling parts becomes a practical, everyday act of stewardship. In a time when supply chains have shown fragility and new parts can be both expensive and scarce, the value of a well-run used-parts operation is not simply nostalgic; it is a functional, forward-looking response to the realities of vehicle ownership and maintenance.

The narrative of De La Huerta Auto Parts, even with gaps in the published historical record, reveals a pattern seen in many longstanding, community-rooted businesses: a blend of practical know-how, inventory stewardship, and a commitment to making transportation affordable and sustainable. Its emphasis on European brands, especially, highlights a niche where knowledge, fitment accuracy, and compatibility matter as much as the availability of a part. The Duarte store does not operate in a vacuum. It participates in a broader movement toward reuse and resilience in the automotive sector, offering a model of how regional players can sustain relevance by combining traditional know-how with modern channels of communication and distribution.

As the chapter closes on this moment in the narrative, the lesson is not that a single store can solve every industry challenge. It is that enduring shops like De La Huerta provide continuity within a dynamic system. They demonstrate that a city block can become a living archive of vehicle history through the components it preserves, the repairs it enables, and the relationships it maintains with customers who depend on a steady supply of usable parts. The chapter leaves us with an appreciation for the quiet, steady work of salvage—the careful cataloging of parts, the careful matching of fit, and the patient cultivation of community trust. It is not a glamorous history, but it is a deeply practical one, and it places De La Huerta Auto Parts within the larger tapestry of the American used-parts landscape as a steady hand guiding cars from one life to the next.

For readers who wish to explore an example of how salvage-driven inventory can intersect with specialized building or restoration projects, consider a prominent example from the broader parts market: 03-06 Mitsubishi Evolution 8-9 JDM Rear Bumper OEM. This link illustrates the type of niche inventory that a well-curated used-parts shop endeavors to locate for enthusiasts and technicians alike. It demonstrates the breadth of cross-model compatibility work that can underpin a store’s ability to serve a diverse clientele, from practical daily drivers to dedicated builders of unique vehicles. The ability to source and verify such parts—whether through a Duarte storefront or a national network—embodies the practical ethos that has sustained De La Huerta Auto Parts through decades of change.

External resource for further context on the circular economy and automotive recycling: https://en.wikipedia.org/wiki/Automotive_recycling

Specialized Inventory and Sourcing at De La Huerta Auto Parts: A Practical Guide to Used European Vehicle Parts

De La Huerta Auto Parts has built a reputation on a clear, practical promise: reliable components, accessible pricing, and knowledgeable service. Over decades of operation in Duarte, the business refined how it assembles inventory and serves owners of European vehicles. This chapter explores the tangible ways that specialization shapes the product range. It covers sourcing, inspection, categorization, customer guidance, and the logistical systems that turn a sprawling yard into a dependable resource.

From a customer standpoint, specialization is most visible in two places: what sits on the shelf, and what the staff can immediately tell you about fitment. The inventory emphasizes parts commonly needed by owners of European models. That means a heavy presence of mechanical cores, electrical modules, body panels, trim pieces, and niche items that new-parts suppliers sometimes take months to obtain. The selection reflects demand patterns gathered from years of service. Customers find what they expect: quality used engines and transmissions, serviceable suspension components, HVAC and electrical assemblies, brake and steering systems, plus a broad array of exterior and interior trim.

Sourcing this inventory starts well before a single component is shelved. The yard relies on disciplined acquisition channels. Salvage vehicles are evaluated for overall condition and rarity. Vehicles with solid structural integrity and intact drivetrains are prioritized. Local partners and national auctions supply many core units, while trade-ins and estate vehicles add valuable, low-mileage examples. Each acquisition is driven by the same calculation: is this donor car likely to provide parts that meet customer need now or in the near future? That pragmatic lens reduces dead stock and keeps the turnover healthy.

Dismantling is where value is unlocked. Trained technicians prioritize careful removal to preserve parts’ function and appearance. Fastidious dismantling reduces the risk of damage to mounting points, connectors, and harnesses. Where electrical modules are involved, connectors are preserved and labeled. Where exterior panels are removed, finishes are protected and minor dents and scratches noted. This approach returns more usable parts to inventory and lowers rework over the long run.

Inspection and testing are key differentiators. Visual checks are the baseline. Beyond that, components with critical tolerances undergo functional verification. Engines and transmissions receive compression or pressure checks when practical. Electrical units are bench-tested or connected briefly to diagnostic interfaces. Cooling components are pressure-tested. Brake components are measured for thickness and inspected for heat damage. Airbag and restraint parts are handled with strict safety protocols and documented. These steps matter because they reduce surprises for buyers and build trust.

Cataloging connects people to parts. Each item receives clear identification and descriptive notes. Fitment details, known compatibility, and any observed defects are recorded. VINs from donor vehicles are logged to allow verification of exact matches when customers provide their VIN. The yard maintains both physical and digital records to speed searches and to support shipping requests. This combination of organized data and hands-on knowledge enables staff to answer fitment questions quickly and accurately.

Pricing balances affordability with fairness. Used parts pricing reflects condition, rarity, and testing status. Common wear items are priced to move. Rare or low-mileage cores command premiums, though still below new-parts retail. Core charges are applied selectively to engines and transmissions when reman cores are part of the transaction. Transparent pricing and the option to inspect parts in person are central to the buyer experience. When customers cannot visit, staff provide detailed photos and measurements to support confident purchases.

Warranty and return policies matter in the used-parts market. Offering short-term guarantees on core mechanical parts and electrical components reduces buyer hesitation. Coverage is clearly defined, and the claims process is straightforward. Warranties typically do not cover installation-related failures or pre-existing conditions undisclosed at sale. Still, even modest assurances are a practical sign that the business stands behind its inventory.

Fitment expertise grows from decades of exposure to European vehicle designs. While vehicle systems change over model years, many components retain cross-compatibility across trims and generations. The staff develops rule-of-thumb knowledge—how certain engines share mounts, how particular body panels fit across submodels, or which electrical modules are interchangeable. This institutional memory speeds the sourcing process and helps customers avoid mismatched purchases. When fitment is uncertain, the team seeks VIN data, part numbers, or physical photos to confirm compatibility.

Packaging and shipping expand the yard’s reach beyond the local area. Smaller wear items are boxed with protective material and shipped quickly. Larger assemblies are prepared on pallets and pallet-strapped for freight. Shipping staff coordinate with carriers experienced in handling auto parts to reduce damage risk. Export shipments are handled with additional documentation and packing standards. For remote customers, the ability to ship nationally or internationally transforms a regional yard into a national resource.

Environmental stewardship is an often-overlooked part of the product story. Every reusable component salvaged and resold keeps material out of landfills. Fluids are drained and recycled; hazardous elements are processed per regulation. Salvaging also reduces the need for new-part manufacturing, which lowers material extraction and energy use. Customers who choose used parts participate in a pragmatic circular-economy model. The yard’s operational choices, from fluid reclamation to parts reclamation, reinforce this environmental benefit.

Customer education is part of product specialization. Because European vehicles sometimes use specialized fasteners and procedures, staff provide installation tips and warnings. They remind buyers to inspect hoses, mounts, and related components when replacing a major assembly. They explain why adjacent parts may need replacement to prevent premature failure. These practical notes often save customers money and prevent repeat visits.

Inventory planning blends analytics with hands-on judgment. Sales trends are tracked by part type, vehicle family, and seasonality. That data guides purchasing decisions for the yard and helps forecast when to seek particular donor vehicles. For example, items subject to corrosion cycles or seasonal demand receive proactive attention months ahead. Planning also includes prioritizing the acquisition of low-mileage donors that can replenish high-value part categories.

Specialization also informs the layout of the physical space. Parts are grouped logically: powertrain cores in one area, driveline and suspension in another, electrical assemblies in a climate-sheltered section, and high-value trim and interior pieces in secure storage. This arrangement speeds location and handling. It also enables staff to perform quick inspections and pull parts for shipping without undue handling, which preserves condition.

Communication channels are a strategic asset. Phone inquiries, in-person visits, and digital messages are handled with consistent workflows. Staff respond to VIN-based questions with focused searches. For complex requests, they create part lists and follow up with images and measurements. The combination of rapid response and precise information reduces friction and builds repeat business.

Service to repair shops and independent mechanics is a core dimension of the product range. Trade accounts allow frequent buyers to reserve parts or request priority dismantling. Such relationships ensure a steady flow of business and justify investments in testing equipment and storage for high-turn items. The mutual benefit is clear: repair shops gain access to reliable components at lower cost, and the yard secures regular demand.

Adaptability keeps the product range relevant. As vehicle designs evolve, so does the inventory. The yard monitors model changes that introduce new component architectures, and it adapts dismantling techniques accordingly. When new generations of vehicles enter the salvage stream, staff quickly learn the differences that matter most to fitment. This responsiveness preserves the yard’s value proposition for owners of both older and newer European vehicles.

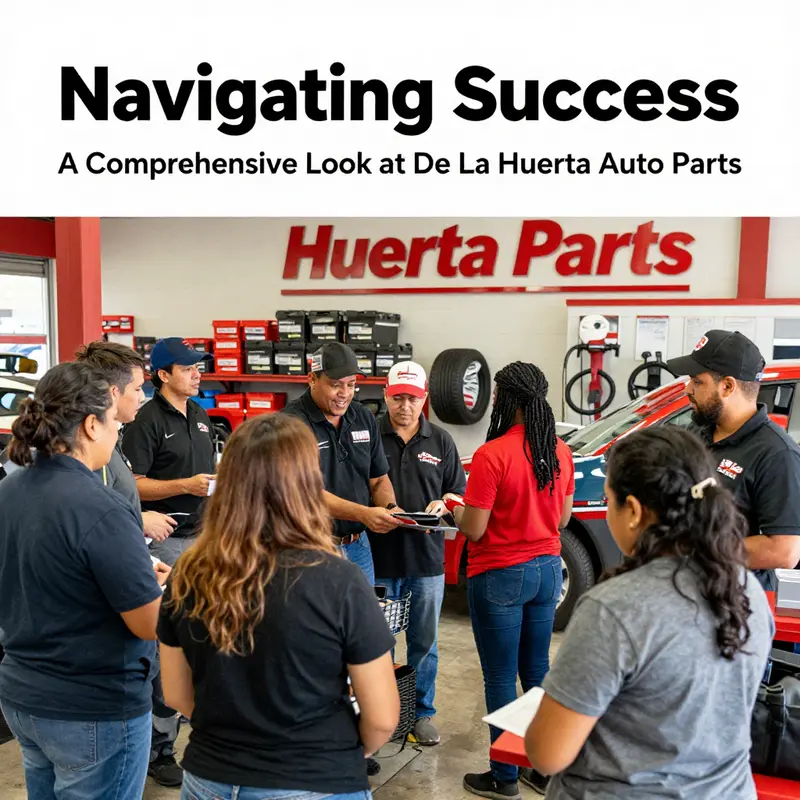

Finally, the human element ties everything together. Knowledgeable staff who combine mechanical insight with parts expertise create the trust that specialization promises. They listen to problems, suggest practical solutions, and match customers with the right parts. That human judgment, supplemented by careful inspection and clear records, creates a product offering that is more than the sum of its parts.

For anyone seeking parts for a European vehicle, the inventory at De La Huerta Auto Parts offers a pragmatic path: a curated selection of used components, inspected and documented, supported by staff who know how those parts fit and function. The yard’s processes—sourcing, careful dismantling, testing, cataloging, and shipping—ensure a high probability that a purchase will meet expectations. That reliability is the real specialization: building systems so the right part is available when it is needed.

External resource: For customer reviews, hours, and local details, see the business listing on Yelp: https://www.yelp.com/biz/de-la-huerta-auto-parts-duarte

How De La Huerta Auto Parts Operates and Shapes Its Community

Operational Practices and Local Influence

De La Huerta Auto Parts has been a visible presence in Duarte, California, since the early 1970s. Its long tenure in the local market gives the company a role beyond simple commerce. Over decades, the business has become a practical resource for drivers seeking reliable used components. The storefront at 852 Alpha St anchors a neighborhood relationship that blends walk-in customers, referral repair shops, and the occasional long-distance buyer who needs a specific part. For many local drivers, calling (626) 358-7316 is the pragmatic first step when a component fails or when a restoration project reaches a difficult stage.

Day-to-day operations at an experienced used parts yard combine practical logistics with hands-on automotive knowledge. Inventory management may look modest from the outside, but it involves careful cataloging, inspection, and storage. Each incoming vehicle is evaluated for salvageable parts. Technicians and yard staff remove components, label them, and stage them for cleaning, testing, and eventual sale. This workflow reduces waste by reusing serviceable components. It also offers a cost-effective option for vehicle owners who want a reliable replacement without the price of new parts.

Quality control matters in this sector. Buyers trust used parts when the seller follows consistent inspection procedures. Visual inspection remains a primary method for many components. Where appropriate, parts are tested for function before sale. Electrical modules, starters, alternators, and similar items may receive bench testing. Mechanical parts are checked for wear and fitment. Hardware and trim are inspected for cosmetic and safety concerns. The trade-off between low cost and dependable function is a constant consideration; the best yards commit to transparent descriptions and reasonable return policies. Building and protecting customer trust requires straightforward communication about condition and compatibility.

Sourcing shapes a used parts operation. Suppliers can include local end-of-life vehicles, trade-ins from repair shops, and vehicles acquired from broader salvage networks. Maintaining strong relationships with tow operators and collision repair facilities brings a steady stream of inventory. Some businesses also participate in wholesale exchanges where yards buy and sell parts across regions. For a yard catering to a mix of local and nonlocal demand, flexible sourcing helps meet the specific needs of drivers and mechanics.

Pricing strategy in the used parts trade balances affordability and sustainability. Competitive pricing attracts bargain-minded customers. At the same time, adequate margins must cover labor, testing, and the space and equipment needed to process components. Many yards price by condition and rarity. Common parts that are easy to replace stay inexpensive. Rare or highly functional components command higher prices because they save customers the time and cost of finding a new equivalent. Transparent pricing and clear explanations of condition encourage repeat business, word-of-mouth referrals, and loyalty from independent mechanics.

Customer service at a neighborhood parts yard is as much about relationships as transactions. Staff with deep automotive knowledge can advise customers about interchangeability, common failure points, and practical repair tips. This expertise transforms a parts purchase into a problem-solving interaction. When customers can talk to someone who knows which generation of a component fits a specific model, they save time and reduce the risk of costly mistakes. The resulting goodwill benefits both customer safety and the store’s reputation.

Beyond individual sales, the yard contributes to the local repair ecosystem. Independent mechanics and small shops often rely on used parts to deliver affordable repairs. In areas where repair costs are a significant factor in vehicle-retention decisions, used parts keep cars on the road longer. That, in turn, supports mobility for workers and families. For communities where new parts are expensive or hard to obtain quickly, a local supply of tested, compatible components fills a practical gap.

The environmental dimension of reusing parts is significant. Salvaging and reconditioning components reduces the demand for new manufacturing. That lowers resource extraction and the energy consumed in producing replacement parts. Recycling whole vehicles and reusing parts also reduces landfill contributions and extends the useful life of many materials. For neighborhoods navigating waste management and sustainability concerns, a well-run parts yard contributes to local environmental goals by diverting usable components from disposal.

However, the business faces modern pressures. The broader automotive parts industry has been shifting toward electrification and software integration. Those macro trends change what parts remain reusable and what kinds of expertise yards must develop. Older mechanical components are often straightforward to diagnose and refurbish. Newer electronic modules may require different testing equipment and programming tools. This evolution forces yards to choose between investing in new capabilities or focusing on niches where used parts retain clear value.

Supply chain dynamics also affect operations. Global disruptions can make some new parts scarce, increasing demand for used equivalents. Conversely, shifts in manufacturing and logistics may flood the market with low-cost new parts, squeezing margins for used suppliers. A resilient yard diversifies sources and maintains flexible pricing to respond to changing availability and customer preferences.

Regulatory and compliance considerations play a role too. Environmental rules around fluid disposal, hazardous materials handling, and vehicle dismantling require proper procedures. Permits and local codes influence how a yard uses its property and handles waste. Compliance adds operational cost but also ensures safety for staff and neighbors. Adherence to regulations protects the business and reassures customers that parts were handled responsibly.

Community impact extends beyond economics and environment. Longstanding businesses become part of the local identity. They sponsor teams, hire locally, and participate in neighborhood networks. Employees gain skills that transfer to other roles in automotive services. For younger workers, apprenticeships and hands-on training at a parts yard can be an informal gateway into skilled trades. That social capital reinforces local resilience, especially in places where vocational opportunities matter.

De La Huerta Auto Parts also sits within a network of similarly named entities in other regions. While some related companies operate in distinct sectors, the U.S. store’s focus remains rooted in serving local automotive needs. That separation means the yard’s community role is driven by its local operations, customers, and staff. Its reputation depends on consistent service and reliability more than corporate affiliations.

Adapting to technology has practical implications. Digital cataloging systems improve accuracy in matching parts to vehicles. An online presence helps customers check availability before visiting. Phone calls remain important, but searchable inventories reduce mismatches and save time. Some yards list high-demand items on third-party marketplaces. Others build their own web pages for local search visibility. Even simple steps like clear photos and concise condition notes reduce returns and improve customer satisfaction.

The used parts model also faces reputational risks when buyers receive incompatible or poor-condition items. Clear policies, honest descriptions, and a practical returns process mitigate those risks. A transparent approach to warranty, pickup, and installation guidance increases confidence. When repair shops can rely on a vendor for predictable parts and clear communication, they form long-term partnerships that stabilize demand.

Looking ahead, the yard’s strategy might emphasize specialization. Some operations focus on particular makes, model years, or component categories. Specialization builds deep expertise that attracts a loyal base. Specialist yards often trade parts nationally because rarity makes local customers willing to pay for shipping. A balanced approach keeps core local services while exploring niche markets that enhance profitability.

Community-facing initiatives can strengthen the business role. Educational workshops, basic repair clinics, and partnerships with vocational programs help raise local mechanical literacy. Such programs create goodwill and introduce prospective customers to the value of used parts. They also help cultivate the next generation of technicians who understand cost-effective repair strategies.

Operational resilience looks like steady inventory flow, clear quality standards, and financial discipline. Customer trust, once earned, becomes a competitive advantage difficult to replicate. For residents of Duarte and surrounding communities, having a reliable local source for tested parts means fewer trips to expensive dealerships and more options to keep vehicles roadworthy.

Taken together, these operational practices and community effects define why a long-standing parts yard matters. It is not only a place to buy components. It is a node in a local network of repair, reuse, and skill development. Its value comes from the everyday work of matching needs with available resources, maintaining standards, and contributing to an ecosystem where practical, affordable vehicle care is accessible.

For further context on how large-scale strategic shifts affect parts companies, see this industry perspective on corporate restructuring and market trends: https://www.genuineparts.com/news/press-releases/genuine-parts-announces-split-into-two-public-companies

For an example of how used-component listings appear online, consider an evo-x halfcut listing that illustrates part-by-part salvage inventory and how sellers describe condition: https://mitsubishiautopartsshop.com/evo-x-halfcut/

Roots, Relationships, and Resilience: De La Huerta Auto Parts within Its Market Web

De La Huerta Auto Parts sits at a crossroads of community trust, niche expertise, and practical sustainability. Operating from Duarte, California since 1971, the business has cultivated a reputation that extends beyond a single storefront. Its specialty in salvage components for European vehicles, and a particularly deep knowledge of one brand known for sturdy engineering, has allowed it to become a dependable node for owners who value authenticity and longevity. That reputation did not emerge overnight. It grew through repeated, hands-on problem solving and through relationships that connect private owners, local repair shops, and collectors to a steady supply of quality used components.

Understanding De La Huerta’s place in the market means looking at two parallel realities. On one hand there is the outward-facing market dynamic: demand for affordable, reliable replacement parts for older and classic vehicles. On the other hand there is the inward, operational reality of how a small salvage yard sources, evaluates, stores, and sells parts in a way that preserves value. Where larger aftermarket suppliers aim for volume and speed, De La Huerta thrives on depth of knowledge and careful curation. Long-term customers repeatedly return because they know the business understands the quirks and weak points of specific models. That trust translates into repeat transactions, word-of-mouth referrals, and a resilient niche position even as the broader auto industry accelerates toward newer technologies.

Relationships are the currency of this market. De La Huerta’s network likely includes tow operators, auctions, private sellers, and other recyclers who supply vehicles and components. Those networks feed an inventory that changes constantly, yet retains consistency in quality because the business treats salvage with care. Each incoming vehicle becomes a source of dozens of individually valuable parts. Experienced staff quickly identify items with reuse potential, from seats and steering columns to electrical modules and suspension components. Years of working with the same vehicle families allow staff to anticipate which parts will be scarce next season, and which will hold their value for years. This institutional memory is a competitive advantage. It allows a small operation to act nimbly where larger chains might be slow or impersonal.

The relationship outward, toward customers, is equally important. Independent mechanics and body shops depend on partners who can provide reliable components with clear provenance. Hobbyists restoring classic cars want authenticity and a fit that will not lead to repeated trips back to the yard. For these buyers, the transactional details matter: clear descriptions, honest assessments of wear, and straightforward return policies. De La Huerta’s long-term customers show that this yard has established a predictable standard. That standard helps it maintain pricing discipline; the business avoids competing purely on lowest price, and instead emphasizes value—parts that fit, work, and last.

At a broader level, the firm’s operations speak to sustainability and the circular economy. Salvage yards inherently extend a vehicle’s lifecycle by reintroducing parts into service. This process reduces the demand for new manufacturing and the associated environmental costs. While De La Huerta may not run large corporate sustainability campaigns, the core activity aligns with conservation principles. Reusing a functioning component prevents raw material extraction and lowers the carbon footprint associated with producing a new replacement part. The environmental benefit is practical and measurable, and it resonates with customers who prefer cost-effective options that carry lower ecological impact.

This ethos connects to wider examples of community-based stewardship. Projects that revitalize local resources—whether urban gardens or corporate recycling programs—show how small-scale, hands-on initiatives create long-term value. Similarly, a salvage yard becomes a local repository of automotive knowledge and material. Staff and customers exchange tips, repair methods, and sourcing strategies. This informal knowledge transfer contributes to a local culture of repair and reuse. It also helps younger mechanics and car owners learn to value durable design and maintain older vehicles rather than discard them.

Market dynamics are shifting in important ways, and De La Huerta’s longevity speaks to its ability to adapt without losing focus. Technological change in new vehicles—advanced electronics, integrated safety systems, and complex sensor-laden components—has complicated salvage for late-model cars. Some parts are difficult to repurpose across vehicles, or require software pairing and reprogramming. Yet many mechanical and aesthetic components remain accessible and valuable. For older vehicles, in particular, the expertise of a yard that understands model-specific wiring, mounts, and tolerances remains irreplaceable. The business’s emphasis on vehicles built with longevity in mind makes its inventory especially relevant when owners face the cost of replacement parts from original manufacturers.

Regulation and compliance also shape how salvage operations run. Proper documentation for part provenance, adherence to safety standards when selling components like airbags or seat belts, and responsible handling of fluids and hazardous materials are all essential. A well-run yard balances the informal trust it builds with customers and formal procedures that ensure legality and safety. This layered approach protects the business and its clientele and reinforces the sense of reliability that long-term customers expect.

Pricing and inventory strategy at a specialty yard are exercises in nuance. When parts are scarce, the yard must decide whether to hoard inventory, raise prices, or broker parts to other recyclers. When supply is abundant, the focus shifts to turnover and storage efficiency. De La Huerta’s long-standing presence suggests it has mastered those choices. By cultivating a steady inflow of vehicles and selectively allocating prized components, the yard can maintain margins while serving both retail customers and trade partners. At the same time, clear communication about condition and compatibility reduces friction and returns, which in turn lowers operating costs.

Customer experience remains a cornerstone. For many buyers, interacting with a salvage yard is a hands-on experience. Customers want to see parts, confirm compatibility, and sometimes test fit components. De La Huerta’s physical location supports those needs. The staff’s knowledge shortens the learning curve for buyers, and the social dimension—neighbors swapping stories about repairs—builds loyalty. Beyond the lot, a modest digital presence, including customer reviews, enhances credibility. Reviews provide prospective buyers with insights that were once limited to local word-of-mouth. A transparent set of operational details—hours, contact methods, and location—makes it easier for both locals and out-of-town buyers to plan visits.

The yard’s association with companies that operate in different sectors or regions is worth noting. Names may overlap across countries and industries, but a clear separation of operations matters. When distinct entities share similar names or family origins, customers should understand which services and guarantees apply locally. De La Huerta’s U.S. operations are focused on automotive salvage, while other companies with related names may work in refrigeration or different markets elsewhere. That distinction matters both for customer expectations and for regulatory or logistical reasons.

Finally, there is a tacit cultural value to establishments like De La Huerta. Small salvage yards preserve not just parts, but memory. They support vehicles that carry family history, daily utility, and personal investment. They make practical repairs affordable and keep older cars on the road. This contribution to mobility and community resilience helps explain why long-term customers stay loyal. It also hints at a broader role for such businesses in an economy that increasingly values reuse and local service.

For readers exploring parts for older vehicles, the salvage market provides options that balance cost, quality, and sustainability. When looking for seats, interiors, or hard-to-find mechanical components, resources beyond mainstream suppliers often yield the best combination of fit and price. For instance, enthusiasts seeking high-quality seating components sometimes look to specialty suppliers who sell original or aftermarket seats designed for performance and comfort. A useful reference is the listing for brand-new Alcantara front Recaro seats, which illustrates how seats remain a key part of the rebuild and restoration market. That listing gives a sense of the choices buyers face between new aftermarket options and well-sorted salvage finds.

To evaluate whether a salvage yard like De La Huerta is the right resource, consider three practical questions. First, does the yard have a demonstrable track record with the vehicle make and model you own? Second, does the yard provide clear condition notes and reasonable return or warranty terms? Third, is the price point aligned with the condition and expected lifespan of the part? If the answers are positive, a salvage yard can be an excellent source.

For more operational details, such as location, contact methods, and customer experiences, consult the yard’s public listing on review platforms. That listing offers practical details that help you plan a visit or a call. External feedback from real customers often highlights specific strengths and potential limitations, making it a useful companion to on-site inspection and direct inquiries.

Altogether, De La Huerta Auto Parts exemplifies how specialized, locally rooted businesses remain central to the automotive ecosystem. By combining hands-on expertise, careful sourcing, and a community-oriented approach, the yard sustains a meaningful role. It connects the material benefits of reuse with the human benefits of trust and knowledge transfer. In markets that prize rapid turnover and novelty, that combination of roots and relationships builds resilience and keeps durable vehicles on the road.

External reference: https://www.yelp.com/biz/de-la-huerta-auto-parts-duarte

Internal reference: brand new Alcantara Recaro seats – https://mitsubishiautopartsshop.com/brand-new-alcantara-front-recaro-seatsoriginal/

Final thoughts

In summary, De La Huerta Auto Parts stands as a significant entity in the used auto parts industry, contributing to the automotive landscape through its historical legacy, specialized product offerings, operational excellence, and community engagement. Understanding the depth of its impact provides valuable insights for business owners and stakeholders in the industry, illustrating the multifaceted roles that such businesses play in both local and broader contexts.