The Lancer Evo X Inspira rear bumper represents a crucial component for vehicle aesthetics and safety. Business owners in the automotive aftermarket will find that understanding the specifications, manufacturing processes, performance, cost analysis, and current market trends of the rear bumper made from polypropylene (PP) is essential for making informed purchasing decisions. Each chapter provides detailed insights that will help businesses navigate the complexities of this product and its significance in the overall automotive landscape.

Material Truths Behind the Inspira-Inspired Rear Bumper: Unraveling PP Promises and Fiber Realities

The rear bumper is more than a cosmetic panel; it is a carefully engineered interface between the car’s safety systems, its aerodynamics, and the everyday realities of driving. When a bumper is described as inspired by a well-known performance sedan, and then marketed as a specific polymer—polypropylene (PP)—the reader expects a precise blend of light weight, toughness, and OEM-like fit. Yet the material story behind a so-called Inspira-inspired rear bumper often reveals a more nuanced picture. What begins as a straightforward swap can quickly become a discussion about the differences between PP and fiber-reinforced options, the realities of aftermarket manufacturing, and the practical consequences for fit, finish, and long-term durability. Understanding these elements helps buyers and enthusiasts separate marketing cues from material realities, and it clarifies why a part may look similar to a factory piece while behaving quite differently in the real world.

Polypropylene has long been a backbone of automotive body components. It is a thermoplastic that combines reasonable rigidity with resilience against impact, weathering, and many chemicals. For bumper shells, PP is prized for its moldability, allowing large, complex shapes to be formed in high volumes with tight tolerances. In OEM applications, PP bumpers are designed to absorb energy during minor collisions and to recover some degree of shape after a nudge. The material’s forgiving nature means that a well-designed PP bumper can survive daily parking lot scrapes without cracking, while still offering a cost-efficient manufacturing path. In many regional supply chains, PP bumpers are manufactured in factories that optimize cycle times and tooling costs, with Taiwan-based facilities being a common source for numerous manufacturers, especially on parts designed to match wide, 1:1 fitment with the original bodywork.

When a product description asserts a rear bumper is made from PP and is a direct replacement for a specific model in a particular generation, it implies a certain alignment of fit and finish. A true PP bumper for a sedan era like the mid-2000s to mid-2010s is typically advertised with terms such as precise 1:1 fit, direct bolt-on mounting points, and compatibility with the original bumper beam and valance trims. The narrative is simple: the part should drop into place with no major trimming, the mounting tabs align, and the paint shop can apply a seamless finish. The reality, however, is that not every aftermarket bumper labeled as PP actually uses the same material chemistry, nor is every listing equally transparent about finish and structural details. Some listings describe “PP” while the actual reinforcement or outer surface is a different polymer blend or a fiber-reinforced variation. Such discrepancies matter, because the difference between a pure PP shell and a glass-fiber reinforced version translates into weight, rigidity, impact behavior, and how the panel responds to temperature changes and UV exposure.

Beyond PP’s properties, there is another material family that often appears in Inspira-inspired rear bumper listings: fiber-reinforced plastics. This term usually refers to a fiberglass or glass-reinforced composite, sometimes marketed as FRP or GF/FRP, depending on the exact formulation. FRP bumpers are typically lighter than solid resins of comparable thickness and can be shaped with high fidelity to complex curves. They also tend to be stiffer and more resistant to distortion under heat, which can be advantageous for enthusiasts who push a car into harsher environments or who want a bumper that maintains its geometry under a wider range of ambient temperatures. But FRP comes with its own caveats. The surface finish can require more careful preparation before painting, gel coats can crack if the surface is stressed improperly, and repairs may involve different techniques than those used with PP. In practice, a bumper marketed as “fiber” often signals a different balance of cost, weight, and rigidity compared with a typical PP shell.

The research materials reveal a key point that is easy to miss in quick listings: a bumper marketed for an Inspira or a Lancer Evolution X-inspired build may borrow styling cues from a well-known sedan, yet its core material and structural approach can be different. In some cases, a rear bumper listing that references PP material for an Evo X-sized fitment is describing a genuine PP replacement intended to match the sedan’s OEM specifications in a 1:1 fashion. In other cases, the same visual silhouette is achieved using a fiberglass-reinforced configuration that aims for a similar external geometry but uses different internal reinforcement and finish processes. This distinction is not merely academic. It influences installation, weight distribution, impact behavior, and the long-term durability of the paint finish and substrate under sun exposure, road debris, or temperature fluctuations. A shopper who assumes PP equals lightweight and flexible may be surprised by the performance of a fiber-reinforced version, and vice versa.

From a practical standpoint, the material decision also shapes how a bumper is prepared for color and clear coat. A PP shell generally benefits from a well-graded primer system designed for thermoplastic substrates. The primer adheres to the surface and accommodates the expansion and contraction of the plastic through heat cycles. On the other hand, fiber-reinforced panels may require gel coats or specialty surface treatments to seal the surface and to provide a robust base for paint. If the surface is not prepped correctly, issues such as orange peel, fish eye, or paint delamination can arise. This is not merely a matter of cosmetic preference; improper adhesion can compromise the durability of the finish in the long run. Enthusiasts who drive in sunny climates or who frequently wash their cars with aggressive detergents should be mindful of UV stability in the Gel coat and the binder system that protects the underlying reinforcement. In short, the material choice drives how the surface holds paint, how evenly the finish lays down, and how resilient the final appearance remains after years of exposure.

Fitment is another arena where the material story matters. An aftermarket bumper’s ability to bolt up to the factory mounting points depends on the precision of the tooling, the consistency of the mold, and the accuracy of the reproduction of stock geometry. A PP shell produced with tight tolerances can deliver a true 1:1 fit, aligning with the factory bumper beam, splash shields, and fender lines. A parallel FRP option can, with the right prep, also achieve a near- OEM alignment, but sometimes it requires additional trimming, careful alignment of the mounting brackets, or reinforcement to prevent flex at high speeds. The result is that even bumpers that visually replicate a familiar silhouette can differ in how they interact with the car’s original hardware and how much work a technician must invest to achieve a pristine, factory-like look.

The research materials also remind us to consider the provenance and manufacturing context. A typical PP bumper intended for a well-known sedan generation is often produced in Asia with a workflow designed to replicate OEM fit and finish in a cost-conscious way. The same general pathway can apply to an Inspira-inspired variant, especially if the goal is a close visual echo of the original styling while offering a direct replacement for collectors of aftermarket parts. Fiber-reinforced options may come from facilities that emphasize resin transfer molding or hand lay-up processes, yielding shells that carry a different tactile feel and surface texture. The result is a bumper that may be lighter or stiffer than a PP alternative, but with a finish that requires specialized preparation for color and gloss uniformity.

For buyers navigating this landscape, several practical considerations emerge. First, verify the material stated by the seller. If the listing claims PP, inspect the finish and, when possible, request technical data sheets or mold-release notes. Second, assess the mounting provisions. Look for clearly defined bolt points and a description of compatibility with the original bumper beam and corner panels. Third, inquire about the surface prep required before painting. Ask whether the part is ready for paint or if it needs primer, sealer, or a topcoat compatible with thermoplastics or FRP. Fourth, consider the intended usage. A daily-driver that encounters varied weather may benefit from a PP bumper’s impact resilience and easier repair, while a fiberglass-reinforced unit can deliver a crisper silhouette and potentially better impact distribution if properly reinforced and finished. Finally, factor in the overall weight and how it affects the car’s balance. Even a small difference in mass distribution can influence handling characteristics, especially in a chassis tuned for precise response.

Within this context, the idea of an Inspira-inspired rear bumper made from PP becomes a nuanced conversation rather than a simple label. The styling alignment with a celebrated performance sedan can be satisfying for the visual identity of a build, yet the material choice dictates how the part behaves under real-world conditions. The most responsible approach for enthusiasts is to treat the material claim as a starting point for due diligence. Compare options not only by price and appearance but also by the underlying resin system, reinforcement strategy, and the intended finish. A thorough inspection—ideally in person or via detailed photos—can reveal whether the part under consideration is a true PP shell, a fiber-reinforced variant, or a hybrid approach that blends surface aesthetics with a different internal structure.

For readers seeking a broader context on rear bumper options and their compatibility with modern builds, a catalog of Evo X rear bumper possibilities provides a useful reference. This resource helps map how different generations and interpretations of the same silhouette are implemented in aftermarket programs. You can explore the Evo X rear bumpers catalog here: Evo X rear bumpers.

In the end, the decision to choose a PP-based Inspira-inspired rear bumper—or any fiber-reinforced alternative—rests on aligning material behavior with the owner’s goals. If the priority is a direct, factory-like fit and a finish that can be achieved with standard automotive primers and paints, a well-documented PP option with clear 1:1 fitment data may be the best path. If the priority leans toward a lighter or stiffer shell with a potentially crisper silhouette and a finish that benefits from specialized surface treatment, then a fiber-reinforced option deserves serious consideration, complemented by a clear understanding of the painting workflow and potential reinforcement needs. By weighing these factors against climate, driving style, and maintenance expectations, the choice becomes less about a single graphic and more about a long-term partnership between body panel and chassis. External validation—through manufacturer specifications, third-party data sheets, and credible listings—helps separate hype from functional reality, ensuring the decision stands up to years of use and the evolving requirements of a modern performance build.

External reference: https://www.ebay.com/itm/B1285-PROTON-INSPIRA-LANCER-REAR-BUMPER-EVO-10-FIBER-NEW-UNPAINTED/374567891234

The Polypropylene Frontier: Manufacturing an Inspired Rear Bumper for a Performance Hatchback

The rear bumper is a boundary object in modern automotive design. It sits at the intersection of aesthetics, aerodynamics, and impact performance, while also serving as a platform for color, texture, and branding. When engineers and fabricators talk about polypropylene (PP) bumpers, they are really describing a class of parts that blend light weight with resilience, and that can be molded into complex shapes with repeatable precision. The allure of PP in aftermarket contexts is clear: it accepts rapid, high-volume production, resists cracking under minor impacts, and accepts color and finish treatments with predictable behavior. Yet the true story behind a PP bumper is less about a single molding event and more about a carefully choreographed sequence of design, molding, finishing, and validation that must align with a vehicle’s mounting geometry and the expectations of performance-minded enthusiasts. In practice, a PP bumper designed for an Inspira- or Evo-inspired concept is part of a broader ecosystem where form meets function, and where the material choices ripple through weight, repairability, and long-term aesthetics.\n\nA robust PP bumper manufacturing workflow begins long before the resin actually enters a mold. It starts with design intent: the bumper must accommodate mounting points, air ducts or grilles, sensor placements where applicable, and a set of edges that align with adjacent panels. Computer-aided design (CAD) models are refined to capture the exact geometry needed for a high-precision injection mold. The mold itself is a tool of extraordinary precision—steel, often CNC-machined, that defines not only the visible surface but every thick rib and every clip pocket that secures the bumper to the chassis. In a global landscape of suppliers, the most dependable partners run through this phase with rigorous tolerances. They translate a stylized silhouette—one that borrows cues from a renowned performance hatchback—into a manufacturable form, ensuring the curvature, flare, and bumper line meet both the aesthetic brief and the practical realities of bumper mounting, alignment with fenders, and pedestrian safety standards.\n\nThe injection-molding step is where PP reveals its true strength. After resin preparation, a well-tuned PP formulation becomes a hands-on partner in shaping the bumper. The base resin is often further enhanced with additives that extend performance in real-world conditions: impact modifiers to blunt low-speed impacts, UV stabilizers to resist sun fading, and color masterbatches that deliver consistent hues across production lots. In many cases, manufacturers blend glass-fiber reinforcement into PP to raise stiffness and heat resistance. This reinforcement shifts the material’s behavior: it becomes less prone to sag under load and more resistant to deformation in hot climates or under repeated flexing at bumper corners. The injection pressure is calibrated to fill intricate corners and hollow sections, yet avoid flash or short shots that could complicate post-processing. The result is a near-net-shape part that minimizes the amount of trimming required, reducing waste and accelerating downstream finishing. The process is rapid, repeatable, and scalable, which is why PP bumpers are a staple for aftermarket lines that target performance enthusiasts who want a production-ready look without long wait times.\n\nBut a bumper made from PP is not simply a hollow shell. It is a composite of geometry, chemistry, and surface behavior. Once the plastic has cured, trim lines are cleaned, burrs removed, and any excess flash addressed. Sanding follows to create a surface that can accept filler primers and topcoats without cracking or delamination. The post-processing stage is where the part begins its transformation from a mold artifact to a showroom-ready panel. This is also where the finishing options can be tailored to the buyer’s desires. For some shops, the emphasis is on achieving a paint-ready substrate with a smooth, uniform surface that makes color matching straightforward. Others push the envelope with special coatings that mimic carbon fiber textures or deliver a visual depth through film laminates or vacuum metallization. These choices are not merely cosmetic; they influence heat dissipation, UV resistance, and the bumper’s perceived rigidity. The atypical geometry of a performance-hatchback-inspired bumper makes these finishing steps especially important, because the bumper must read as a cohesive part of the car’s rear visual stance while carrying a finish that endures exposure to road grime, rain, and sun.\n\nIn a realistic aftermarket ecosystem, the supply chain matters as much as the recipe. Suppliers who can deliver PP bumpers with ISO 9001 or equivalent process controls bring predictability to a market that prizes both customization and reliability. The manufacturing hubs that dominate this space—places with deep experience in high-precision plastics and automotive accessories—offer more than machinery; they provide a culture of repeatable quality. When a customer orders a PP bumper, the expectation is not simply a single part but a production-ready solution that can be painted to match a vehicle’s palette and installed with standard mounting hardware. The logistics of delivering hundreds or thousands of units, with consistent color and finish, hinge on the supplier’s quality management systems, their ability to keep tooling in top condition, and their readiness to scale production without compromising tolerances. The result is a bumper that looks right, fits right, and lasts right, with a surface feel that echoes the look of a factory component while offering the customization required by enthusiasts.\n\nYet the real nuance comes from understanding the tradeoffs between PP and other materials used in similar aftermarket applications. A genuine PP bumper excels in weight savings and ease of manufacturing, but it can be prone to surface scratching or chipping if a higher-density impact occurs. Fiber-reinforced or composite bumpers, by contrast, may deliver greater stiffness and impact resistance on the exterior surface, but at the cost of heavier weight and more complex repair procedures. In the market and among tuners, this distinction shapes how a designer approaches the bumper’s core and its finish. A PP-based shell often relies on a primer system and a flexible clear coat that tolerates minor flexing, while a fiber-reinforced alternative may require different prep steps to ensure the resin-rich surface adheres properly to paints and coatings. For buyers and installers, the choice between PP and a fiber-reinforced alternative becomes a conversation about weight, repairability, and long-term durability under varied climate conditions. It also becomes a conversation about color stability, as color-matching across a cured PP substrate interacts with the specific shade and topcoat chosen for the project. In short, a polypropylene-based rear bumper is not just a single material decision; it is a network of choices that collectively deliver a predictable, tunable, and visually cohesive outcome.\n\nSome of the most telling lessons about how these bumpers come to life come from observing real-world catalogs and the practical realities of the aftermarket. A widely referenced product listing that surfaces in the global market shows a rear bumper designed for an Inspira-inspired program, noting its fiber-reinforced construction rather than PP. This distinction matters. It underscores the possibility that on certain design concepts, especially those that borrow cues from high-performance platforms, suppliers may lean toward continuous-fiber composites to gain stiffness and impact resistance, even if PP could be used for other trim levels or production runs. For buyers, this means reading the technical specifications carefully and asking about material families—PP, glass-filled PP, or fiber-reinforced composites—so they can anticipate weight, repairability, and paint behavior. It also means understanding that sometimes a part marketed as “inspired by” a popular model might depart from the exact OEM or the originally intended material in favor of a solution that balances cost and performance in a different way. The practical upshot is clear: PP bumpers deliver efficiency and mass production friendliness, while fiber-reinforced alternatives deliver stiffness and resistance to deformation. The best choice depends on the goals of the project, the budget, and how the car will be used on track, street, or show.\n\nFor greater context on the broader marketplace, one can explore a catalog of rear bumper options that targets the Evo X-era chassis, where aftermarket suppliers emphasize compatibility with the chassis’s mounting geometry and existing bumper-to-body interfaces. This context helps explain why a single part can exist in multiple material families, each with its own production story and its own performance signature. If you want to see how a particular retailer frames these parts, you can review a representative listing that discusses rear bumpers for a well-known performance hatchback, which provides a concrete example of the interface, finish options, and packaging considerations typical to this sector. For a direct look at such a catalog, see the product page that presents rear bumpers for a popular Evo X-era chassis: rear bumpers for Mitsubishi Lancer Evo X (2008-2015). This page illustrates how the design language, mounting interfaces, and finish choices align with a single, coherent aftermarket solution. You can click through to the listing here: rear bumpers for Mitsubishi Lancer Evo X.\n\nAs the chapter closes, it’s worth returning to the central thread: PP as a manufacturing platform is a practical, scalable solution for an aspiring bumper that carries both aesthetic intent and functional performance. The decision to use PP, or to explore a composite alternative, depends on a constellation of factors—from desired weight and stiffness to the ease of painting and the endurance of the surface under outdoor exposure. The lesson from the production floor is that material choice reverberates through design tolerances, tool life, cycle time, finishing options, and ultimately the user’s experience of the finished vehicle. The chapter’s focus on the PP path helps reveal how an otherwise straightforward component becomes a nexus of engineering trade-offs, supply-chain realities, and stylistic ambitions that, when aligned, deliver an aftermarket part that looks like it belongs on a high-performance car while delivering predictable, repeatable performance for owners who value both form and function.\n\nExternal reference: Lancer Evo X Parts Supplier Guide: Top Chinese Manufacturers for B2B Buyers (February 2, 2026) https://www.b2bautopartschina.com/lancer-evo-x-supplier-guide-2026

Rethinking the Rear Bumper: PP Material Performance vs. Fiber Realities in Performance-Inspired Upgrades

A rear bumper is more than a shell; it is an interface between aerodynamics, aesthetics, and everyday road life. When designers compare materials for a bumper that evokes a high-performance silhouette, the decision between polypropylene (PP) and fiber-reinforced composites is about more than weight or color. It governs fit, repairability, and how the car behaves in daily driving and in the rare moments of a bump or scrape. In the broader conversation about performance-inspired upgrades, the rear bumper becomes a test case for whether form can meet function without compromising long-term value. The Inspira-inspired fiber bumper described as new and unpainted illustrates the material realities: a true fiber-based panel demands paint and finishing work, careful surface preparation, and ongoing protection to preserve appearance.

PP bumpers offer light weight, cost efficiency, and forgiving repair options. Polypropylene can be molded into near 1:1 shapes with predictable fit, and its elasticity helps absorb minor impacts without catastrophic failure. Surface protection and UV stabilizers help mitigate yellowing and chalking over time. Repairs are typically simple, often involving warm plastic welding or patching, and repainting may not be necessary for minor cosmetic work.

Fiber-reinforced bumpers, typically glass-fiber reinforced polymer (GFRP), can deliver crisper geometry and a higher-end surface finish. The stiffness supports precise contours that align with aggressive styling cues and can improve airflow management at speed. However, FRP is usually more brittle under sharp impacts and repairs tend to be more involved, requiring patching, sanding, resin topping, and careful paint matching to maintain a seamless look. A well-executed FRP finish offers durability in heat and a premium appearance, but it relies on meticulous finishing work and quality paint.

In practice, aftermarket fit varies. PP bumpers leverage molding tolerances to deliver tight seams and easier installation on compatible platforms, while FRP bumpers often require templates, trimming, and thorough finishing to achieve factory-like integration. For readers pursuing an Inspira-inspired look, the fiber-based option signals a commitment to crisp lines and a high-fidelity surface, with the caveat that paint and weather-resistance must be planned from the outset.

The bottom line: if the priority is ease of installation, lower upfront cost, and a forgiving surface for daily driving, PP offers a compelling package. If the goal is sharper lines, a premium surface finish, and a paintable canvas for meticulous color matching, FRP has the edge. The choice depends on goals, budget, and how the owner values long-term appearance and maintenance.

Rethinking the Inspira-Influenced Rear Bumper: Polypropylene Hope, Fiberglass Reality, and the Economics of Fitment

When the aftermarket world starts talking about a rear bumper that visually echoes a beloved performance silhouette, the material behind the façade often becomes the quiet turning point. This chapter, anchored by the topic of the Inspira-inspired rear bumper and its PP material questions, moves beyond glossy photos and quick price checks. It looks at what the term PP—polypropylene—promises for a bumper cover, what fiberglass or fiber-reinforced options actually deliver, and why the economics of production, customization, and fitment matter as much as the initial sticker price. The dialogue here is not a battle between brands but a conversation about engineering tradeoffs, lifecycle costs, and how buyers interpret “performance” when they stand in front of a bare unpainted panel, waiting for the painter and the installer to finish the job.

Polypropylene is widely celebrated in aftermarket bumpers for its低 cost and mass production capabilities. It is the material most suppliers lean on when they want to cover a broad market quickly. In large manufacturing hubs, you can find tooling and molding ecosystems that support high-volume PP bumper covers with tight tolerances and predictable cycles. The appeal is clear: lower unit cost, faster fulfillment, and the comfort of a known set of physical properties. Yet the cheapness of the base resin does not tell the whole story. A bumper is not just a single material block; it is a complex assembly of design, engineering, and finishing steps that determine how well the part actually performs on the road.

What unfolds when you push past the supplier price tag is a more intricate narrative about how a piece is designed to work in real driving conditions. The typical PP bumper cover relies on injection molding to shape the outer silhouette. Inside, it often requires reinforcement and mounting provisions that align with the vehicle’s underlying structure. But there is a catch: many enthusiast-grade rear bumper concepts that imitate the look of a higher-performance model deliberately trade some of that injection-molded ease for stiffness, sculptural fidelity, and surface finish. That is where fiberglass or other fiber-reinforced options enter the discussion. A fiber-based bumper, often labeled as FIBER or FRP (fiber-reinforced polymer), starts as a different kind of project: a hand-layup or resin-infused process, where a layup of fiberglass cloth or mats is saturated with resin to produce a rigid shell. The result can be a bumper with sharper lines, crisper detailing, and a more substantial surface that responds well to finishing work. But it carries a heavier price tag in labor, time, and paint preparation, and it demands careful curing and post-processing to achieve a uniform, seamless appearance.

In the marketplace, this distinction has real implications for the total cost of ownership. PP bumpers benefit from economies of scale and predictable, repeatable manufacturing cycles. Fiber bumpers, whether used for a direct silhouette match or a bespoke interpretation, depend on skilled labor and multi-step finishing. The material cost may be higher, but so too can the cost of finishing, sanding, and precise color matching. And because surface fidelity matters when a panel sits in a driveway or a showroom, the post-processing requirements are not optional. A high-gloss, paint-ready FRP surface can demand more meticulous prepping, compared with a finished, pre-primed PP shell that is ready for coating after minor prep.

The chapter’s core point, however, is not simply “which material is cheaper” but how the entire supply chain shapes the final price. A tiered evaluation framework used by suppliers highlights several factors beyond unit price and minimum order quantity. Engineering flexibility, the ability to customize the part’s geometry to improve fitment with specific subframes, mounting points, and adjacent panels, all play into the cost. When a supplier can tailor a bumper’s geometry to better align with unique vehicle variants or trims—while preserving the intended silhouette—manufacturing becomes a service as much as a product. This is particularly relevant when the bumper draws aesthetic cues from a high-performance model but is intended for a different platform. In such cases, the “look” can be achieved through careful sculpting and finish work, even if the core material is PP. Conversely, if the design requires additional internal ribs, stiffening foams, or integrated lighting pockets, even a PP-based part can incur meaningful costs.

Market-visible prices often reflect these subtleties. A listing for an EVO X-inspired rear bumper, advertised as PP, can appear as a compelling value proposition. Yet the broader landscape shows a spectrum of realities. Some listings emphasize the “1:1 original” fit or the presence of a Taiwan-origin fabrication, which can influence perceived quality and, by extension, price. On the other hand, there are complete body kit bundles that bundle multiple components—front bumper, rear bumper, side skirts—at a single price point, suggesting a bundled savings model that makes the per-piece price seem more attractive. The key takeaway for a buyer is to parse not just the sticker price but the scope of what is included, the expected finish, and the ease (or difficulty) of achieving a factory-like appearance after paint and assembly.

A telling illustration of this complexity can be found in the actual material labeling of an Inspira rear bumper marketed as EVO-10 compatible. The part is described as a “fiber” bumper rather than PP, signaling a fiberglass-based approach rather than injection-molded PP. This distinction is not merely semantic; it points to a different pathway for production, a different set of finishing steps, and a different set of expectations for weight, rigidity, and repairability. The visual appeal of a bumper silhouette—its lines, the way it curves around wheel wells, and how it aligns with adjacent panels—can be achieved in both PP and fiber, but achieving the same level of surface flatness and paint readiness often requires different stages of surface preparation and primer systems. In many enthusiast communities, the fiber option is valued for its ability to be shaped with high fidelity to the target design, while PP is praised for its resilience to minor impacts and ease of mass production. In practice, the decision is rarely a simple matter of price; it is a question of how the part will be used, maintained, and refinished over years of ownership.

For readers who want a concrete reference point without losing sight of the broader picture, consider how a dedicated Evo X rear bumper catalog might present options. A specific internal page dedicated to 2008-2015 Mitsubishi Lancer Evolution X rear bumpers showcases the kind of product family that a hobbyist or professional installer might explore when seeking a direct replacement or a commemorative design cue. The page exists within the same ecosystem that hosts a wide range of bumpers, including those designed to emulate a high-performance silhouette, while also catering to different materials, colors, and finish levels. The important implication is that buyers must weigh not only the appearance but the material, the production process, and the practical implications for installation and ongoing maintenance.

From a practical standpoint, choosing between PP and fiber comes down to the expected use case. If a bumper is intended for daily street driving with occasional curb contact, PP’s forgiving nature and lighter weight can offer a practical advantage. If the goal is an eye-catching show car with precise lines and a high-gloss shell after paint, a fiber approach—despite higher upfront costs—may deliver superior surface quality and a more authentic reproduction of the silhouette’s curves. In either case, the installation throws its own challenges: mounting points must align, mounting hardware must be compatible, and the repainting process must account for the bumper’s material-specific priming and top-coat requirements. For a kit that places emphasis on authenticity of form, the finishing stage is as important as the casting stage. A well-chosen bumper is only as good as the paint job and the undercarriage fitment that holds it together during road use.

To help readers navigate this terrain, a pragmatic approach is essential. Start with a clear definition of what you want from the bumper: cost ceiling, intended usage, desired weight, and finish expectations. Then examine the supplier’s capabilities: is the part a direct PP injection-molded shell, or a FRP piece requiring extensive surface work? Are there structural reinforcements or mounting adjustments that will affect fitment? Are there customization options that enable a closer match to the exact silhouette you want without sacrificing practicality? These questions often determine whether the best value comes from a straightforward PP cover or a fiber-reinforced alternative that better mirrors the intended design language.

The forum discussions and catalog pages often reflect a shared understanding: there is no one-size-fits-all answer. The evocative look of an Evo X-inspired rear bumper can be achieved in multiple ways, and the material choice will depend on how the owner plans to use the vehicle, how much time and money they are willing to invest in finishing, and how much weight they are prepared to carry in the rear end. In this sense, the PP material promise is not a universal fix but a practical option within a broader spectrum of possibilities. The Rivals of similar projects repeatedly remind buyers that the most satisfying outcome seldom comes from chasing the lowest price; it comes from aligning the material choice with the driver’s ambitions, the caretaker’s skill, and the shop’s capacity to deliver a finished, paint-ready product that truly supports the look and feel of the intended design language.

Internal resource for further exploration: 2008-2015-mitsubishi-lancer-evolution-x-rear-bumpers

External resource: https://www.ebay.com/itm/B1285-PROTON-INSPIRA-LANCER-REAR-BUMPER-EVO-10-FIBER-NEW-UNPAINTED/374567891234

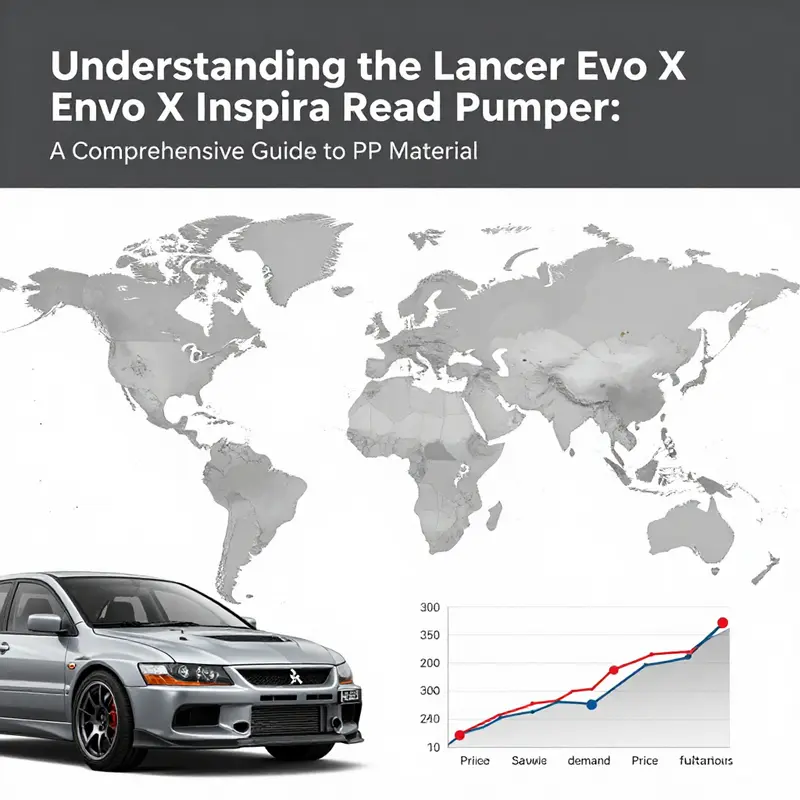

Material Echoes: How Polypropylene Bumpers Are Shaping the Aftermarket Landscape for Evo X-Inspired Designs

Material choice often sits in the shadow of aesthetics and fitment, yet it quietly governs how a replacement bumper behaves, repairs, and ages. In the world of rear bumper replacements that aim to mimic or align with a high-performance silhouette, the polypropylene (PP) option sits at a critical intersection of price, processability, and practicality. The narrative around PP bumpers in this niche is not merely about plastic vs. composite; it is about how a market driven by cost-conscious enthusiasts negotiates performance, repairability, and availability across a regional aftermarket ecosystem. What begins as a straightforward swap grows into a study of supply chains, material science choices, and the subtle psychology of ownership in a segment where the difference between a factory panel and an aftermarket stand-in can influence everything from DIY repaint times to how a car’s rear end is perceived from curbside.

First, the material story matters. Polypropylene has become a staple in many aftermarket front and rear bumpers because it offers a practical blend of impact resistance, flexibility, and cost. Its ease of molding makes 1:1 replacement shapes attractive to buyers who want a straightforward swap rather than a bespoke build. In markets where customers expect quick turnaround and predictable pricing, PP provides a baseline that is difficult to beat when the goal is to restore a vehicle’s original look without a premium on materials. Yet, the PP story is not universal. There are listings and catalogs that market rear pieces with a silhouette inspired by a well-known performance model but use a different core material—fiber-reinforced plastics, for example. These fiber-based components often advertise new, unpainted condition, and they tout rigidity rather than the impact-absorption profile typical of PP. The presence of such fiber options underscores a practical reality: buyers must read the material spec carefully, because a “similar shape” does not guarantee the same performance envelope in a crash, in UV exposure, or during repaint work.

A closer look at the regional market shows a clear pattern. Southeast Asian markets, with Malaysia as a focal point, exhibit active demand for PP rear bumpers that claim 1:1 fitment and compatibility with legacy performance-oriented silhouettes. A prominent listing from a well-trodden e-commerce platform highlights a PP bumper advertised with 1:1 fitment to the original design. It is specifically noted as made from PP, with Taiwan as the manufacturing origin. This combination—geographic focus, explicit material, and a direct-fit claim—helps explain why PP bumpers enjoy steady traction in these markets. For a buyer, the practical takeaway is that, in this segment, price stability and compatibility drive purchasing decisions more than rare-material prestige or engineering pedigree.

Direct-fit claims matter precisely because the aftermarket ecosystem is, by necessity, a patchwork of imperfect reproductions. The ideal of a perfect, factory-original replacement hinges on precise mold geometry, consistent resin chemistry, and flawless paint compatibility. In practice, a buyer evaluating PP options must reconcile several realities. First, PP’s performance can degrade under prolonged UV exposure if not stabilized properly, and repainting a PP bumper can be more challenging than with some fiber composites that take paint differently. Second, even when a product is marketed as “1:1” and “OEM-like” in fit, the mounting points and the bracket interfaces must be spot-on. Third, color matching remains a practical hurdle. A unpainted PP bumper is a clean slate for color technicians, but the real world shows that batch variations, molding imperfections, and even post-mold shrinkage can complicate a perfect shade match. These are not barriers to use but realities buyers weigh when calculating total repair costs and downtime.

Material diversity in this niche is also driven by the trade-offs buyers are willing to accept. In the same marketplace where PP bumpers are popular for their cost-to-performance weight, other materials offer different strengths. Thermoplastic urethane (TPU) is lauded for its flexibility and impact resistance, particularly in low-speed collision scenarios where the bumper may flex rather than crack. Fiberglass-reinforced polyester (FRP) brings rigidity and a cleaner surface for high-quality finishing, albeit at the cost of higher brittleness under certain impact conditions and more intensive repair work. Carbon fiber, of course, offers lightness and stiffness but at a price that moves into the premium tier and raises repair complexity. The PP option, by contrast, sits in the middle—more forgiving during tweaks and maintenance than FRP or carbon fiber, while typically cheaper to purchase and repair than composites. This triad of material options explains why a robust PP aftermarket exists alongside higher-end alternatives: different owners have different thresholds for weight, resilience, and the total cost of ownership.

The market signals captured in recent reports point to a steady, if specialized, demand rather than a mass-market surge. The supply chain for PP bumpers—particularly those marketed as direct replacements with credible fitment—appears to leverage a network that includes Taiwan as a production locus. This is meaningful in two ways. First, it hints at a manufacturing ecosystem that has evolved to balance cost with quality control, using established plastic processing expertise to deliver consistent parts at scale. Second, it suggests that regional distributors can secure stock with predictable lead times, a crucial factor for shops and showrooms that rely on quick replenishment. In practice, buyers and shop technicians gauge availability by following showroom visits, social-media announcements, and marketplace restocks. The dynamic is not about a single catalog or a single supplier; it is about a living supply chain that can respond to demand spikes—whether from a new wave of enthusiasts entering the scene or a seasonal shift when replacement parts are more commonly needed after track days or road incidents.

The distinction between a “true PP” bumper and a fiber-based remnant that merely imitates the silhouette becomes more than academic when a buyer contemplates repairability, repainting, and long-term durability. A fiber-backed part may deliver excellent rigidity and a factory-like surface for finishing, but it can demand different repair techniques, different primers, and potentially more cautious handling during installation. PP, on the other hand, tends to tolerate a wider window for adhesive curing and paint adhesion, provided the surface is prepared correctly. This practical nuance matters because most buyers in the target markets aim to complete a job in a reasonable time frame and with predictable costs. The safer path is to scrutinize the material specification, confirm the supplier’s stated resin type, and consider the local availability of compatible paints and primers. The risk of misalignment between expectation and reality is minimized when buyers recognize that the term “inspired” or “similar silhouette” may hide a material reality that carries different performance characteristics and repair implications.

In this environment, the narrative around 1:1 fitment is essential but not sufficient. Fitment has to be paired with an understanding of how the part behaves in the heat and humidity cycles of a tropical climate, and how it ages when exposed to aggressive road grime, road salt in certain markets, and the common eye of the spray gun. The availability of unpainted PP bumpers means that ambitious owners or professional painters can tailor the finish to their personal preference, but it also places more responsibility on the installer to prepare the surface properly and to monitor color matching under varying lighting conditions. The market’s optimism about PP is balanced by practical caution: readers should not assume that a low price implies a flawless product that requires no follow-up work.

A related and equally important thread in this discussion is the role of information flow. As enthusiasts navigate this space, showrooms and online platforms become primary educators. The vibrant sales channels—both physical and digital—allow buyers to compare prices, check fitments, and evaluate optional add-ons such as pre-primed or unpainted options. In the absence of a centralized OEM catalog for these specific aftermarket pieces, buyers rely on real-world feedback and documentation from vendors and fellow enthusiasts. For a broader context, see the historical rear-bumper catalogs that cataloged the Evo X lineage and its derivatives, where vendors maintained the 1:1 shapes and offered a spectrum of material choices. This historical perspective helps explain why, even as new versions of the silhouette emerge, the market continues to value a reliable, clone-friendly, and cost-conscious PP option that can be installed with conventional hand tools and standard body-shop practices. For readers curious about how the Evo X rear bumper family has been historically addressed, you can explore a detailed reference on 2008-2015-mitsubishi-lancer-evo-x-rear-bumpers.

External reference and context further illuminate the material landscape. A representative listing from an international marketplace demonstrates the fiber-based route, showing how some vendors market an Inspira/Evo-10 styled bumper in fiber with a new, unpainted finish. This contrast between a fiber option and a PP option underscores that the aftermarket space is not monolithic; it is pluralistic, with multiple materials coexisting to serve different budgets and repair philosophies. Buyers are well-served to treat the PP option as one component of a broader decision matrix, rather than the sole solution. The matrix includes the probability of faster repaint cycles, simpler repairs with readily available primers and topcoats, and a price envelope that remains accessible for enthusiasts who want performance cues without a premium tag. For readers who want to see a concrete example of fiber-based offerings that glow under showroom lights, an external listing provides a tangible data point about the fiber route and its market presence.

In sum, the PP bumper market for this family of vehicles sits at an interesting crossroads. It is simultaneously a consumer-focused solution for quick, affordable restoration and a signal of the broader shift toward accessible materials in the performance-car aftermarket. Buyers benefit from understanding the material core, recognizing the reliability of a 1:1 fit claim, and weighing the long-term ownership costs against the initial price tag. The ecosystem thrives on transparent specifications, credible fitment data, and accessible channels for purchase and installation. As the market continues to evolve, the PP path will likely maintain a steady presence, supported by regional demand, evolving manufacturing capabilities, and the ongoing appetite of enthusiasts who want a practical, visually cohesive, and durable rear end for their high-performance-inspired projects.

Internal reference: 2008-2015-mitsubishi-lancer-evo-x-rear-bumpers

External reference: https://www.ebay.com/itm/B1285-PROTON-INSPIRA-LANCER-REAR-BUMPER-EVO-10-FIBER-NEW-UNPAINTED/374567891234

Final thoughts

Understanding the specifications, manufacturing processes, performance, cost analysis, and current market trends of the Lancer Evo X Inspira rear bumper made from polypropylene allows business owners to make strategic decisions. By leveraging this comprehensive knowledge, businesses can position themselves advantageously in the competitive automotive market, ensuring they meet customer expectations and maintain a robust inventory of essential parts. The insights outlined in this article can serve as a foundation for navigating the complexities of the automotive aftermarket.