The Mitsubishi Evo 8, renowned for its performance and racing heritage, has become a coveted engine choice for enthusiasts and businesses alike. With a wide array of components and complete performance kits available, understanding what to look for and where to source these products effectively is crucial for business owners operating in the automotive sector. This article delves into the Evo 8 engine components available, high-performance kits that elevate vehicle performance, and effective strategies for choosing reliable suppliers to enhance inventory and customer satisfaction.

Chasing the Evo 8 Engine: Markets, Mastery, and the Quest for Reliable Power

The search for an Evo 8 engine or its essential components unfolds like a pilgrimage through a crowded marketplace where performance rides alongside risk. The Evo 8, a car that fused rally heritage with street-legal aggression, continues to attract builders, racers, and weekend tuners who want power with a checklist of dependability. In this chapter, we wander through the market realities—where complete cylinder heads and refurbished rocker systems sit beside turbocharger upgrades and comprehensive overhaul kits—while keeping a steady eye on quality signals that separate a solid purchase from a costly misstep. The aim is not simply to catalog parts, but to knit a practical understanding of how to evaluate supplier capability, validate performance data, and align choices with the long-term reliability that true Evo 8 power demands. The journey begins in the broad, sometimes noisy terrain of online marketplaces, where the language of engines—heads, turbos, rings, seals—becomes a shorthand for what a buyer must test for, compare, and ultimately trust.

Across the globe, platforms that host aftermarket and remanufactured components have become the default highway for Evo 8 parts. The reality is that a complete cylinder head, a core component that determines air flow, combustion efficiency, and ultimately peak power delivery, can appear in listings with alarmingly low price tags. A head listing priced at just a few hundred dollars, offered with a minimum order of one piece, can seem almost too good to ignore to someone seeking a quick fix or a budget-compatible rebuild. Yet price alone can mask a host of variables: the quality of alloy, the precision of valve seats, the integrity of the porting, and whether the component has undergone any form of quality validation. This tension—between affordability and reliability—is at the heart of every Evo 8 engine purchase decision. The cylinder head is not a cosmetic piece; it is the engine’s air-handling heart, shaping how air enters the cylinders, how it mixes with fuel, and how the resulting flame travels through the chamber. A misstep here can translate into loss of efficiency, elevated temperatures, and, over time, accelerated wear or even catastrophic failure.

Another category in this marketplace is the rocker system—rocker arms and the rocker cover. These components are integral to valve timing and sealing. The rocker cover protects the top of the engine, while the arms control the motion of the valves in sync with the camshaft’s rotation. In practice, many Evo 8 builders turn to refurbished or OEM-aligned options when they rebuild or upgrade an engine, balancing the desire for factory-like tolerances with the realities of availability and budget. A typical scenario is to source a pre-owned cover and arms that pair well with a rebuilt head, enabling a cleaner restoration of the engine’s top-end while avoiding the higher price of a brand-new, purpose-built set. The negotiation here is nuanced: buyers look for documented wear patterns, evidence of proper seating and seating surface condition, and assurances that the components have not been compromised by prior overheating scenarios or improper torque histories. The value proposition rests on a quiet yet persistent confidence that the parts will hold their seal and maintain proper valve timing at high RPMs and under boost.

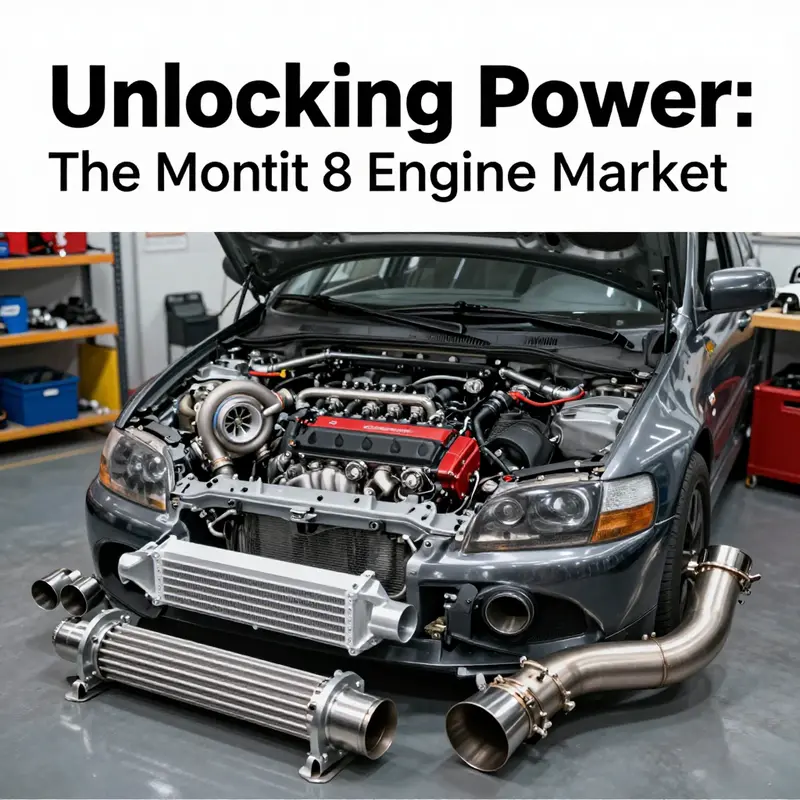

A different thread in the Evo 8 engine market speaks to the turbocharger—the heartbeat of the car’s forced induction system. The stock turbo, designed to deliver a strong response and a balanced power band, becomes a focal point for enthusiasts seeking a broader power envelope. For some, the goal is a modest but meaningful upgrade that preserves street manners while shaving seconds off lap times or quarter-mile runs. For others, the aim is a more ambitious jump into the realm of big-power capability. In either case, the decision to upgrade cannot be divorced from the realities of turbine sizing, compressor maps, and the turbine housing’s ability to maintain spur and surge margins across operating ranges. A higher-capacity unit can unlock 350 horsepower and beyond, but it also demands supportive modifications: upgraded intercooling, fuel delivery, engine internals that can withstand elevated boost pressure, and a cooling strategy robust enough to prevent heat soak on long sessions. The trend toward larger, more responsive turbos is accompanied by a cautionary note: the system must be matched to the engine’s fundamental strength and durability. The Evo 8’s legacy rests on its compact, responsive architecture; any upgrade must preserve this immediacy while expanding the power ceiling without inviting reliability problems.

Beyond the surface-level parts, the marketplace also features more comprehensive, engine-focused packages—often described in terms that imply a complete solution: a crate engine, a long-block, or an overhaul kit designed for deep engine restoration. Crate engine solutions promise a curated assembly with components validated for compatibility and performance. Their appeal lies in the promise of an integrated, validated starting point that reduces the guesswork involved in sourcing individual parts from disparate suppliers. The real value, however, hinges on what “validated” means in practice: heat cycle testing, leakage testing, and cold-flow testing data are not mere accessories; they are the essential signals of a design’s resilience under the real stress of boost and heat cycling. In markets where suppliers demonstrate these checks—where a cylinder block has dimensions milled to tight tolerances, where valve seats meet precision standards, and where crankshafts are balanced with dynamic finesse—there is a greater likelihood that the resulting engine will perform not only at the moment of purchase but for tens of thousands of miles and a succession of track days or drag runs.

The practical navigator’s toolkit for this landscape is simple in theory but demanding in practice. Start with supplier capability: a seller who can show photos or documents of CNC machining, valve-seat work, and dynamic balancing is signaling a seriousness about quality that mere listing verbiage cannot guarantee. In a market where a part can be bought for a price that seems almost too attractive to ignore, the presence of machining evidence and performance data becomes the decisive factor. The second criterion is quality validation: evidence that parts have undergone heat cycles and leakage testing, plus cold-flow data, suggests that the supplier has subject matter expertise and an engineering-backed process. This is not just about one-off tests; it is about a process that yields consistent results across lots and over the long term. The third criterion is compatibility and fitment: Evo 8 engines do not exist in a vacuum. They pair with a wide ecosystem of fuel systems, intercoolers, exhaust manifolds, and transmission configurations. A reputable supplier will be able to discuss tolerances, gasket interfaces, and timing components with a level of specificity that gives a buyer confidence in a trouble-free assembly.

But how does a buyer separate the valid, technically credible options from the price-led temptation that dominates some marketplaces? One answer lies in cross-referencing supplier performance claims with independent data points. Where possible, buyers should seek third-party validation—test results, performance lab data, or credible testimonials that reference the specific engine build and operating conditions. A credible seller who can point to a track-tested crate engine, or a rebuilt head that was bench-tested and leak-tested, provides a tangible bridge between the claim and the reality of use. The ethos here is not cynicism, but disciplined due-diligence. The Evo 8 is a high-strung platform with a devoted following; its power potential invites both careful planning and rigorous verification. The buyer who treats the engine as a system rather than a collection of parts is more likely to end up with something that performs in the real world and endures in the long run.

The role of a credible marketplace becomes more pronounced when we consider the broader ecosystem around the Evo 8 engine. A complete solution may come from a vendor that can claim full manufacturing capabilities, including careful material selection, precision machining, and rigorous testing. In this context, a supplier who can document process control, quality-control inspections, and post-manufacture testing data provides an assurance that the parts will behave as intended under boost, load, and temperature cycles. It is not merely about achieving a higher peak horsepower figure; it is about preserving engine integrity, reducing the risk of head gasket failures, oil leaks, or bearing wear that can lead to expensive repairs and downtime on track days. In practice, the marketplace rewards those who blend technical validation with realistic performance projections. An engine or component that can be expected to deliver consistent power while maintaining reliability—across a series of hot laps, daily commutes, and cold starts—constitutes genuine value.

Given the global nature of the Evo 8 market, buyers also navigate shipping, customs, and regional support considerations. A seller with robust manufacturing and testing data is more likely to offer reliable delivery timelines, precise part fitment, and clear warranty or return policies. The logistical piece, while perhaps less glamorous than raw performance figures, is the practical backbone of any successful Evo 8 engine project. When a buyer contemplates a motor, a head, or an assembly, they are weighing not only the mechanical fit but also the certainty that the part will arrive, perform as advertised, and stand behind its performance over the life of the engine. In this sense, the Evo 8 market mirrors the broader world of performance automotive engineering: excellence is a function of both design and discipline, of the parts chosen and the processes that validate them.

The global market’s complexity becomes more navigable when buyers approach with a framework that values both the artistry of tuning and the science of engineering. The chassis and the engine operate as a system; the engine’s breathing, combustion, and control interact with the suspension, transmission, and cooling. When a buyer commits to a complete or semi-complete solution, the best outcomes stem from a coherent plan that aligns the power unit with supporting subsystems. An engine compatible with a high-quality fuel system, a well-tuned intercooler circuit, and a robust cooling strategy will perform more consistently at a higher level than a piecemeal build assembled from disparate parts with uncertain provenance. In other words, the Evo 8 engine market rewards a holistic approach that treats the build as an integrated project rather than a collection of discrete purchases. This philosophy helps buyers avoid common pitfalls: mismatched tolerances, incompatible head gaskets, or turbocharger combinations that outrun the engine’s internal strength. It also channels the emotional energy of the project into a disciplined process, one that values repeatability, traceability, and post-sale support.

For those who prefer a more guided pathway, the market presents reliable signals in the form of vendor transparency and documented validation. A seller who can present machining records, balance reports, and test data offers not just a part but a traceable lineage of quality. The value proposition shifts from mere price to proven performance, from a quick fix to a durable solution. In markets where such transparency is standard practice, builders gain a productive shorthand for assessing risk. They can compare one crate engine’s validation package with another, weighing the depth of testing, the material quality, and the finish of the assemblies. The result is a more confident decision that aligns with the evo ethos: a car that is both exhilarating to drive and dependable enough to keep on the road or the track without the shadow of recurring failures.

As we close the loop on the Evo 8 engine marketplace narrative, it is worth touching on the practical steps a buyer can take to translate this understanding into a purchase that endures. Begin with a clear specification of what you need: is this a rebuild of the stock configuration, or a robust upgrade intended for higher boost and track use? Define your budget, but anchor it to the level of validation you require. Then, map potential suppliers against three pillars: manufacturing capability (do they CNC, machine, or balance in-house or via trusted partners?), testing and validation (are there heat-cycle, leakage, and cold-flow test data?), and post-sale support (what happens if a part arrives with a concern or fails under warranty?). The final step is the practical one: request documentation, demand test results, and, if possible, arrange a discussion with a technician who can interpret the data and translate it into real-world expectations for your build. The Evo 8 is a car that thrives on precision and timing. Treat the engine toward that standard, and the odds of a satisfying and enduring result improve markedly.

To connect this exploration with practical resources, one can glance at a widely cited listing that demonstrates how such components are marketed and validated in the global marketplace. That listing, which highlights a factory-issued complete cylinder head for a similar 2.0-liter, four-cylinder engine family, illustrates how suppliers position core components at accessible price points while also signaling the need for due diligence. While the specific engine family and model year in that listing may not be identical to the Evo 8, the underlying principles are transferable: understanding the part’s role, verifying build quality, and confirming compatibility with your intended setup.

For readers seeking related materials and cross-references, a deeper dive into Evo 8 parts and related projects can be found through a curated set of automotive parts resources. One internal link offers direct access to a page featuring Evo 8- and Evo 9-era components and upgrades, providing context on how compatible parts interact with the engine platform and the broader vehicle architecture. This internal reference can help readers explore the ecosystem without losing sight of the engine’s core role.

Internal link: brand-new-original-carbon-fiber-bonnet-hood-for-mitsubishi-lancer-evo-x

The journey through the Evo 8 engine marketplace is one of careful listening and disciplined selection. It is tempting to chase big horsepower numbers with flashy listings, but the most enduring builds hinge on the quiet, methodical validation of parts and the reliability that follows. The advice here is not to distrust the marketplace but to engage it with a plan: prioritize suppliers who can demonstrate manufacturing capability and data-backed testing, insist on compatibility checks, and budget for quality control as a core line item. In the end, the Evo 8 engine for sale is not merely a thing you acquire; it is a gateway to a built world—one where power is matched by trust, where every bolt torques to spec, and where the road, the street, and the track all become stages for a well-tuned, reliably powered machine.

External resources provide a broader technical frame for these decisions. For readers who want to see a concrete example of the external market data in context, the following listing offers a representative glimpse into how a complete cylinder head can appear in online marketplaces, including price ranges and ordering terms. This reference helps anchor the discussion in real-world dynamics and demonstrates the balance buyers seek between affordability and the assurance of quality.

External resource: https://www.alibaba.com/product-detail/Factory-Hot-Sale-4-Cylinders-2-0L-diesel_1600724527289.html

From Core to Completion: Navigating High-Performance Evo 8 Engine Kits for Real-World Reliability

The Evo 8 engine, built on the 4G63T platform, remains a focal point for builders who seek both streetable reliability and true performance. The best high-performance kits emphasize a coherent system where core machining, balanced rotating assembly, and precise tolerances work together with upgraded turbocharging, fuel delivery, cooling, and ECU calibration. Validation data such as thermal cycling results, leak-down checks, and cold-flow measurements help buyers understand durability beyond peak power. A well-designed kit integrates with upgraded turbo, intercooler, fuel system, exhaust, and engine management in a way that preserves reliability while increasing power. The result is a package that delivers meaningful gains with repeatable behavior and robust support. When evaluating options, look for transparent development stories, documented tolerances, clear warranty terms, and accessible technical support. Three pillars guide the decision: core quality, system integration, and aftercare. A thoughtful combination of these elements yields not just horsepower but confidence in daily driving, track sessions, and long-term ownership. External resource: https://www.kingtecracing.com/

Sourcing the Evo 8 Power: Building a Reliable Supply Chain for Engine Parts

Sourcing the Evo 8 engine parts is not about chasing the lowest price but about establishing a stable, validated supply chain that can endure high performance use. Enthusiasts want torque, quick response, and a set of parts that work together across track days and daily driving. The Evo 8 market is not a simple storefront; it is a network of suppliers, process validation signals, and engineering data that, when aligned, yields engines that perform reliably. The challenge is to sift through listings, spec sheets, and marketing claims to identify partners who can deliver durable hardware, repeatable quality, and effective after sales support. A reliable sourcing strategy starts with understanding where parts are made, how they are validated, and how buyers can build working relationships that last beyond a single purchase or project cycle.

In practice, credible sourcing rests on regional strengths. The automotive component ecosystem around China remains a key hub for performance Evo parts. Within this landscape two regional clusters stand out for their capacity to produce and validate high tolerance components. The first cluster is in Guangdong Province, with dense networks around Guangzhou and Shenzhen. These cities host many CNC machining facilities, seasoned engineers, and logistics links that enable fast turnaround and tight supply management. The second cluster is in the Yangtze River Delta, spanning Shanghai, Jiangsu, and Zhejiang. This area is known for precision engineering and advanced manufacturing often serving motorsport teams and OEM programs that demand tight tolerances and repeatable performance. Taken together, these regions offer capabilities from block casting and crank balancing to detailed test data that validate performance and reliability.

A practical approach is to identify suppliers who demonstrate in house competencies across the key steps of engine componentry. The most consequential capabilities are not merely assembly, but block machining with suitable roundness and surface finish, porting and gasket matching of heads with consistent volumes, crankshaft grinding and balancing to tight tolerances, and dynamic balancing of rotating assemblies. It is in these operations that precision becomes reliability. Buyers should seek verifiable evidence of process validation such as thermal cycling, leak down testing, and cold flow bench results. When a supplier can present these data sets alongside a documented quality management system, the likelihood of long term performance improves substantially.

To translate this framework into practice, buyers should look for suppliers who provide clear documentation of capabilities and an ongoing commitment to validation. A fully validated crate engine, for example, is more valuable than a bare block with a few components if there is no evidence of dyno testing or thermal cycling across operating conditions. In the absence of such evidence, buyers face risk of inconsistent tolerances, uneven valve seating, or imbalance that can degrade reliability over time. The best suppliers mitigate this risk by offering data driven validation packages, including complete dyno curves, fuel and ignition maps, and documented post test inspection results. For builders aiming to push Evo 8 setups toward higher boost or aggressive cam profiles, these validation artifacts are the difference between a reliable power band and a fragile installation.

The sourcing framework also considers quality certifications and collaboration with technical institutes. ISO certified operations signal disciplined quality management and process control. Partnerships with universities or research groups can accelerate adoption of advanced materials, improved heat management, and refined engine dynamics. For builders who treat their Evo 8 projects as ongoing programs, these relationships provide a foundation for continuous improvement and a framework for validating new ideas against rigorous tests. While certifications and collaborations are not guarantees of perfection, they indicate organizational maturity aligned with engineering rigor and long term reliability.

As buyers navigate this landscape, marketplaces and supplier directories become relevant. A careful approach is to favor suppliers that offer comprehensive manufacturing capabilities and a coherent package of services that can confirm build integrity from block to dyno. Practically, this means asking about CNC block tolerances, porting details, and valve seat processes; requesting evidence of crankshaft grinding and dynamic balancing; and reviewing test data that can be inspected and referenced. It also means evaluating a supplier’s willingness to share references or connect buyers with third party validation sources. This is not about chasing a perfect vendor, but about identifying a credible partner who provides traceability, repeatability, and ongoing support for a durable Evo 8 platform.

In the Evo 8 community it is common to encounter listings that imply full capability while offering only fragments of the validation narrative. A prudent buyer trains their eye to distinguish marketing from engineering practice. A robust sourcing plan therefore includes a validation checklist, a request for sample data or test results, and a negotiation posture that aligns price with the scope of validation, track record of delivery, and willingness to back up claims with data. The payoff is not merely a solid component but a link between quality and uptime: fewer failures, faster turnarounds, and the confidence that the engine build is supported by engineering fundamentals rather than luck.

For readers ready to translate these ideas into concrete buying choices, practical actions begin with clear build goals, mapping the parts ecosystem to those goals, and demanding evidence. Define whether the build aims for a reliable daily driver or a race oriented package that accommodates higher boost and aggressive cam profiles. Map the parts ecosystem, focusing on components that directly impact reliability, such as the block to head interface, deck flatness, valve seat consistency, and the balance of rotating assemblies. Demand evidence in the form of dyno data, thermal cycling results, leak down figures, and cold flow bench results. Favor suppliers who offer a complete validation narrative and strong after sales support with clear warranty language. Treat the relationship as a collaborative partnership that can evolve as the project grows, rather than a one time vendor transaction.

As you pursue reliable Evo 8 parts, a practical touchstone is to see how equipment and documentation fit into an engineering story. When a supplier can describe a build in terms of production steps, validation tests, and real world performance data, they provide a credible frame for planning future work. In markets where performance temptations can lead to corner cutting, a disciplined approach helps prevent downtime and misaligned expectations.

For readers looking to deepen their understanding of sourcing best practices, consider reviewing resources that discuss validation and testing practices for high performance engines. External references that explore credible sources and validation expectations can offer broader perspectives on Evo 8 parts sourcing and verification.

Final thoughts

In the competitive landscape of automotive parts and performance upgrades, understanding the Mitsubishi Evo 8 engine segment can significantly impact business success. With a variety of components available for sale, along with high-performance kits that can transform vehicle capabilities, the potential for profit lies in leveraging quality parts to meet customer demand. Additionally, the emphasis on securing reliable suppliers not only enhances product offerings but also guarantees the longevity and performance expected by the Evo enthusiast community. Focusing on these key areas will enable businesses to thrive in the rapidly evolving automotive market.