As the Mitsubishi Lancer Evolution X solidifies its legacy among car enthusiasts and racers, the demand for robust front bumpers has surged. From 2008 to 2015, this model captivated automotive hearts with its dynamic performance, but age and wear necessitate the quest for high-quality aftermarket replacements. This guide illuminates crucial details on the global supply chain, supplier insights, compatibility, and best practices for B2B procurement of Evo X front bumpers, ensuring you connect with the right resources for effective business expansion.

The Global Engine Behind Evo X Front Bumpers: Manufacturing Hubs, Materials, and Momentum

The front bumper is more than a face for the Mitsubishi Lancer Evolution X; it is a fused outcome of engineering intent, aerodynamic strategy, and a complex global supply chain that makes timely delivery of high-performance parts possible. When enthusiasts talk about the Evo X bumper, they often focus on design, fit, and finish. Behind those conversations lies a network of specialized manufacturers, regional strengths, and cross-border logistics that translate a concept into a market-ready component. This chapter traces that network, revealing how location, materials, and process maturity coalesce to create bumpers that not only replace damaged parts but also unlock new levels of performance for track-ready builds and high-end restorations alike. The narrative centers on a dominant truth: in the realm of Evo X front bumpers, the global supply chain is as decisive as any sculpted curve on the car itself, shaping what is possible for buyers, builders, and brands across the world.

China emerges as the dominant manufacturing hub for Evo X front bumpers because the country offers a mature, vertically integrated ecosystem that brings together mold making, composite fabrication, surface finishing, and packaging under close geographic proximity. The heart of this ecosystem sits in Guangdong Province, around the city of Guangzhou, where one of the world’s most concentrated clusters of automotive accessories manufacturers operates. In these industrial clusters, injection molding facilities, fiberglass (FRP) fabrication units, carbon fiber production lines, paint shops, and tooling experts operate within a few kilometers of each other. The result is a highly coordinated pipeline that reduces production bottlenecks, shortens lead times, and enables both rapid prototyping and steady bulk production. For B2B buyers, this translates into the ability to move from a single prototype to full-scale production runs with a level of agility that offshore suppliers often struggle to match.

At the heart of this geographic concentration is the logic of proximity—nearby suppliers can iterate on a design, test a fit against OEM tolerances, and complete cosmetic finishes in a tight loop. This is especially important for Evo X bumpers, which must align with the factory’s geometry and mounting points across various model years. Guangdong’s ecosystem extends beyond simply producing bumpers; it supports the entire lifecycle of a part—from mold design and material selection to surface finishing and packaging. This integrated capability helps ensure that a bumper not only adheres to dimensional accuracy but also carries the right surface texture, paint compatibility, and structural integrity required for performance-focused applications. The clustering effect reduces bottlenecks and accelerates time-to-market, enabling suppliers to offer flexible production models with MOQs that start at a single unit for prototypes and scale into hundreds of units per month for larger programs. Such scalability matters for restoration shops, race teams, and aftermarket specialists who need to balance cost efficiency with the demand for precise, repeatable parts.

Beyond Guangdong, regional specialization further refines the supply chain for Evo X bumpers. Zhejiang and Jiangsu provinces are renowned for their efficiency in injection molding and the tooling infrastructure that supports mass production. They emphasize affordable production of bumper covers using materials such as polypropylene (PP) and thermoplastic olefin (TPO), which provide cost-effective, high-volume options for replacement bumpers and more economical aeroclar variants. The mature tooling and process control in these provinces help lower unit costs while maintaining acceptable tolerances for non-performance-focused applications. In contrast, Guangzhou-based manufacturers leverage their strengths in advanced composites, including carbon fiber and FRP. For high-margin, performance-oriented projects—such as widebody conversions or OEM-style restorations that demand lighter components with a strong aesthetic—the carbon fiber route represents an attractive proposition. The contrast between these regional strengths illustrates a broader principle: the Evo X bumper market is not monolithic. It reflects a spectrum of materials and production philosophies that buyers can navigate depending on their performance goals, budget, and required lead times.

The resulting supply flow is a careful choreography of design, fabrication, and finishing. Mold design begins with CAD-driven concepts that align with OEM mounting interfaces while leaving room for weight reduction and aerodynamics tuning. In carbon fiber or FRP paths, layup schedules, resin systems, and curing cycles are optimized for stiffness, impact resistance, and surface fidelity. Surface finishing then follows—paint, clear coats, and protective coatings that not only provide aesthetic appeal but also resist road rash and environmental exposure. Close coordination across mold design, surface finishing, and packaging ensures that lead times are minimized. The ecosystem’s maturity helps shorten the distance from design brief to finished product, and in practice, lead times can be reduced by as much as thirty percent compared to more fragmented offshore alternatives. This acceleration matters as teams chase performance targets, test new configurations, or respond to market demand for specific colorways, finishes, or fitments that reflect regional examples of Evo X ownership.

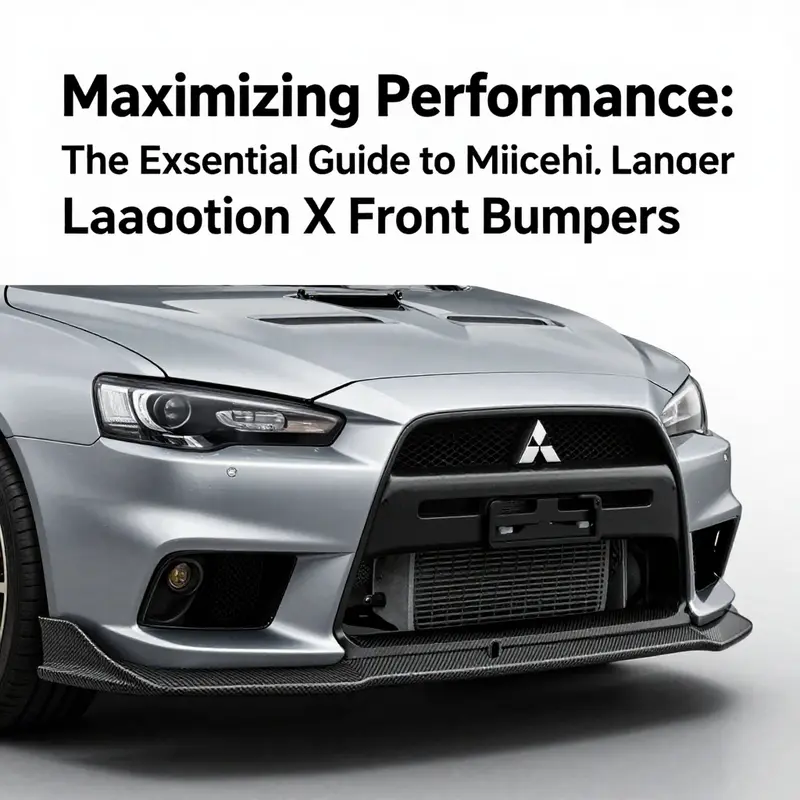

Compatibility remains a core consideration for buyers. The Evo X front bumper lineage spans model years 2008–2015, covering a range of variants and trim levels that share common front-end geometry while presenting specific mounting points or sensor placements in particular markets. In this context, the Chinese manufacturing hub’s ability to deliver both OEM-replica ABS bumpers and carbon fiber kits becomes a strategic advantage. ABS bumpers serve as accurate, durable, and economical replacements that preserve factory aesthetics and crash-energy management, while carbon fiber kits offer the performance gains of weight reduction—typically around 30 percent lighter than traditional fiberglass components—and the potential for enhanced aerodynamics and track responsiveness. The availability of both paths underlines the value of a diversified supply chain: buyers can select from standard replacement options to high-performance aero packages based on budget, weight targets, and the intended use case, whether restoration, street performance, or competition-grade builds.

To illustrate how a practical buyer navigates this landscape, consider the integration of a carbon-fiber front bumper kit as part of a broader Evo X build. The kit would typically feature a carefully engineered layup to balance stiffness and torsional strength, a finish that accepts a color-matched coating or a raw-carbon aesthetic, and integration with existing mounting points and air dam interfaces. In markets where vehicle weight reduction is prioritized for track performance, carbon fiber brings a measurable advantage that translates into improved acceleration, braking, and cornering stability under high-speed conditions. At the same time, the presence of a robust, low-MOQ development path in the Guangdong cluster means that prototyping a new configuration—such as a carbon lip or a lightweight insert—can be done quickly and with manageable risk. This is particularly important for teams conducting ongoing aero development or shops experimenting with aesthetic variants that demand precise fitment while maintaining the structural integrity of the bumper assembly.

For buyers seeking to anchor their sourcing strategy in tangible options, a widely cited reference path in the ecosystem is a corner of the market that demonstrates how color and finish choices come together with form and function. A specific front bumper variant illustrates how a color-compatible, performance-focused bumper can be sourced as a comprehensive package that includes mounting hardware, paint-ready surfaces, and consistent quality assurance across production slots. Within this context, the Evo X bumper ecosystem demonstrates how a single SKU can morph into a family of options—spanning standard plastics, reinforced FRP, and high-strength carbon fiber—while preserving fitment compatibility across the model years. The result is a flexible procurement environment in which buyers can pursue a mix of low-cost replacements and high-performance aero components that are designed to work with the Evo X’s distinct styling cues and aerodynamic goals.

For B2B buyers, the procurement path is optimized by a set of well-established practices that align with the realities of a multi-region supply network. First, material quality verification becomes essential, with emphasis on certified materials and traceability. Second, evaluating technical specifications—dimensional tolerances, mounting interfaces, weight, and aerodynamic parameters—ensures the part meets both performance and safety expectations. Third, certifications such as ISO or other industry standards provide a baseline for quality management and supplier reliability. Fourth, negotiating terms that include volume discounts, extended warranties, and flexible shipping—whether FOB, CIF, or other arrangements—helps manage total cost and risk across long-term programs. Fifth, relying on verified platforms that offer supplier vetting and performance history—whether for ABS or carbon fiber variants—helps buyers reduce the uncertainty that often accompanies cross-border sourcing.

These best practices are not merely theoretical; they reflect the realities of a market where a single bumper can travel from a coastal plant in Guangdong to a workshop in Europe or the Americas within days, thanks to tightly knit logistics networks and standardized packaging that protects the part during transit. The practical implication for buyers is clear. When planning Evo X bumper projects, a well-structured supply chain approach that leverages regional strengths can yield not only cost efficiencies but also better alignment with project timelines, ensuring that a build can progress from concept to completion with fewer interruptions. As a result, the Evo X’s front bumper community benefits from a robust, adaptable system that supports both mass-market replacements and customized, high-performance aero programs that push the boundaries of what the chassis can do on the track or on the street.

An illustrated thread through this network reveals a single critical insight: the Evo X bumper ecosystem is more than the sum of its parts. It is the product of regional specialization, scalable manufacturing, and coordinated logistics that collectively enable a diverse range of outcomes for buyers. The Guangzhou cluster provides rapid prototyping and agile production; Zhejiang and Jiangsu deliver cost-effective mass production; Guangzhou’s composite capabilities enable high-performance paths. The combination reduces cost, shortens lead times, and expands the range of options for builders who demand precise fitment and robust durability in endurance contexts or weekend-warrior street builds. The result is a supply chain that can respond to changing demand patterns—whether a surge in aftermarket carbon fiber demand driven by track teams or a steady flow of OEM-style replacement bumpers for aging Evo X fleets—without sacrificing quality or consistency.

For readers seeking a concrete pointer into the broader ecosystem, a representative path can be explored through a front bumper option that demonstrates the practical integration of red-color finishes and OEM-aligned geometry for Evo X front-end styling. This specific variant, which embodies the red-color finish and the Evo X’s established front-end relationship to its fenders and cooling ducts, serves as a helpful anchor for understanding how a supplier can deliver a cohesive, coloring-compatible component that respects the car’s signature lines while offering the possibility of enhanced aero performance. The link to this variant provides a tangible example of how color and form can be harmonized in a single, drop-in part within a globally sourced supply chain. cz4a-lancer-evolution-evo-10-front-bumper-red-color

Rev Up Your Ride: CZ4A Lancer Evolution EVO 10 Front Bumper in Striking Red

External reference: for an external resource that illustrates the scale and capabilities of carbon-fiber Evo X bumpers within the global marketplace, see the following listing, which highlights automotive-grade carbon-fiber construction and performance-focused design. Alibaba listing

The Evo X bumper story, then, is a story of a global supply chain that blends regional strengths, material science, and modern logistics into a single, scalable solution for enthusiasts and professionals alike. It is a narrative that continues to unfold as new iterations, finishes, and performance targets emerge, each leveraging the same core framework: a network that can deliver precise fit, consistent quality, and the right combination of weight savings and structural integrity to meet the evolving demands of the Evo X community.

Supplier Capabilities and Performance Features: Sourcing Front Bumpers for the Lancer Evolution X

The market for front bumpers tailored to the Lancer Evolution X blends precision engineering with supply-chain efficiency. For B2B buyers, success depends on understanding how supplier capabilities, material choices, and design features combine to meet performance and durability expectations. This chapter explains how manufacturing clusters shape lead times and costs, why material selection matters for track and street use, which product features deliver real-world benefits, and how to evaluate suppliers for consistent, scalable procurement.

Regional specialization drives speed and value. Around Guangzhou and the greater Guangdong province, manufacturers have built an ecosystem that houses injection molding, fiberglass layup, carbon fiber shops, paint facilities, and toolmakers within short distances. That proximity reduces handoff time between processes and cuts production bottlenecks. For a parts buyer, that translates to shorter lead times and flexible minimum order quantities. Suppliers there can handle single-piece prototypes, small pilot runs, and high-volume batches without losing consistency. This geographic concentration also simplifies logistics for component sourcing such as fasteners, reinforcement brackets, and finishing materials, lowering per-unit costs.

Material innovation is central to product differentiation. Carbon fiber remains the premium choice for buyers seeking weight savings and stiffness. Compared with traditional fiberglass, carbon fiber assemblies typically weigh roughly 30 percent less for similar dimensions. The weight reduction improves handling responsiveness and reduces unsprung mass when combined with complementary upgrades. Carbon also resists heat better and maintains structural integrity under higher stress cycles. Fiberglass, or FRP, offers a balance of cost and finishability. It accepts repairs and custom shaping more readily than carbon, making it ideal for cosmetic restorations and low-budget performance builds. ABS plastic provides impact resistance and dimensional stability that closely mimic OEM fitment. ABS is a strong option when retaining factory crash characteristics or matching body panel tolerances is crucial.

Design choices translate directly to aerodynamic and service benefits. Modern aftermarket bumpers are not mere visual replacements. Curved lips, integrated canards, and shaped air dams can reduce drag while increasing front downforce. When optimally designed, these features lower aerodynamic drag by measurable percentages and improve high-speed stability. Central openings and optimized side ducts also support improved engine bay cooling. For turbocharged Evo X variants, additional airflow to intercoolers can reduce intake temperatures by keeping charge air cooler under sustained stress. Practical design elements such as adjustable mounting points allow ±5mm of alignment tolerance. That small range simplifies installation after suspension changes or fender modifications and reduces rework for shops handling fitment.

Customization options affect both appeal and cost. Carbon weave patterns such as plain, twill, or unidirectional influence aesthetics and perceived value. Twill weaves often present a balanced look favored by enthusiasts, while unidirectional fibers advertise a race-oriented performance image. Clear-coat finishes, pre-preg versus wet-layup construction, and optional reinforcements at mounting interfaces also define durability. Buyers should request sample pieces or detailed photos under consistent lighting to assess clear-coat thickness, weave uniformity, and edge finish. For painted assemblies, matched paint codes and solvent testing ensure adhesion and long-term finish stability.

Certification and traceability reduce procurement risk. Reputable suppliers will provide documentation for material grades and factory certifications such as ISO 9001. These documents help ensure consistent process control and product repeatability. Certifications do not eliminate the need for inspection but guide which suppliers can scale reliably. Material test reports for carbon fiber or resin batches, along with process control logs for curing cycles, provide additional assurance for performance applications. For products intended for regulated markets, CE or other local compliance marks are relevant, depending on jurisdiction.

Supplier selection hinges on verification and testing. Start by validating platform credentials on major B2B marketplaces. Look for verified supplier badges and documented transaction histories. Once candidates are shortlisted, require physical samples. Sample testing should cover fitment against an OEM reference, finish inspection, and a lightweight structural test. For track-focused components, fatigue cycling of mounting points and impact resistance tests are advisable. If possible, arrange a virtual or on-site factory audit to assess tooling quality, worker skill, and quality control processes. Inspect the molds, layup area cleanliness, curing ovens, and paint booths. A supplier with in-line quality checks and statistical process control will typically deliver more consistent results.

Contract terms matter as much as part quality. Negotiate minimum order quantities that allow economical prototyping and scaling. For initial orders, secure clear warranty terms and an agreed inspection window upon receipt. Use escrow or milestone payments for higher-risk suppliers and include penalties for late delivery or out-of-spec parts. Shipping terms should be explicit, whether FOB or CIF, and lead times must account for seasonal capacity fluctuations. Many factories offer tiered pricing that rewards predictable, repeat orders. Locking in quarterly forecasts can unlock better prices and priority scheduling.

Pricing varies by material and complexity. Carbon fiber components command higher prices, often several times those of FRP or ABS alternatives. Within carbon offerings, complexity of ducts, integrated lights, or fog housings increases cost. Typical market ranges show lower-cost FRP or ABS full bumpers priced to be accessible to repair shops, while race-ready carbon assemblies appear at premium price bands. Buyers should balance margin expectations against product positioning. For distributor models, offering both an ABS OEM-replica and a premium carbon variant covers more customer segments. Keep packaging and branding consistent across variants to maintain perceived value and ease of stock management.

Logistics and packaging deserve careful attention. Well-packed bumpers survive long shipping legs. Use strong corner protection, foam inserts at mounting points, and crush-resistant outer crates for international freight. Label inner boxes with SKU, production batch, and color code. This aids warehouse staff and streamlines returns or warranty claims. For cross-border shipments, request export documentation, customs harmonized codes, and clear instructions for palletization. Freight consolidation options can reduce per-unit costs for initial shipments.

After-sales support separates reliable suppliers from casual vendors. Warranties covering structural defects and fitment issues reduce downstream headaches. Suppliers who offer a one-year warranty and a clear RMA process make it simpler to resolve issues without disrupting retailer operations. Require photos and defect descriptions during claims and agree on repair versus replacement remedies. For high-value parts, an advance replacement policy while a claim is investigated reduces end-customer frustration.

Quality control checkpoints are non-negotiable. Establish incoming inspection criteria at your receiving dock. Check dimensional tolerances against CAD references or OEM templates. Inspect finish quality under standardized lighting and measure clear-coat thickness where applicable. For carbon parts, verify resin saturation and void absence in high-stress areas. Conduct trial-fit tests on a vehicle mock-up or jig to validate mounting points. Document findings and feedback to suppliers. Over time, this feedback loop improves consistency and reduces rejection rates.

Inventory planning should match product lifecycle expectations. Evo X parts have enduring demand, but model-specific variations and colors create inventory complexity. Maintain baseline stock for highest-demand items like OEM-style bumpers. For premium carbon units, consider just-in-time ordering or consignment models to avoid capital tie-up. Work with suppliers on lead-time guarantees for spot replenishment, and use sales forecasting to optimize safety stock.

Finally, integration with adjacent product lines enhances margins. Pair front bumpers with validated headlight assemblies, lower lips, or side skirts. Bundling improves average order value and simplifies marketing for dealers. Ensure accessory compatibility through shared fitment testing to avoid field returns. For customers seeking complete aesthetic packages, a coordinated approach to finish and part numbering creates a smoother buying experience.

For a concrete supplier reference and technical listing that illustrates many of these attributes, consult this external product listing: https://www.alibaba.com/product-detail/YH-FOR-LANCER-EVO-X-Carbon-Fiber_1600723794857.html.

For an internal reference on genuine fitment and OEM-style options, see the cz4a Lancer Evolution X front bumper page available here: cz4a-lancer-evolution-x-front-bumper-genuine.

The Fit That Fuels Demand: Compatibility and Market Dynamics of the Lancer Evolution X Front Bumper

The front bumper of the Mitsubishi Lancer Evolution X is more than a cosmetic feature or a mere panel to replace when damaged. It is a keystone component that ties together aerodynamics, structural integrity, and the signal a vehicle makes to the street and track. In the aftermarket ecosystem, where every gram of weight and every tenth of a second in drag can influence lap times, the compatibility of a front bumper becomes a decisive factor for B2B buyers who must balance performance, cost, and lead times. The Evo X, with its distinctive CZ4A chassis lineage, continues to command attention well beyond its production window. While the model years vary from 2008 through the late 2010s, the swap landscape has settled into a pattern: bumpers are most often selected not as generic replacements but as precision parts designed to preserve or enhance a vehicle’s factory geometry. This is essential because even small deviations in fit can affect not just aesthetics but the way air flows around the front of the car, influencing downforce, cooling, and the efficiency of the entire aerodynamic profile. Buyers who source through reputable channels increasingly insist on explicit compatibility for the 2008–2017 CZ4A family, including the Evo X and Ralliart variants, to ensure the new part aligns with the car’s front fascia, mounting points, and under-hood architecture. In practice, this means that catalogs and listings emphasize exact fitment, often detailing whether a bumper is intended for all Evo X configurations or specifically for certain trims. For the B2B buyer, a misfit is more than a cosmetic setback; it is a disruption to production schedules, an added engineering audit, and a risk to warranty coverage. Because the Evo X front end has evolved with different trims and lifecycle updates, the safe path is to verify the bumper’s compatibility against the chassis code and year range, an alignment that minimizes retrofit work and maximizes the return on investment. The value proposition here is not merely about whether a bumper can be bolted on but whether it preserves the intended aerodynamic balance of the front end. In this regard, the aftermarket sector has moved toward kits that promise exact dimensions, integrated hardware, and complete installation packages. Rather than a simple shell, buyers now expect canards, brackets, and mounting hardware to be included, reducing the likelihood of misalignment and the need for additional sourcing. The importance of integrated components cannot be overstated. When a front bumper ships with matching canards, brackets, and hardware, it signals a holistic approach to aerodynamics and installation practicality. It also reflects that the supplier recognizes the tight tolerances required by modern performance vehicles, where even the curvature of a bumper lip can influence airflow patterns across the radiator, intercooler, and intercooler piping. A well-matched kit minimizes the number of on-car adjustments and preserves the intended visual massing of the Evo X’s front end, a factor that matters for both street appeal and track reliability. The market has responded by offering a spectrum of options that vary in material, finish, and thickness, yet all converge on a common aim: compatibility that respects OEM geometry while delivering improved or maintained aerodynamic performance. The most direct expression of this is the availability of front bumpers that align with the 2008–2017 CZ4A chassis family, including models that share a front-end blueprint with the Evo X’s distinctive silhouette. Buyers must, however, be diligent in confirming year-by-year fit, as subtle changes between the earliest Evo X models and later revisions can affect bolt patterns, bumper reinforcement shapes, and mount locations. To aid decision-making, many listings include dimensional data, mounting diagrams, and sometimes images of the bumper installed on a visibly identical chassis, offering a pragmatic preview of fit before a purchase decision is made. From a supply-chain perspective, compatibility becomes a strategic selector. When a supplier asserts compatibility across a broad range of years and trims, savvy buyers search for corroborating documentation, including engineering drawings, tolerance specs, and references to OEM mounting points. The broader aftermarket landscape also accommodates this demand by offering kits that are engineered for exact fitment, sometimes accompanied by reinforcement brackets and hardware that mirror the factory assembly. In these cases, even the appearance of the bumper—its line, curvature, and edge detailing—evokes the feel of an OEM-like restoration or a precise performance upgrade. The practical implications extend into logistics and warranty terms. Bumpers that come with a complete hardware kit and installation instructions simplify warehouse operations and technician workflows, reducing the risk of returns due to mismatches or incomplete fittings. Warranty coverage, often cited as a critical risk-mitigation tool for B2B buyers, becomes an important decision criterion. Suppliers that bundle a robust warranty with clear service terms convey confidence in the durability of their product under the kinds of stress a front bumper can endure when a car is propelled into corners at track speeds or used in demanding street driving. This is where the supply chain dynamic amplifies the value of compatibility. In the high-volume, cost-sensitive world of automotive accessories, the Guangdong cluster in China—especially around Guangzhou—plays a pivotal role. Its proximity to injection molding facilities, fiberglass fabrication units, paint shops, and tooling experts enables a level of vertical integration that accelerates time-to-market. For B2B buyers who need consistent supply, the advantage is not simply about price; it’s about the predictability of lead times, the ability to source in bulk, and the assurance that a supplier can scale orders without compromising dimensional accuracy. Materials used in Evo X front bumpers illustrate the trade-offs buyers weigh when balancing cost, performance, and durability. ABS plastic remains a robust, impact-resistant choice for OEM-style replication and budget-conscious builds. For teams that chase lighter weight or enhanced strength, carbon fiber has become the material of choice. Carbon fiber composites offer the dual benefits of reduced weight—an attribute that translates to lighter steering inertia and potentially improved handling response—and enhanced stiffness that can contribute to more predictable front-end behavior at the limits. In practice, carbon fiber bumpers tend to be marketed as part of a broader aero package, with canards and lips designed to optimize airflow around the bumper’s contours. The weight savings associated with carbon fiber can amount to roughly a third lighter than traditional fiberglass, a non-trivial difference when every kilogram is scrutinized in a race or time-attack setting. The aerodynamic promise of these carbon components often includes claims of drag reduction and increased downforce at speed. A well-designed carbon bumper integrates curves that align with the Evo X’s profile, ensuring that there is no adverse interference with the grille, intercooler ducts, or sensor housings where applicable. For track-focused configurations, even modest improvements in downforce or reduction in drag can yield measurable gains in cornering stability and high-speed balance. Yet, while the physics are compelling, buyers still demand rigorous verification. Aerodynamic claims are strongest when they are backed by data and tested on compatible chassis, not merely by renderings or generic performance figures. This is why, in practice, buyers seek parts that provide certified or traceable performance data, along with material certifications such as aerospace-grade standards for carbon fiber and safety certifications that align with automotive wear conditions. In addition to material and fitment, the market demonstrates a robust interest in practicality and risk management. The Evo X’s front bumper is a frequent entry point for broader aerodynamic kits, which may include lip extensions, canards, and splitter elements designed to work in concert with the bumper to manage airflow. The compatibility of these accessories is often a predictor of how coherent a whole kit will feel on the vehicle. When a buyer chooses a bumper with an integrated set of add-ons, installation becomes more straightforward, reducing vehicle downtime and ensuring repeatable results across a fleet of vehicles in a dealership, race team, or tuning shop. The market demand for reliable, high-fidelity bumpers extends beyond new parts alone. Used OEM bumpers in good condition remain actively traded, especially among shops that perform restorations or maintain older Evo X fleets for track programs. The appeal of genuine parts, even when sourced secondhand, rests in retained geometry, consistent paint compatibility, and the assurance that the mounting points will align with factory reinforcement structures. This robust secondary market is complemented by a vibrant aftermarket ecosystem that provides new front bumper options with modern finishes, improved air management features, and the potential for faster shipping and warranty options. For B2B buyers, the ability to source both used OEM alternatives and fresh aftermarket kits through verified platforms is a testament to the market’s resilience. The combination of compatibility, material choice, and supply-chain efficiency translates into a compelling business case: a front bumper that fits precisely, offers aerodynamic benefits, and can be procured in scalable quantities with predictable delivery times. In this context, the decision-making calculus for buyers often starts with a strict compatibility check and ends with a holistic assessment of performance, aesthetics, and total cost of ownership. Buyers look for clear specification sheets, dimensional data, mounting references, and installation diagrams. They seek platforms that can provide validated supplier credentials, consistent quality control, and transparent warranty terms. And to safeguard the supply chain, several listings emphasize compatibility for the Evo X’s CZ4A family within the 2008–2017 window, including the Evo X and Ralliart models, while noting that some variations may exist between early and late production runs. The net effect is a market that rewards precision and reliability as much as style and speed. For the practitioner, this means choosing a bumper that not only matches the vehicle’s lines but also aligns with the shop’s capability to install and finish it to race-ready standards. It means confirming that all mounting hardware, brackets, and auxiliary pieces are included or readily sourced, and that the finish, paint compatibility, and protective coatings meet the expectations of dealers, teams, and individual enthusiasts who demand long-term durability under demanding conditions. In the broader picture, the Evo X front bumper’s compatibility and market demand illustrate the shift from a fragmented aftermarket space into a more cohesive ecosystem. The corridor of supply—comprising engineering validation, material science, and logistical scalability—has become as critical as the bumper’s aesthetics. Buyers who understand this broader frame are better positioned to build resilient procurement strategies, ensuring that each bumper not only looks right but performs reliably in real-world use, whether on the street, on the drag strip, or on a closed-course circuit. The practical takeaway is simple: compatibility reduces risk, while a well-supported supply chain reduces cost of ownership and lead times, enabling shops and distributors to offer customers a smoother, more predictable purchasing experience. To those evaluating options, the genuine route can be pursued through a dedicated front bumper option that preserves OEM-like geometry while delivering available upgrade pathways; this is often the most straightforward way to maintain the Evo X’s distinctive front-end profile without compromising fit. For more on genuine CZ4A Evo X bumpers, see the dedicated listing that aligns with this chassis family: front bumper for Evo X. Beyond this, the market continues to grow as brands pursue refined composites and finish options that cater to demanding riders seeking a balance of speed, stance, and durability. As a result, compatibility becomes not just a technical checkbox but a strategic decision that shapes sourcing strategies, influences pricing, and ultimately informs the value proposition that distributors present to workshops and performance teams. In review, the Evo X front bumper stands as a microcosm of the larger aftermarket economy: a component whose fitment, materials, and supporting logistics determine whether a project is completed on time, within budget, and with the performance outcomes that enthusiasts and professionals expect. The evolving landscape—driven by strong demand, rigorous compatibility standards, and the Guangdong manufacturing ecosystem—signals continued growth for parts that fulfill the twin promises of precision and value. External reference: for a practical look at carbon-fiber aero components that underpin many modern bumper programs, see the external resource on carbon-fiber front- and canard configurations. https://www.alibaba.com/product-detail/YH-FOR-LANCER-EVO-X-Carbon-Fiber_1600749775817.html

Strategic Procurement Playbook for Lancer Evolution X Front Bumpers

Strategic Procurement Playbook for Lancer Evolution X Front Bumpers

Sourcing front bumpers for the Mitsubishi Lancer Evolution X requires a disciplined procurement strategy that balances cost, quality, and delivery reliability. This chapter unifies the practical steps buyers must take to reduce risk and secure parts that meet performance and regulatory expectations. It moves beyond checklists and delivers a coherent approach covering supplier selection, technical validation, contractual safeguards, logistics, and aftermarket support. The aim is to create a resilient sourcing flow that protects margins and brand reputation while delivering parts that fit, function, and last.

Begin by narrowing the supplier field to platform-verified vendors. Prioritize sellers with verifiable credentials on established B2B marketplaces. Verification badges and escrow-enabled payments lower the risk of fraud. Review each supplier’s transaction history and feedback, focusing on buyers who purchased similar aerodynamic components. Ratings alone are not enough; cross-check order volume against claimed manufacturing capacity. A supplier with steady, documented throughput is likelier to meet bulk commitments without compromising quality.

Certifications serve as your first hard filter. Require suppliers to show valid ISO 9001 certificates and any regional conformity marks required by your markets. Ask for copies of test reports and material certificates. For composite bumpers, insist on traceable material declarations that identify fiber type, resin system, and curing process. For thermoplastic parts, confirm the polymer grade and impact modifiers. Proper documentation reduces ambiguity during inspections and simplifies customs clearance in regulated territories.

Sample testing is non-negotiable. Always obtain physical samples before placing a production order. Samples reveal fitment issues that CAD files might miss. Test for dimensional accuracy against OEM mounting points. Inspect mounting tabs, clip engagement, and hole alignment. Check finish quality, paint adhesion, and surface tolerance under bright light. For composite parts, assess laminate quality for voids, delamination, and resin-rich or resin-starved areas. For injection-molded parts, evaluate sink marks and weld lines that could affect appearance or strength.

Establish a structured testing protocol that aligns with your quality expectations. Define acceptance criteria for force-to-failure of mounting points, flex tests for repeated loading, and impact resilience under standard test conditions. Use a mix of visual inspection, simple mechanical tests, and, when appropriate, non-destructive evaluation methods. Request bend and recovery tests for thermoplastics and tap-knife or ultrasound checks for composite bond integrity. Record test outcomes in a sample report and require suppliers to address any nonconformities before mass production.

When procurement value is significant, arrange on-site factory audits. A physical visit gives insight into production flow, equipment condition, and quality culture. Audit tooling rooms, paint booths, and composite layup areas. Verify that curing ovens and prepreg storage meet specifications. Review documented quality control checkpoints and defect-tracking logs. Where travel is impractical, commission third-party inspection services to perform factory audits and first-article inspections.

Contracts must be precise. Define material specifications, dimensional tolerances, color codes, and mounting interface points. Insert clauses for penalties tied to delivery windows and quality failures. Include provisions for rework, scrap handling, and replacement timelines. Specify dispute resolution methods and choose applicable law that is practical for both parties. Use payment structures that protect both buyer and supplier, such as staged payments tied to production milestones and independent inspection sign-off.

Negotiate clear logistics and warranty terms. Determine Incoterms that match your risk appetite. FOB terms might work when you control freight, but CIF can simplify import management for first-time orders. Define lead times with buffers for tooling and paint cycles. For aftermarket parts, require a minimum warranty period with logistics support for replacements. Warranty terms should cover manufacturing defects and fitment issues, not wear from normal use.

Leverage regional manufacturing strengths when selecting vendors. Suppliers in southern coastal provinces typically excel at advanced composites and high-finish paint processes. Northern and eastern industrial regions often offer cost advantages for injection molding and high-volume thermoplastic production. Match supplier capabilities to your product tier—premium, lightweight composite bumpers demand different factories than economy ABS reproductions. Tailor your sourcing strategy to the supplier’s technical strengths rather than forcing one vendor to serve all needs.

Confirm OEM compatibility and document customization options in writing. Clarify whether the buyer wants an exact OEM-style replacement or a track-biased version with enhanced airflow and splitters. Where customization is required, request CAD data exchange and agree on revision cycles. Ask suppliers to supply as-built drawings, 3D scans, or digital measurement reports post-production. These deliverables facilitate inventory management and aftersales support for end customers and installers.

Inspect packaging and spare parts provision closely. Bumpers are vulnerable in transit. Define packaging standards to minimize shipping damage. Require protective inner layers, corner guards, reinforced crates for long-distance sea freight, and clear labeling. Insist suppliers include any necessary mounting hardware, clips, and gaskets, or state them as optional line items. A complete kit reduces returns and improves installation success for end customers and dealers.

Plan for paint and finish matching early. If bumpers arrive primed only, identify local paint partners or establish supplier-applied paint standards. Provide suppliers with precise color codes and target gloss levels. Request paint adhesion and chip testing reports. For visible carbon finishes, specify clearcoat thickness, UV resistance, and weave orientation. For matte finishes, define acceptable surface texture ranges. These details prevent downstream rework and costly repaints.

Set up an acceptance and returns workflow. Define when a unit is considered accepted. Create inspection checkpoints at arrival and before distribution. For failed items, agree on repair, replacement, or credit processes. Keep SLA timelines for resolving claims. A quick, predictable claims process prevents stockouts and limits customer dissatisfaction.

Manage minimum order quantities and forecasting carefully. Bumpers for a niche model like the Evo X have uneven demand cycles. Work with suppliers on flexible MOQs and phased production runs. Use historical sales data to develop rolling forecasts. Offer suppliers visibility into your sales pipeline to justify tooling investments. When demand spikes, a supplier with established capacity and a history of responsiveness will be invaluable.

Protect intellectual property and design ownership. If buying custom or private-label bumpers, include clear IP clauses. Require assignment or licensing terms that prevent suppliers from selling your custom designs to competitors. Where tooling is paid for by the buyer, define ownership and control over tool custody, maintenance, and depreciation schedules.

Plan customs and compliance in advance. Understand regulatory requirements for each target market. Some regions require specific material labeling or conformity declarations for automotive parts. Prepare CE or equivalent documentation if necessary. Engage customs brokers early to avoid clearance delays, especially for batches with multiple SKUs.

Invest in relationship management. A reliable supplier relationship reduces friction and creates room for problem-solving when issues arise. Maintain regular technical reviews, quarterly business reviews, and shared improvement targets. Offer feedback loops from installers and end users so suppliers can refine product and process. Mutual transparency about capacity and constraints builds trust and lowers lead-time variability.

Include aftersales and technical support obligations in your procurement strategy. Ensure suppliers provide installation instructions, torque specifications, and recommended fasteners. Offer training sessions for large dealers or fitment centers. A supplier who supports installation reduces warranty claims and contributes to positive customer experiences.

Finally, incorporate continuous improvement into procurement. Track metrics like first-pass yield, return rate, and on-time delivery. Use these metrics to adjust supplier scorecards and sourcing decisions. Encourage suppliers to present cost-reduction plans that do not sacrifice quality. Over time, this disciplined approach yields a supply chain that supports both the product and the brand’s reputation.

For a direct example of a supplier listing that demonstrates many of these procurement features, see this internal reference for a genuine front bumper option: CZ4A Lancer Evolution X front bumper (genuine).

For further supplier-level detail and a model listing used by many B2B buyers, consult the following external product page:

https://www.alibaba.com/product-detail/YH-FOR-LANCER-EVO-X-Carbon-Fiber_1600548548547.html?spm=a2700.details.0.0&url=subdetail

Final thoughts

In the ever-evolving automotive aftermarket, understanding the dynamics of the Mitsubishi Lancer Evolution X front bumper market will give business owners a competitive edge. From leveraging the global supply chain in China to sourcing durable parts that meet varied performance requirements, these insights lay the groundwork for successful procurement. Engaging with trustworthy suppliers, evaluating component features, and understanding market demands are integral to delivering value to customers. As such, ensuring a strategic approach to sourcing front bumpers extends far beyond mere replacement; it positions businesses to thrive within a niche market.