Understanding the intricacies of auto body parts is essential for business owners in the automotive industry. This guide explores the various facets of A to Z auto body parts, focusing on supplier overviews, specific components, manufacturing processes, and market insights. Each chapter is designed to equip you with the necessary knowledge to make informed decisions in sourcing and selling automotive components effectively. By the end, you’ll have a clearer picture of how to navigate the auto body parts landscape, ensuring you meet customer demands while maintaining quality and efficiency.

From A to Z Auto Body Parts: Mapping the Global Supply Web Behind Your Car’s Skin

The market for auto body parts operates like a vast, interconnected ecosystem where the word “A to Z” is less a slogan than a framework for thinking about what a complete, safe, and aesthetically coherent vehicle needs. Buyers, whether they are OEMs, repair shops, or aftermarket distributors, approach this landscape with a clear set of demands. They want parts that meet precise material standards, adhere to exact technical specifications, arrive on time, and perform consistently across a spectrum of conditions. They also want partners who can adapt to a changing order mix, whether that means high-volume replenishment for best-selling sheet-metal components or low-volume, highly customized runs for niche items. The underlying truth is simple: when a body panel or a structural component is in play, quality and reliability are not optional; they define the vehicle’s safety, durability, and appearance over its entire life cycle.

The path from raw material to finished part is where the A to Z concept becomes tangible. In today’s global supply web, many of the most capable suppliers are not just makers of parts. They are vertically integrated operations that control a sequence of processes—from the earliest stage of material preparation to the final packaging and shipment. This integration reduces the risk that can accompany multi-supplier chains, where delays or quality gaps in one link can ripple across the entire order. A vertically integrated facility typically houses coil steel processing, stamping, welding, painting, and inspection under one roof or within a single corporate umbrella. The result is tighter process control, improved traceability, and shorter lead times. This is especially valuable for complex panels, crash-relevant components, or cosmetic elements that require consistent surface finish across thin gauge metals or advanced composites.

Geography matters, too. In many regions—most notably in high-volume manufacturing hubs—suppliers have built dense ecosystems that accelerate development and shorten time to market. A province like Zhejiang, for example, has matured into a network where material suppliers, tooling houses, and assembly lines sit within relatively close reach of one another. This proximity is not merely about lowering transport costs; it strengthens coordination among design, tooling, and production teams. It enables rapid prototyping, faster iteration cycles, and more reliable ability to scale when demand shifts. The capacity to manage an end-to-end cycle—from CAD-based design and prototyping to final assembly and packaging—offers a meaningful advantage for buyers facing tight schedules or voluminous orders. Such capabilities are increasingly recognized as a differentiator in a crowded market where the barrier to entry for new suppliers is lower than ever, yet the cost of inconsistent quality remains high.

A distinguishing feature of leading suppliers is the blend of technical depth and practical flexibility. In-house engineering teams are more than a label; they are the engine that translates a buyer’s needs into manufacturable geometry and reliable performance. These teams work across multiple processes—laser cutting for precision, CNC bending for complex angles, extrusion for profile elements, forging for strength, and injection molding for plastics used in interior panels or trim. When a factory can manage these processes in coordination, it can reduce lag time between concept and prototype and then between prototype and production. The value extends beyond the machine shop floor. A robust engineering capability supports rapid design change management, such as adjusting a component to improve fitment for multiple vehicle platforms or accommodating new safety standards without forcing a complete supply chain overhaul.

A practical facet of this capability is the ability to maintain tolerances and ensure consistency across large production batches. Modern facilities deploy advanced technologies to support this goal. Robotic welding cells deliver repeatable joints with high structural integrity. Electrostatic paint booths ensure uniform coatings with minimal overspray, while digital quality inspection systems enable traceable records of dimensional accuracy and finish. In a world where a misaligned panel or a scratched finish can ruin an entire assembly, such technologies do more than improve aesthetics; they uphold safety and durability. The convergence of automation, data capture, and disciplined workmanship allows suppliers to keep pace with evolving vehicle designs and stricter regulatory expectations while delivering on-time, every time.

From the buyer’s perspective, the ideal partner blends two core strengths: deep technical capability and a dependable, scalable service model. The technical side is about capability—will the supplier handle laser cutting, CNC bending, extrusion, forging, and injection molding in-house? Can they supply end-to-end solutions that cover CAD, prototyping, testing, and final packaging? The service side is about reliability—how predictable are lead times, what is the quality yield across multiple lots, how does the supplier handle post-sale support and warranty issues, and can they scale operations when the order mix shifts from high-volume panels to highly customized parts? When a supplier demonstrates both, buyers gain leverage in negotiations and greater security in long-term planning. Even so, the journey from design to delivery remains a collaborative process. It demands clear data, transparent communication, and a shared language about fitment tolerances, material choices, and performance expectations.

A rich illustration of these principles is the way some facilities consolidate casting and machining operations under one umbrella. While not naming specific firms, consider how a provider with hundreds of listings across casting and machining can leverage its breadth to optimize for both standard parts and custom components. Such breadth is not merely about volume; it signals the ability to refine a part from initial formation to the final, certified product. In practice, this means a part like a trunk lid or a bumper panel—structural elements with responsibilities in both crash energy absorption and alignment with sensors and lights—can be designed, cast or forged, machined to tight tolerances, and finished with a protective coating in a single continuous workflow. The synergy reduces variability, accelerates problem solving, and improves the predictability buyers rely on to meet production schedules.

In the sourcing stage, material selection carries consequences that ripple through life-cycle costs. Manufacturers choose between sheet metal, advanced high-strength steels, aluminum alloys, and various plastics based on weight, strength, and resistance to corrosion. Each material class has a distinct processing chain, equipment set, and quality control regime. For example, a body panel that must resist denting yet remain formable requires precise metallurgy, careful thermal treatment, and rigorous inspection of thickness uniformity. Suppliers who document material specifications, provide clear data sheets, and offer warranties tend to be more trustworthy partners. Such documentation supports compatibility checks with assemblies that rely on precise fitment—an essential factor when a panel must align with adjacent parts, lighting modules, and sensors as a complete system.

The path from raw material to final part also includes considerations of packaging and logistics. Packaging must protect sensitive finishes, prevent deformation during transit, and facilitate straightforward assembly on the customer’s line. In many modern facilities, packaging is treated as an integral production step rather than an afterthought. This mindset supports better line efficiency and reduces waste because packaging choices are aligned with the actual downstream handling and storage processes. A well-coordinated flow—from material receipt to finished part, through final inspection, and into shipping—minimizes risk and speeds delivery. For buyers, this translates into lower total cost, fewer expedites, and more reliable production planning. A supplier who can articulate the entire production cycle, from CAD to packaging, signals true operational maturity and a partner willing to invest in long-term performance.

To appreciate how a single part’s journey embodies A to Z thinking, picture a front-end assembly’s evolution from initial concept to the showroom floor. The design team drafts a geometry that satisfies both crash performance and aesthetic requirements. Engineers collaborate with process specialists to determine the most economical and reliable manufacturing route. Then the production floor transforms the design through laser cutting, bending, and welding, while the paint shop applies a finish that resists chips and corrosion. Finally, the part is inspected for dimensional accuracy and surface quality, labeled, and packed for shipment. The same cycle would apply to other components—roof rails, rocker panels, and trunk lids—each with their own specific tolerances and performance goals. The end result is a cohesive system of body parts that not only fit together physically but also work together functionally to support safety systems, lighting, and thermal management.

For buyers seeking a concrete approach to supplier selection, the narrative above underscores several practical criteria. First, verify material standards and the supplier’s capability to document them clearly. Second, confirm the breadth and depth of in-house capabilities, particularly for parts requiring multiple processes. Third, assess production capacity and the ability to scale, including the supplier’s track record with lead times, defect rates, and on-time delivery. Fourth, evaluate customization flexibility: can the partner accommodate design changes, alternate materials, or variations in finish without disrupting schedules? Fifth, examine post-sale support, warranties, and the ability to provide rapid replacement or remediation if a defect arises. A well-rounded supplier who meets these criteria offers more than parts; they deliver a reliable engineering alliance that reduces risk and accelerates innovation.

One way to ground these considerations in real-world behavior is to imagine the logistics of a single, representative part’s journey in the supplier’s system. The raw material is sourced, processed, and formed into a near-net shape. The team then conducts a series of checks—dimensional tolerances, surface finish, and coating integrity—before the part is assembled with mating components. Any deviation triggers feedback into the design or process control loops, ensuring that future runs stay within spec. The data generated through this cycle—tolerances, defect rates, and cycle times—becomes a valuable asset for the buyer, enabling better forecasting and more precise budgeting. When suppliers can demonstrate this kind of closed-loop discipline, buyers gain a level of assurance that is hard to replicate with fragmented supply chains.

Human factors matter as well. Engineers, machinists, quality inspectors, and logistics coordinators must communicate effectively. The best suppliers foster a culture of collaboration, anchored by transparent data sharing and clear responsibility for each stage of the process. In practice, this means accessible design data, shared quality dashboards, and agreed-upon response times for issues. The result is a smoother procurement experience, with fewer surprises during nightly production runs or weekend maintenance cycles. For organizations seeking a true A to Z partner, such a culture makes the difference between incremental improvements and a step-change in reliability and speed.

As buyers navigate this complex landscape, a final consideration is the sourcing philosophy itself. The most resilient partners balance cost with technical depth and strategic alignment. They are not merely vendors but development partners who can contribute to long-range roadmaps—whether that means adopting lighter-weight materials, exploring new protective coatings, or integrating advanced sensor housings into cosmetic panels. This kind of collaboration helps vehicle programs avoid costly redesigns later in the program life cycle and supports a more predictable cost trajectory over time. It also aligns procurement with broader corporate goals around sustainability, durability, and total lifecycle value. In short, A to Z thinking in auto body parts is as much about building the right partnerships as it is about selecting the right component.

For readers who want a practical entry point into this ecosystem, a single, representative reference can illuminate how a supplier’s catalog becomes a tangible, on-schedule delivery. See the front bumper page for a concrete example of how a single component’s data, process flow, and packaging are coordinated to fit into a larger assembly sequence. front bumper page.

As this chapter unfolds, the underlying message remains consistent: the A to Z framework is not a ritual of procurement jargon. It is a practical, measurable approach to sourcing auto body parts that emphasizes end-to-end capability, rigorous quality control, and the kind of collaborative engineering that turns a mere sheet of metal into a functional, safe, and aesthetically coherent part of a vehicle’s skin. In an industry where safety, performance, and appearance hinge on the performance of every small component, choosing the right supplier is not a cosmetic decision. It is a strategic one that can influence a program’s schedule, its cost structure, and, ultimately, the experience of every driver who relies on the vehicle to perform as designed. The landscape continues to evolve, but the core principle stands firm: true A to Z suppliers are defined by their ability to deliver consistently across the entire lifecycle of a part, from concept to customer, with transparency, accountability, and enduring support.

External resource for further reading: How to Evaluate Auto Parts Suppliers by Quality, Compatibility, and Delivery

Anatomy and Choices: Understanding Specific Components in A to Z Auto Body Parts

Auto body parts shape a vehicle’s identity and protect its occupants. From the visible outer skin to hidden structural members, each component has a defined role. Understanding those roles helps when sourcing parts, planning repairs, or specifying upgrades. This chapter walks through the essential components you encounter in an A-to-Z parts catalog, explains how they are made, and highlights practical considerations for fit, function, and safety.

A vehicle’s external panels form the immediate impression and take the brunt of everyday hazards. Bumpers, for example, are designed to manage low-speed impacts while protecting major assemblies behind them. Modern bumpers combine a painted outer cover with internal energy-absorbing elements. Those inner structures may be foam, composite, or stamped metal. When replacing a bumper, verify attachment points, integrated sensors, and reinforcement types. A direct-fit cover alone may look correct yet fail to align with crash absorbers or bracket mounts.

Adjacent panels such as fenders and quarter panels serve both aesthetic and defensive functions. They redirect debris, guard wheel wells, and help control airflow. Their shapes are often complex, so precision in stamping or molding is crucial. Repairing a dent in a fender sometimes works well; replacing a rusted or severely creased quarter panel often does not, due to hidden alignment issues. When choosing replacement panels, confirm whether inner hems, spot-weld locations, and drainage channels match the original design.

Hoods and trunk lids protect cargo and engine bays. These panels are engineered with controlled deformation in mind. Crumple features and hinge mounts are precisely located to channel energy away from the cabin. Materials vary. Steel remains common for its strength and cost efficiency. Aluminum and composite panels reduce weight and can improve fuel economy or handling. However, mixed-material repairs require attention to joining methods and corrosion control. Bolting or adhesive bonding parameters differ between metals and composites, and technicians must follow manufacturer repair guidelines to maintain safety performance.

Doors are more than entry panels. They are part of the safety cell. They house windows, locking hardware, wiring harnesses, and sometimes side-impact beams. Replacement doors must match latch striker locations and wiring conduit paths. For doors with integrated electronics, check for sensor housings and connector compatibility. Even minor misalignment can compromise seals, cause wind noise, and strain hinges. Proper selection ensures long-term fit and prevents premature wear of latch mechanisms and weatherstrips.

Grilles, radiator supports, and front-end assemblies influence cooling and crash performance. A grille mod may seem cosmetic, but altered airflow can affect radiator efficiency. Radiator supports carry core components and absorb frontal energy. When sourcing these parts, verify the mount points for the radiator, condenser, and headlight assemblies. Replacing a grille alone without the correct support can create fitment gaps and cooling issues.

Aerodynamic elements and trim—spoilers, side skirts, diffusers—blend style with function. At highway speeds, a well-designed spoiler alters lift and stability. Trim pieces protect edges and hide junctions. Many aftermarket kits offer dramatic looks but can change airflow and road noise. Always check for interference with sensors and ground clearance before committing to a full kit.

Beneath visible panels, the internal skeleton defines crashworthiness. The body shell, frame rails, and cross members form the structural backbone. These parts are calibrated to deform in staged ways. Frame rails guide forces around the passenger compartment. Cross members stabilize suspension points and maintain torsional rigidity. When these elements are damaged, repair requires precise measurement, often on a frame bench. Minor panel replacement differs from structural repair; the former can be completed with basic alignment, while the latter demands certified techniques.

Interior panels and trim complete the package. Dash boards, door cards, and consoles control sound, ergonomics, and aesthetics. While not load-bearing, they conceal airbags, sensors, and wiring. Replacement interior pieces must accommodate airbag deployment areas and sensor locations. Upholstery choices also affect perceived quality. For restoration projects, finding color-matched trim pieces can be more challenging than obtaining exterior body panels.

Materials and manufacturing processes explain much about part choice. Stamped steel panels are produced by high-pressure presses using large dies. This method yields accurate shapes for mass production. Plastic components typically originate from injection molding. Molded parts are light and cost-effective for complex shapes, but their finish and paint adhesion require careful surface preparation. Composite parts, like carbon-reinforced hoods and splitters, are layered and cured. They offer stiffness at low weight but can be brittle under certain impacts. Each process has tolerances that affect fitment. When selecting parts, request dimensional tolerances or teardowns where possible.

Tooling quality matters. Low-cost replacement parts may be produced from worn molds or with simplified fixtures. That can result in misaligned tabs, inconsistent thickness, and poor seam fit. Conversely, parts produced with new, precision tooling deliver clean gaps and easier installation. For projects demanding a flawless fit, prioritize suppliers that disclose tooling age and provide fitment assurances.

Joining methods influence repair choices. Traditional welding is common for steel panels. Resistance welding and spot welding restore original joints but require correct seam placement. Adhesive bonding and rivet-bonding are common when joining dissimilar materials or when original designs avoid heat. Modern adhesives can yield structural bonds but require proper surface prep, cure times, and applied pressures. When mixing metals, protect against galvanic corrosion. Sealers and coatings should be compatible with both base materials and paint systems.

Paint, corrosion protection, and finishing determine longevity and appearance. OEM parts often come with a primer or sealer. Aftermarket blanks may be bare metal or primed. Match the corrosion protection level to the environment. Galvanized steel offers better long-term rust resistance. For aluminum and composites, ensure coatings are suited for the substrate. Paint application requires correct primer, basecoat, and clearcoat processes for a durable, color-accurate finish. Pay attention to OEM color codes or electronic color-match data when ordering painted panels.

Sensors and functional attachments are increasingly critical. Modern bumpers and fenders integrate proximity sensors, cameras, and warning devices. Replacement panels must provide exact mounting locations and wiring pass-throughs. Headlamp fitment affects beam aim and illumination. Replacing a part without the correct provisions for sensors can cause systems to malfunction or provide false warnings. Always confirm presence and location of brackets, harness clips, and sensor mounts before ordering.

Deciding when to repair and when to replace carries practical implications. Small dents and minor creases often respond well to paintless dent removal. Corrosion, severe deformation, or compromised weld zones usually warrant replacement. Consider labor time, availability of parts, and vehicle value. For some older models, salvaged original parts may offer better fit than modern aftermarket reproductions. For newer models, choose parts that meet crash-test and emissions-related regulations.

Sourcing parts is a careful balance between cost, quality, and compatibility. Confirm the vehicle identification details before ordering. VIN, model year, and trim level determine many fitment variables. Where possible, request part numbers and compare them with manufacturer catalogs. Insist on clear return policies and fitment guarantees. For larger orders, consider supplier audits, sample approvals, and small initial runs to verify fit.

Finally, longevity comes down to correct installation and maintenance. Proper torque on fasteners, correct adhesive cure times, and accurate panel gaps prevent premature failures. Regular washing, undercoating in corrosive climates, and prompt repair of paint chips extend part life. When modifying aerodynamics or adding aftermarket trim, check for sensor interference and legal compliance with local regulations.

For a practical example of fitment and bumper considerations, see this 2006–2008 front bumper reference. For broader standards, grades, and performance guidance across common sedans, consult a detailed vehicle body parts guide.

- 2006–2008 front bumper reference: 2006–2008 front bumper reference

- Detailed vehicle body parts guide: detailed vehicle body parts guide

This chapter bridges the visible and hidden aspects of auto body parts. It equips you to assess panels, choose compatible replacements, and understand how manufacturing and material choices affect fit, safety, and longevity. Use this knowledge to make informed sourcing and repair decisions, and to communicate clearly with parts suppliers and technicians.

From Blank Sheet to Finished Skin: Manufacturing the Full Range of Auto Body Parts

Manufacturing auto body parts spans a chain of tightly linked disciplines. Each stage transforms raw material into a component that must meet strength, fit, finish, and safety targets. The process begins with material selection and ends with rigorous inspection. Along the way, stamping, forming, joining, coating, and finishing interact with tooling, automation, and quality systems. This chapter follows that continuum, showing how modern shops produce the full alphabet of body parts with repeatable precision.

Sheet metal stamping is the workhorse of body-part production. Large coils of steel or aluminum are slit, leveled, and fed into presses. Dies convert blanks into complex three-dimensional panels. Engineers design progressive, transfer, or single-hit dies to match part geometry and production volume. Die design controls flange locations, hem shapes, and the placement of locating features. Modern dies include sensors and quick-change interfaces to speed tool swaps. Press tonnage, lubrication, and blank holder force are tuned to avoid springback and cracking. When high-strength alloys are used, process windows narrow and tool steel selection becomes critical. Controlled heating or press-hardening processes can increase part strength while allowing thinner gauges.

Beyond conventional stamping, manufacturers deploy specialty forming technologies. Hydroforming lets tubular or sheet structures take complex shapes using fluid pressure. It produces smooth contours with uniform thickness for components such as frame rails or multi-curved panels. Roll forming and incremental sheet forming handle continuous or low-volume parts with less tooling cost. When geometry or stiffness is paramount, stretch forming and hemming operations complete edges and mating surfaces. For heavier-gauge or high-strength parts, hot stamping and press hardening create martensitic microstructures that boost crash performance without added weight.

Polymers and composite materials coexist with metal processes. Injection molding and thermoforming are used for bumpers, grilles, interior trim, and some fascia components. Tooling for these parts includes injection molds, compression molds, and blow-mold tools for specific shapes. Material choices—thermoplastic olefins, polypropylene blends, reinforced plastics—affect impact behavior, paint adhesion, and repairability. In higher-performance or luxury segments, carbon-fiber and glass-fiber reinforced parts are made by prepreg layup, resin transfer molding, or autoclave curing. These processes demand climate-controlled facilities and precise cure cycles to ensure part integrity.

Once individual components are formed, they move to body-in-white assembly. This stage fuses panels into a structural shell through welding, riveting, clinching, and adhesives. Resistance spot welding remains ubiquitous. Controlled current, electrode force, and weld time produce consistent nugget sizes. Laser welding provides narrow heat-affected zones and cleaner joints for visible seams. Robotic welding cells combine multiple processes, including filler wire deposition or seam sealing, and are often integrated with vision systems for part alignment. Structural adhesives complement welding by distributing loads and improving fatigue life. The correct adhesive selection, surface preparation, and cure profile are essential for joint durability.

Automation dominates modern assembly. Robots handle repetitive joins with micron-level repeatability. PLCs and manufacturing execution systems synchronize stamping, transfer, and welding operations. Digital twins model process behavior and flag deviations in real time. Flexible manufacturing lines permit multiple variants to be produced with minimal changeover, enabling responsiveness to market demands. Tooling indices, modular fixtures, and quick-change die systems shorten downtime. Yet automation cannot substitute for robust process engineering. Engineers still define weld schedules, spot sequences, and clamp locations to control assembly distortion and maintain dimensional tolerance chains.

Surface protection and paint processes follow BIW completion. Pretreatment includes degreasing, phosphating, and cathodic electrocoating. The electrocoat bath uniformly deposits a corrosion-resistant layer inside cavities and on complex shapes. After rinsing and curing, primer, base coat, and clear coat are applied. Paint robots, equipped with high-resolution nozzles, create thin, even films while minimizing overspray. Advanced coating chemistries reduce volatile organic compounds and improve abrasion resistance. Infrared and convection ovens cure coatings under controlled temperatures. Environmental controls and solvent recovery systems capture emissions and reduce waste. For some parts, powder coating or specialized coatings are used for durable finishes and improved environmental performance.

Plastic and composite parts receive tailored surface preparation. Thermoplastic bumpers are primed for adhesion and painted using lower-temperature cure cycles. Composite bonnets or hoods may undergo gelcoat application and sanding prior to paint. When parts require a cosmetic outer skin with an energy-absorbing inner structure, two-shot molding or overmolding techniques produce integrated assemblies.

Tooling and mold production underpin all these operations. Toolmakers fabricate dies, fixtures, and molds using CNC machining, EDM, and surface grinding. Precision is non-negotiable. Die maintenance programs manage wear, rectify misalignment, and ensure consistent part geometry across long runs. Injection molds incorporate conformal cooling and hardened inserts to maintain cycle time and dimensional stability. For composite tooling, matched metal molds or female tools control surface finish and cure pressures.

Quality assurance permeates every step. Statistical process control monitors critical variables like press tonnage, weld current, and paint film thickness. Coordinate measuring machines and laser scanning capture part geometry and verify tolerances. Dimensional control plans map inspection points across assemblies to ensure fit and finish. Non-destructive testing methods, such as ultrasonic inspection or dye penetrant checks, validate weld integrity or composite lamination quality. Material traceability systems record batch numbers, supplier certificates, and heat treatments to maintain provenance and support warranty claims.

Supply chain and material sourcing influence manufacturing choices. Strategic sourcing secures steel, aluminum, polymers, and composite preforms. Just-in-time logistics and kanban systems reduce inventory and lower costs. However, tightly coupled supply chains require robust contingency planning. Tooling lead times, seasonal demand shifts, and alloy availability shape production schedules. Sustainability initiatives encourage high recycled-content materials and closed-loop recycling of scrap metal. Melt shops and recycling partners return trimmed stampings to the supply chain, conserving resources and reducing raw material costs.

Integration of design and manufacturing accelerates development. CAD models link directly to CAM systems. Forming simulations predict springback and thinning before a die is cut. Finite element analysis models crash behavior, stacking rules, and material strain limits. Virtual tryouts reduce physical tooling iterations and shorten time to production. Digital process control systems capture assembly metrics to refine robot paths and optimize cycle times.

Repairability and aftermarket considerations also inform manufacturing decisions. Parts intended for repair are designed with standardized fasteners, replaceable sub-assemblies, and accessible weld points. OEM parts follow original specifications for fit and crash performance, while equivalent aftermarket components must meet similar technical requirements. A robust change-management practice records engineering revisions, ensuring parts from different production runs remain compatible.

Human expertise remains essential despite automation. Skilled technicians program robots, maintain dies, and diagnose process issues. Continuous training in welding parameters, adhesion science, and coating chemistry preserves institutional knowledge. Cross-functional teams of engineers, quality specialists, and production staff solve complex integration challenges. Lean manufacturing practices reduce waste and improve flow. Root-cause analysis and corrective action systems close the loop on defects.

The manufacturing ecosystem also adapts to emerging mobility trends. Lighter materials reduce energy consumption and improve range for electrified vehicles. High-strength alloys and composite reinforcements maintain safety while lowering mass. Modular architectures allow platform sharing and higher economies of scale. As regulation and consumer demand evolve, process flexibility and rapid retooling capacity become competitive advantages.

For practitioners seeking deeper technical grounding, authoritative references document manufacturing systems and process integration. These resources discuss die engineering, assembly automation, and paint chemistry in greater depth. They explain how flexible stamping lines and integrated BIW systems enable efficient production of diverse part families.

For an illustrative case study showing advanced manufacturing and system integration, see this resource on automotive body manufacturing systems and processes: https://www.wiley.com/en-us/The+Automotive+Body+Manufacturing+Systems+and+Processes-p-9781118026549

For a real-world example of a lightweight exterior component produced with composite techniques, consult this carbon fiber bonnet example. (https://mitsubishiautopartsshop.com/brand-new-original-carbon-fiber-bonnet-hood-for-mitsubishi-lancer-evo-x/)

The arc from raw coil and resin to a painted, crash-certified body part depends on coordinated engineering, precise tooling, and robust quality systems. Each decision—from alloy selection to weld schedule—affects performance and cost. Mastery of these interconnected processes lets manufacturers deliver the full range of auto body parts consistently, across many models and many production cycles.

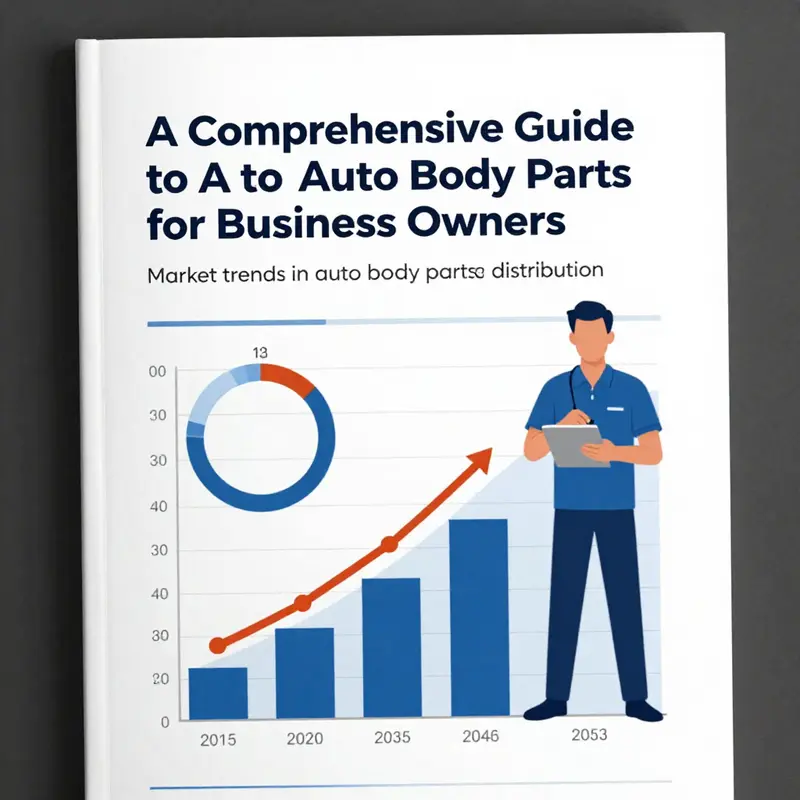

How A to Z Auto Body Parts Move: Market Dynamics, Hubs, and Sourcing Best Practices

The distribution of auto body parts—from a single fender to complete front-end assemblies—operates at the intersection of manufacturing geography, vehicle design trends, and buyer expectations. Global demand for body parts is rising, and this growth reshapes how parts flow from mold shops and stamping presses to repair bays and parts warehouses. Understanding that flow is essential for anyone building a resilient parts business or sourcing effectively across regions.

At the heart of the market shift is vehicle architecture. The move toward integrated, unibody designs has increased the value of pre-fitted assemblies. Components such as hoods, fenders, and bumper covers are now engineered to mate precisely with adjacent panels and internal systems. This reduces installation time and warranty issues, but it raises manufacturing complexity. Suppliers must now deliver parts that include mounting points, painted finishes, and sometimes embedded electronic features. The result is a higher prevalence of larger, more finished wholesale parts and fewer simple, raw blanks.

Geography plays a decisive role in distribution. One region supplies an outsized share of global volume, supported by dense industrial clusters that concentrate tooling, molding, finishing, and logistics. These clusters provide a full manufacturing continuum, from mold fabrication to final assembly and inspection. Proximity to raw material processors, such as polymer compounders and steel mills, shortens procurement cycles. For distributors, this translates to predictable lead times and lower landed costs when sourcing from integrated hubs.

Specialization within those clusters drives efficiency. Certain cities become known for plastic injection molding, others for precision metal stamping, and still others for surface treatment and painting. Suppliers in such clusters can produce complete, ready-to-fit parts with turnaround measured in weeks rather than months. Typical lead times after sample approval fall between 15 and 30 days for standard runs, assuming tooling exists and raw material flow is stable. For custom molds or low-volume parts, timelines lengthen to account for mold design and validation.

Product-level trends further influence distribution patterns. Bumper covers have emerged as a high-turnover category. They face frequent minor impacts and are often replaced without structural repairs. Modern bumpers often house sensors for parking assist, radar modules, and wiring harnesses. These embedded systems increase part value and complicate returns and warranty processing. Distributors that build capabilities to handle sensor calibration, connector checks, and functional testing add tangible value to repair shops and fleet clients.

Quality expectations have risen alongside complexity. Certification remains the baseline; however, buyers increasingly demand expanded documentation. Material Test Reports, dimensional inspection sheets, and weld integrity logs are now table stakes for larger wholesale contracts. Performance metrics such as on-time delivery rates above 98% and rapid response times are used as proxies for operational reliability. Suppliers that can expose production metrics and share traceability data gain trust from national and regional distributors.

Order profiles are changing, too. Smaller Minimum Order Quantities for validation batches are now common. This lowers the barrier for distributors to test new parts and reduces inventory risk. Conversely, strategic buyers still leverage volume commitments to secure favorable pricing and priority production slots. Balancing these needs requires flexible supplier relationships and a clear understanding of MOQ trade-offs when negotiating lead times and prices.

Logistics remain a critical variable. Parts that are large or fragile require protective packaging and specialized carriers. Sea freight dominates international movement for high-volume shipments, while air freight is reserved for urgent replenishment or high-value components. Inland logistics within producing regions can be a competitive advantage. Shorter distances to seaports and major highways reduce transit variability and storage time. Efficient exporters bundle shipments and coordinate consolidation to lower per-unit freight costs and reduce handling damage.

Technology now supports smarter sourcing decisions. Digital catalogs with 3D fitment data, photo-realistic images, and parts interchange references accelerate matching and reduce return rates. Suppliers that integrate fitment data into distributor systems shorten order cycles. In parallel, electronic documentation for compliance and testing reduces friction during audits. Distributors seeking to scale should prioritize partners who share digital assets and participate in common data exchange formats.

Supplier selection must be multi-dimensional. Price remains important, but it is no longer the sole decisive factor. Material compatibility—metal versus plastic construction—affects finish options, repairability, and fitment behavior. Assessments should include factory capabilities for painting, e-coating, and assembly. A supplier that offers integrated finishing reduces handling steps for the buyer. Buyers should also verify tooling ownership and maintenance regimes for critical molds and dies, as tooling health directly affects dimensional consistency across lots.

Risk management in distribution is practical rather than theoretical. Diversifying suppliers across clusters reduces exposure to regional shocks. Where possible, maintain a mix of local quick-response vendors and offshore volume suppliers. Quick-response vendors serve emergency repairs and expedite small runs. Offshore partners handle scale and cost efficiency. Contractual terms should define quality metrics, inspection rights, and spare tooling arrangements to mitigate lead time risks.

Customer-facing services differentiate distributors in a crowded field. Offering matched sets, painted panels to color codes, and pre-assembled subcomponents enhances perceived value. For electrified and sensor-laden parts, providers that can test interfaces and validate function before shipping reduce installation headaches for repairers. Warranty handling and reverse logistics policies that are clear and fair improve buyer confidence and reduce disputes.

Sustainability is an emerging procurement criterion. Recycled-content materials and solvent-free painting processes are becoming visible in supplier dossiers. While not yet a purchasing mandate for many buyers, sustainability can be a competitive advantage when presenting to large fleets or corporate procurement teams. Firms that can demonstrate reduced VOC emissions or material circularity may find new business with environmentally conscious clients.

Data-driven procurement practices are becoming the norm. Track and measure supplier KPIs such as lead-time consistency, defect rate per thousand parts, and responsiveness. Use these metrics to tier suppliers and assign business according to performance. Transparent scorecards reduce subjective decision-making and align expectations for continuous improvement. For distributors scaling across regions, centralized procurement teams can standardize evaluation and negotiate volume-based incentives across a supplier network.

For those building an A to Z inventory—the full slate of body parts from A-pillars to zippers for trim—inventory planning is critical. Forecasts must account for accident patterns, seasonality, and the age profile of the vehicle parc in target markets. SUVs and trucks are frequent targets for bumper and fender sales, while older sedans may drive demand for more generic exterior panels. Channel strategies should prioritize rotational stock that matches local demand profiles and supplement with rapid replenishment from cluster suppliers for less-frequent items.

Finally, the most successful distributors treat supplier partnerships as strategic assets. They invest in joint quality programs, co-funded tooling where appropriate, and collaborative forecasting. This alignment shortens lead times, stabilizes pricing, and improves service. The market rewards those who can supply complete, tested, and reliable parts with predictable logistics and transparent documentation.

For a practical example of a finished bumper available through a parts catalog, see this front bumper example for a mid-size vehicle.https://mitsubishiautopartsshop.com/2006-2008-mitsubishi-eclipse-front-bumper/

For deeper macroeconomic context and market sizing, refer to the comprehensive industry analysis published by a leading market research firm: https://www.grandviewresearch.com/industry-analysis/automotive-body-parts-market-size-share-trends-analysis-report-by-product-by-region-and-segment-forecasts-2025-2033

Final thoughts

In summary, the landscape of A to Z auto body parts is vast and interconnected, encompassing a variety of suppliers, specific components, intricate manufacturing processes, and dynamic market insights. For business owners, staying informed about these aspects is critical for success and competitiveness in the automotive industry. By leveraging the knowledge gained from this guide, you can optimize your sourcing strategies, enhance your inventory management, and better meet your customers’ needs. Embrace these insights to navigate the complexities of the auto body parts market and drive your business forward.