The street auto parts market has emerged as a pivotal player in the automotive industry, driving innovation and customization. For business owners, understanding this market is essential for harnessing its potential. This article delves into the intricacies of the street auto parts market, examining its dynamics, the role these parts play in vehicle customization, the economic impacts on local communities, technological advancements in the supply chain, and societal trends shaping demand. Each chapter will provide insights that are vital for businesses that want to thrive in this competitive landscape.

Under the Streetlights: The Urban Forge of Street Auto Parts and Its Global Pulse

Street auto parts markets are not merely shops. They are living ecosystems where culture, engineering, and commerce mingle in a shared space. In cities with dense manufacturing and logistics networks, such markets become the arteries of a vast aftermarket. They cater to a spectrum of needs, from routine consumables to high-performance components that promise a personal signature on every ride. The dynamic energy of these markets comes from the convergence of craftspeople who cut metal, engineers who model flow, retailers who source from distant suppliers, and customers who blend aspiration with a practical budget. In many places, that energy is intensified by a cultural appetite for customization that translates into a thriving local economy. The market is not a static shelf; it is an ongoing conversation between what a driver wants and what a workshop can responsibly deliver.

In cities with dense manufacturing ecosystems, the market environment reveals a practical truth. Vendors cluster around streets, sheds, and warehouses, creating a dense map of sourcing options. The choices offered are defined as much by availability and price as by engineering fit. A component that might seem routine in one context can be a gateway to a performance goal in another. For instance, within the same urban area, cylinder heads are often crafted from lightweight aluminum. This choice reflects a real balancing act: better thermal management and reduced engine weight translate into less parasitic drag and improved fuel economy, especially important for customers chasing performance gains in a crowded, traffic-heavy city. Aluminum is not magic; it is a calculated decision that must withstand heat, vibration, and the wear of thousands of miles. The market’s professionals read those signals as part of a larger equation. Material selection, manufacturing tolerances, and compatibility with existing engines all matter when a shop’s reputation and a customer’s budget hang in the balance.

The market is shaped by global trends that ripple through every stall and warehouse. The automotive aftermarket is large in its own right, and its growth mirrors the broader shifts in vehicle ownership, maintenance needs, and the rapid evolution toward electrification. The global forecast suggests a substantial expansion in value over the next decade. By mid-decade, the aftermarket is projected to cross the $457 billion mark, and by the mid to late 2030s it could approach $605 billion. Those numbers are more than symbols; they translate into more parts in more hands, more choices at more price points, and a continuous push for faster, safer, and more reliable sourcing. In parallel, the manufacturing side of the industry is expected to grow even more robustly. The pipeline of electronic sensors, precision-machined components, and intelligent vehicle systems is expanding as OEMs and aftermarket providers alike invest in new technologies. The market becomes a bridge that links owners seeking customization with workshops that turn ideas into a ride that stands apart from the crowd.

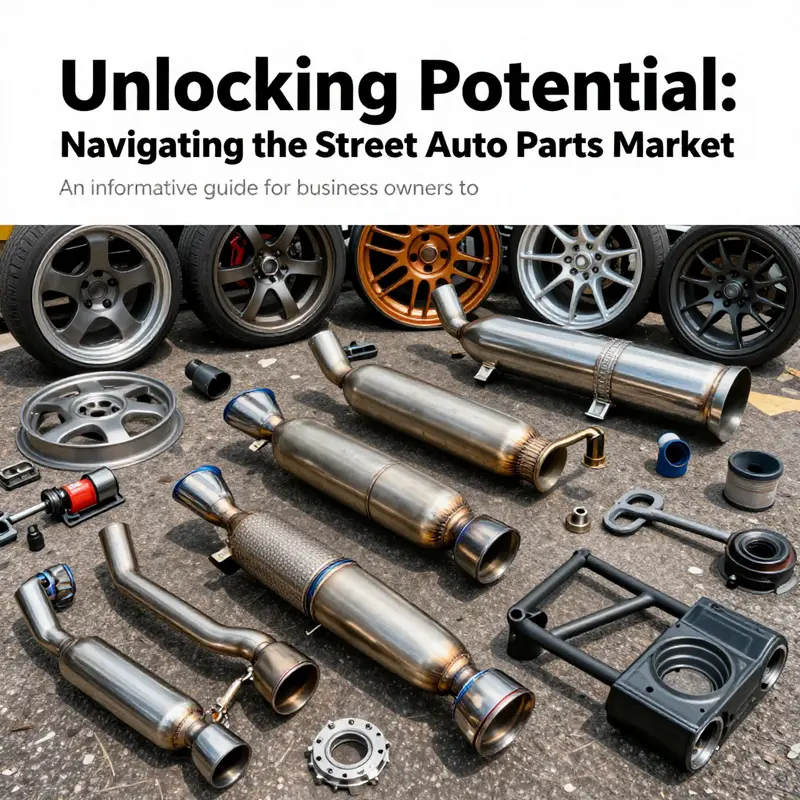

A useful way to see specialization at work is to consider the exhaust and exhaust-related parts ecosystem. The market hosts a spectrum of offerings designed to tune performance, sound, and emissions handling. Mechanisms like exhaust pipes, mufflers, and end tips illustrate how specialized these parts can be. The enhancements they promise—more power, deeper tone, or lighter weight—often require careful installation by trained professionals. There is a trade-off to consider: the same modification that improves top-end performance can alter the ride feel on everyday roads. For some, that stiffer sensation and altered NVH (noise, vibration, and harshness) may be a fair price for the thrill of a sharper throttle response. For others, comfort remains king, and thus the market balances those preferences by offering a spectrum of configurations, from street-oriented setups to race-inspired systems designed for controlled environments. The narrative of these components is a reminder that the street auto parts world is not simply about snapping in a new piece; it is about aligning a vehicle’s character with the driver’s intent and the road’s demands.

To navigate this space effectively, professionals lean on a shared base of technical knowledge. They must understand not only what a part does but how it behaves under real-world conditions. Materials, tolerances, and application-specific advantages matter because a misfit can lead to misfires, overheating, or warranty concerns that cascade into a damaged reputation. Quality management and traceability take on real significance in this context. The supply chain is a mosaic of suppliers and manufacturers, and the most credible players are those that can offer verifiable origins and compliant documentation. In a market that grows with every new model year and every new powertrain architecture, dependable sourcing and clear communication become competitive differentiators. Firms that invest in transparent processes, systematic quality checks, and reliable logistics tend to outperform less organized peers. They can forecast demand with greater accuracy, ship parts faster, and stand behind what they sell with confidence.

Geography adds another layer to the story. Guangdong, Zhejiang, and the major urban centers inland—Beijing and Shanghai—emerge as key nodes in the web of production, assembly, and procurement. These places work as hubs where components are machined, tested, and repackaged for distribution to a broad spectrum of markets. The regional concentration of manufacturing know-how means that many of the parts that arrive in street markets have traveled short and well-trodden paths from toolrooms to storefronts. The convergence of engineering skill and logistical capability creates an ecosystem that supports both accessibility and sophistication. It is not unusual to find market stalls that can provide both a tested, standards-compliant part and a customized option tailored to a customer’s exacting needs—a blend of reliability and individuality that keeps customers coming back.

This ecosystem, like any living market, has to adapt to broader industry dynamics. The automotive world is in a period of rapid recalibration. The push toward electrification shifts demand in nuanced ways: more focus on sensors, controllers, high-efficiency charging solutions, and electronics for energy management; fewer parts devoted to traditional internal combustion engine subassemblies; and a parallel demand for cooling, safety, and software validation. Yet the demand for high-performance modifications, maintenance, and restoration remains stubbornly strong among enthusiasts who want to personalize their rides. The larger narrative is not just about parts; it is about how a city’s street culture and its manufacturing backbone intersect to shape an entire market segment. The market thrives on community knowledge, with skilled technicians passing expertise through apprenticeships, precise workshop practices, and the habit of sharing what works and what does not. Real-time data, field feedback, and collective experience help sellers and buyers alike stay aligned with current realities, ensuring that a modification chosen in a shop will perform as advertised on the open road.

The broader industry story, including a recent wave of strategic restructuring within the automotive parts sector, hints at how market participants may recalibrate their portfolios. As the industry contemplates how to balance traditional aftermarket strength with the accelerating adoption of electrified powertrains and connected vehicle systems, participants seek organizational models that enable scale, reliability, and faster response times. The takeaway is not simply about growth in dollars but about a shift in how value is created and delivered. In an environment where a single part can be sourced from a dozen potential suppliers across continents, the ability to demonstrate traceability, offer customization, and meet logistical demands becomes the differentiator between a fleeting trend and a lasting relationship. For students of the street auto parts market, this is a reminder that the market is as much a negotiation between speed and certainty as it is between horsepower and styling. The industry’s future will hinge on how well players in street markets translate global signals into localized action, turning a city’s rhythm into a reliable supply chain.

For readers seeking a concrete illustration of how these dynamics play out in a practical context, consider a gateway example from the community’s content ecosystem: a detailed page on a specific body part that often appears in conversations about street performance and customization. The page highlights a very particular piece and its fitment details, offering a glimpse into how markets translate theory into a real, install-ready item. You can explore it here: 08-15-mitsubishi-lancer-evolution-evo-x-hood-phantom-black-oem-u02. This link illustrates how a single component from a vendor portal can symbolize the broader market forces at work: the tension between stock reliability and aftermarket innovation, the need for precise compatibility, and the value of a straightforward sourcing path for enthusiasts who want to move quickly from idea to on-road reality.

The global context, the technical realities of parts and materials, and the street-level pragmatism of markets like those in Guangzhou and other hubs combine to form a rich tapestry. The chapter of street auto parts is not a tale of isolated shops but a story about how a city’s mechanical culture threads itself into global supply chains. It is about how confidence, not just chrome, becomes the currency of trust between seller and buyer. It is about how the urban market keeps pace with technological shocks while preserving a space where personal expression through vehicles remains possible. And as the industry continues to evolve, the street auto parts market will persist as a key arena where people meet, tinker, and push the art and science of mobility forward.

External resource: For a broader industry perspective on the dynamics at play, see McKinsey’s analysis of the new dynamics of automotive supply: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/the-new-dynamics-of-automotive-supply

Beyond the Factory Line: How Street Auto Parts Shape Personal Identity and Performance

Street auto parts are more than a catalog of add-ons. They are a language spoken by a generation that treats automobiles as living canvases, tuned machines, and social statements. In the world of vehicle customization, street parts operate at the intersection of engineering precision and cultural expression. They transform not only how a car moves, but how its owner is perceived and how a community around modification przestrz. The result is a dynamic ecosystem where performance goals, aesthetic ambitions, and daily usability meet in a single machine that carries personal history and a traceable path toward future upgrades.

Performance-driven pieces anchor the street project in physics and practicality. The core promise of aftermarket components is to alter a vehicle’s behavior in predictable, measurable ways. Upgraded exhaust systems, for instance, are not merely loud accents; they are designed to improve engine breathing, reduce backpressure in selected RPM ranges, and shift power delivery to align with the driver’s intent. A well-mchosen intake system can unlock a few extra degrees of freedom in throttle responsiveness, while a tuned air path helps the engine operate closer to its design sweet spot. Suspension components, from coilovers to bushings and sway bars, translate road texture into controllable feedback, sharpening cornering attitude and reducing body roll. Braking kits, larger rotors, and upgraded callipers convert momentum into stopping power with a safety margin that matters in real-world driving, track days, and spirited street sessions alike. When these parts are selected with a clear understanding of the vehicle’s weight, power band, and intended use, the result is not simply faster laps on a strip of asphalt but a car that communicates more honestly with its driver, rewarding precise inputs and disciplined driving.

But performance is not a stand-alone goal. It sits alongside aesthetics, and in many street projects the two domains are braided from the start. The visual impact of a vehicle—a front splitter, a set of wide wheels, a lowered stance, a sculpted rear diffuser—often mirrors the performance logic underneath. Body kits become a language of function and form, where airflow considerations and stance geometry cohere to create a silhouette that communicates aggression, speed, or refinement, depending on the owner’s intent. Wheels and tires—color, gloss, and finish on forged or flow-formed rims—are not only tactile and visual statements; they also influence handling through mass, inertia, and contact patch dynamics. Aesthetic choices frequently flow into practical ones: a broader tire may require fender modifications; a carbon fiber hood may reduce weight, which again affects suspension tuning and handling balance. The synergy between form and function is not a luxury; it is a core part of how an owner translates a personal vision into a can-do project that withstands daily wear and tear while still turning heads at a weekend gathering.

The comfort and usability dimension of street parts often gets overlooked in conversations that hype horsepower and showmanship. Yet it matters deeply for anyone who spends hours in the driver’s seat, or who relies on a car for daily commutes, errands, or weekend getaways. Interior upgrades—adjustable, grippy steering wheels, supportive seats, improved HVAC routing, and refined sound systems—make long drives more enjoyable and reduce fatigue during intensive sessions behind the wheel. Ergonomic improvements, like seat bolstering that aligns with a driver’s posture or a cockpit layout that reduces reach for controls, can transform a project from a display piece into a trusted daily companion. This is where the street parts ethos expands beyond the showroom or desert track; it becomes a philosophy of long-term usability, where modifications are tested under both showroom glare and rain-soaked potholes, ensuring reliability alongside spectacle.

Identity emerges as perhaps the most intimate facet of customization. Each part is a brushstroke in a larger portrait of who the owner is and what the car represents. This is not about chasing trends but about curating a coherent narrative across components, colors, textures, and finishes. A street project often begins with a concept—a taste for a particular era of styling, a nod to a specific racing lineage, or a personal memory attached to a certain road. As the build evolves, the choices weave together into a recognizable character: a car that speaks of discipline, or one that embodies bold risk, or a combination of both. The parts chosen by the owner serve as milestones in a journey, each upgrade marking a phase of learning, testing, and refinement. In communities that share this passion, the car becomes a social artifact as much as a personal machine. Photos, videos, and build threads turn private projects into shared experiences, inviting feedback, critique, and inspiration from peers who understand the language of vibrations, balance, heat, and torque.

This interconnected ecosystem relies on a robust supply chain that can sustain customization at scale while preserving integrity and traceability. The modern street auto parts landscape spans continents, with production hubs in regions renowned for precision engineering and rapid prototyping. The research landscape notes that Guangdong and Zhejiang in China, alongside major metropolitan manufacturing zones such as Beijing and Shanghai, are pivotal for sourcing electronic sensors, precision machined components, and sophisticated vehicle systems. This geographic specialization empowers builders to source a diverse array of parts—from lightweight composites to high-precision fasteners—while enabling communities to assemble, test, and iterate with flexibility. The operational reality of this market rests on quality management and supplier credibility. For any builder, seeking ISO or TS-like certifications, verifiable part provenance, and reliable B2B support is essential to ensure that a project not only looks good but also maintains safety and durability across miles and seasons. The emphasis on traceability and compliance is not just about risk management; it is about enabling sustained creativity. When a builder can rely on a steady supply of consistently manufactured components, the focus shifts from just fixing a problem to evolving a concept with precision.

Within this framework, the vision for street parts becomes clear: each piece must align with a broader strategy of performance, aesthetics, comfort, and identity, rather than serve as a mere one-off impulse. That alignment is what makes a build sustainable, scalable, and scalable to a diverse audience. It also frames a practical approach to choosing parts. A thoughtful buyer evaluates not only the technical specs but also how a component integrates with existing systems, how it interacts with the vehicle’s weight distribution and suspension geometry, and how it will fare under the vagaries of daily use. The decision matrix includes durability, serviceability, availability of aftermarket support, and the potential to upgrade further. In short, street auto parts function as a continuous upgrade ladder, allowing owners to incrementally elevate performance and style while maintaining a coherent narrative across the vehicle’s evolving silhouette.

An emblematic example of this integrated approach is the choice to incorporate advanced, lightweight materials into the car’s exterior and engine bay. Consider a carbon fiber hood, which not only reduces unsprung weight and push-rod drag but also creates a distinctive visual signature that signals a performance orientation without sacrificing practicality. The decision to pursue such a feature is rarely isolated to its own merits. It cascades into cooling strategies, hood latch fitment, alignment tolerances, and hood venting logic, all of which must be harmonized with the rest of the car’s aero profile and mechanical layout. In this regard, the use of a high-end component often requires a broader plan that includes compatible upgrades in sensors, wiring harnesses, and even software calibration to ensure that the car’s engine management, climate control, and electrical systems continue to function seamlessly. For readers who want to visualize this kind of integration, a tangible example is the carbon fiber bonnet hood for a Mitsubishi Lancer Evolution X, which embodies the synthesis of weight savings, aggressive aesthetics, and functional airflow management. See this example here: carbon fiber hood for Mitsubishi Lancer Evo X.

As the market matures, the path from concept to completed build becomes clearer. Builders increasingly favor a holistic planning approach that maps out the sequence of upgrades, identifies potential compatibility challenges, and frames testing protocols that verify performance gains in real driving conditions rather than in isolated bench tests. They begin with a vision, then assemble a parts dossier that includes performance targets, aesthetic cues, and ergonomic benchmarks. They discuss weight distribution, center of gravity, and the car’s dynamic responses to steering inputs and throttle modulation. They consider the impact of upgrades on reliability, service intervals, and maintenance costs. This disciplined mindset does not stifle creativity; it channels it. It ensures that each addition contributes meaningfully to the car’s overall character and capability, rather than turning the project into a random pile of parts that look good in photos but perform poorly on the road.

Finally, there is the cultural layer that keeps street auto parts vibrant. Social spaces, online communities, and local car clubs create feedback loops that accelerate learning, showcase best practices, and celebrate transformative builds. These communities thrive on storytelling—the narrative of a build arc, the challenges overcome, the way a particular part interacted with another, and the moment when the car finally achieved a satisfying balance of speed, grip, and presence. In this sense, street parts are cultural artifacts as much as mechanical components. They record a time, a demand for individuality, and a shared curiosity about how far engineering can bend to support personal expression. The result is a landscape where parts are curated not just for their technical claims but for their ability to communicate a story about who drives the car and why.

External resources and industry trends offer framing for this evolving landscape. For enthusiasts seeking deeper insight into the strategic shifts within the automotive aftermarket, Car and Driver’s guide to car customization provides a broad, practical perspective on how individual choices accumulate into a coherent project and how builders balance performance, aesthetics, and daily usability across the lifespan of a car. (External resource: https://www.caranddriver.com/features/a45698732/the-ultimate-guide-to-car-customization/)

How Street Auto Parts Fuel Local Economies: Jobs, Skills and Community Resilience

How street auto parts create value in neighborhoods and small business networks

A street auto parts ecosystem is more than a collection of stalls and workshops. It is a living local industry that channels demand for mobility into livelihoods, skills and micro-enterprise. Where formal aftermarkets and dealerships do not fully serve a population, street-level parts markets step in. They supply affordable components. They keep vehicles on the road. They incubate tradespeople. Those outcomes ripple through neighborhoods and small towns, shaping employment patterns, informal credit systems and localized supply chains.

These markets typically cluster where transport links, skilled labor and accessible retail space coincide. That clustering lowers transaction costs for both buyers and sellers. A motorist can compare options within a short walk. A mechanic can source replacement parts quickly. A small shop can offer installation and minor fabrication on the spot. These efficiencies matter to low- and middle-income vehicle owners. They matter to businesses that rely on predictable mobility. They also create steady demand for a range of services: logistics, packaging, metalwork, upholstery and used-parts recycling. That demand is often undercounted in formal statistics, yet it sustains hundreds, sometimes thousands, of microbusinesses around a single market.

Job creation in the street auto parts economy is both diverse and flexible. Direct roles include salespeople, mechanics, part refurbishers and fabricators. Indirect roles include couriers, waste handlers, tool makers and small-scale shippers. Many participants work in hybrid roles—selling parts during the day, installing them in the evening, and sourcing components between jobs. This fluidity supports income smoothing for households. It also allows new entrepreneurs to experiment with low capital risk. A modest stall, some used parts and a willingness to learn can become a viable business within months. This low barrier to entry is a major source of resilience in neighborhoods with limited formal employment options.

The local multiplier effect amplifies the industry’s contribution. Money spent on parts and repairs seldom leaves the community immediately. It pays wages, which are spent on food, rent and local services. Mechanics buy tools from nearby suppliers. Parts sellers hire local transport and use local fabrication shops for customization. Even marginal increases in sales can support ancillary micro-lenders who provide short-term capital. Over time, these flows create thick networks of transactions that support both formal and informal actors.

Yet the informal nature of many street auto parts markets introduces risks. Unregulated supply chains can allow counterfeit or substandard parts to circulate. Those parts may be cheaper, but they can compromise vehicle safety and raise long-term ownership costs. Informality also limits tax revenue and access to formal credit, blocking opportunities for shop upgrades and compliance investments. Environmental externalities are another concern: used oil, solvents and discarded parts can pollute soil and waterways when disposal is unmanaged. These harms affect public health and the livability of commercial districts.

Addressing risks without undermining the sector’s benefits means adopting pragmatic, phased interventions. Local governments can start by recognizing the industry as an economic asset. Simple steps—formalizing property tenure for markets, providing waste-collection services, and offering basic training in safety and parts identification—produce large returns. Training programs that teach identification of critical safety components help mechanics and sellers distinguish reliable parts. Those programs reduce accident risk and support consumer confidence. They also create pathways for shops to voluntarily adopt certification standards in exchange for preferential contracting and access to microfinance.

Integration into formal supply chains is another path to uplift local value. When a small parts seller gains traceability documentation and basic quality checks, larger retailers and fleet operators consider them as suppliers. This shifts revenue patterns from purely spot sales to ongoing contracts. To make that shift feasible, intermediary organizations—trade associations, business incubators or cooperative networks—can aggregate demand and standardize procurement. Aggregation reduces logistical complexity and raises bargaining power, making investments in compliance and quality economically viable for small operators.

The geographical dimension matters. Production clusters in regions with machining, electronics, and materials capabilities feed street markets elsewhere. Cities with strong manufacturing footprints are natural nodes for higher-value aftermarket components, such as sensors, precision brackets and performance suspension parts. Conversely, markets that primarily trade recycled or salvaged parts rely on local salvage yards and cross-border informal flows. Policy that supports transparent sourcing and logistics bridges these worlds. Simple improvements, like clearer customs guidance for used parts and streamlined certification for refurbished components, reduce friction across the supply chain.

Skills development is an overlooked multiplier. Many successful mechanics and fabricators start as apprentices in street markets. Hands-on problem solving—retrofitting parts, fabricating brackets, diagnosing wiring faults—builds adaptive expertise that formal training alone rarely produces. Supporting this apprenticeship culture with short, modular vocational courses multiplies returns. Courses that focus on safety-critical inspection, emissions controls and electronic diagnostic tools raise the baseline competence of the sector. They also create a talent pipeline for more formal businesses seeking trained technicians.

Financial inclusion unlocks further growth. Informal credit networks supply many microbusinesses with working capital. But these networks often charge high rates and tie borrowing to personal networks. Microfinance tailored to parts sellers and mobile payment systems can reduce cost and increase predictability. Lending criteria that value repeat sales records, supplier relationships and local reputation can provide a bridge from informal credit to formal financing. When shops can invest in proper toolsets, inventory management, and environmental safeguards, the whole local cluster becomes more resilient and less risky for outside investors.

Regulation should be risk-based, not punitive. Blanket bans on used parts or informal workshops often push activity deeper underground. A better approach targets the most harmful practices while incentivizing safer behavior. For example, differential registration fees for regular vendors, access to subsidized waste disposal, and recognition programs for shops that meet safety checklists all nudge markets toward formality. Enforcement paired with opportunity—technical support, training and financing—produces durable compliance.

Sustainability interventions are feasible and inexpensive when designed for the street context. Organized collection points for used oil, coolant and scrap metal reduce pollution and recover value. Group purchases of recycling equipment and shared off-site storage reduce individual costs. In some cities, structured take-back schemes for specific parts have emerged, returning value to sellers while ensuring environmental compliance. These programs require coordination, but their cost is often modest relative to long-term public health benefits.

Finally, the macro context shapes local outcomes. Shifts in global parts distribution, corporate reorganizations, and certification trends affect local suppliers. Strategic industry moves—such as the separation of large distribution businesses into focused entities—signal changing priorities in logistics and aftermarket service models. Local actors who monitor these trends can position themselves to capture new opportunities. Urban planners and economic development agencies can help by mapping local competencies and connecting them to regional manufacturing hubs. Where local clusters align with regional strengths—metalwork, electronics assembly or precision machining—they can move from mere retail markets to integrated nodes of the broader supply chain.

A practical example of connection between local aftermarket activity and broader supply dynamics appears in aftermarket listings that showcase higher-value components for customization. These listings reveal the demand for specialty items and adaptive installation services that street shops provide. Such demand often spurs complementary businesses, from performance fabrication to bespoke upholstery, broadening the economic base.

In short, street auto parts industries are engines of local economic activity. They provide low-barrier entrepreneurship, create jobs, and sustain mobility essential to many livelihoods. They also present challenges in safety, taxation and environmental protection. Policymakers and community leaders who treat these markets as assets, rather than nuisances, find practical ways to raise standards without destroying livelihoods. Targeted training, phased formalization, financial inclusion and basic environmental services produce measurable gains. In doing so, cities and regions preserve the adaptability of street markets while capturing greater economic value for communities.

For a broader perspective on how the auto industry contributes to economies, including formal manufacturing and the wider aftermarket, consult this in-depth analysis: Deloitte Insights: Auto Industry Impact on Economy.

For a concrete example of aftermarket listings that illustrate demand for higher-value replacements and customization services, see an example aftermarket carbon-fiber bonnet listing: aftermarket carbon-fiber bonnet listing.

Smart Streets: How Technology Is Rewiring the Street Auto Parts Supply Chain

Smart Streets: How Technology Is Rewiring the Street Auto Parts Supply Chain

City garages, specialist tuners, and independent parts dealers rely on speed, certainty, and authenticity. Street auto parts—components for customized, high-performance, and style-focused vehicles—carry unique demands. Many parts are low-volume, high-value, or fragile. They require precise sourcing, careful transit, and clear provenance. Recent technological innovations are not incremental. They reshape how parts are sourced, verified, stored, and delivered to the people who build and maintain street culture vehicles.

Digital platforms now act as the nervous system of the supply chain. Centralized inventory systems collect live stock data from warehouses, regional distributors, and retail shelves. APIs and vendor portals unify purchase orders, invoices, and shipment notices. A parts manager can see snap counts across multiple locations. This visibility reduces overstocking and prevents costly stockouts that stall a shop for days. For specialty pieces, like a carbon fiber bonnet for a celebrated sports model, knowing stock levels and delivery windows changes whether a shop accepts a job. Digital platforms also enable quicker procurement cycles. They automate reorders, match demand signals to supplier capacity, and provide a single source of truth for pricing and availability.

At the heart of authenticity and trust is traceability. Counterfeit and improperly refurbished components pose safety risks and reputational damage. Blockchain technology offers a tamper-resistant ledger for part provenance. Each component can be issued a digital identity at manufacture. That identity follows the part through inspection, transport, and sale. When a buyer scans a code or taps a tag, they access a full chain of custody. This record informs warranty claims and supports compliance audits. Blockchain also supports multi-party workflows. Suppliers, logistics providers, and repair shops can verify milestones without relying on a single intermediary. For niche street parts, such as limited-run wheels or bespoke exhaust sections, that recorded provenance protects value and ensures buyers receive what they expect.

Artificial intelligence refines how inventory changes hands. AI-driven demand forecasting blends historical sales, live point-of-sale data, telematics, and local event calendars. It identifies patterns unique to neighborhoods and seasons. In cities, weekends with car meets alter demand for cosmetic and performance upgrades. AI models detect those surges early and trigger dynamic replenishment. This reduces dead stock and speeds access to sought-after items. For small suppliers, AI also supports price optimization. It suggests margins that balance turnover with profitability. When combined with supplier lead-time data, AI can recommend safety stock levels for long-lead custom parts.

IoT-enabled sensors make the physical flow of parts smart. GPS trackers on shipments provide continuous location data. Temperature, humidity, and shock sensors monitor conditions for sensitive items like carbon fiber components or electronics. If a sensor registers an impact during transit, automated alerts prompt quality checks at the destination. Fleet telematics feed route optimization engines. Couriers adjust plans to avoid delays, and receiver systems update expected arrival times. Inside warehouses, RFID and vision systems accelerate pick-and-pack operations. Workers locate parts faster. Automated sorting reduces errors that otherwise cascade into misfits or returns.

These technologies stack to create resilient networks. Consider a mid-sized urban distributor sourcing electronics modules from coastal manufacturing hubs. Manufacturing centers in cities such as Guangzhou and Ningbo provide advanced sensors and precision components. Beijing and Shanghai host design and integration firms. A distributor integrates supplier feeds into its digital platform. Blockchain records parts as they leave factories. AI forecasts demand spikes tied to local retrofit trends. IoT monitors shipment conditions across ocean, road, and last-mile legs. If a disruption occurs—say a port delay—AI suggests alternative supplier allocations and rebalances inventory among regional micro-fulfillment centers. The result is continuity of supply with minimal inventory waste.

Quality standards matter more than ever. Suppliers that hold recognized quality certifications signal reliability. Systems that surface certificates and batch test records accelerate buyer decisions. For aftermarket or customized components, inspection records tied to a part’s digital identity prevent spurious claims. Shops and end users gain confidence. This reduces returns and costly dispute processes.

Logistics strategies have adapted to urban realities. Street-level demand favors fast, flexible delivery. Micro-fulfillment centers near city clusters shorten delivery windows. These smaller hubs store commonly requested parts and provide same-day pickup. Integrating real-time inventory with last-mile routing keeps transport efficient. Delivery vehicles equipped with IoT devices not only report location. They also send condition data and confirm handoffs. This real-time feedback loop improves service and reduces customer wait times.

Reverse logistics and remanufacturing form a growing part of the lifecycle. Street parts often undergo intense wear. High-performance components are rebuilt, recycled, or reconditioned. Digital records track original part histories, making remanufacturing decisions smarter. When a core assembly returns, a technician reviews its service record and past repairs. That data guides rebuild choices and helps price the remanufactured item fairly. A transparent lifecycle reduces waste and retains value within the network.

Interoperability and standards remain practical challenges. Many small shops use basic inventory tools. Larger suppliers use enterprise systems. Bridging these systems requires flexible integration layers and common data models. Open APIs, standardized part numbering, and consistent metadata templates ease data flow. Where full integration isn’t feasible, middleware can translate between formats and protect data integrity.

Security and data governance shape technology adoption. Parts provenance and customer records are commercially sensitive. Permissioned ledgers and role-based access control protect who sees what. Secure serialization, using RFID, NFC, or QR codes, prevents easy cloning. When paired with blockchain, those serialized tokens carry immutable proof of origin. This combination deters counterfeiters and elevates consumer trust.

For street auto parts suppliers, technology also changes customer relationships. Digital catalogs with rich media help buyers assess fit and finish. Augmented images and fitment tools reduce mismatches. Integrated feedback loops let shops rate suppliers and parts. That reputation data becomes part of procurement algorithms. Suppliers that consistently meet quality and delivery targets benefit from better placement within digital marketplaces.

Adopting these technologies requires a clear roadmap and realistic milestones. Start with digitizing inventory and order flows. Next, deploy telematics and basic IoT for logistics visibility. Then introduce AI models for forecasting, tuned to local patterns. Pilot blockchain for high-value or high-risk parts where provenance matters most. Each step must align with staff training and supplier onboarding. Measured adoption reduces friction and builds internal trust in new workflows.

Policy and regulation will influence future directions. Traceability and safety standards are likely to tighten. Data portability and cross-border compliance will shape how blockchain and AI are implemented. Suppliers should invest in flexible architectures that adapt to evolving rules. Multisourcing and nearshoring options will also gain attention. Balancing cost, lead time, and quality will remain a strategic exercise.

The combination of digital platforms, blockchain, AI, and IoT does more than improve logistics. It elevates the entire market for street auto parts. Faster fulfillment, verifiable authenticity, and precise forecasting mean less downtime for garages. They also enable more ambitious custom projects. For instance, a tuner ordering a carbon fiber bonnet for an iconic street model can verify origin, transit condition, and available stock before committing. That certainty shortens project timelines and reduces financial risk. See an example of a carbon fiber bonnet hood for Lancer Evo X to visualize the kind of specialty item that benefits from end-to-end traceability: carbon fiber bonnet hood for Lancer Evo X.

These innovations form a feedback loop. Better data drives smarter forecasts. Smarter forecasts reduce waste and free capital. Free capital supports more investment in quality and service. Over time, the street auto parts ecosystem becomes more reliable and more responsive to the tastes and needs of urban vehicle culture. For detailed research on innovation in automotive supply chains, consult this study: https://www.researchgate.net/publication/392574860InnovationintheAutomotiveSupplyChain

From Curb to Workshop: How Social Shifts Drive Street Auto Parts Demand

Shifting Values, Shifting Shelves

A new cultural landscape is reshaping demand for street auto parts. Individual expression, tighter urban living, evolving environmental priorities, and rapid technology adoption have all changed what drivers want. The market that once sold replacement brake pads and basic filters now stocks performance components, aesthetic upgrades, and specialized electrical modules. These changes are not isolated. They interact and amplify one another, creating a different kind of aftermarket that blends hobbyist energy with mainstream necessity.

Customization is no longer confined to a small subculture. Younger buyers view their vehicles as extensions of identity and lifestyle. They want parts that reflect a mood, a heritage, or a subcultural code. This drives demand for visually expressive components: wheels with distinct finishes, lighting upgrades, bodywork that alters silhouette and stance. Equally strong is the appetite for performance upgrades. Shoppers seek better handling, sharper brakes, and more responsive power delivery. As a result, suppliers that once focused purely on fitment and function now compete on design, finish, and narrative. Parts are marketed as lifestyle choices as much as mechanical solutions.

At the same time, sustainability concerns steer purchase decisions in new directions. Many consumers prefer repairing and upgrading existing vehicles rather than replacing them. That shift supports higher demand for durable, high-quality replacement components and boosts the market for used and recycled parts. Salvage and recycling operations that can certify provenance, offer warranties, and provide quality grading capture customer trust. They also meet an environmental need by extending vehicle lifecycles.

Electric vehicles complicate this picture. EVs reduce demand for many traditional mechanical components. Yet they increase demand for electrical, thermal management, and battery service parts. Suppliers who adapt their catalogues to include sensors, inverters, battery cooling parts, and retrofit accessories find new revenue streams. The aftermarket’s future will be hybrid: a blend of legacy mechanical components and emerging EV systems. Retailers and distributors must therefore plan inventory that balances both worlds.

Urbanization and mobility shifts exert steady pressure on part selection and sales channels. In dense cities, ownership models vary. Some drivers keep cars for longer, while others rely on shared mobility. Those who maintain older vehicles prioritize reliability and cost-effective solutions. This creates a stable niche for affordable OEM-equivalent parts and aftermarket alternatives that promise ease of fit and long service life. Meanwhile, the popularity of DIY repair and modification increases. Consumers who can install parts themselves look for clear fitment information and straightforward instructions.

Digital platforms accelerate these trends. Online marketplaces host reviews, installation guides, and community builds. Enthusiasts share before-and-after photos that inspire purchases. Social proof becomes a major factor in part selection. Detailed user feedback reduces purchase risk and elevates certain SKUs. Parts with strong online visibility move faster. This dynamic favors brands and sellers who invest in photography, specification clarity, and responsive customer service.

Supply chain geography matters more than ever. Manufacturing hubs in certain regions provide advantages for different product types. Some centers specialize in precision electronics and sensor modules. Others excel at composite body panels, alloy wheels, or suspension components. Suppliers that build relationships with reliable manufacturers in these regions can offer shorter lead times and better pricing. They also need quality certifications to gain trust. Standards and traceability—such as industry-recognized quality systems and documentation—are no longer optional for suppliers that want to compete internationally.

Regulatory change and compliance shape the aftermarket quietly but powerfully. Emissions rules, safety mandates, and parts traceability requirements can affect the availability and legality of certain upgrades. Retailers and installers must stay informed about local and national regulations. Customers expect transparency about what is street-legal and what is not. Clear labeling, documented testing, and accessible compliance statements help sellers avoid disputes and build trust.

Community and culture continue to be defining forces. Car clubs, online forums, and local workshops create feedback loops. A well-executed build featured in a community post can shift demand overnight. This cultural momentum benefits parts that have an emotional appeal. At the same time, communities push standards. Enthusiasts share best practices on safety, value, and long-term performance. Parts sellers who engage directly with these groups benefit from authentic endorsements and repeat business.

Retail strategy must respond to these layered shifts. Successful businesses manage a three-legged challenge: inventory choice, information clarity, and delivery reliability. Inventory must cover style-driven items and essential maintenance parts. Information must explain fitment, installation difficulty, and regulatory limits. Delivery must be fast and trackable. Combined, these elements determine conversion rates. Vendors who invest in user-friendly listings, fitment databases, and transparent return policies reduce friction and increase customer loyalty.

For wholesalers and B2B suppliers, customization and OEM-quality replication are growth areas. Workshops demand consistent supply of both routine maintenance parts and specialized kits for performance work. Suppliers who offer bulk pricing, reliable lead times, and technical support find durable partnerships with installers. They also benefit when they help shops expand service offerings by bundling parts with installation guidance.

The secondhand market warrants special attention. Used and reconditioned parts offer affordable alternatives for cost-conscious owners and for rare or out-of-production models. Proper grading, photographed condition reports, and basic warranties convert hesitance into purchases. Salvage providers that invest in cleaning, measuring, and certifying reused parts increase their value proposition. Recycling networks that repurpose electronics or composite materials for rebuilds reduce waste and open new revenue models.

Technology both enables and complicates aftermarket growth. Additive manufacturing, digital modeling, and CNC machining facilitate small-batch production of niche parts. These tools let designers iterate quickly and bring concept parts to market. At the retail level, tools for augmented reality and fitment visualization reduce uncertainty. Customers can preview how parts change appearance and fitment before buying. Yet as parts become more technologically complex, technical documentation must improve. Installation manuals, torque specs, and compatibility matrices become essential content.

Business models will continue to diversify. Subscription services for consumables, parts-as-a-service offerings, and certified refurbishment programs are emerging. They reflect a broader shift: ownership of vehicle function can be unbundled into components, services, and experiences. This is an opportunity for suppliers to build recurring revenue and for consumers to access higher-quality components without large upfront costs.

Throughout these shifts, trust remains central. Consumers want assurance that parts perform as promised. Proof of origin, certification, clear warranties, and honest returns policies all reduce perceived risk. Retailers that foreground quality and information earn repeat customers.

If there is one pragmatic takeaway, it is this: the market is becoming more conversational. Customers speak through reviews, communities, and purchase patterns. Suppliers who listen and adapt their products, information, and logistics will thrive. The street auto parts market is now a convergence of culture, technology, and utility. Success depends on navigating that convergence with clarity, speed, and respect for evolving values.

For further reading on how retail auto parts will adapt to these societal shifts, see this industry analysis: https://www2.deloitte.com/us/en/insights/industry/technology/future-of-retail-auto-parts.html

You can also view a sample listing that reflects the customization trend in the market, such as a carbon fiber bonnet listing for performance-oriented vehicles: carbon fiber bonnet listing.

Final thoughts

The street auto parts market is not merely a segment of the automotive industry; it represents a cultural movement, a source of innovation, and a significant contributor to local economies. Business owners who recognize and adapt to the dynamics of this market are better positioned to leverage opportunities for growth and customer engagement. As technological advancements continue to reshape supply chains and societal trends drive demand, staying informed and proactive will ensure sustained success in this vibrant marketplace.