The automotive industry is not only influenced by original equipment manufacturers (OEMs) but is significantly shaped by the aftermarket sector, particularly Parts and Accessories (P & A). This segment includes a vast range of products essential for vehicle maintenance and enhancement, making it crucial for business owners to understand its dynamics. Chapter one will delve into the fundamentals of P & A auto parts, elucidating their relevance in vehicle servicing. The second chapter focuses on current market dynamics, highlighting emerging trends that can influence business strategy. Finally, the third chapter gazes into the future, showcasing potential innovations that could alter the landscape of P & A auto parts and offer new business opportunities.

Decoding P & A: How Parts and Accessories Shape Every Repair and Upgrade

What “P & A” really means for vehicle owners and technicians

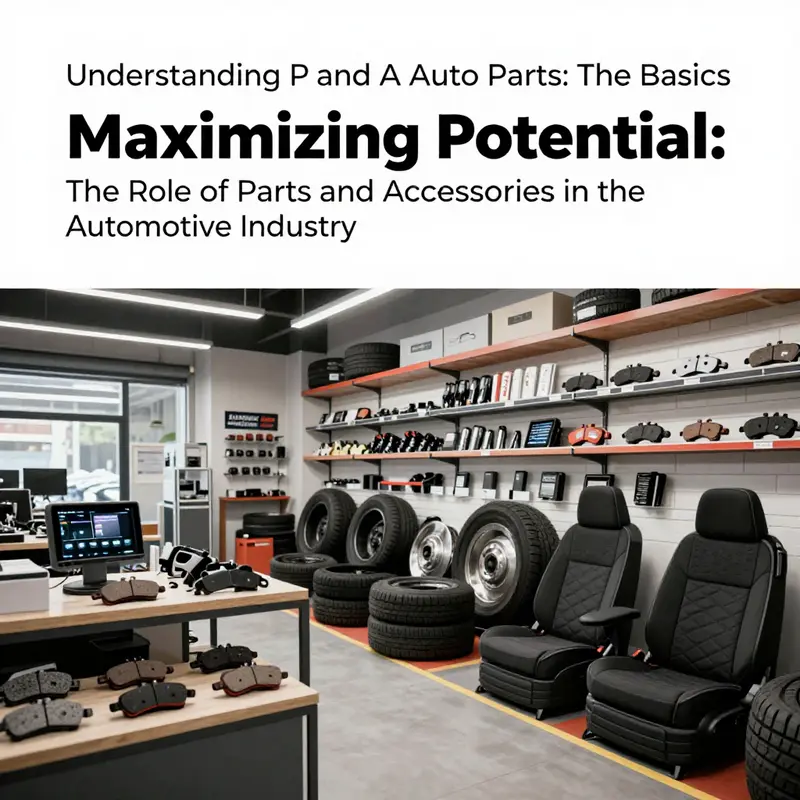

When you hear the shorthand “P & A” in the auto parts world, it points to a simple idea with wide consequences: Parts and Accessories. The phrase covers everything that replaces worn components in a vehicle, and everything added to change how that vehicle looks, performs, or feels. Parts are the items a vehicle needs to run safely and reliably. Accessories are the add-ons that tailor the car to a driver’s needs or tastes. Together, they form the backbone of the aftermarket — the vast ecosystem beyond the original factory supply.

Understanding this distinction matters every time you choose components. Replacement parts range from critical safety items, like brakes and steering components, to routine consumables, like filters and wiper blades. Accessories span protective pieces, comfort upgrades, and performance enhancements. Some accessories alter the vehicle’s physical behavior. Others only change how it presents itself. The line between part and accessory sometimes blurs, especially when an accessory affects safety or emissions.

A clear view of what you are buying begins with fitment and function. Not all parts that look similar perform the same way. Fitment refers to whether a part will physically install on a particular vehicle. Function refers to whether it will perform the intended role. Modern vehicles carry many computerized systems. Installing the wrong sensor or unauthenticated electrical accessory can cause error codes or reduced performance. Even a simple mechanical part can have different tolerances and mounting features between model years and trims. This is why identifying the correct part number or using the vehicle identification number (VIN) when searching is so important.

Quality tiers and what they mean for outcome and risk

Aftermarket parts come in a range of quality tiers. At one end are parts that match factory standards closely. These are made to the original specifications, with similar materials and tolerances. At the other end are low-cost, generic items with uncertain lifespan and variable fit. Between them are remanufactured parts, specialist performance items, and premium accessories built to higher standards.

Choosing a lower-cost part may save in the short term. But for safety-critical systems, cheap components can fail faster. When components affect braking, suspension, steering, or structural integrity, higher-quality parts reduce risk. Remanufactured units often offer a good balance. They return a used core to factory standards and usually include a warranty.

For accessories, quality affects durability, appearance, and how the vehicle integrates with its electronics. A cheaply built infotainment add-on might seem to work at first. But over time, poor shielding and connectors can create noise, lose functionality, or even interfere with vehicle systems.

Sourcing: where parts come from and how to verify them

Parts and accessories arrive through many channels. Large distribution networks serve national and regional retailers. Smaller suppliers and specialty shops deal in niche or performance components. Salvage yards and used-part vendors provide lower-cost options for older vehicles. Direct imports and drop-shipped items increase choice but raise questions about traceability.

Verification begins with documentation. A seller should provide a clear part number, manufacturing information, and fitment notes. Packaging often carries identifiers such as barcodes or batch numbers. Where such identifiers are absent, proceed with caution. Ask the seller for photos of the item and any labeling. Request a written warranty and understand the return policy. Reputable suppliers will list fitment by VIN and will support returns if the part is incorrect or defective.

Counterfeits are a real concern. Look for consistent quality in materials and finish. Fragile plastic clips, misspelled labels, and inconsistent coloring are red flags. For electrical parts, poor connectors and missing seals indicate trouble. When in doubt, compare the item to a known genuine part or consult a trusted installer.

Fitment, compatibility, and the role of electronic systems

Many replacement parts are straightforward. A wiper blade has defined sizes. A filter fits to a housing. But some parts require calibration after installation. Sensors, airbags, steering angle modules, and wheel-speed sensors fall into this group. Installing these parts may need dedicated tools or dealer-level software to reset or calibrate the system. Failing to calibrate can produce warning lights or degraded function.

Integration with vehicle software is increasingly common. New accessories may require firmware updates or specific communication protocols. When adding a non-factory infotainment unit or driver assistance sensor, verify compatibility with the vehicle’s CAN bus or other networks. Improperly integrated accessories can create diagnostic trouble codes, disable safety features, or drain the battery.

Documentation and traceability help here. Keep installation instructions, receipts, and calibration records. This information helps any later technician diagnose issues and proves whether a part was installed properly.

Warranty, returns, and the economics of choice

Warranties tell a lot about expected quality. A longer warranty indicates a supplier’s confidence. Understand what the warranty covers. Some warranties cover only manufacturing defects. Others cover normal wear for a specified period. Remanufactured parts often have warranties that mirror new components.

Return policies matter. A no-return policy on a keyed or vehicle-specific part can lead to wasted expense if fitment is wrong. Check whether the seller covers return shipping and restocking fees.

Economics is more than price. Consider life-cycle cost. A cheaper brake pad that requires replacement twice as often may cost more in the long run. Conversely, paying premium prices for non-essential cosmetic accessories may not yield value. Think in terms of safety-critical vs. aesthetic upgrades.

Installation decisions: DIY versus professional work

Some parts and accessories are well-suited to do-it-yourself installation. Consumables, simple filters, and many accessories fall into this category. For these, clear instructions and basic tools are often sufficient.

Other tasks need specialized tools or training. Airbag modules, steering components, and advanced sensors frequently require torque-critical fasteners and specific calibration. Suspension work often needs alignment afterward. When a part replacement calls for software resets, professional shops have the diagnostic tools to perform those steps. Choosing an installer reduces risk and preserves warranties.

Even for DIY projects, have a fallback plan. Save original parts until the new one proves reliable. Keep all fasteners and small hardware. Take photos at disassembly to aid reassembly. If an installation triggers warning lights, stop and seek professional help.

Regulation, safety, and emissions considerations

Certain categories of parts are subject to regulation. Emissions-related components, safety systems, and lighting often must meet standards. Aftermarket parts for these systems should comply with local laws. Noncompliant parts can create legal issues and fail inspections.

Lighting and emissions are particularly sensitive. Replacing components with non-approved variants can affect inspection status. For safety, structural parts and collision repair components must meet repair standards to ensure crashworthiness.

A practical checklist for buying P & A

- Verify the correct part number using your vehicle’s VIN. Keep the VIN handy when shopping.

- Ask for clear fitment notes. Confirm model year and trim compatibility.

- Inspect photos and packaging. Check for batch numbers and labels.

- Confirm whether calibration or coding is required after installation.

- Read the warranty carefully. Note coverage duration and exclusions.

- Understand the return policy, including shipping costs and restocking fees.

- Check reviews and seller reputation, especially for electronics and performance parts.

- Consider remanufactured alternatives when cost and quality make sense.

- Compare life-cycle costs, not just purchase price.

- Keep documentation and installation proof for future service needs.

Accessories: choice, aesthetics, and functional trade-offs

Accessories let owners tailor their vehicles. They offer utility, comfort, and personalization. Some accessories are purely cosmetic. Others improve practicality, such as cargo systems, weather protection, and seating covers. High-performance accessories can enhance handling, reduce weight, or boost output. But upgrades sometimes carry trade-offs. Lightweight body panels may change crash behavior. Coilovers that improve handling can reduce ride comfort. Aftermarket audio systems may affect electrical loads.

Choose accessories with full awareness of trade-offs. If you change exterior components, ensure the new pieces do not disrupt sensor lines. If you add cargo accessories, mind roof load ratings and aerodynamic effects. If comfort items require airbag removal or seat modification, verify safety implications.

Used parts, salvage, and NOS options

Used parts and salvage can offer value for older vehicles. Buying used needs caution. Inspect for damage, corrosion, and wear. For mechanical parts, check moving surfaces and mounting points. For electrical parts, test connectors and function whenever possible.

New-old-stock (NOS) parts may be unused but obsolete stock held by suppliers. NOS can be a great source for discontinued vehicles. However, age-related deterioration in rubbers, gaskets, and seals matters even if the part was never installed. Check return policies and warranties on NOS items.

Quality assurance and testing for critical parts

Serious suppliers perform testing. They validate fitment, material properties, and performance. Certifications, third-party testing, and compliance marks give confidence. For brake components, load testing and friction consistency are key. For structural items, tensile strength and fatigue testing matter. For electronics, interference and environmental testing help ensure long-term reliability.

When a supplier shares test data or certifications, that transparency boosts trust. If data are unavailable, rely on seller reputation and documented warranty terms.

Impact on vehicle value and insurance

Modifications and non-factory parts affect value. Some upgrades can increase desirability for certain buyers. Others reduce resale value or complicate insurance. Document every installed part and keep receipts. If a modification increases replacement value or risk, inform your insurance provider. Failure to disclose significant changes can affect claims.

A note on vendor names and small-brand confusion

Not every label you encounter represents a well-known company. Some names reflect a small local business or a brand shorthand. When a name like “P and A” appears, it may simply be shorthand for parts and accessories rather than a specific supplier. Always verify the seller, read reviews, and confirm contact details. If a vendor’s name is ambiguous, treat the purchase with more scrutiny. Ask direct questions about origin, warranty, and returns.

A practical example

If you plan to replace a lightweight hood on a specific performance model, confirm fitment for the exact year and trim. Check whether the new hood requires different latch hardware or reinforcement. Ask if the hood’s finish matches adjacent panels or will need repainting. If the hood contains sensors or vents, verify they do not interfere with the vehicle’s cooling strategy. Document the purchase and installer notes.

When an accessory or replacement part touches electronics or safety systems, require documentation that installation and calibration were performed. Keep that documentation with the vehicle. It helps future owners and protects you in warranty or insurance situations.

Final practical note

Choosing the right P & A item is a balance of knowledge and caution. Know the part number, understand compatibility, evaluate quality and warranty, and plan for installation needs. Where safety, emissions, or electronics are affected, rely on experienced installers. Keep records. These steps protect your vehicle’s performance and your peace of mind.

For further reference on major industry distribution networks, see this external resource: https://www.genuineparts.com

For a practical example of an aftermarket exterior component, consider this carbon fiber bonnet option for a specific Lancer Evo model: https://mitsubishiautopartsshop.com/brand-new-original-carbon-fiber-bonnet-hood-for-mitsubishi-lancer-evo-x/

How A&P Auto Parts Markets Move: Global Forces, Technology, and Sourcing Strategies

Market Dynamics and What They Mean for Buyers and Suppliers

The aftermarket world of parts and accessories—often called A&P—moves at the intersection of manufacturing geography, fast-changing technology, and shifting buyer behavior. Understanding that intersection helps suppliers find margins and reliability, and helps buyers balance cost, fitment, and performance. The current market is best seen as a set of linked forces: regional industrial strengths, global supply-chain mechanics, tiered quality and pricing, and the accelerating role of data and materials innovation. These forces shape availability, speed to market, and the options that both businesses and consumers face.

China remains the central axis of production for many A&P categories. Its scale and depth in electronics, sensors, and accessory manufacturing create cost advantages that few regions can match. Clusters in industrial corridors concentrate high-precision engineering, tooling, and integrated R&D in a way that shortens development cycles. This concentration supports a broad range of outputs, from basic service parts to higher-tech modules. The result is a wide spectrum of price and quality choices for buyers across global markets.

At the same time, established engineering centers in Europe and East Asia continue to set benchmarks in fit, durability, and regulatory compliance. Their factories and suppliers maintain process controls and testing routines that justify higher price points. Those price premiums—often between 30 and 50 percent above comparable suppliers in lower-cost manufacturing hubs—reflect labor costs, certification expenses, and localized innovation. For many buyers, these premiums translate into lower risk in fitment and warranty claims. For suppliers, they support investments in testing, advanced materials, and quality systems.

Emerging nearshoring options are changing the calculus for manufacturers and distributors. Countries in the Americas and Southeast Asia are investing in component manufacturing capacity. These regions offer lower logistics lead times and reduced exposure to long-haul disruptions. For buyers pursuing shorter replenishment cycles, nearshoring can lower landed costs when logistics volatility is priced into procurement decisions. The shift toward regional diversification should not be seen as replacing established hubs, but as complementing them to build resilience.

Procurement decisions in the A&P market are increasingly data-driven. Professional buyers rely on performance metrics and structured evaluation frameworks to choose suppliers. Key indicators now extend beyond price and lead time. They include delivery consistency, first-pass yield, warranty claim rates, responsiveness to design changes, and the supplier’s ability to integrate into digital workflows. A strategic sourcing process in 2025 typically combines historical quality data, real-time inventory signals, and scenario modeling. The aim is to reduce downtime for repair shops and fleet operators, while protecting brand reputation for parts resellers.

For individual consumers, market dynamics translate into richer choice and more competitive pricing. The aftermarket supports multiple quality tiers, frequent promotions, and bundled value propositions. That plurality is a strength: vehicle owners can prioritize durability, original-equipment equivalence, or low cost. Yet choice brings complexity. Nonstandard fitment, inconsistent warranty coverage, and variable customer support remain common trade-offs. Clear product information, verified fitment guides, and reliable return policies help consumers manage these risks.

Material and manufacturing innovations also push the market forward. Lightweight aluminum castings, for instance, appear more frequently in replacement engine components and performance-oriented accessories. Such materials reduce weight and improve thermal performance, aligning aftermarket choices with broader mobility trends. Additive manufacturing and precision machining shorten prototyping timelines and enable small-batch production for niche applications. For accessories and performance parts, these capabilities allow suppliers to iterate designs more quickly and to localize production for specific markets.

Technology is not only in materials. Sensors, control modules, and connected accessories are changing how the aftermarket is defined. Electronics-heavy parts require tighter integration between supplier software and vehicle systems. That raises questions about calibration, cybersecurity, and long-term interoperability. Suppliers that pair hardware with software expertise can capture higher margins. They also shoulder responsibilities for updates and compatibility testing across vehicle platforms. For buyers, the lesson is clear: the aftermarket is now as much a software challenge as a hardware one.

Inventory dynamics are equally important. Recent trends show inventory reductions in many markets, yet improved overall supply-demand balance. That combination suggests leaner stocking strategies coupled with better forecasting. Real-time analytics and shared industry data enable participants to respond to short-term spikes while minimizing excess. For distributors, this means adopting digital inventory platforms and collaborating closely with manufacturers on replenishment parameters. For smaller retailers and repair shops, it means leaning on catalog accuracy and supplier lead-time transparency.

Quality variability remains a core market characteristic. Even when two parts look identical, their manufacturing process, material traceability, and inspection rigor can differ. For B2B buyers, this variability underscores the need for supplier audits and sample validation. For consumer-facing channels, robust warranty programs and clear quality tiers help reduce returns and negative feedback. Some suppliers use third-party testing and independent certification to differentiate their offerings. Those signals help professional buyers and informed consumers to separate commodity items from engineered components.

Pricing in the A&P segment is driven by competition and tiering. Basic maintenance items face price pressure as commoditization increases. Performance and specialty accessories retain margin because of design complexity or perceived value. Volume discounts, promotional cycles, and bundled deals further shape the retail landscape. Sellers who combine competitive pricing with dependable logistics and visible quality claims usually perform best. In a crowded marketplace, the user experience—accurate fitment information, clear warranty policies, and fast fulfillment—becomes a competitive advantage.

Regulatory and compliance factors add another layer. Different regions enforce emissions, safety, and material standards that affect which parts can be sold for specific applications. Suppliers that invest in certification and documentation can access regulated markets more easily. They can also offer stronger warranties and support claims. Conversely, failure to meet regulatory requirements risks costly recalls or market withdrawal, which can damage reputation and cash flow.

For companies operating in the aftermarket, building resilience is no longer optional. Diversifying supplier bases across geographic regions, maintaining buffer inventories for critical SKUs, and investing in digital supply-chain visibility reduce exposure to disruption. Nearshoring can be part of this resilience strategy, providing geographic redundancy and shorter transit times. Partners with local engineering capability can accelerate corrective actions and customizations for regional vehicle fleets.

The role of analytics cannot be overstated. Industry-grade data platforms now inform nearly every major original equipment manufacturer and a large share of tier-one suppliers. That same approach benefits aftermarket stakeholders. Predictive analytics enable demand sensing, optimize inventory levels, and trigger replenishment before outages occur. For retailers, predictive insights guide promotional planning and prevent overstock in slow-moving SKUs. For suppliers, analytics identify margin leakage and point to opportunities for product rationalization.

Practical sourcing guidance emerges from these dynamics. First, map your critical SKUs and rank them by risk: availability, lead time sensitivity, margin impact, and regulatory exposure. Second, build supplier scorecards that include objective metrics: on-time delivery, defect rates, and responsiveness to engineering changes. Third, invest in pilot runs and sampling when switching suppliers, including fitment verification and lifecycle testing. Fourth, maintain communication channels for fast escalation and root-cause analysis. These steps shorten the learning curve when introducing new parts into a supply chain.

Smaller players and entrepreneurs benefit from the same principles. Niche accessory makers that focus on clear design differentiation, documented fitment, and direct-to-consumer fulfillment can succeed despite larger competitors. Crowded categories reward specialization and fast iteration. Where possible, using modular designs and standard interfaces reduces complexity and improves fit across multiple vehicle models.

The consumer experience will shape the aftermarket’s future as much as supply-side capabilities. Buyers increasingly expect transparent information: exact fitment data, realistic warranty terms, and visible proof of quality. Digital-first channels that present clear comparisons, verified reviews, and return-friendly policies build trust. For parts that interface with vehicle electronics, offering installation support and firmware updates creates additional value.

Case studies show that combining regional manufacturing strengths with data-driven procurement produces the best outcomes. A distributor that pairs high-volume commodity sourcing from low-cost hubs with regional nearshored production for time-critical SKUs achieves both low landed cost and reliability. A supplier that invests in materials innovation and certification commands premium pricing for high-performance parts. These approaches are replicable across different market segments.

For professionals planning for 2025 and beyond, the strategic imperative is to align sourcing, technology, and risk management. That means building supplier relationships that are transparent and measurable. It means using analytics to make proactive decisions rather than reactive ones. It means recognizing that aftermarket parts are not only physical goods but also data and services, especially as electronics and connected accessories proliferate.

An illustrative example in product design highlights these points. Lightweight components created with thermal-management improvements reduce strain on vehicle systems. When such components come from a supplier with strong documentation and testing, buyers see fewer warranty claims. When the supplier also offers digital compatibility notes, installation becomes smoother. The synergy between material innovation and operational discipline is where margin and trust are built.

Finally, the market’s long-term direction favors adaptability. Suppliers and buyers who move quickly on regional shifts, invest in testing and certification, and deploy analytics for better decision-making will lead. For anyone operating in the A&P ecosystem, the practical takeaway is simple: treat sourcing as strategic, not transactional. Build redundancy, measure performance rigorously, and use data to guide both price and quality decisions. These practices will unlock more predictable service levels and healthier margins across the aftermarket.

For a concrete example of a high-performance accessory from the aftermarket, see this listing for a carbon-fiber bonnet for a popular performance sedan: brand-new original carbon fiber bonnet for Lancer Evo X.

Further market resources and parts listings can be explored on major B2B and B2C platforms. For broader market data and parts marketplace trends, consult industry trading portals and analytics providers for up-to-date reports and sourcing options. For example, a comprehensive marketplace of auto parts and accessories is available here: https://www.alibaba.com/

Beyond Spare Parts: The Next Wave of A and P Auto Parts and the Quiet Reengineering of Reliability

In the world of automobiles, the shorthand P and A—Parts and Accessories—has long signified the aftermarket space that sits to the side of original equipment manufacturer (OEM) kits. It encompasses the pieces that keep a vehicle running long after it leaves the factory floor and the add-ons that let drivers tailor a car to their preferences. This chapter does not pretend that the future belongs only to pristine OE parts or to glossy upgrades; it envisions a more integrated, responsible, and data-driven ecosystem where P and A auto parts become a central thread in the broader story of mobility. The core shift is not merely about new shapes or better finishes; it is about how parts are imagined, engineered, produced, tested, and serviced in a connected world that demands greater transparency, durability, and compatibility across brands and models. The lessons from the wider manufacturing landscape—especially innovations emerging in the automotive sector—offer a blueprint for what the aftermarket can achieve when it embraces sustainability, digitalization, and intelligent design. A revealing example from the industry highlights how a focus on debris collection during processing can ripple outward, improving efficiency, lowering environmental impact, and reducing waste across the supply chain. Such a patent, while rooted in manufacturing practice, signals a broader principle: the way a part is made can influence how well it performs in the field, how long it lasts, and how easy it is to recycle or repurpose when its useful life ends. This idea—production as a driver of sustainability—will echo through the next generation of P and A components, from everyday maintenance items to complex add-ons that redefine a vehicle’s capabilities.

The most consequential trend shaping future A and P parts is the steady integration of advanced manufacturing technologies with real-world vehicle data. In practice, this means three interlocking moves. First, engineers will increasingly employ smart materials and adaptive designs that respond to temperature, vibration, moisture, and wear conditions. Second, parts will come with embedded or connected sensing capabilities that relay their condition, enabling real-time monitoring and predictive maintenance. Third, the data generated by these sensors, and the analytics that interpret it, will feed back into the manufacturing process itself, improving quality control, reducing waste, and enabling more precise customization for end users. The convergence of these elements—smart materials, real-time monitoring, and data-driven processes—promises to lift aftermarket parts from a static inventory to a dynamic, service-oriented layer of modern mobility. The potential is wide if the industry can harmonize safety standards, preserve compatibility across fleets, and maintain the agile responsiveness that has long defined the aftermarket segment.

Consider the way a modern manufacturing line can evolve when a company adopts a circular mindset. A key example from recent industry practice centers on the introduction of processing equipment designed to minimize debris and capture waste streams. While the technical specifics are hidden behind patent language, the practical takeaway is accessible: improved debris collection and waste reduction translate into leaner operations, lower material costs, and cleaner environmental footprints. In a sector where margins are thin and supply chains stretch across continents, the ability to produce cleaner, more efficient parts is a competitive differentiator. This kind of improvement does not belong only to the factory floor; it seeps into the end product through more consistent tolerances, longer component life, and fewer surprises for technicians during installation. For aftermarket players, the implication is clear: sustainability and efficiency are not ancillary goals but core design criteria that can shape part performance, cost, and reliability over a vehicle’s lifetime.

As the aftermarket landscape moves toward greater interconnectedness, the notion of a part as a single, standalone object evolves. Real-time monitoring sensors embedded in components—such as filters, bearings, or braking system add-ons—can deliver live health data to the vehicle’s central computer, to a technician on site, or to a cloud-based service that tracks a fleet’s status. This capability does not demand a luxury budget; it demands thoughtful integration and a robust data framework. The resulting feedback loop—between what the part reports, how the vehicle interprets that information, and how the manufacturer or retailer responds—creates a more proactive maintenance culture. Customers benefit from fewer breakdowns, earlier detection of faults, and more predictable maintenance costs. Shops and distributors gain from better diagnostic clarity, better inventory planning, and fewer call-backs due to ambiguous wear patterns. In short, the interplay of smart materials, real-time condition monitoring, and data-driven manufacturing is turning P and A parts into instruments of reliability as opposed to mere replacements.

A sustainability axis threads through all of this. If the automotive industry is moving toward greener production, the aftermarket will not be exempt. Eco-friendly production methods, improved material efficiency, and integration with smart vehicle technologies collectively reduce the environmental burden of car parts. Additive manufacturing (3D printing) and advanced casting or forming techniques allow for lighter parts with sufficient strength, enabling better fuel economy and lower emissions over a vehicle’s life cycle. The potential to remanufacture or refurbish a component to a like-new standard, rather than disposing of it, is not a marketing slogan but a pragmatic approach that aligns with the circular economy. When a part is disassembled and its elements can be recovered or recycled with minimal energy, that same part contributes less waste to landfills and requires fewer raw materials for replacement. The sustainability thread is not separate from performance; it is woven into the fabric of durability, service intervals, and maintenance costs. The frontier is not simply more efficient production but smarter, resource-conscious production that respects the finite nature of raw inputs and the shared responsibility of manufacturers, retailers, and consumers.

Alongside sustainability, the design and manufacture of P and A parts are increasingly guided by interoperability and standardization. The aftermarket thrives when parts fit a broad range of vehicles, yet it also competes on precision, durability, and fit. A future-ready approach will emphasize standardized interfaces, modular construction, and digital twin-based testing that simulates real-world wear. By using digital simulations to test how a part behaves under varying driving conditions, manufacturers can optimize geometry, materials, and coatings before a single prototype is produced. This not only shortens development cycles but also reduces the risk of field failures. The result is a more resilient supply chain that can respond quickly to demand shocks, geopolitical disruptions, or shifts in consumer preference without sacrificing quality. The integration of digital traceability—documenting the origin, processing steps, and end-of-life options for each part—gives technicians and customers confidence that replacements meet consistent criteria across time and geography. A well-designed system of interoperability makes it easier to honor warranties, coordinate recalls, and manage fleet maintenance in a way that minimizes downtime for drivers and keeps repair shops moving.

The consumer experience in P and A will also be transformed by these advances. Shoppers will encounter richer, more transparent product data; smarter installation guides; and clearer maintenance expectations. A part will no longer be viewed in isolation but as part of a broader service ecosystem. Imagine a scenario in which a brake pad aftermarket part ships with a diagnostic profile that communicates with the vehicle’s control system and with the service network. The driver receives a maintenance alert that anticipates a wear threshold and suggests a compatible upgrade or optimization, and the technician retrieves real-time part metadata that confirms compatibility with a specific model year and trim. This degree of connected intelligence reduces guessing, speeds up repairs, and reinforces trust in the aftermarket. It also invites new business models in which access to parts is coupled with data-driven services, from proactive maintenance reminders to longer-term warranty coverage that reflects actual wear patterns rather than generic time-based schedules.

The commercial implications of these shifts are substantial. Companies operating in the P and A space have an opportunity to move from traditional inventory management to a more dynamic, service-oriented stance. Parts-as-a-service, subscription access to maintenance kits, and bundled offerings that combine components with diagnostics and guidance could redefine the economics of repair and customization. Suppliers that invest in robust data platforms, secure connectivity, and traceable materials will be better positioned to forecast demand, optimize pricing, and deliver value across the lifecycle of a vehicle. In this new paradigm, a part becomes the anchor for a broader value proposition—one that includes installation support, diagnostic insights, and ongoing performance optimization—rather than a one-off sale that ends at the moment of purchase. The resulting loyalty and repeat business come not from a single transaction but from a trusted relationship that spans years and mileages.

To illustrate a concrete expression of this trend, the aftermarket can look to the growing emphasis on lightweight, high-strength materials and smart integration while maintaining a disciplined eye on cost and accessibility. A notable feature on the supply side is the emergence of dedicated platforms that showcase advanced materials and processing methods, sometimes linking to pages that highlight new capabilities for high-performance or specialty applications. These developments do not promise overnight revolutions in every product line; they indicate a direction in which the most forward-thinking aftermarket players are moving. They are also a reminder that the value of P and A parts rests in how well they adapt to evolving vehicle architectures, increasingly electrified powertrains, and the growing importance of software-enabled features. As vehicles become more software-defined, the line between a part and a service blurs, and the aftermarket stands ready to participate.

In closing the thread of this chapter, the future of A and P auto parts will be defined not by a single breakthrough but by an integrated approach that blends sustainable production, intelligent materials, real-time data, and thoughtful standardization. The best companies will design parts with a lifecycle mindset, anticipating how a component can be remanufactured, upgraded, or recycled long before it leaves the factory floor. They will invest in digital infrastructure that supports traceability and interoperability while delivering tangible benefits to technicians, fleet managers, and drivers. The vision is not merely about more durable bolts or shinier trim; it is about turning every part into a component of a longer, smarter, and more sustainable mobility narrative. And as this narrative unfolds, the aftermarket will continue to play a pivotal role in keeping vehicles safe, reliable, and adaptable to an ever-changing technological landscape. For readers who want to explore a concrete example of the kinds of manufacturing improvements that align with this outlook, a detailed external resource on automotive parts processing equipment and debris collection can be found here: https://patents.google.com/patent/CN120205904B/en. In addition, a practical glimpse into specific aftermarket pages that illustrate the ongoing push toward advanced materials and compatibility can be explored through internal references that connect to the broader ecosystem of P and A parts.

An exploratory note on the broader context and why this matters to practitioners in the field: the evolution of A and P auto parts is inseparable from the shift toward sustainable, data-enabled, and service-oriented mobility. The innovations described here—whether they take the form of greener production lines, smart sensors embedded in components, or standardized interfaces that make cross-brand compatibility feasible—are all aimed at one outcome: increasing the reliability and lifespan of the parts that keep vehicles running between factory and finish line. When a part is designed with its entire lifecycle in mind, it becomes easier to repair, upgrade, and retire in a way that aligns with environmental goals and consumer expectations. The aftermarket is uniquely positioned to translate these advances into practical, affordable, and widely available solutions for drivers. The road ahead is not a simple upgrade path but a reimagining of what it means to maintain, personalize, and optimize a vehicle through its entire journey on the road.

Internal link note: for readers interested in a concrete example of materials and design directions that echo the themes described above, see the internal reference page titled brand-new-original-carbon-fiber-bonnet-hood-for-mitsubishi-lancer-evo-x for a sense of how the industry is experimenting with lightweight, high-strength forms within the aftermarket space. brand-new-original-carbon-fiber-bonnet-hood-for-mitsubishi-lancer-evo-x

Final thoughts

Understanding the intricacies of Parts and Accessories auto parts is vital for any business owner looking to thrive in the automotive aftermarket. The comprehensive exploration of the basics, market dynamics, and future innovations lays a solid groundwork for strategic decision-making. Embracing these insights will not only sharpen your competitive edge but also help you adapt to market evolutions effectively. By focusing on the potential of P & A auto parts, your business can navigate the challenges of the aftermarket landscape successfully, ensuring sustainability and growth.