The Mitsubishi Lancer Evolution VIII (Evo 8) has secured its legacy within the performance tuning community, captivating enthusiasts globally. A key component that enhances both aesthetics and functional performance is the front bumper, which plays a pivotal role in aerodynamics and cooling. For business owners in the aftermarket auto parts space, understanding the diverse options available—ranging from materials to designs—is critical. Equally important are the underlying supply chain dynamics that facilitate efficient sourcing and manufacturing. This article will delve into the material options you have for Evo 8 bumpers, explore various design styles, analyse supply chain logistics, and showcase performance enhancements and market trends. By the end, you’ll gain valuable insights to guide your procurement decisions and stay ahead of market demand.

Choosing the Right Material for an Evo 8 Front Bumper: Performance, Fitment, and Finish

Material choices and trade-offs for the Evo 8 front bumper

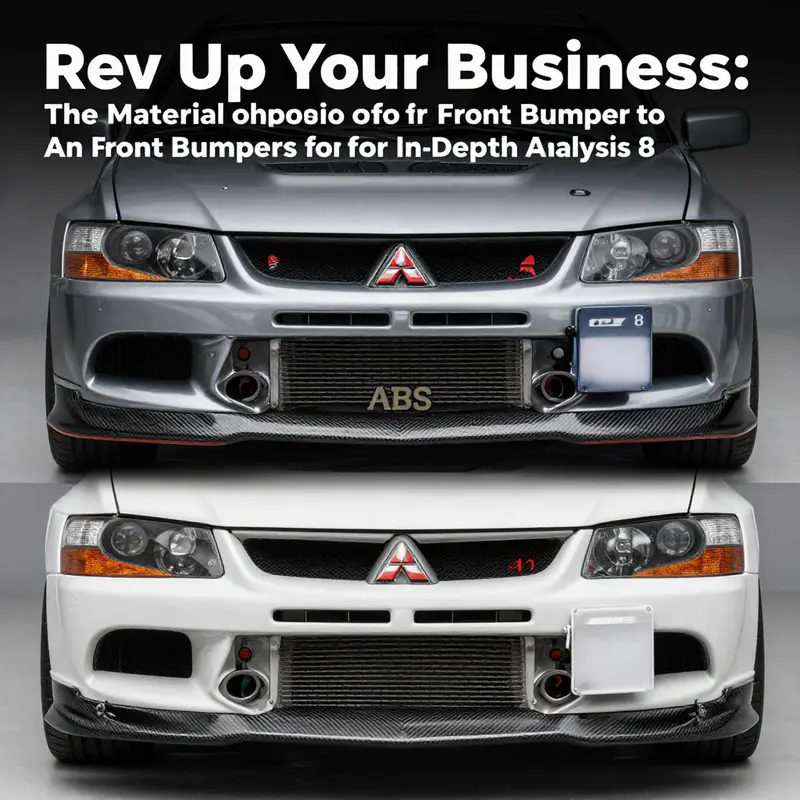

Selecting the right material for a Mitsubishi Lancer Evolution VIII front bumper is more than a matter of looks. It shapes aerodynamics, cooling efficiency, durability, and the driving experience. Enthusiasts and buyers face a set of consistent trade-offs: weight versus cost, strength versus repairability, and factory fit versus bespoke styling. Understanding how carbon fiber, forged carbon, FRP, and ABS behave—both in manufacture and in service—lets you match the material to your goals.

Carbon fiber remains the benchmark for performance-first builds. Its high strength-to-weight ratio reduces unsprung and rotational mass, subtly improving turn-in, braking, and acceleration. Modern aftermarket carbon bumpers are most commonly made from 3K plain or twill weave fabrics laid up using vacuum infusion or resin-transfer techniques. These methods yield consistent fiber-to-resin ratios and minimize voids. After curing, a UV-stable clear coat preserves the glossy weave and protects the laminate from yellowing. Carbon parts excel on track-focused cars where every kilogram matters. They also produce the signature woven aesthetic that many owners prize.

That performance comes at a price. Carbon fiber fabrication requires precise molds, controlled environments, and skilled layup. Labor intensity and material cost push prices well above those of fiberglass or thermoplastic alternatives. Dimensional accuracy must meet tight tolerances to ensure reliable fitment with adjacent panels and mounting points. When procuring carbon bumpers, insist on documented tolerances, inspection reports, and photos of the internal layup. Small misalignments or improper hole placement become major headaches during installation.

Forged carbon fiber addresses some of carbon fiber’s limitations while introducing its own strengths. Unlike woven fabric, forged carbon uses chopped fiber mixed into resin and pressed into a mold. The result is a dense, isotropic laminate with a mottled, metallic-like appearance. Forged carbon offers improved impact resistance relative to woven laminates and resists localized delamination. It often weighs similarly to traditional carbon parts but feels tougher to the touch. Visually, it delivers a bold, complex surface that stands out from the uniform weave of 3K carbon.

Forged carbon is typically reserved for premium builds because of its cost and the specialized molds required. It is less forgiving to repair cosmetically; patching a damaged forged carbon surface to a seamless finish is harder than repairing a woven weave or fiberglass. For owners who value a distinctive aesthetic plus stronger resistance to small impacts, forged carbon is an attractive option—provided budget and repair strategy align.

Fiberglass Reinforced Plastic, commonly called FRP or simply fiberglass, is the pragmatic choice for many Evo 8 owners. Modern FRP parts offer respectable strength at a significant cost saving. They are light compared to stamped steel and more affordable than carbon. Manufacturers can mold FRP to complex shapes and textures, including smooth primer-ready surfaces and finishes that mimic a carbon look. FRP also tends to be easier and cheaper to repair after impact; a competent body shop can restore shape and finish without expensive composite equipment.

The main compromise with FRP is that it cannot match the stiffness or the lightweight advantage of carbon. For street and show cars, or for owners who rotate bumpers frequently for different styling, FRP is a reliable middle ground. It also allows quicker production from existing molds, which keeps lead times shorter and unit costs lower.

ABS plastic and other thermoplastics offer another route when durability and cost-effectiveness matter. ABS retains shape under impact better than untreated FRP and tends to flex rather than crack. Factory-style replacement bumpers often use ABS because it offers consistent OEM-like fitment, impact resistance, and simple finishing. ABS parts are usually injection-molded, giving excellent dimensional stability and repeatable mounting point accuracy. For a replacement that preserves factory lines and fit, ABS is the sensible pick.

However, ABS is heavier than carbon and lacks the high-end visual appeal. It also limits aesthetic customization unless combined with add-ons like lips or splitters in different materials. When planning cooling upgrades or additional ducting, remember that ABS tolerances are reliable, simplifying integration of intercooler or radiator modifications.

Beyond the base materials, finish and manufacturing profoundly affect value. Vacuum-infused carbon and well-cured FRP achieve a denser, more consistent laminate with fewer voids and higher tensile properties. UV-stable clear coats prevent yellowing and keep gloss levels consistent. Proper mold engineering—3D scanning the OEM part, building precise tools, and validating first-off samples—ensures hole locations, mounting tabs, and trim clearances align with expectations. Suppliers operating in Guangdong and Fujian have refined these processes. Their vertically integrated workshops can move from scanning to mold-making to final coating in-house. That reduces lead times, keeps costs competitive, and allows for faster design iterations.

For procurement-minded buyers, the focus must be on technical specification and quality assurance. Key metrics include dimensional accuracy, impact resistance, paint adhesion, and weathering resistance. Ask suppliers for test data: dimensional reports, pull-tests for mounting points, paint adhesion results per ASTM standards, and accelerated weathering certificates. Insist on sample inspection before large orders. This protects against fitment surprises and dissatisfied customers.

Repairability and serviceability are also practical considerations. Carbon and forged carbon require specialty repair techniques and may not be economically repairable after severe damage. FRP and ABS are more easily mended or replaced at lower cost. For a track car with frequent impacts, a blend of materials can be the smart approach: a carbon-look FRP bumper for visual congruence, reinforced with metal mounting points, or a carbon main structure with easily replaceable ABS or FRP lower lips.

Cost signals should be read with context. Premium carbon pieces draw higher initial spend but may enhance resale value for the right buyer. FRP and ABS reduce upfront cost and lower insurance and repair bills. Prices for OEM-style hoods and bumpers can fluctuate; recent market examples show OEM-style hoods listed above the thousand-dollar mark, with projected price adjustments over time. Keep lead times, shipping costs, import duties, and potential rework into your total landed cost calculation.

Finally, consider how the material choice fits your broader build. A full-carbon front bumper suits a lightweight, performance-driven Evo 8. Forged carbon suits a high-end, show-oriented yet durable build. FRP offers balanced affordability and ease of repair. ABS keeps factory fit and robustness for daily driving. If you want visual inspiration or confirmation of fitment options, review aftermarket bumper assemblies such as the Evo 8/9 front bumper with carbon lip for real-world styling and fit examples: https://mitsubishiautopartsshop.com/evo-8-9-varis-front-bumper-with-carbon-lip/.

For a concrete reference showing material details and market availability, consult a verified aftermarket listing that illustrates premium carbon specifications and finishes: https://www.ebay.com/itm/404762951436

Frontal Force and Form: Exploring Evo 8 Front Bumper Variants, Materials, and Aerodynamic Aesthetics

The front bumper of the Mitsubishi Lancer Evolution VIII has always been more than a shield for the radiator and headlights. It is a statement of intent, a canvas where airflow, cooling, weight distribution, and visual aggressiveness converge. In the Evo 8 scene, the bumper is a living interface between the car and the road, a component whose design reverberates through handling, downforce, and even the perception of speed. Enthusiasts treat it as a primary platform for personalization, where the choice of shape, material, and finish can transform a stock silhouette into a bold, track-ready profile. The task of choosing a bumper, however, is not merely about aesthetics. It is a disciplined balance of aerodynamics, weight, rigidity, and fitment. The goal is to optimize how air moves across the front end, how the radiator and intercooler breathe, and how the lower lip manages boundary-layer separation at high speeds. In this context, the Evo 8 front bumper becomes a practical performance decision as much as it is a visual one, and this dual role drives a broad spectrum of design variants that cater to different driving philosophies and use cases.

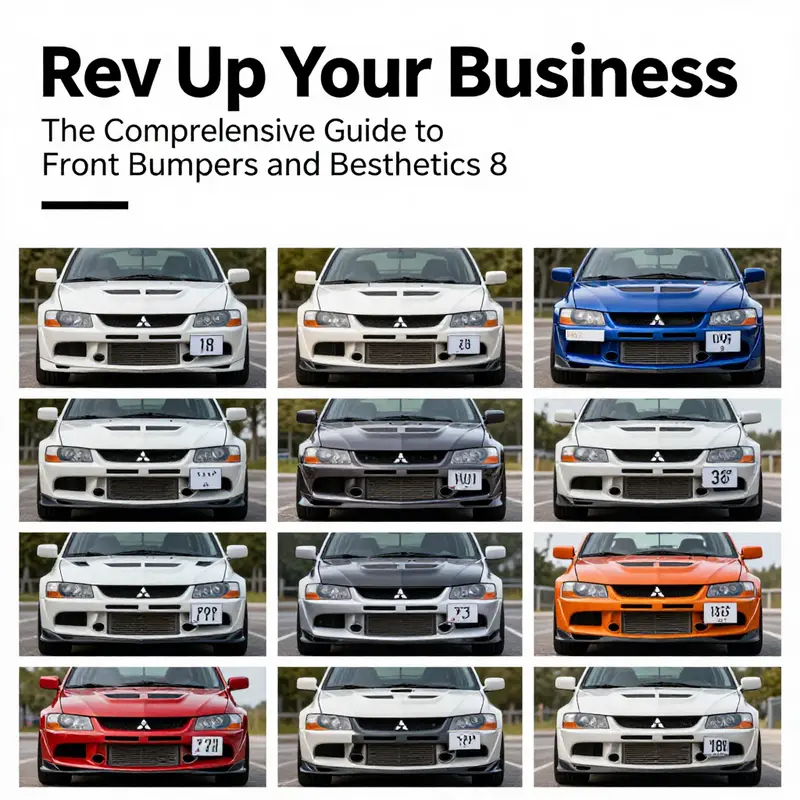

When we talk about the most common directions in front-bumper styling for the Evo 8, four broad trajectories emerge, each offering a distinct visual language and aerodynamic philosophy. The first leans into aggression, emphasizing sharp angles, bold central inlets, and pronounced side vents. This approach creates a race-inspired frontal presence, signaling intent even when the car is stationary. The second direction favors integration and refinement. Here the bumper visually flows with the fenders and hood, delivering a factory-like finish that still houses a large central opening for cooling while minimizing visual disruption. The third path reinterprets the Evo’s face with a sleek, modern silhouette—curved lines, a refined grille treatment, and a carefully sculpted air intake that reads as both performance-minded and mature. The fourth direction targets aerodynamics and downforce, featuring an aggressive front lip, well-defined air channels, and channeling devices designed to extract and manage high-speed air with minimal drag penalty. Each of these variants serves a distinct purpose and will appeal to different builders—whether the objective is track reliability, daily usability, or a statement of personal style.

Within this spectrum, a notable way to realize a high-performance look without abandoning street practicality is to incorporate carbon-fiber lips or lips integrated into the bumper’s lower edge. The carbon lip not only contributes to aesthetics but also plays a tangible role in managing airflow beneath the vehicle. For builders who want a concrete example of this integration, consider a well-known option that showcases a carbon lip paired with a bold front contour. The design emphasizes a pronounced carbon lip while maintaining a large central intake and precise side ducting. This approach is especially appealing for track days, where every watt of downforce and every degree of cooling matters. A polished option that demonstrates this balance can be explored through a dedicated bumper option that riders often cite for its carbon lip geometry: evo-8-9 varis front bumper with carbon lip. The link anchors a design language built around strengthened front geometry, a lip that grips air at the leading edge, and a vent pattern that keeps intercoolers and radiators breathing, even under demanding load.

Materials used in these aftermarket bumpers reflect a trade-off between weight, rigidity, and cost. Fiberglass-reinforced plastics (FRP) remain the most budget-friendly option, offering solid impact resistance and compatibility with straightforward paint processes. For enthusiasts seeking weight savings and a race-oriented stiffness, carbon-fiber variants come into play. Wet carbon fiber, with its resin-rich layups, brings good strength and a high-quality finish but at a modest weight premium. The pinnacle, dry carbon fiber, delivers the greatest stiffness-to-weight ratio and an unmistakable raw carbon aesthetic, though it commands a premium price and demands careful handling in fabrication and installation. These material choices influence not only the bumper’s performance but also the maintenance and repair philosophy of the owner. A typical track-focused build might lean toward dry carbon for the exposure to high speeds and heat, while a street-oriented car could favor FRP or wet carbon for ease of repair, affordability, and a more forgiving finish.

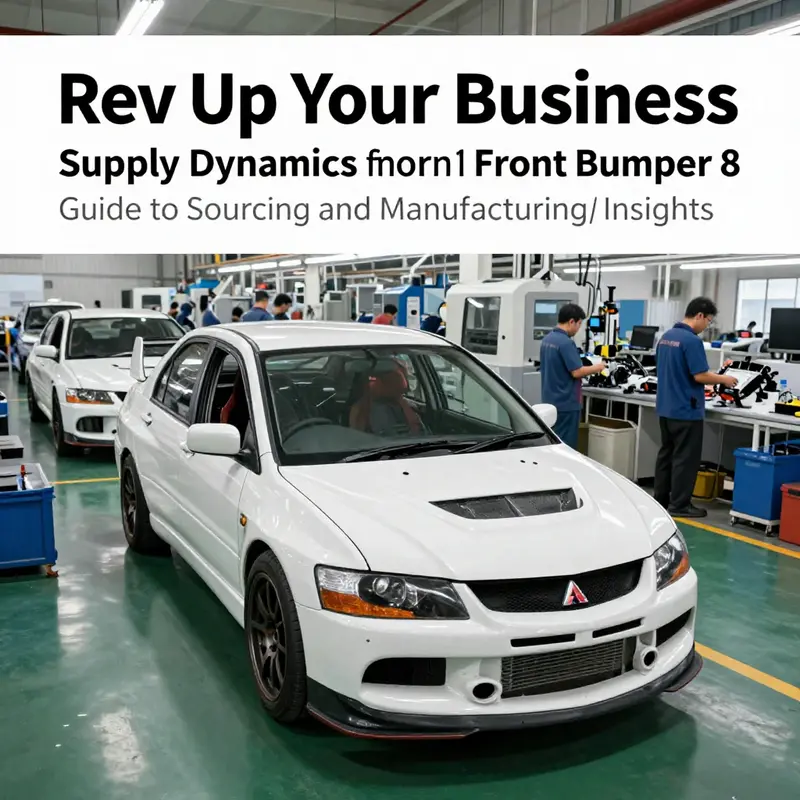

The way these bumpers are produced and delivered reinforces the sense that the Evo 8’s front end is not a generic off-the-shelf item but the product of a sophisticated supply chain. In recent years, manufacturers in China—particularly in the Guangdong and Fujian regions—have become the nucleus of high-fidelity front-bumper production for a global audience. The value proposition here goes beyond price. Guangdong and Fujian embody integrated ecosystems where the entire production flow—3D scanning of OEM references, mold development, carbon-fiber layups, finishing, and UV-protected clear coating—can be managed in a cohesive cycle. That vertical integration translates into shorter lead times, tighter quality control, and input-cost reductions that make Chinese suppliers highly competitive for both buyers who need a single unit and shops handling larger orders. A practical implication of this setup is the ability to offer multiple design variants with consistent fitment, an important consideration given the Evo 8’s well-defined bumper-mount geometry.

From a procurement standpoint, the decision to adopt a particular bumper design often hinges on a combination of fitment, weight, cooling performance, and visual impact. Dimensional accuracy and weathering resistance become focal metrics, especially when the bumper is paired with a factory hood, fenders, and a cooling system designed for specific climates. Paint-adhesion quality is another critical factor because a mismatch in coatings can quickly detract from the intended look and durability. This is precisely why many buyers and B2B buyers rely on data-driven supplier evaluation that emphasizes repeatable QA processes and traceable material testing. The practical upshot is that for Evo 8 enthusiasts, choosing a bumper is less about chasing a single “best” design and more about selecting a family of options that best aligns with the car’s intended use, the owner’s skill set, and the local environment.

Beyond design language and materials, fitment remains a non-negotiable consideration. The Evo 8 platform, while robust, benefits from careful measurement and alignment checks during installation. Not every bumper variant is interchangeably compatible with other Evo generations, and in many cases slight modifications are required to preserve mounting points, fog-light cutouts, and intercooler clearance. The process of verification—checking exact fitment against a known EVO 8 specification—ensures that buyers experience seamless installation and predictable performance. This is especially important when dealing with a bumper that features a large central intake or multiple ducts, where misalignment can affect airflow paths and under-hood temperatures. The emphasis on precise fitment mirrors the broader ethos of performance tuning: it is not enough to create a visually striking piece; it must also perform as designed in real-world conditions.

Material and design choices are ultimately a reflection of the builder’s priorities. For some, the goal is to shave weight and maximize downforce at high speed, which pushes them toward dry carbon or high-grade FRP with engineered lip spoilers. For others, a more restrained look with dependable durability and ease of maintenance suits daily driving and occasional track sessions. The beauty of the Evo 8’s front-bumper ecosystem lies in its flexibility. By combining a bold frontal language with a practical approach to airflow and cooling, enthusiasts can tailor a bumper to their car’s personality and performance target without sacrificing reliability. In practice, the most compelling builds often blend a strong visual target with a well-considered aerodynamic strategy, ensuring the front end communicates intent while remaining predictable in how it handles air, heat, and impact.

As the community continues to refine what makes a bumper both beautiful and functional, it is worth acknowledging the stock molds that keep certain configurations readily available. For buyers seeking quick delivery without sacrificing style, a few popular configurations can be kept in stock by suppliers, enabling faster fulfillment while preserving the option to customize later. This balance between readily available molds and bespoke fabrication is the backbone of a robust aftermarket ecosystem, which supports both casual hobbyists and serious racers who demand repeatable performance.

For builders who want a tangible example of how carbon and form interact on the Evo 8 front, the idea of a carbon lip integrated into a bold bumper remains a compelling reference point. The carbon lip not only completes the aesthetic with a racing edge but also works with the bumper’s airflow channels to guide air toward the intercooler and radiator areas. When paired with a bumper design that emphasizes large central intake and refined side ducts, the overall effect is a front end that looks as purposeful as it performs. This synergy—between a visually strong profile and an aerodynamically efficient geometry—is what turns a mere modification into a meaningful upgrade that can be felt on the road and track alike.

In this evolving landscape, the Evo 8 bumper scene offers a spectrum of choices that meet diverse goals. The available materials, the sophistication of the manufacturing processes, and the proximity to integrated supply chains in China collectively expand what is possible for the front end. The combination of aggressive styling cues, refined integration, and performance-driven details means that builders can pursue something as radical as a full carbon front end or as practical as a well-crafted FRP bumper with a carefully designed lip. Either path can deliver improved cooling, better airflow, and a stronger road presence, provided the installer respects fitment and the car’s cooling requirements. The Evo 8 remains a template for experimentation, where the front bumper is not just a cover but a functional part of a broader performance narrative.

External resource: https://www.automotiveworld.com

Mold to Momentum: The Global Flow of Evo 8 Front Bumpers and What It Means for Performance, Timing, and Price

The front bumper of the Mitsubishi Lancer Evolution VIII is more than a shield for the engine bay. In performance circles, it is a lever that can sharpen aerodynamics, increase cooling efficiency, and add an uncompromising presence on the road or the track. The Evo 8’s bumper is a focal point where engineering ambition meets supply chain discipline. To understand why options proliferate and prices move, you must trace how a global, vertically integrated system now pulls the parts from the workshop to the customer with precision and speed.

In the most strategic corridors, Guangdong and Fujian have matured into the heartland of aftermarket front bumpers. Within these provinces, clusters of factories orbit around the same set of capabilities: high-fidelity mold engineering, composite material sourcing, and streamlined export logistics. Cities such as Guangzhou and Fuzhou host workshops that do more than assemble. They 3D scan original equipment parts to capture exact fitment, then mill or polish prototypes, then execute carbon fiber laminates through vacuum infusion, and finally seal with UV-protected clear coatings. The result is a finished product that aligns with factory geometry, yet delivers the performance and aesthetic that independent builders crave. Because the producers control every step—design validation, material testing, finishing—the process is far more synchronized than in years past, and the cost story has shifted as a consequence. Lead times that once stretched into months can now shrink to the 15–25 day window that many buyers expect, provided orders align with stocked molds for the most popular configurations.

The economics of the Evo 8 bumper trade have evolved beyond simple price tags. The vertical integration model in southern China reduces input costs and adds speed by up to thirty percent when compared with Western supply chains. That margin is not only about labor or materials; it reflects a tightly coupled flow from CAD data to finished panels. Buyers today can choose among several material families: glass-reinforced polyester (FRP), wet carbon fiber, dry carbon, or hybrids that fuse carbon with resin-rich matrices. Each path changes strength, weight, and cost in meaningful ways. FRP remains rugged and forgiving for OEM-style replacements where factory fitment is paramount, offering resilience in daily use and at moderate price points. Dry carbon, conversely, embodies stiffness and a lighter profile, but traverses a longer, more exacting set of fabrication steps that push unit costs higher. The choice is not merely about aesthetics; it is a decision about how a build will behave on track versus street, how quickly it can be produced in higher volumes, and how tolerances align with the Evo 8’s aggressive aero configuration.

The carbon fiber option captures attention with a distinctive balance of weight and rigidity. The laminates use premium weaves, often 3K plain or twill cloths, layered in controlled infusions to maximize stiffness while avoiding resin starvation. The finish extends beyond the woven surface; many parts are treated with protective coatings that resist weathering and maintain color fidelity under sun and heat. Yet the supply chain must accommodate the craft: layup tolerances, resin cure cycles, and inspection protocols all feed into a predictable product. For enthusiasts focused on track performance, this is not just about how a bumper looks, but how it anchors the entire aerodynamic package. The speed of fulfillment matters equally. Stock molds for the most commonly requested configurations help shops deliver within the 15–25 day lead time; when orders require custom geometry, factor in extra days for verification and finishing.

From port to pavement, proximity to export hubs enhances the value proposition. Guangdong and Fujian sit near Shenzhen and Hong Kong, gateways that compress transit time and reduce freight costs for international buyers. The logistics advantage means a chassis-wide update can reach customers with fewer days in transit, keeping inventories lean and response times brisk. Many factories have also pursued compliance with rigorous standards. TÜV-certified processes and formalized quality management systems signal to buyers that fitment, durability, and weathering performance meet well-defined criteria. In a market where aerodynamic performance depends on exact hood lines, bumper contours, and mounting points, such assurances carry real weight. For buyers who manage supplier ecosystems across continents, the ability to verify profiles, transaction histories, and customer feedback on a reputable platform translates to confidence without the need for a personal site visit.

Pricing is nuanced. The Evo 8 bumper ecosystem sits on a spectrum from value-driven OEM-style replacements to high-end carbon builds. A practical touchstone for the broader package is the price of a related OEM-style front bonnet on the same spectrum: listed at roughly $1,206.57 USD, with a predicted drift downward to around $1,025.58 USD as volumes scale and commodity costs evolve. Carbon fiber variants, while heavier in material labor, command higher prices reflecting their manufacturing demands and performance benefits. The market remains robust because it marries enduring enthusiast interest with a supply chain that has matured around standards, data, and capability. Where a track-ready build demands aggressive stiffness and lightness, carbon with dry processing may be the preferred path. For routine replacements that prioritize fit and longevity, FRP-based options are attractive, blending durability with predictable outcomes.

B2B buyers and procurement teams operate within a framework that values four core dimensions: material integrity, manufacturing process consistency, responsiveness, and customization agility. Material integrity speaks to the resin systems, fiber orientations, and the absence of voids or delamination after exposure to heat and moisture. Manufacturing process consistency covers process controls, repeatability of lamination schedules, curing cycles, and post-mold finishing. Responsiveness reflects the supplier’s ability to quote, prototype, and adapt to demand spikes without sacrificing quality. Customization agility relates to the willingness to modify geometry, align with revised fitment data, and deliver different surface textures or coatings as required. These dimensions translate into data-driven supplier selection. Platforms that present verified supplier profiles, transaction histories, and verifiable customer feedback become essential tools for buyers who cannot easily tour facilities in person. The result is a more transparent market, where decisions rely on proven performance metrics rather than anecdotal promises.

In this environment, the Evo 8 bumper market continues to ride a cycle of demand and capability. Enthusiasts seek improvements in cooling, flow management, and aggression, while builders chase the combination of light weight, strong impact resistance, and precise fit. The Chinese suppliers that dominate the space have built a globally evident advantage: a comprehensive ecosystem that spans concept, production, and distribution. The close proximity to major ports reduces risk and cost, while advanced process controls and certification schemes provide a level of reliability that was once the province of specialized Western shops. With an internal tooling capacity that can reproduce many popular configurations from existing molds, suppliers reduce lead times and protect margins in a market where delays can ripple through project timelines. Buyers who take advantage of verified supplier information and transparent histories can manage risk more effectively, aligning schedules with production slots and ensuring consistent quality across batches.

To anchor the discussion in practical terms, consider the broader ecosystem of Evo 8 aftermarket bumpers as a whole. The demand persists across city streets and race programs, sustaining a vibrant market that rewards readiness to adapt. The combination of carbon options, FRP substitutes, and hybrid approaches ensures there is a path for almost every build budget and objective. The numbers reinforce the point: a 15–25 day delivery frame is not a distant promise but a common outcome when a project aligns with stocked molds and streamlined processing. The capacity to deliver quickly is not only a sales advantage; it reduces the risk of misaligned production calendars, which can slow down entire modification programs. As buyers weigh choices between carbon fiber and fiberglass, they are choosing more than a material; they are selecting a production philosophy—one built around integrated facilities, rigorous testing, and proactive service.

For readers who want a concrete path into this supply chain, a practical route is to examine how data and standards guide supplier decisions. A modern Evo 8 bumper program thrives when a purchaser can cross-check fitment data, tolerance analyses, and weathering projections against quantified benchmarks. The result is a selection process that mirrors the engineering discipline behind the bumpers themselves: everything is measured, expected, and validated before it ships. If you are sourcing in volume, you will likely benefit from a cluster of factories that share tooling, test rigs, and quality-control routines. If you are building a boutique, high-end carbon set, you will still appreciate a vertically integrated shop that can deliver consistent results in the required time frame.

For readers seeking additional context from the broader research landscape, the external resource offers a comprehensive view of how top Chinese manufacturers have structured, audited, and scaled Evo 8 bumper production. External reference: https://www.b2b-sourcing-guide.com/evolution-8-front-bumper-suppliers-china/

To bring the internal navigation into sharper focus, consider an internal touchpoint that connects the chapter to practical application: the evo-8-9-front-bumper variant page, which illustrates how a single design family can be produced across materials and finishes with consistent fit and a predictable timeline. This is not merely a gallery of shapes; it is a window into how the supply chain realigns itself around common interfaces, standardized testing, and repeatable quality outcomes. The page serves as a reminder that the most successful Evo 8 bumper projects are those that treat suppliers as partners and data as currency. When a buyer can balance cost, schedule, and performance across the four core supplier dimensions, the result is a program that meets the spirited expectations of enthusiasts while sustaining a robust, scalable market for years to come.

Aero Precision and Cooling Mastery: Front Bumpers for the Evo 8

The Mitsubishi Lancer Evolution VIII has long stood as a benchmark for tuners who value precision under pressure. When a chassis is as tightly engineered as the Evo 8, the front bumper becomes more than a visual statement; it is a carefully tuned aerostructural element that quietly dictates how heat, air, and downforce interact with every mile of high-speed running. Upgrading the Evo 8’s front end is a decision rooted in two interlocking goals: to refine the car’s aero characteristics for stability at speed and to unlock cooling pathways that keep the engine and brakes performing at their best during spirited driving or track sessions. In this light, the modern front bumper is less about a single dramatic feature and more about a holistic rebalancing of airflow, heat transfer, and weight under the skin of a car that thrives on precision execution.

Aerodynamics, first and foremost, is about directing air where it does the most work and letting it exit with the least resistance. Purpose-built front bumpers for the Evo 8 typically present larger, strategically positioned air intakes that channel cool air into the engine bay and toward brake ducts. The logic is straightforward: turbocharged power, when sustained, moves a lot of heat. The turbocharger and the decades of engineering beneath the hood demand a steady supply of cooling air not just for the engine core but for auxiliary components such as the intercooler and charge piping. When air moves efficiently through these channels, there is a tangible reduction in heat soak, which translates into more consistent performance and resilient throttle response during extended pushes on a track. The same aero philosophy also affects the underbody flow. A redesigned lower splitter and integrated lip elements work in concert to manage air beneath the bumper. By guiding this air along clean, controlled paths, the car minimizes front-end lift and cultivates downforce that helps preserve tire grip as cornering speeds rise. The Evo 8’s frontal profile, sharpened by a purpose-built component, thus becomes a tool that improves high-speed stability and cornering confidence without sacrificing predictability at the limit.

Beyond the raw performance math, these bumpers project a more aggressive silhouette that aligns with the Evo 8’s track-focused identity. The visual language—clean lines, tighter gaps, and a sculpted front edge—signals intent: this is a car built to slice through air, dissipate heat, and maintain rhythm when pushed hard. For enthusiasts that track days into into late evenings, this is not mere theater; it is a practical enhancement that mirrors the car’s engineering ethos. The subtle but deliberate difference in airflow is often most noticeable during sustained high-speed runs where stability and steering feel become the deciding factors between a confident lap and a compromised one.

Cooling, the companion benefit to aero work, is where the Evo 8’s upgraded front end earns its keep. Larger air intakes enable a greater volume of air to reach the engine bay at a time when heat is a constant adversary. The turbocharged 4G63 platform, already a heat generator by design, benefits from improved airflow that expedites the dissipation of hot gases and reduces the likelihood of heat soak, particularly in hot climates or on long straights that push airflow through the radiator and intercooler repeatedly. Equally important is the improvement in brake cooling. With ducts and channels aligned to direct cooling air to rotors and calipers, the front bumper upgrade helps manage brake temperatures during aggressive braking and repeated hard stops. This translates into more consistent brake response, reduced fade, and a tangible confidence boost when chasing pace on track or canyon roads.

Implementing these cooling enhancements requires more than bigger holes; it requires careful integration with the Evo 8’s cooling architecture. The bumper must provide clear, unimpeded paths for air to travel to the intercooler, radiator, and brake ducts while maintaining compatibility with the car’s bumper beams, crash structure, and mounting points. The result is a system that preserves the integrity of OEM safety features while delivering measurable gains in thermal management. It is a reminder that performance parts thrive when they respect the vehicle’s original design language and the way air behaves around a low, aggressive profile.

From a materials and manufacturing perspective, the market for Evo 8 front bumpers has evolved into a mature ecosystem that blends performance engineering with international supply chains. In recent years, China has emerged as a dominant hub for high-fidelity front bumper production, particularly in regions renowned for their composite and mold-making ecosystems. Guangdong and Fujian, with their integrated workshops, provide a vertically aligned workflow that can handle the entire lifecycle—from 3D scanning of OEM parts to the final UV-protected coating. This end-to-end capability helps reduce lead times and drive down input costs, benefits that are especially meaningful for both volume buyers and smaller shops pursuing niche aesthetic or performance configurations. The vertical integration means that a shop can iterate quickly, validate fitment, and deliver consistent quality across batches, an advantage that matters when a bumper must align with the Evo 8’s precise geometry, mounting points, and air intake pathways.

Material choices vary, with carbon fiber bumpers offering the pinnacle of weight savings and stiffness, and ABS or composite bumpers providing robust, OEM-style fitment at a more accessible price point. The carbon fiber options, while more labor-intensive and expensive, bring a compelling performance case for track-focused builds where every gram matters and structural rigidity under dynamic load can influence handling and aero performance. The ABS and composite alternatives, by contrast, emphasize durability, ease of repair, and straightforward factory fit. For the Evo 8, where a blend of performance and reliability is often the aim, many builders select a bumper that preserves the factory geometry while introducing more aggressive cooling ducts and a refined aero profile. The result is a front end that works with the car’s chassis dynamics rather than fighting against it.

Within this landscape, the availability of multiple design profiles allows builders to tailor the front end to their goals. A more aggressive, track-oriented profile may emphasize wider air intakes, an integrated lower splitter, and pronounced canards that channel air along the vehicle’s sides. A more restrained, street-ready configuration might prioritize a cleaner silhouette that remains visually cohesive with the Evo 8’s lines while still improving airflow and cooling efficiency. Either path underscores a larger truth: the front bumper is a performance component, but it is also a design element that communicates purpose. A well-chosen bumper integrates with the car’s overall aero balance, chassis setup, and powertrain strategy, ensuring that the gains in cooling or downforce do not come at the expense of stability or drivability.

For readers exploring the spectrum of options, it is worth reviewing how a bumper family may be approached from a procurement standpoint. In B2B contexts, the emphasis shifts from a single product to a suite of evaluation criteria. Technical evaluation, quality assurance protocols, and data-driven supplier selection emerge as critical tools for ensuring that the chosen part not only fits but performs across a range of conditions. Dimensional accuracy, paint adhesion, weathering resistance, and the integrity of the mounting system are prioritized metrics. This framework helps buyers avoid mismatches between the bumper’s profile and the Evo 8’s mounting geometry, which can otherwise translate into gaps, misalignment, or compromised aerodynamics. A practical takeaway for builders is to request CAD data, surface finish specifications, and coating warranties before committing to a supplier. In parallel, test-fitments on a sample car provide early feedback on fit and functional flow, reducing the risk of late-stage setbacks.

From a cost perspective, the spectrum widens with material choices, finish quality, and whether the bumper is designed to emulate OEM lines or to push a more aggressive, track-ready aesthetic. Carbon fiber generally commands a premium due to raw material costs and the labor-intensive process of layup and cure. ABS or other composites tend to offer a more accessible entry point while still delivering meaningful gains in airflow and cooling efficiency. For Evo 8 owners weighing the trade-offs, the decision often centers on the intended use case: weekend track days, daily driving with occasional racing, or a blended approach that keeps the car practical yet unmistakably purposeful. The evolving market supports these divergent paths, enabling owners to balance weight savings, durability, ease of replacement, and the psychological impact of a front end that communicates that the vehicle is ready to chase speed.

To consider a concrete example without drifting into branded nomenclature, one might explore Evo CT9A family options that share a lineage of front-bumper design philosophy. The concept here is to appreciate how a single chassis family can embrace different intake layouts, splitter geometries, and duct arrangements while maintaining consistent OEM geometry and mounting points. Such an approach helps ensure compatibility with radiator and intercooler kits, piping routes, and suspension geometry that can influence aerodynamics indirectly through ride height and weight distribution. It also invites a broader conversation about how to pair a bumper upgrade with a complementary set of components—intercooler upgrades, a tuned exhaust, or a refined brake package—to maximize the impact of the upgrade without triggering unintended consequences in engine management or chassis balance.

For readers seeking a direct path to market examples, a practical route is to review supplier pages that emphasize compatibility with EVO platforms and to compare fitment notes, warranty terms, and available finishes. The key is to verify that the chosen bumper aligns with the car’s safety systems and that the finish, coating, and UV protection meet the local climate’s demands. The conversation around bumpers for the Evo 8 is not merely about appearance or superficial aero; it is about collecting components that work in concert with the vehicle’s heritage of performance engineering. When done thoughtfully, a front bumper upgrade becomes a mechanical partner for the driver, enhancing aero stability, cooling reliability, and the visceral confidence that defines a car built to engage the road and the track with equal fervor.

As a launching point for deeper exploration, you can examine a representative catalog of compatible options linked here: Evo CT9A front bumper (7-8-9) options. This resource provides a tangible sense of how designers translate airflow goals into practical shapes that fit the Evo 8 chassis while accommodating the realities of manufacturing tolerances and aftermarket installation requirements. For readers seeking broad context beyond the Evo line, a well-regarded external reference that captures the spirit of these upgrades and their impact on performance is available here: https://www.racingparts.com.au/mitsubishi-lancer-evolution-viii-front-bumper/.

Front Bumper Evo 8: Pricing Dynamics, Demand Growth, and the Global Aftermarket Network

Across the Evo 8 aftermarket scene, the front bumper stands as more than a cosmetic component. As of early 2026, demand for Evo 8 front bumpers has expanded rapidly, with a 22 percent year-over-year rise driven by tightening emissions regulations in many regions and a renewed interest among collectors to preserve the car’s original character while elevating performance through refined upgrades. In practice, bumpers are not merely replacements; they function as performance adapters that shape aerodynamics, cooling efficiency, and the car’s aggressive stance on both street and track. Enthusiasts chase combinations of dedicated cooling pathways and carefully tuned airflow management, while still seeking a silhouette that honors the Evo 8’s distinctive face. The result is a marketplace where quality and fit matter as much as appearance, and where a well-chosen bumper can influence overall vehicle balance during high-speed runs and long endurance sessions alike. The conversation around value has moved beyond simple price tags toward a more holistic view of lifecycle cost and reliability under load.

Pricing in this ecosystem is a moving target shaped by material quality, manufacturing precision, and the geographic footprint of the supplier. Chinese manufacturers, particularly those anchored in Guangdong and Fujian, have built a robust, vertically integrated supply chain that can deliver OEM-like fidelity at materially lower input costs than many Western producers. They achieve this by combining advanced 3D scanning to capture OEM geometry, precise mold handling, vacuum-infused carbon fiber layups, and UV-protected clear coatings that resist yellowing and surface wear. The net effect is a spectrum of products that sit comfortably between factory-fit replacements and lightweight, track-ready composites. For buyers who value speed, stock molds for common variants make it feasible to ship in roughly 15 to 25 days, a pace that keeps inventory turns healthy and minimizes the opportunity cost of waiting on custom tooling. This balance—high fidelity with rapid fulfillment—defines the current pricing narrative and shapes purchasing decisions across both hobbyist projects and professional inventory programs.

Material choice remains a central driver of price and performance. Carbon fiber bumpers bring a premium that reflects not only material costs but the labor-intensive processes required to achieve consistent prep, weave alignment, resin impregnation, and flawless surface finishes. ABS plastic bumpers, by contrast, offer durability and cost efficiency while maintaining close adherence to OEM geometry. The choice between carbon and ABS often mirrors the buyer’s intended application: carbon for track-focused builds where weight reduction and stiffness translate into improved cornering behavior and cooling efficiency; ABS for street-oriented builds that prioritize durability and a more budget-conscious implementation. Across the market, pricing for OEM-style hoods or bonnets sits in a mid-to-high range in US dollars, and carbon options tend to command a noticeable premium as the manufacturing steps—particularly layup quality and surface finishing—add incremental cost. Finishes, coatings, and tiered grades of resin content further modulate the final price, making the spectrum wide enough to accommodate both brisk project builds and longer-term collector restorations.

Design variants have crystallized into several mainstream configurations that buyers expect to see in stock or close to stock form. These variants benefit from shared tooling and common geometry, which reduces risk and accelerates fulfillment for both dealers and repair shops. The advantage is twofold: it gives customers confidence that parts align with other panels and mounting points, and it accelerates production cycles, enabling faster replenishment for high-demand periods. For those seeking a concrete reference point within the chain, a representative variant family can be explored at evo-8-9-varis-front-bumper-with-carbon-lip. The ability to source from stock molds means shops can promise shorter lead times while still offering customization options through finishes, lip extensions, or ancillary aero accessories. This setup is critical in a market where even modest delays ripple through sales forecasts and project timelines, potentially pushing customers toward interim OEM-style replacements while waiting for the preferred finish or a carbon option.

Beyond the product itself, the value proposition for B2B buyers hinges on a multidimensional evaluation framework that goes far beyond price alone. Technical precision is non-negotiable; bumpers must align with OEM tolerances to ensure seamless integration with headlights, grilles, and under-hood cooling ducts. A misaligned front can undermine air curtain performance or complicate paint processes when panels are reassembled on a car with a tuned cooling system. Quality consistency matters just as much—buyers must trust that batch-to-batch variation stays within tight specifications to avoid warranty claims and to protect the perceived value of the entire installation. Responsiveness is equally essential; clear timelines, proactive status updates, and transparent communication about material SKUs and capacity shifts keep programs on track and enable contingency planning. Finally, customization agility—how quickly a supplier can adapt molds, finishes, and packaging for different regional markets without sacrificing speed—often becomes the decisive factor for buyers who manage multi-market inventories or frequent model year updates. In a market that thrives on change, mature suppliers that demonstrate a track record of reliable delivery and QA discipline tend to secure long-term partnerships and predictable supply chains.

Regional dynamics also illuminate why the Evo 8 bumper market remains robust. Guangzhou and Fuzhou, in particular, anchor ecosystems where composite sourcing, mold engineering, and export logistics converge. These hubs do more than assemble parts; they synchronize design iterations with production capacity, enabling a streamlined transition from concept to customer. The proximity of resin suppliers, carbon fiber fabric, and finishing specialists creates a conveyor belt effect—reducing lead times, improving cost predictability, and enabling even smaller buyers to experiment with different looks without incurring prohibitive setup costs. The cumulative effect is a market that can accommodate both volume orders and limited-edition runs with similar reliability. For buyers who scale their programs in steps, this translates into meaningful cost savings over time and lowers the friction associated with product diversification. The supply chain maturity in these regions also cushions the market against fluctuations in currency and freight costs, providing a buffer that helps stabilize pricing during periods of global volatility.

In terms of supplier evaluation, mature procurement teams anchor their decisions in a balanced assessment of risk and opportunity. Suppliers who publish and adhere to traceable process controls, maintain QA checkpoints at critical stages, and demonstrate consistent performance under variable production loads tend to outperform those that lack visibility. The most successful partnerships combine a steady cadence of new variant introductions with robust high-volume capacity, ensuring that customers can respond to market demand without sacrificing quality or schedule integrity. This blend of innovation and reliability is increasingly valued as emission regulation frameworks evolve, and as enthusiasts demand bumper systems that not only perform under stress but also preserve the car’s original character. With a growing emphasis on lifecycle value—considering maintenance, repaint compatibility, and long-term durability—buyers are more likely to cultivate relationships with suppliers who can prove a track record of steady performance across multiple production cycles.

Looking ahead, the Evo 8 front bumper market is positioned for continued expansion, but the trajectory will hinge on how well producers balance scale with fidelity. The demand for high-quality composite and plastic options will likely endure, fueled by collector interest and the ongoing desire for track-ready conversions that maintain a classic silhouette. The aerodynamics trend will continue to push for more efficient cooling and cleaner airflow management, while aesthetic expectations will push suppliers to deliver with smoother finishes, consistent gloss, and durable protective coatings. As the ecosystem grows, buyers should expect more data-driven supplier selection processes, with emphasis on long-term partnerships that deliver predictable quality across batches and years. In this environment, the strategic relationship becomes the central asset—an asset built on technical alignment, delivery reliability, and a shared commitment to maintaining the Evo 8’s authentic presence while expanding its capabilities on modern roads and circuits.

External reference and broader context for the Evo 8 parts market in 2026 corroborate this growth pattern and the pricing dynamics described above. For readers seeking a comprehensive view of how Evo 8 bumper demand is evolving across regions and channels, the following external resource offers a detailed market analysis and buyer guidance: https://www.autosupplyinsider.com/evolution-viii-parts-market-trends-2026

Final thoughts

The Mitsubishi Lancer Evo 8 front bumper market represents a vibrant sector within the automotive aftermarket. By understanding material options, design variations, and supply chain efficiencies, business owners can make informed decisions that enhance product offerings and align with market demands. Continuous monitoring of performance benefits and pricing trends is crucial for maintaining a competitive edge. The robust ecosystem surrounding Evo 8 bumpers not only caters to consumer desires but also drives innovation and efficiency within production processes, making it an exciting time to engage with this market.