The Mitsubishi Lancer Evolution X (Evo X) epitomizes performance engineering, cementing its legacy among automotive enthusiasts. Since its discontinuation in 2016, the demand for high-quality OEM and aftermarket parts has surged, leading businesses to seek reliable suppliers. This article delves into the sourcing landscape of Evo X parts, addressing key manufacturing hubs, supplier categories, engine performance parts, suspension components, and brake systems. Each chapter offers insights tailored for procurement managers and business owners, equipping them with the tools needed to maintain a robust supply chain for these iconic vehicles.

China’s Production Geography for Evo X Parts: Where to Source Suspension, Bumpers, and Performance Components

When building a reliable, scalable supply chain for Lancer Evolution X parts, understanding the manufacturing geography is essential. China dominates supply, but it does so through specialized clusters. Each cluster offers distinct technical strengths, logistics advantages, and quality control practices. Procurement teams that align component needs with the correct regional capabilities will reduce lead times, lower rework risk, and improve unit economics.

Regional Hubs and Strategic Sourcing

Guangdong Province, centered on Guangzhou and Shenzhen, is the most important node for Evo X parts. The region supports dense, vertically integrated ecosystems. Within short distances you find mold-making shops, injection molding plants, fiberglass and carbon fabrication units, paint booths, and advanced assembly lines. That proximity reduces handoffs and shortens production cycles. Suppliers here commonly produce suspension systems, drivetrain parts, turbo systems, body kits, interior accessories, and OEM-style wheels. They also benefit from experienced engineering teams adept at reverse engineering and OEM replication, making Guangdong the go-to region for complex assemblies and complete parts packages.

A major practical advantage of Guangdong is logistics. The region sits near multiple deep-water ports and international gateways. Access to ports such as Nansha and Shekou, along with regional air freight hubs and nearby container yards, streamlines export shipping. This matters for procurement managers who balance consolidation, just-in-time replenishment, and carrier lead-time variability. Choosing Guangdong suppliers often reduces inland transit time and simplifies customs processing for major export lanes.

In manufacturing terms, Guangdong firms excel in materials and processes commonly used for Evo X body and exterior parts. Injection molding of ABS, high-quality painting and clearcoating, and carbon fiber layups are well established. For example, authentic-looking bumpers, aerodynamic lips, and full carbon or FRP panels are routinely made to tight visual standards. Buyers who need near-OEM cosmetic fidelity alongside structural performance generally source these items from Guangdong. If front bumper replication or high-fidelity exterior components are core to your catalog, consider suppliers in this cluster. For a direct example of what to expect from genuine look items, see this genuine Evo X front bumper supplier listing: genuine Evo X front bumper.

Zhejiang Province offers a different set of advantages. Its strength is precision engineering at competitive scale. Cities like Ningbo, Wenzhou, and Danyang host advanced CNC machining centers, high-volume alloy forgings, and electronics assembly facilities. These capabilities make Zhejiang ideal for engine internals, precision drivetrain components, and modern engine management electronics. Buyers seeking forged connecting rods, CNC-ported cylinder heads, or high-tolerance turbo housings will find suppliers in Zhejiang that maintain close tolerances and consistent batch quality.

Zhejiang also houses efficient injection molding lines for thermoplastic olefins and polypropylene. For procurement teams sourcing bumper covers at scale, or components that require tight dimensional repeatability, Zhejiang’s rapid prototyping and in-house testing services speed development. Shared testing labs and rapid prototyping centers allow shorter iteration cycles for fitment checks and tooling revisions.

Jiangsu Province completes the triad with strong die-casting and sheet metal forming expertise. Jiangsu-based factories are well-suited to exhaust systems, intercoolers, and structural body panels. Their die-casting capabilities produce consistent, thin-walled castings with high dimensional stability. For parts where metal forming and heat treatment determine performance, Jiangsu suppliers combine process control with high throughput. If your part list includes exhaust manifolds, welded intercooler cores, or stamped body reinforcements, Jiangsu is often the most technically appropriate region.

Matching Components to Clusters

Effective sourcing pairs parts to the region whose strengths match manufacturing requirements. Use Guangdong for aesthetic and composite assemblies, trim, and integrated packages. Use Zhejiang for precision machined internals, turbo hardware, and electronics. Use Jiangsu for metal-intensive systems and structural components. This alignment optimizes cost, reduces defect rates, and improves supplier responsiveness. For multi-component assemblies, consider a two-stage sourcing strategy. Source critical metalwork from Jiangsu, precision internals from Zhejiang, and exterior panels from Guangdong, then consolidate assembly in a single, capable facility to reduce cross-border logistics and minimize lead times.

Supplier Evaluation and Process Considerations

When evaluating suppliers across these hubs, assess tooling and mold ownership, testing capabilities, and export experience. Tooling ownership indicates long-term stability and cost predictability. In-house testing labs or partnerships with third-party labs suggests robust development practices. Export experience reduces friction on documentation, compliance, and freight consolidation.

Ask suppliers for detailed process documentation. Key items include material specifications, process flows, and first article inspection (FAI) reports. For engine internals, request metallurgical certifications and tolerance charts. For suspension components, demand fatigue test data and compliance with relevant durability standards. For painted exterior parts, verify color matching systems and adhesion test results. When possible, request images and video of production runs to verify process consistency.

MOQ, Lead Times, and Cost Dynamics

Minimum order quantities and lead times vary by region and process complexity. Guangdong’s high mix of small-to-medium suppliers often offers negotiable MOQs for painted exterior kits. Zhejiang’s precision shops sometimes require higher MOQs to amortize tooling. Jiangsu’s die-casting operations typically demand higher minimums due to mold costs and cycle planning.

Lead time expectations should account for tooling, validation runs, and certification. Typical timeline components include tooling lead (4–12 weeks), prototype validation (2–6 weeks), pre-production run (1–3 weeks), and full production ramp (2–8 weeks). These windows vary by part complexity and by supplier backlog. Build scheduling buffers into procurement plans to avoid stockouts in high season or during carrier disruptions.

Quality Assurance and Compliance

Quality systems matter as much as factory capability. Prefer suppliers with documented quality management systems, traceability protocols, and a record of third-party audits. Factory accreditation and export history are proxies for reliability. When sourcing safety-critical parts, insist on batch traceability and serial-numbered components where feasible.

For parts affecting vehicle dynamics—suspension, brakes, and drivetrain—require independent validation testing. This may include fatigue testing, thermal cycling, and tolerance stack-up analysis. When suppliers offer warranties or performance guarantees, clarify the terms. Extended warranty commitments can be a differentiator when comparing otherwise similar bids.

Packaging, Shipping, and Post-Sales Support

Packaging protects parts and reduces return rates. For bumpers and painted surfaces, use custom crates or foam inserts. For machined internals, use rust-proof packaging and desiccants. Coordinate packaging standards with your freight forwarder to optimize container utilization and reduce damage claims.

Post-sales support is essential. Suppliers that provide clear RMA processes, spare tooling availability, and fast replacement parts reduce downstream risk. Build service-level agreements into contracts specifying turnaround times for replacements, tooling repairs, and recall support.

Risk Mitigation and Long-Term Strategy

Diversify across regions to reduce concentration risk. Maintain at least two qualified suppliers in different provinces for critical SKUs. Use staggered lead times and safety stock to cover transit variability. Consider strategic inventory placement in your distribution network to balance lead time and carrying costs.

Invest in supplier development. Short-term premium on engineering support can lower long-term costs. Jointly develop testing protocols, improve yield rates, and optimize material selection. Suppliers with invested relationships often prioritize orders, provide faster engineering responses, and offer better pricing as volumes grow.

Practical Next Steps for Procurement Teams

Map your parts to the regions described here. Prioritize commencement orders for high-risk SKUs. Request detailed capability matrices and FAI documentation. Schedule remote or in-person factory visits to verify processes. Negotiate MOQs with trial orders that include performance clauses. Finally, build lead-time buffers into Q4 or seasonal plans to avoid capacity crunches.

Aligning the right provincial strengths with specific Evo X components reduces risk. Guangdong delivers cosmetic fidelity and integrated assembly. Zhejiang provides precision machining and electronics skill. Jiangsu offers robust metal forming and die-casting. By matching parts to these strengths, procurement teams will establish resilient, high-quality supply chains for Lancer Evolution X components.

For up-to-date supplier listings and marketplace verification tools, consult the GoldSupplier Wholesale Marketplace for Lancer Evo X parts (https://www.goldsupplier.com/automotive-parts/mitsubishi-lancer-evo-x).

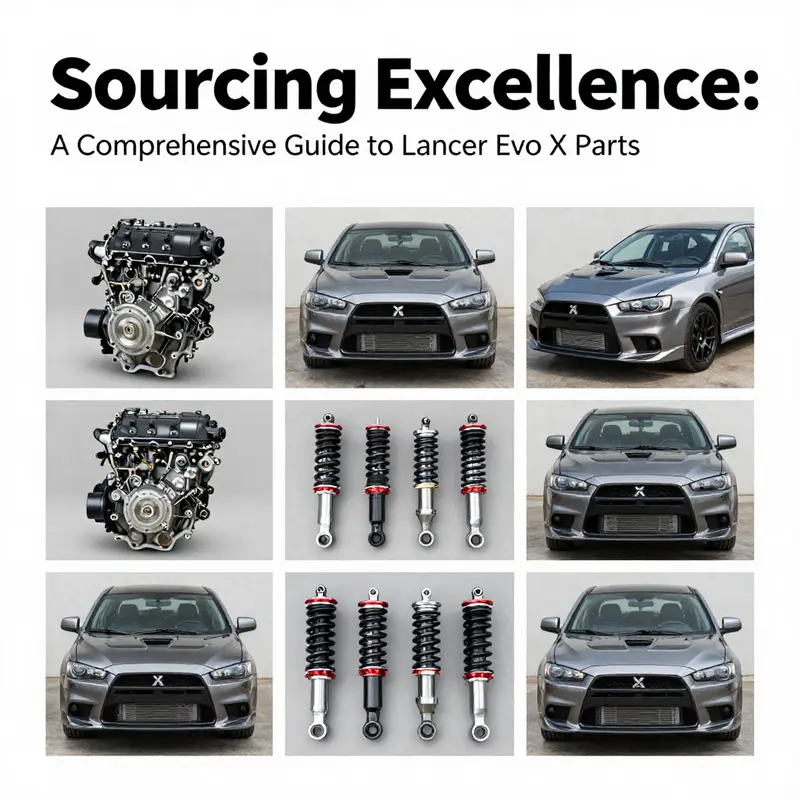

The Parts Map: Top Supplier Categories for Lancer Evo X Parts and the China-Driven Engine Behind the Evo X Ecosystem

In the world of performance sedans, the Evo X stands as a benchmark for enthusiasts and procurement teams seeking precision, reliability, and scale. The chapter that follows does not merely list components; it maps the sourcing terrain that underpins long-term supply resilience for the Lancer Evolution X ecosystem. Even as the model has ceased production, the demand for OEM-spec and high-performance aftermarket parts continues to grow. For procurement managers, the challenge is not just finding parts but aligning a supply chain with the Evo X’s dynamic heritage and the realities of global manufacturing. The answer, increasingly, rests in a distributed network of specialized hubs across China. Each hub concentrates distinct capabilities—machining, casting, sheet metal forming, composites, and advanced electronics—creating an ecosystem where the right part is produced in the right place, with the right quality controls, and delivered at scale. Understanding this landscape helps buyers balance performance, price, and lead times while reducing risk across the lifecycle of the parts program.

The leading regional clusters offer a practical lens on how to source Evo X components with confidence. Guangdong Province, especially its core expansion zones around major ports and logistics corridors, serves as the performance and innovation hub. It is the place where a broad spectrum of capabilities converges: turbo systems and engine components that demand tight tolerances; suspension and drivetrain parts that must communicate precisely with the Evo X’ dynamic all-wheel control architecture; and even aerodynamic and aesthetic components crafted from advanced composites. The proximity to export hubs and a dense network of engineering talent create a dense supply lattice. The result is not merely speed to market; it is the ability to sustain iterations, support high-frequency testing, and scale custom or limited-run items without sacrificing form or fit. In practice, buyers can source from Guangdong with more confidence when seeking integrated solutions that combine high-performance engineering with reliable logistics and after-sales support. Inline with this, the region’s access to skilled composite work and machining advances translates into parts that are both visually authentic and structurally robust, from carbon fiber hoods and front lips to complex engine housings that must kiss factory tolerances while remaining race-ready under heat and vibration.

Zhejiang Province represents the precision engineering powerhouse within Evo X sourcing. Here the emphasis is on high-precision metal parts and forged-internals that demand exceptional strength, durability, and dimensional accuracy. For purchasers, Zhejiang offers a portfolio that includes forged internal components and other metallic structures produced through advanced machining and alloy fabrication. The advantages are clear: deep materials knowledge, access to high-grade alloys, and sophisticated CNC capabilities that deliver consistent performance under the Evo X’s demanding operating envelope. In practical terms, a buyer looking to build or refresh high-horsepower engines, or to reinforce crank assemblies and related internals, can rely on Zhejiang suppliers to deliver components that meet exacting tolerances while supporting tight production schedules. This precision focus complements Guangdong’s performance orientation, allowing buyers to pair a high-performance assembly with parts that will retain geometry and alignment over thousands of miles of spirited driving.

Further north, Jiangsu Province functions as the die-casting and sheet-metal specialist within the Evo X parts map. Jiangsu’s strengths align with the mass-production tempo that modern performance programs often require. Exhaust systems, intercoolers, bumpers, grilles, and other body panels are areas where die-casting and sheet-metal forming deliver the economy and repeatability needed for larger-scale projects. For procurement teams, Jiangsu offers an efficient route to cost-effective, robust components that still maintain the necessary tolerances and fit. The combination of large-volume production capacity and proximity to tier-one automotive ecosystems helps ensure consistent part quality while keeping lead times reasonable. When a program calls for stamped or injection-molded panels alongside durable metal components, Jiangsu becomes a preferred partner, enabling a well-rounded parts portfolio without compromising on consistency or delivery.

Hebei and Fujian complete the regional mosaic with specialized capabilities that broaden the Evo X parts spectrum. Hebei is known for targeted components that benefit from precise machining and mass-produced valve components, while Fujian—particularly its coastal subregions—has emerged as a niche hub for premium FRP and carbon-fiber fabrication. For buyers, this pairing is meaningful: Hebei’s focus on specific machined parts ensures dependable performance across engine and mechanical interfaces, while Fujian’s FRP and carbon-fiber capacity opens pathways to lighter-weight bodies, spoilers, and widebody conversions that preserve structural integrity and aesthetic fidelity. This diversification matters because it reduces sole-source risk. It gives procurement teams the option to specify high-performance composites from a dedicated carbon-fiber supplier or to choose FRP alternatives when speed and cost balance are paramount. The combined regional strengths—engineered internals from Zhejiang, turbo and suspension ecosystems from Guangdong, mass-produced metal and body components from Jiangsu, and specialized composites from Hebei and Fujian—form a practical, risk-aware blueprint for Evo X sourcing.

The strategic value of this regional mosaic goes beyond fit and finish. It translates directly into supply-chain stability and the ability to respond to market dynamics. When demand spikes for a specific class of parts, buyers can tap into Guangdong’s rapid prototyping and high-productivity networks to iterate, test, and scale. If a project requires precise, high-load engine components, Zhejiang’s machining ecosystems can deliver repeatable performance with the exact tolerances required for reliable operation. For high-volume body parts or heat-tolerant exhaust assemblies, Jiangsu provides a cost-efficient pathway to mass production without sacrificing essential quality, whileHebei and Fujian ensure access to specialized components and advanced composites that support weight reduction and aero performance. The synergy is not accidental; it is the outcome of clusters that have evolved to export at scale while maintaining strict QC standards and responsive after-sales support.

This is not a philosophy of simple price competition. It is a blueprint for procurement strategy that recognizes where best-in-class capabilities reside and how to align them with specific Evo X parts programs. The sourcing discipline begins with clear part specifications and a validation plan. Buyers look for suppliers that offer platform-verified status on reputable marketplaces. Those indicators signal that the supplier has undergone quality checks and meets minimum standards for product conformity and business practices. They also help procurement teams reduce the need for initial supplier audits and accelerate onboarding. The guidance is practical: prioritize partners with verifiable quality controls, a track record of exporting to your target markets, and robust post-sales support. These attributes empower buyers to navigate the Evo X parts landscape with confidence rather than conjecture, creating a supply chain capable of handling both routine servicing and ambitious performance builds.

The decision to source from these hubs should also reflect a thoughtful approach to part classification. Engine and turbo systems demand the highest standards of reliability and heat resistance; suspension and drivetrain components require precise geometry alignment with the vehicle’s dynamic all-wheel control system; and body and aero components must balance strength, stiffness, and aerodynamics. In turn, the regional capabilities offer a natural alignment between the part’s functional requirements and the manufacturing strengths of the hub. A buyer can reasonably expect that a forged-internal component is produced in a precision-centric zone, while a high-load exhaust or a carbon-fiber body panel is more plausibly sourced from the composite-focused corridor. This alignment reduces rework, shortens testing cycles, and enhances the prospect of reliable delivery over the long term.

Sourcing practice, however, remains anchored in disciplined supplier evaluation. Buyers should seek platform-verified icons on reputable marketplaces, which indicate a baseline of trust and compliance. Negotiable MOQs can be a meaningful lever when project scales vary, but require careful forecasting and collaboration with suppliers to avoid overstock or capacity bottlenecks. For critical components—those that play a central role in engine performance, structural integrity, or safety—verification of material specifications, heat treatment, and endurance data is essential. Beyond technical compatibility, post-sales support—warranty terms, replacement part availability, and accessible technical assistance—often determines the success or failure of a long-running Evo X program. In other words, the most effective sourcing approach blends regional capability, rigorous supplier vetting, and a collaborative mindset that treats supply partners as long-term stakeholders rather than one-off vendors.

The practical upshot for procurement teams is straightforward: design the sourcing plan around the strengths of each hub, but centralize governance around quality, reliability, and stability. Guangdong can be your rapid-response center for high-performance composites and integrated systems; Zhejiang can supply the precision metal components that keep engines and drivetrains aligned; Jiangsu can handle the scale of body parts and exhaust-related products with cost efficiency; and Hebei plus Fujian can extend your portfolio with highly specialized and advanced composite items. The combination ensures diversity of supply and resilience in the face of demand fluctuations or geopolitical shifts, while preserving the Evo X’s performance-centric ethos.

For buyers keen to see real-world options, a useful practical step is to explore marketplace platforms that host verified Evo X-part suppliers. The marketplace updates pricing, availability, and supplier statuses, offering a snapshot of how the ecosystem evolves over time. For current pricing and verified suppliers, see GoldSupplier Wholesale Marketplace – Lancer Evo X Parts. As with any strategic sourcing initiative, the path to scale lies in thoughtful supplier selection, rigorous specification, and proactive relationship management. The Evo X parts map is not a single corridor but a network. When navigated with discipline, it becomes a reliable engine for sustaining performance, longevity, and value across the model’s continued life on the road and in competition. If a buyer wants to drill down into a specific component category, the linked internal resource can guide navigation toward compatible options and ensure the chosen path aligns with the broader sourcing strategy. For instance, those seeking aero and exterior enhancements can find practical, authentic-looking options via a dedicated product page that highlights compatibility and finish quality. The linked page serves as a reminder that, in a mature supply ecosystem, even the most specialized parts can be sourced with confidence when the buyer understands the regional strengths and the verification signals that accompany each supplier. The Evo X parts map is a living framework, constantly refined through collaboration between buyers, engineers, and manufacturers who share a commitment to performance and reliability.

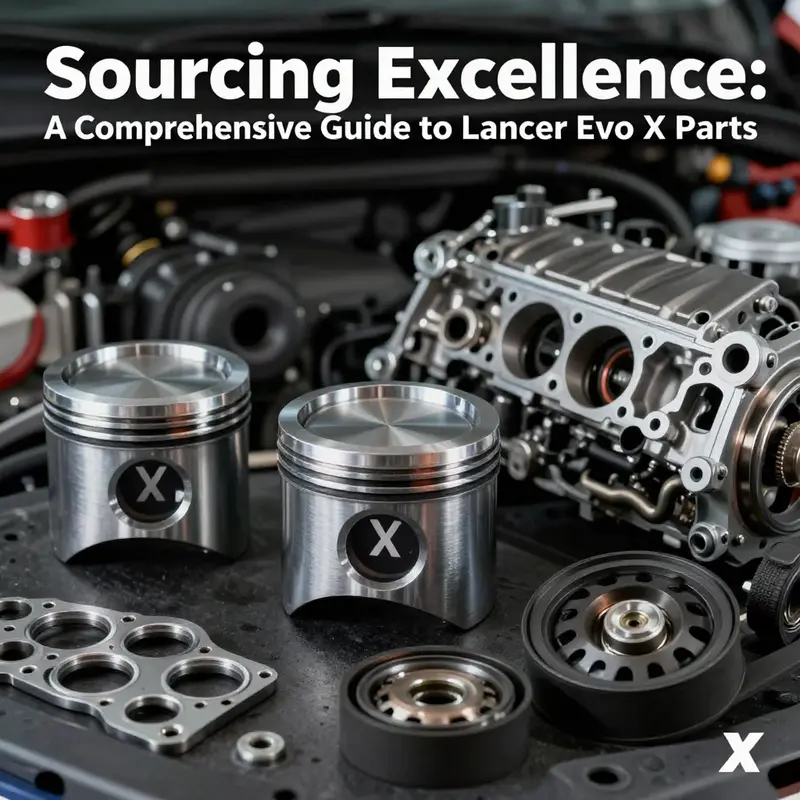

Forging Power Under the Hood: Engine Upgrades that Define the Evo X’s Performance Legacy

The Lancer Evolution X carries a storied reputation built on a single, relentless conviction: power delivered with precision. Its heart is a high-performance, 2.0-liter turbocharged inline-four that thrives on smart tuning and disciplined engineering. For procurement teams aiming to sustain or elevate Evo X performance at scale, the engine is more than a component; it is a system whose parts must sing in harmony. The lure of engine upgrades lies not only in peak numbers but in predictable, repeatable response across a broad range of conditions. When sourcing engine-related parts, buyers chase components that improve spool, flow, and endurance without compromising reliability or the integrity of the factory calibration that makes the Evo X feel cohesive on everything from daily commutes to backroad duels. In this context, the sourcing ecosystem around the Evo X has become a tapestry woven from regional strengths, technical rigor, and strategic risk management, with China playing a central role in delivering precision-engineered pieces at scale while maintaining the discipline required for high-performance applications.

At the front of any engine upgrade strategy is the turbocharger itself. Upgrading this core component can transform how the engine responds, especially in the mid-range where boost onset translates into noticeable acceleration and linear power delivery. The right turbo upgrade reduces lag and sharpens throttle response, enabling the engine to spool more quickly and reach higher sustained boost levels without tipping into unstable pressure curves that can stress ancillary parts. But the benefits are contingent on complementary systems: robust intercooling to keep intake temperatures in check, precise fueling and ignition control, and matching exhaust flow to prevent unintended backpressure or compressor surge. In practice, the upgrade becomes a careful balancing act where compatibility and calibration govern long-term performance. For procurement teams, this means prioritizing suppliers who can demonstrate consistent quality in high-temperature, endurance testing and who provide reliable data on thermal management performance. The goal is not merely more boost, but reliable, repeatable power across a spectrum of driving scenarios, from spirited mountain passes to high-load, extended sessions on the track.

Thermal management follows closely behind as a force multiplier for any turbo-centric upgrade. Intercoolers are not just heat exchangers; they are guardians of power stability. A high-efficiency intercooler preserves air density as it travels to the intake, minimizing heat soak during repeated pulls and maintaining charge purity when ambient temperatures rise. The practical payoff is steadier torque curves and a lower propensity for knock, which means the engine can sustain more aggressive timing strategies without sacrificing durability. For buyers, the emphasis is on core performance metrics—temperature depression under load, pressure drop across the core, and the intercooler’s resistance to heat cycling over time. Suppliers who can present repeatable test data and clear quality assurance trails tend to offer the best long-term value, especially when orders must scale from a handful of units to hundreds or thousands for a performance shop network or a regional distributor. The intercooler’s role is a reminder that rarefied power comes with a demand for holistic engineering discipline; every thermal advantage contributes to the reliability that enthusiasts expect.

Airflow into the engine is another pivotal domain where upgrades pay dividends. An enhanced intake manifold, paired with an optimized intake track, can improve volumetric efficiency and throttle response, especially at higher engine speeds where air demands surge. Improved air delivery supports more efficient combustion and better acceleration, which translates to more usable power in real-world driving rather than solely on a dyno chart. In procurement terms, this means seeking manifolds and associated piping that maintain resonance and impedance characteristics appropriate for the Evo X’s intake design, ensuring compatibility with the engine’s cam timing, fuel system, and engine control logic. The impact on drivability—quicker throttle reaction, smoother low-end torque, and more linear power delivery—has tangible benefits for fleet operators, specialty builders, and private-label performance shops seeking dependable results across diverse operating environments.

Exhaust systems round out the trio of performance enablers by shaping how exhaust flow and backpressure influence the turbocharged setup. A well-designed, performance-oriented exhaust path reduces backpressure and enhances scavenging, enabling the turbo to breathe more freely and sustain higher speeds under load. The audible character—a deeper, more purposeful exhaust note—often accompanies the functional gains, yet the emphasis remains on consistent flow, heat resistance, and structural integrity under high thermal stress. For buyers, the focus should be on exhaust components that offer proven resonance with the engine’s calibration, while preserving emissions compliance where required and ensuring fitment with the Evo X’s chassis and exhaust routing. In practice, this means sourcing from suppliers who can demonstrate robust corrosion resistance, stable substrate flux during high-temperature operation, and reliable hardware that holds tolerances across multiple production runs.

Beyond the external hardware, the engine’s internal components carry the highest stakes for longevity when power levels ascend. Upgraded internals—crankshafts, connecting rods, pistons, and related fasteners—are the backbone of serious performance programs. These components must balance strength, weight, and thermal resilience, enabling higher piston speeds and reduced risk of fatigue under sustained boost. The conversation around engine internals is inseparable from the broader narrative of reliability. For procurement teams, the challenge is to identify sources that can provide forged or otherwise strengthened internals with validated material certifications, consistent machining tolerances, and traceable lot data. The objective is to minimize failure modes while enabling higher power targets, and to do so with a supply chain that can support large-volume production and rapid reorders without compromising quality or delivery timelines.

In this ecosystem, sourcing and manufacturing insights become more than regional trivia; they shape risk, cost, and performance outcomes. Chinese manufacturing hubs, particularly in southern regions, have matured into capable ecosystems for high-performance automotive components. Guangdong’s concentration of automotive engineering capabilities—spanning molding, metal fabrication, surface finishing, and precision assembly—creates a near one-stop environment for complex engine parts and their associated support hardware. The advantage is not only cost efficiency but the speed with which components can move from design concepts to finished products ready for testing and calibration. For buyers, this means shorter lead times, easier quality checks, and a clearer path to maintaining consistent supply for evolving performance programs. Yet speed without verification carries risk. That is why buyers increasingly couple the manufacturing proximity with rigorous supplier evaluation criteria, platform verification on marketplaces, and robust post-sales support. It becomes a practical framework for maintaining product integrity as orders scale and as performance requirements evolve.

Quality assurance, then, anchors the entire sourcing strategy. Buyers are advised to prioritize suppliers who present verifiable certifications, transparent testing data, and a demonstrable track record with motorsport teams or OEM collaborations. Sample testing remains essential for critical components, especially when upgrading internal tolerances or introducing new material technologies. On-site factory audits provide the deepest assurance of process discipline, enabling buyers to observe machining practices, heat-treatment protocols, and inspection regimes that underpin repeatable outcomes. Payment structures that include escrow or milestone-based releases help manage risk, while clearly defined penalties for contract deviations reinforce accountability. In practical terms, the interplay between supplier capability, product data, and logistical reliability determines whether engine upgrades enhance performance or introduce avoidable variability into a supply chain. The Evo X’s legacy thus rests not only on the parts chosen but on the procurement discipline behind them.

Integrating these elements into a long-term strategy means acknowledging the breadth of the Evo X’s engine ecosystem and the realities of sourcing at scale. For buyers pursuing consistent performance across markets, the focus must be on components that deliver predictable, field-proven results and a clear path to ongoing availability. This approach pairs the engineering discipline of high-performance parts with a procurement framework designed to sustain quality, supply, and service over multiple model cycles or aftermarket program runs. The goal is to preserve the Evo X’s character—the immediacy of acceleration, the certainty of cornering, and the precision of control—while ensuring that every upgrade integrates smoothly with the car’s electronic management, drivetrain geometry, and chassis dynamics. The result is a cohesive performance narrative: power that responds with clarity, reliability that survives repeated heat cycles, and a supply chain robust enough to support a thriving aftermarket ecosystem.

For readers seeking current marketplace visibility and verified supplier options, industry resources continually update pricing, availability, and supplier credentials. An external reference provides a panoramic view of leading sources and catalog breadth for Evo X parts, offering a framework for evaluating offerings across regions and price points. This external resource complements the internal guidance by mapping the landscape of suppliers and enabling informed, scalable purchasing decisions: https://www.goldsupplier.com/wholesale/mitsubishi-lancer-evo-x-parts.html. To further explore practical sourcing opportunities within a controlled internal framework, consider an internal resource that highlights core engine upgrade options without naming specific products, helping buyers balance performance ambitions with procurement risk: https://mitsubishiautopartsshop.com/4b11t-billet-block/. This combination of global marketplace insight and targeted internal options equips procurement teams to steward Evo X engine programs with both ambition and discipline, ensuring that power remains a defining attribute of the Evo X for years to come.

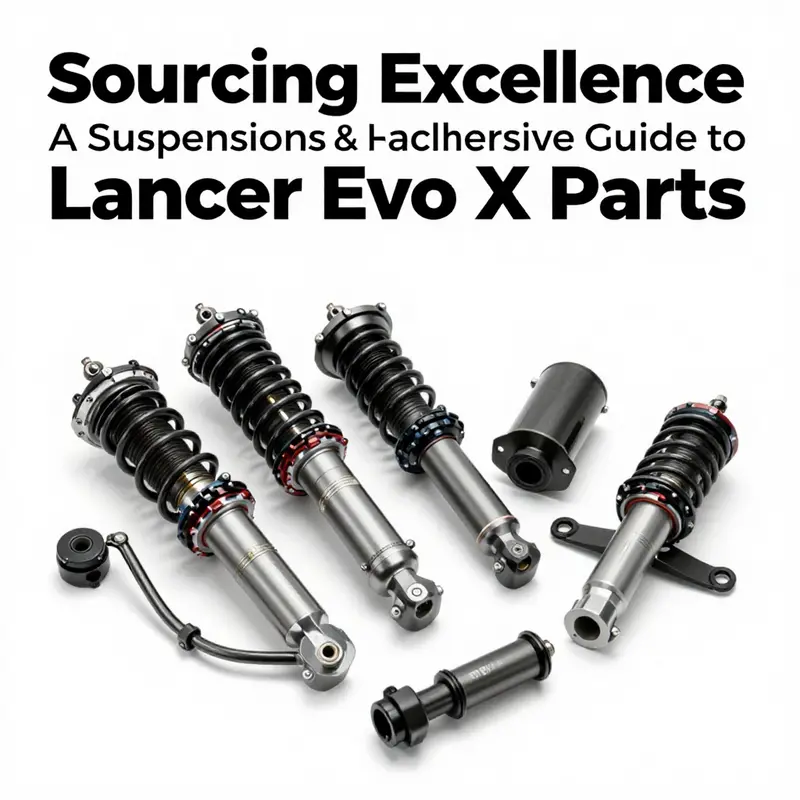

Precision in Motion: Mastering Suspension and Handling in Lancer Evo X Parts

The Mitsubishi Lancer Evolution X is defined as much by its handling as by its straight-line speed, and that precision begins with the suspension. In the Evo X, every link, bushing, and damper is calibrated to deliver a balance of agile response and composure under demanding conditions. For procurement and engineering teams, understanding how these components interact, and how they can be sourced and validated, is essential to sustaining performance across a vehicle that remains a benchmark for driving dynamics. The suspension and handling system is not a collection of isolated parts but a cohesive orchestra in which shocks and struts, sway bars, control arms, and bushings harmonize with the vehicle’s all-wheel control architecture to maintain tire contact, stabilize weight transfer, and preserve steering fidelity in corners, braking zones, and transitions. This integrated perspective is as important for a daily driver seeking reliability as it is for a racer chasing lap times. The goal is not simply replacement, but preservation of the Evo X’s characteristic balance—an equilibrium where stiffness does not translate to harshness, and precision does not come at the expense of ride quality.

At the heart of any handling story are the shocks and struts, the components that govern how the chassis recovers from perturbations and how it communicates road input back to the driver. OEM shocks and struts for the Evo X are specifically tuned to the car’s rally-inspired geometry, ensuring that the initial bite of steering inputs translates into predictable, linear responses. This tuning supports the S-AWC system, a hallmark of the Evo X that integrates yaw control, braking, and torque distribution to optimize traction through every corner. When considering replacements or upgrades, the balance between damping, stiction, and rebound characteristics becomes critical. For track days, enthusiasts may seek damping curves that favor faster data acquisition and sharper turn-in, while street-driven examples often prize compliance that preserves comfort over long distances. The best options in this category retain compatibility with the Evo X’s suspension geometry while offering improved consistency under thermal load, a common driver for upgrading to aftermarket variants. It is here that the procurement decision must weigh long-term durability, NVH (noise, vibration, and harshness) implications, and the potential need for re-alignment after service intervals or impact events, all without compromising the core handling philosophy that defines the model.

Sway bars are the quiet workhorses of the Evo X’s cornering behavior. Their role is to modulate roll stiffness, a parameter that directly impacts tire contact and, consequently, grip during aggressive cornering. A well-chosen set of sway bars maintains a predictable roll couple, allowing the driver to apply steering inputs with confidence while preserving the intended front-to-rear balance. On a chassis as tuned as the Evo X, even modest changes in bar diameter or end-link geometry can noticeably shift the handling envelope. For processors and engineers, the question becomes how to source sway bars that meet factory tolerances or offer controlled improvements without upsetting compatibility with the S-AWC system. The practical considerations extend to bushings and mounts, too. Worn bushings can introduce unwanted deflection and millisecond-level delays in control arm movement, eroding the directness that drivers expect. The replacement path, therefore, must consider material quality, heat resistance, and the ability to dampen vibrations transmitted from uneven surfaces. The goal is a seamless continuation of the Evo X’s dynamic intent—reliable, repeatable responses that enable the driver to place the car precisely where they want it, even as the road punishes grip with cambers, bumps, or gravel.

Control arms serve as the structural conduits that translate the damping and roll characteristics defined by the shocks and sway bars into steering precision. They govern the geometry of the suspension, influencing camber gain, toe change, and the overall stiffness of the front and rear chassis. In high-performance contexts, control arms must withstand repeated cycles of load without distorting alignment beyond factory tolerances. The right choice here is a control arm that preserves alignment integrity under lateral loading and braking, while delivering the stiffness needed to prevent imprecise steering feedback. Materials play a crucial role; advanced alloys and carefully engineered forging can provide a favorable strength-to-weight ratio, reducing unsprung mass and improving suspension responsiveness. When sourcing these components for Evo X builds, buyers must verify machining tolerances, surface finishes, and compatibility with existing knuckles and hubs. The chain of trust in procurement extends to the support network around these parts: testing data, warranty terms, and the availability of installation guidance that ensures the geometry remains faithful to the original design intent.

Bushings, often overlooked in negotiations, are fundamental to how a vehicle communicates between chassis and suspension. High-quality bushings suppress unwanted vibration while permitting modest, controlled motion in the suspension links. In the Evo X, where ride-generation demands meet high-speed stability, bushings that combine durability with precise damping characteristics contribute to a smoother transfer of forces through the suspension, preserving steering feel and reducing the likelihood of micro-vibrations that can disrupt traction. The material choice—ranging from reinforced steel interfaces to performance composites—directly influences long-term reliability and maintenance cycles. For buyers, this is not merely a replacement exercise but a chance to recalibrate the balance between comfort and control. If a vehicle spends significant time on back roads or race circuits, it may benefit from bushings designed to minimize lateral play and maintain consistent alignment under load. For those who use the Evo X primarily on regular roads, a design that emphasizes noise reduction and living-with-it durability can be more appropriate, as long as the fundamental connection between wheels and chassis remains robust.

The chain of performance extends beyond individual parts; it requires a holistic view of how each component contributes to a stable, predictable handling platform. The Evo X was engineered with deep knowledge of rally dynamics and track performance, a philosophy that continues to guide modern revision paths and OEM-grade replacements. The objective for engineers and procurement teams alike is to identify parts that deliver consistent behavior under varying temperatures and road textures while maintaining a high degree of interchangeability with the vehicle’s electronic stability software and steering calibration. In practice, that means validating tolerances and material specifications, confirming that the components can withstand repeated heat cycles without deformation, and ensuring that servicing and maintenance can be performed within reasonable timeframes and with predictable costs. The chassis should feel alive but not unruly, with a sensation that every input—whether a turn-in, a brake threshold, or a mid-corner throttle modulation—translates into a measured, confident response.

From a sourcing perspective, the Evo X suspension ecosystem benefits from the same regional manufacturing dynamics that shape other parts of the car. In major Chinese manufacturing clusters, particularly Guangdong Province’s automotive zones, suppliers have developed the capacity to deliver integrated components—from dampers and springs to control arms and bushings—within a tight tolerance framework. These clusters provide the logistical proximity and the ecosystem of tooling, coatings, and testing that reduce lead times and support scalable production runs. When evaluating suppliers, procurement managers should look for platform-verified icons and evidence of compliance with quality standards. Negotiating MOQs becomes a practical tactic to balance inventory risk with the need for consistent supply, especially for rare or high-demand Evo X variants. For example, a supplier with demonstrated export experience and robust post-sales support can help a buyer align with long-term maintenance plans, ensuring that critical components are available in the market when needed and that consistent performance benchmarks are preserved across fleets of Evo X vehicles.

Beyond the OEM-aligned pathway, aftermarket options exist that promise refined damping, stiffer bushings, or altered roll characteristics. Enthusiasts chasing specific handling personalities may opt for dampers with tuned rebound to reduce dive under braking or sway bars with calibrated anti-roll stiffness to sharpen corner exit. In choosing such options, it is essential to consider how the changes interact with S-AWC and total vehicle dynamics. The ideal configuration is one that preserves steering precision and stability, even as the driver explores more aggressive line choices or higher cornering speeds. For readers who want to explore the broader Evo X parts ecosystem, the Evo X parts landscape includes a wide array of components spanning body, chassis, and cosmetic categories, illustrating how a single platform supports a diverse performance spectrum. See, for a focused example within the Evo X parts ecosystem, the Evo X side-skirt options at this Evo X parts marketplace:

As the final pages of this chapter close on suspension and handling, the core message returns to predictability, repeatability, and resilience. The Evo X’s handling identity does not hinge on a single component but on the synergy of dampers, bars, arms, and bushings that translate driver intent into controlled motion. For procurement teams, the path forward involves meticulous specification checks, performance benchmarking, and a sourcing network that values both engineering fidelity and service reliability. The result is a fleet of Evo X vehicles that retain their edge—cars that respond with confidence, reward precise input, and preserve the driving thrills that made the Evo X an icon. For those who seek a deeper technical foundation about how these suspension features support industry-leading design, a comprehensive Mitsubishi overview offers technical context on the Evo X suspension and its role in supporting high-performance engineering. External reference: https://www.mitsubishicar.com/tech/evo-x-suspension-features.

Precision Braking and the Evo X: Unpacking the Brake System that Powers Every Turn

The brake system of the Evolution X is more than a stopping mechanism; it is a physics-based negotiation between heat, friction, and control that defines how the car translates driver intent into response at the limit. In high-performance driving, stopping power and heat management are as critical as horsepower and torque. The Evolution X, with its sport-oriented chassis and drive electronics, relies on a braking architecture designed to endure repeated high-pressure demands while preserving pedal feel and line stability through a full range of speeds and cornering maneuvers. At the heart of this architecture is a front axle that carries a large, four-piston caliper clamping assembly paired with ventilated front rotors of substantial diameter, and a rear axle that uses a two-piston caliper with its own ventilated rotors. The geometry and sizing of these components are calibrated to deliver consistent bite, predictable fade resistance, and reliable stopping power even when a track session extends into the late afternoon heat. The front brakes, in particular, bear the bulk of the braking load during aggressive deceleration and therefore are designed to handle higher clamp force and greater heat input. The rear brakes complement this effort, providing the necessary balance to maintain stable weight transfer and a controlled return to baseline speed without necessitating an abrupt shift in steering line or chassis attitude. The numbers tell a clear story: front rotors measure approximately 13.8 inches in diameter, a size chosen to optimize heat dissipation and rotor surface area under sustained braking, while the rear rotors sit around 13 inches, offering ample stopping force with lower rotational inertia to maintain smooth pedal modulation. Together, they form a system that supports spirited driving and track use while preserving daily reliability and predictable, linear response across a broad temperature range.

In operation, the system’s performance hinges on more than rotor diameter and caliper count. It rests on harmonizing friction material, caliper design, and rotor cooling with the car’s electronic braking controls and chassis dynamics. The Evolution X’s braking arrangement is tuned to work in concert with the car’s stability and traction control systems, as well as its all-wheel control logic, to deliver confident deceleration without surprising the driver as weight shifts during corner entry. Even as track sessions push heat into the ceramic-like edges of the rotors and the brake fluid becomes more viscous, the basic relationship between pad bite, initial pedal travel, and rotor temperature remains recognizable. This consistency is what allows drivers to push into the apex, knowing the brakes will deliver repeatable performance without sudden fade or pedal mush.

For enthusiasts who seek to extend the system’s capabilities, there exists a robust aftermarket ecosystem that targets the same design principles while offering higher clamp forces, more pronounced initial bite, and enhanced resistance to heat soak. Upgraded calipers can provide stiffer chordal clamping and reduced flex under load, while high-performance brake pads are developed to maintain friction coefficients at elevated temperatures, avoiding the sharp drop-off that comes with cooler or uneven temperatures. Drilled or slotted rotors are commonly pursued to improve gas venting and cooling under track conditions, though their benefits depend on driving style and heat management, as well as the specific pad compound in use. Stainless steel brake lines are another widely adopted modification, aimed at reducing pedal fade by minimizing hydraulic hose expansion and maintaining a more consistent pedal feel through repeated cycles of heat and pressure. The objective of these upgrades is not simply to achieve maximum stopping force, but to sustain control and feedback as speed decreases and the car’s mass transitions through braking zones. In this context, even the seemingly small details—such as the compatibility of upgrade components with the Evo X’s dynamic balance and electronic aids—become decisive, because a well-muned braking system contributes to faster corner entries and, ultimately, faster laps.

Beyond performance, the braking system’s reliability rests on durability and compatibility with the vehicle’s structural and control architecture. Replacement components, including parking brake assemblies, are commonly designed from aluminum to optimize weight, heat dispersion, and longevity, ensuring that the parking mechanism remains functional under varied climates and long-term use. For a team managing a fleet or a workshop that services Evo X owners, this translates into concrete procurement considerations: sourcing parts that will fit precisely with the car’s geometry, maintain correct pad-to-rotor clearances, and maintain alignment with the vehicle’s electronic calibration. The overall goal is to secure a supply chain capable of delivering consistently high-quality components at scale, with predictable lead times and robust post-sale support. In a mature market, this means partnering with suppliers who understand the Evo X’s braking language and can translate it into parts that preserve or even enhance the car’s existing brake balance, pad life, and rotor longevity.

From a sourcing perspective, the Evo X brake system sits within a broader supply chain landscape that has evolved to support both OEM-style replacements and performance-oriented upgrades. Central to this landscape is the geographic concentration of manufacturing and engineering clusters in regions known for automotive components. In particular, a major production hub in southern China—an area notable for automotive accessory manufacture—offers proximity to tooling, painting, and assembly services that can reduce turn-around times for brake system components and related hardware. This clustering translates into tighter tolerance control, faster prototyping, and more straightforward logistics for buyers seeking a steady influx of front and rear calipers, pads, rotors, and lines that align with the Evo X’s specifications. For buyers, this means a potential combination of cost efficiency, scalability, and the confidence that the parts will perform consistently across a broad spectrum of operating conditions. It also means a willingness to navigate the complexities of cross-border sourcing, where quality assurance, certification, and after-sales support become essential elements of a durable supply chain.

In evaluating suppliers, procurement teams should emphasize platform verification and quality-track records. A supplier with verified status and proven exports to the target market is more likely to provide components that meet tolerances and performance expectations. Negotiating MOQs that reflect real market demand is also essential, particularly for high-performance components where the cost of small-batch orders can be prohibitive. When it comes to critical elements such as the braking system, buyers should request material specifications, heat tolerance data, and endurance testing results. This information helps ensure that upgraded parts will perform consistently when subjected to repeated deceleration and high-temperature exposure, while preserving the Evo X’s overall handling characteristics and balance.

To illustrate how a buyer can position such a program, consider the broader Evo X components ecosystem as a coordinated catalog of performance upgrades and replaceable OEM-style parts. The brake system, with its front four-piston and rear two-piston architecture, is a natural focal point for a performance-oriented maintenance and upgrade program. The availability of aluminum parking brake assemblies further supports the objective of maintaining reliable operation under load and temperature variations. For those exploring upgrade options alongside a standing OEM-replacement path, there is value in examining the integrated approach that combines caliper design, pad materials, rotor configurations, and hydraulic lines with the vehicle’s electronics and chassis dynamics.

As a nod to the wider upgrade landscape, readers can explore related Evo X components that embody the same ethos of precision and reliability. For instance, the broader catalog of Evo X body and accessory parts demonstrates the level of manufacturing sophistication achievable in the current market, where advanced injection molding and composite fabrication enable high-fidelity replicas for body kits and aero components. If you’re curious about how high-precision composites are being utilized in Evo X upgrades, you can view a representative listing focused on carbon-fiber bonnet-hood assemblies. This entry highlights how a component engineered for strength, lightness, and fit can complement braking performance by reducing overall mass and improving cooling pathways around the hood area. carbon-fiber bonnet hood for Mitsubishi Lancer Evo X.

For readers seeking external perspectives on braking performance and real-world testing, standard references in automotive journalism provide a wealth of data that contextualizes Evo X braking behavior beyond the dyno and the shop. A detailed overview of the Evo X braking system, including testing data and component specifications, is available from Car and Driver, offering analytical insight into how these brakes perform under track conditions and during aggressive street drives. This resource complements the procurement-focused narrative by illustrating how the brake geometry translates into pedal feel, bite, and fade resistance under real-world scenarios. https://www.caranddriver.com/mitsubishi/lancer-evolution-x

In sum, the Evo X brake system is a compact, high-performance package designed to deliver precise control, consistent bite, and robust heat management under a spectrum of driving conditions. Upgrades exist that can enhance stopping power and pedal feel, but they must be selected with care to maintain harmony with the car’s electronic controls and chassis geometry. For procurement teams, the path to stability lies in sourcing from clusters with integrated capabilities, validating material specifications and endurance data, and using MOQs that align with demand cycles. The objective is a reliable, scalable supply chain that preserves the Evo X’s distinctive braking identity while enabling repeatable performance across a diverse owner base. The chain of decisions—from caliper and rotor selection to fluid lines and parking brake assemblies—should be treated as a single, coherent program that respects the vehicle’s design intent and the driver’s quest for confidence on every turn.

Final thoughts

As the demand for Mitsubishi Lancer Evo X parts continues to thrive, businesses must strategically source these components from reputable manufacturers. This guide highlighted the essential manufacturing hubs, various supplier categories, and the critical components that contribute to the Evo X’s performance. By focusing on quality and reliability, procurement professionals can ensure they meet the needs of enthusiasts and maintain their competitive edge in the dynamic automotive market.